How Do I Get A Senior Homestead Exemption In Florida Web 12 Sept 2019 nbsp 0183 32 If you are 65 years of age or older were living on your homestead property as of Jan 1 of the year you file for this exemption and had household income less than the amount set by the Florida Department of Revenue about 31 100 you may be eligible for an additional exemption of up to 50 000

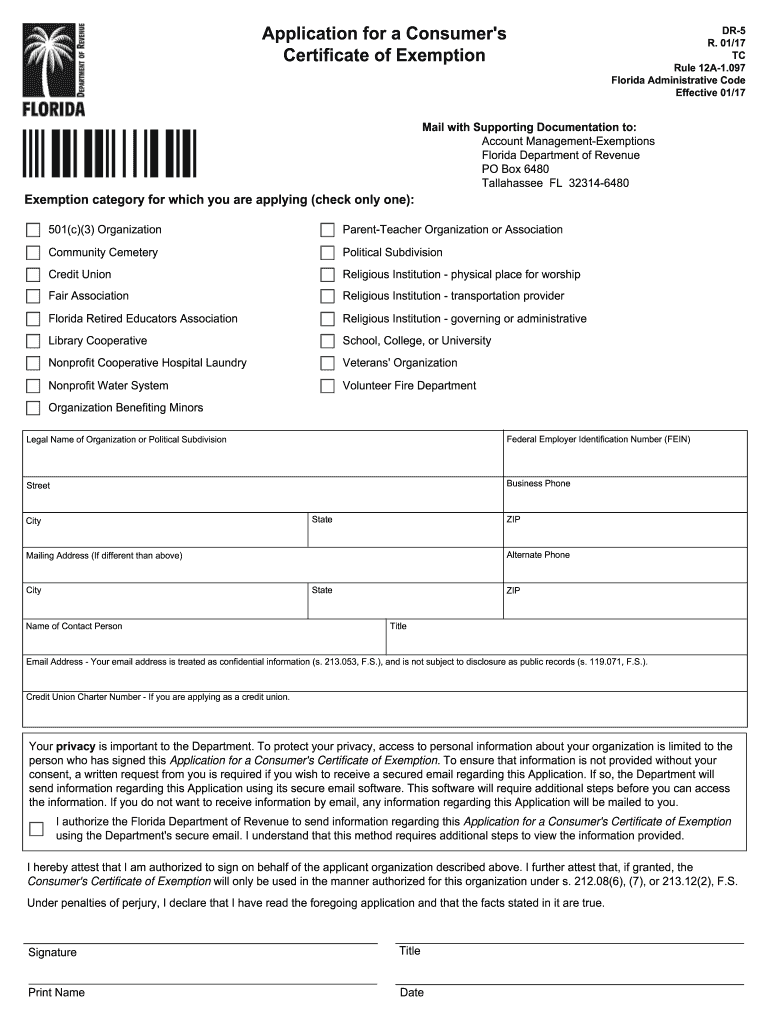

Web The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service members disabled first responders and properties with specialized Web Florida Constitution and section 196 075 Florida Statutes allowing one or both of the additional homestead exemptions described below Contact your local property appraiser for information on any ordinances passed in your county These exemptions apply only to the tax millage a county or city levies when it adopts a local

How Do I Get A Senior Homestead Exemption In Florida

How Do I Get A Senior Homestead Exemption In Florida

https://www.wikihow.com/images/thumb/6/67/Apply-for-a-Homestead-Exemption-in-Florida-Step-1.jpg/aid8705792-v4-728px-Apply-for-a-Homestead-Exemption-in-Florida-Step-1.jpg

How To Apply For A Homestead Exemption In Florida 15 Steps

https://www.wikihow.com/images/f/f0/Apply-for-a-Homestead-Exemption-in-Florida-Step-15.jpg

How To Apply For A Homestead Exemption In Florida 15 Steps

https://www.wikihow.com/images/thumb/5/53/Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg/aid8705792-v4-728px-Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg

Web In order to qualify for the Low Income Senior Exemption for 2024 an applicant must be 65 or older as of January 1 2024 receive the Homestead Exemption on the property AND have a combined household adjusted gross income for 2023 not exceeding 35 167 based on the income limitation set for last year please note this adjusted gross income li Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

Web Vor 6 Tagen nbsp 0183 32 Longtime limited income senior exemption This one s a county by county exemption and is available only to those who are 65 or older have lived in Florida for at least 25 years and have income below a certain threshold If you meet these criteria and your home is worth less than 250 000 you may qualify for a 100 percent Web Rulemaking Rule 12D 7 0143 F A C Additional Homestead Exemption Up To 50 000 for Persons 65 and Older Whose Household Income Does Not Exceed 20 000 Per Year the forms listed above and Rule 12D 16 002 F A C Index to Forms will be addressed through rulemaking to reflect the law change

Download How Do I Get A Senior Homestead Exemption In Florida

More picture related to How Do I Get A Senior Homestead Exemption In Florida

The Fund Shop Print 2019 Florida Homestead Exemption

https://www.thefund.com/getattachment/28076945-8349-4223-b3f4-2589c112b6b5/2019-Florida-Homestead-Exemption

Florida Homestead Exemption 2017 2024 Form Fill Out And Sign

https://www.signnow.com/preview/423/935/423935544/large.png

Florida Homestead Exemption Explained Easily YouTube

https://i.ytimg.com/vi/5N1vxwY1ss4/maxresdefault.jpg

Web By local ordinance only Age 65 and older with limited income amount determined by ordinance Age 65 and older with limited income and permanent residency for 25 years or more 5 000 widowed 5 000 blind 5 000 totally and permanently disabled Total and permanent disability quadriplegic Certain total and permanent disabilities limited inco Web DR 501SC Long Term Resident Senior Exemption The Long Term Resident Senior Exemption is an additional homestead exemption that provides a local option for county and city governments excluding school board to eliminate their ad valorem portion of the tax bill to qualifying low income seniors

Web 20 Apr 2021 nbsp 0183 32 There are exemptions for deployed servicepersons disabled veterans people who built granny flats onto their homes homeowners who suffered damage from a storm or other catastrophe senior citizens the list goes on Some of these exemptions can be valuable Web Lake Park 5 000 Greenacres Royal Palm Beach You may mail in your completed form with documentation to the Palm Beach County Property Appraiser s Office 301 N Olive Ave 1st Floor West Palm Beach FL 33401 by March 1st If you have any questions please call our office at 561 355 2866 for assistance

How To File For Florida Homestead Exemption Smart Title

https://smart-title.com/wp-content/uploads/2021/01/0121-homestead-blog-banner-d1.jpg

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

https://floridahomesteadcheck.com/blogs/homestead-articles/flori…

Web 12 Sept 2019 nbsp 0183 32 If you are 65 years of age or older were living on your homestead property as of Jan 1 of the year you file for this exemption and had household income less than the amount set by the Florida Department of Revenue about 31 100 you may be eligible for an additional exemption of up to 50 000

https://floridarevenue.com/property/pages/taxpayers_exemptions.a…

Web The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service members disabled first responders and properties with specialized

Florida Homestead And Related Tax Exemptions Application Form DocHub

How To File For Florida Homestead Exemption Smart Title

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

Homestead Exemptions For Senior Citizens Florida Homestead Check

What Is A Homestead Exemption In Florida YouTube

5 Tips On Homestead Exemption In Florida YouTube

5 Tips On Homestead Exemption In Florida YouTube

To Ensure That You Get The Most Out Of The Florida Homestead Exemption

Florida Homestead Exemption Explained Bios Pics

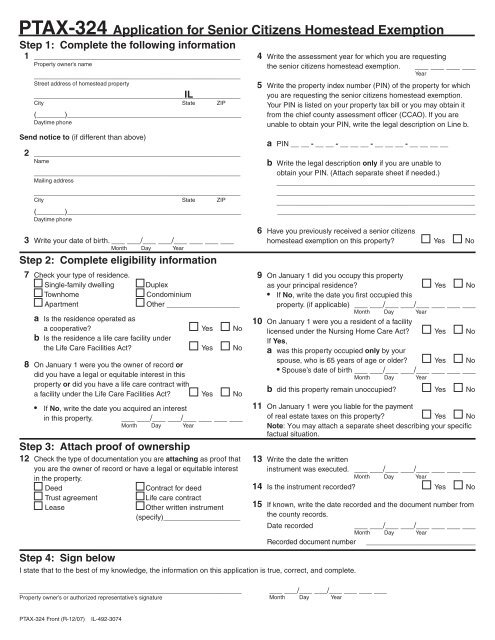

PTAX 324 Application For Senior Citizens Homestead Exemption

How Do I Get A Senior Homestead Exemption In Florida - Web In order to qualify for the Low Income Senior Exemption for 2024 an applicant must be 65 or older as of January 1 2024 receive the Homestead Exemption on the property AND have a combined household adjusted gross income for 2023 not exceeding 35 167 based on the income limitation set for last year please note this adjusted gross income li