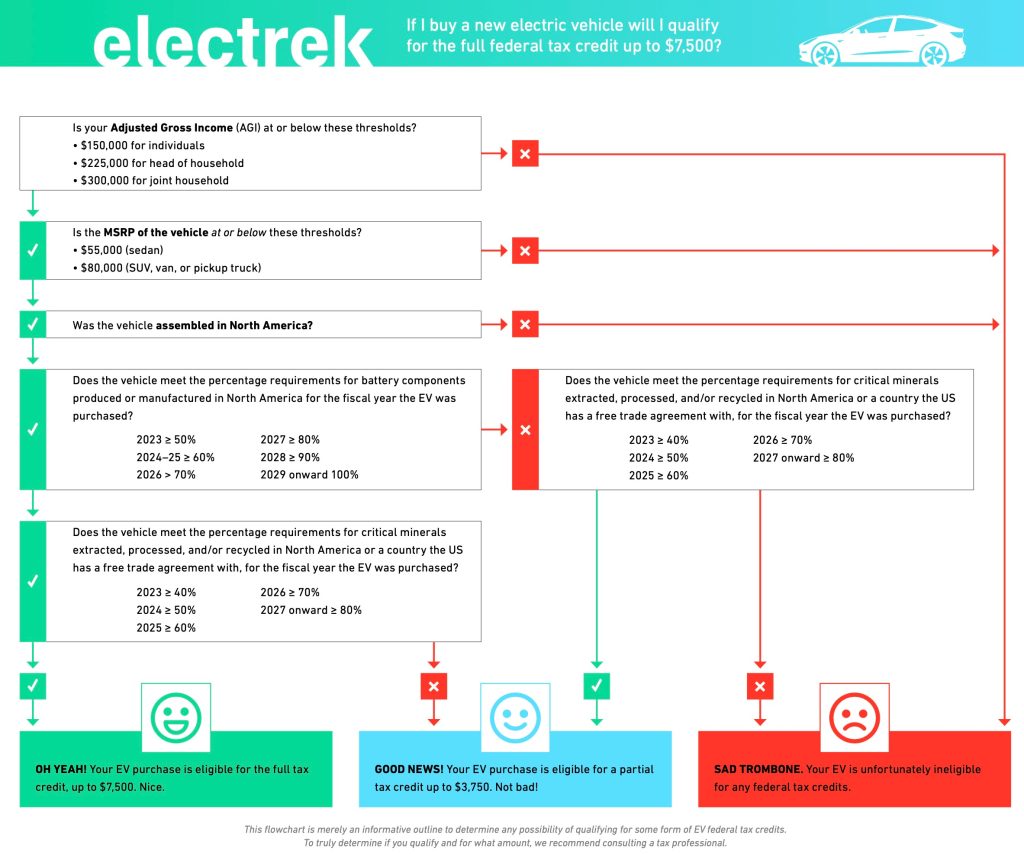

How Do I Qualify For Ev Tax Credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought

How Do I Qualify For Ev Tax Credit

How Do I Qualify For Ev Tax Credit

https://electrek.co/wp-content/uploads/sites/3/2022/12/Screenshot-2022-12-04-at-12.53.01-PM.jpg?quality=82&strip=all&w=1024

IRS EV Tax Credit 2023 Who Can Qualify Qualified Vehicles

https://teqip.in/wp-content/uploads/2023/01/cfe69sh325Y5BRMCUpTwrE.jpg

Tesla s Model Y Other EVs Now Qualify For 7 500 Tax Credit CBS

https://assets1.cbsnewsstatic.com/hub/i/r/2023/02/03/37584224-0091-4ba7-b367-fd80a864c391/thumbnail/1200x630/596d68b3a930a35770b458a1c0b28b64/ae5f0c70-0a2a-440a-90b2-7d41a2a09a41.jpg

How to claim the 7 500 EV tax credit on your return To claim the EV tax credit you file IRS Form 8936 with your federal income tax return You ll need the VIN vehicle identification The IRS has made the EV tax credit easier to obtain and in 2024 it s redeemable for cash or as a credit toward the down payment on your vehicle Here s what you ll need to qualify for

How Do Consumers Claim the EV Tax Credit Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle EV tax credit on their annual tax filing for To claim the credit report an eligible EV purchase on IRS Form 8936 when you fill out your tax return The credits range from 2 500 to 7 500 depending on the battery s capacity and

Download How Do I Qualify For Ev Tax Credit

More picture related to How Do I Qualify For Ev Tax Credit

Earned Income Tax Credit City Of Detroit

https://detroitmi.gov/sites/detroitmi.localhost/files/2019-01/ETIC-Chart.jpg

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Is The 2023 Toyota BZ4X Eligible For The Federal EV Tax Credit

https://www.motorbiscuit.com/wp-content/uploads/2022/07/2023-Toyota-bZ4X-Limited-AWD-Heavy-Metal.jpg

How To Claim the EV Tax Credit To benefit from the EV tax credit you ll need to fill out IRS Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit when you file your tax return Starting January 1 many Americans will qualify for a tax credit of up to 7 500 for buying an electric vehicle The credit part of changes enacted in the Inflation Reduction Act is designed

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit Which new vehicles qualify for the federal EV tax credit How do I claim the EV tax credit FAQs 1 Was the vehicle assembled in and sourced from the right countries

How To Qualify For A Personal Loan Loans Canada

https://loanscanada.ca/wp-content/uploads/2016/04/116567372.jpg

How To Qualify For A Home Loan Http reinvestortv how to qualify

https://i.pinimg.com/originals/bd/6d/ad/bd6dad15ea2a2ee00fc9f851210f390d.jpg

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

EV Sales Approaching Milestone 10 Million This Year Online EV

How To Qualify For A Personal Loan Loans Canada

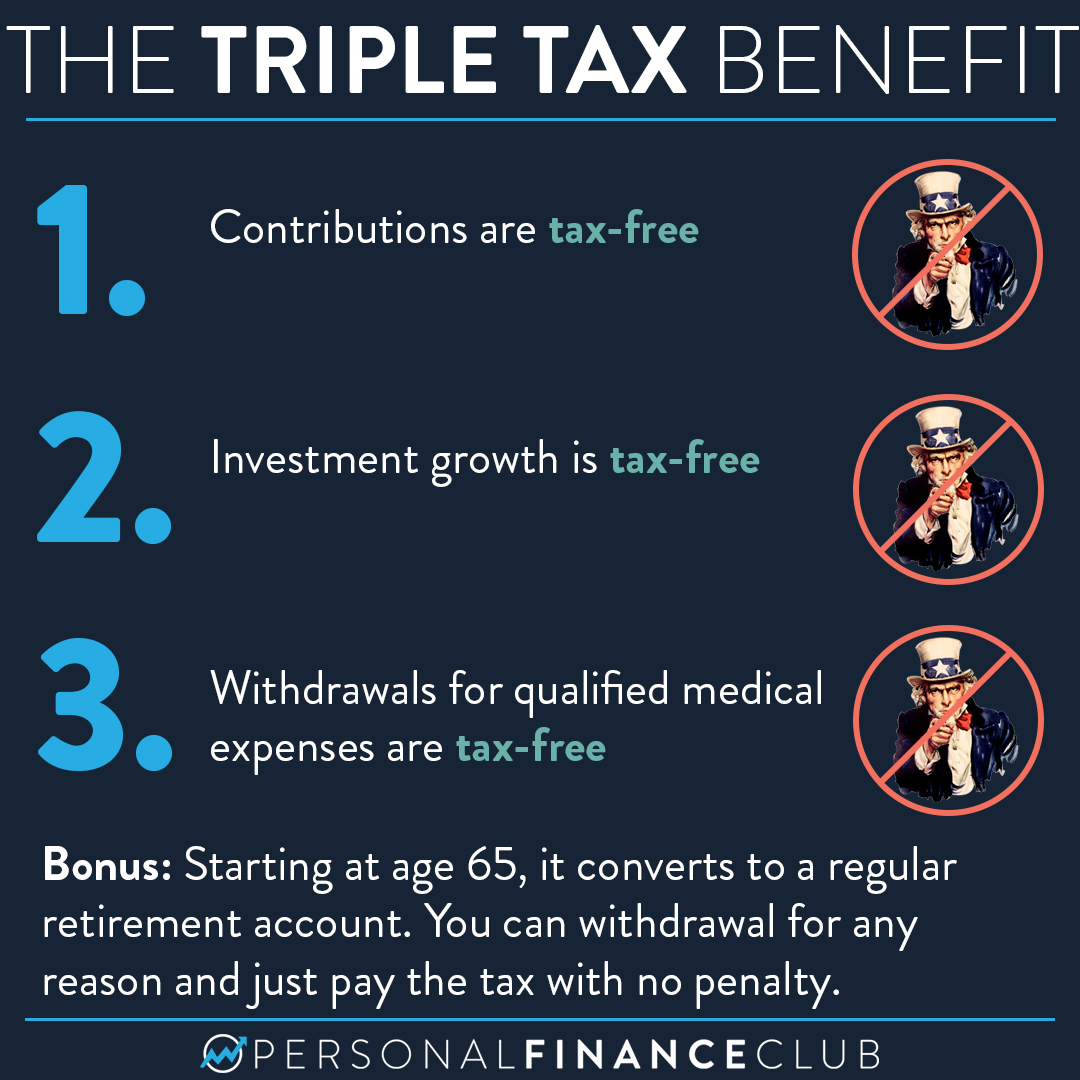

How Does An HSA Work The Ultimate HSA Guide Personal Finance Club

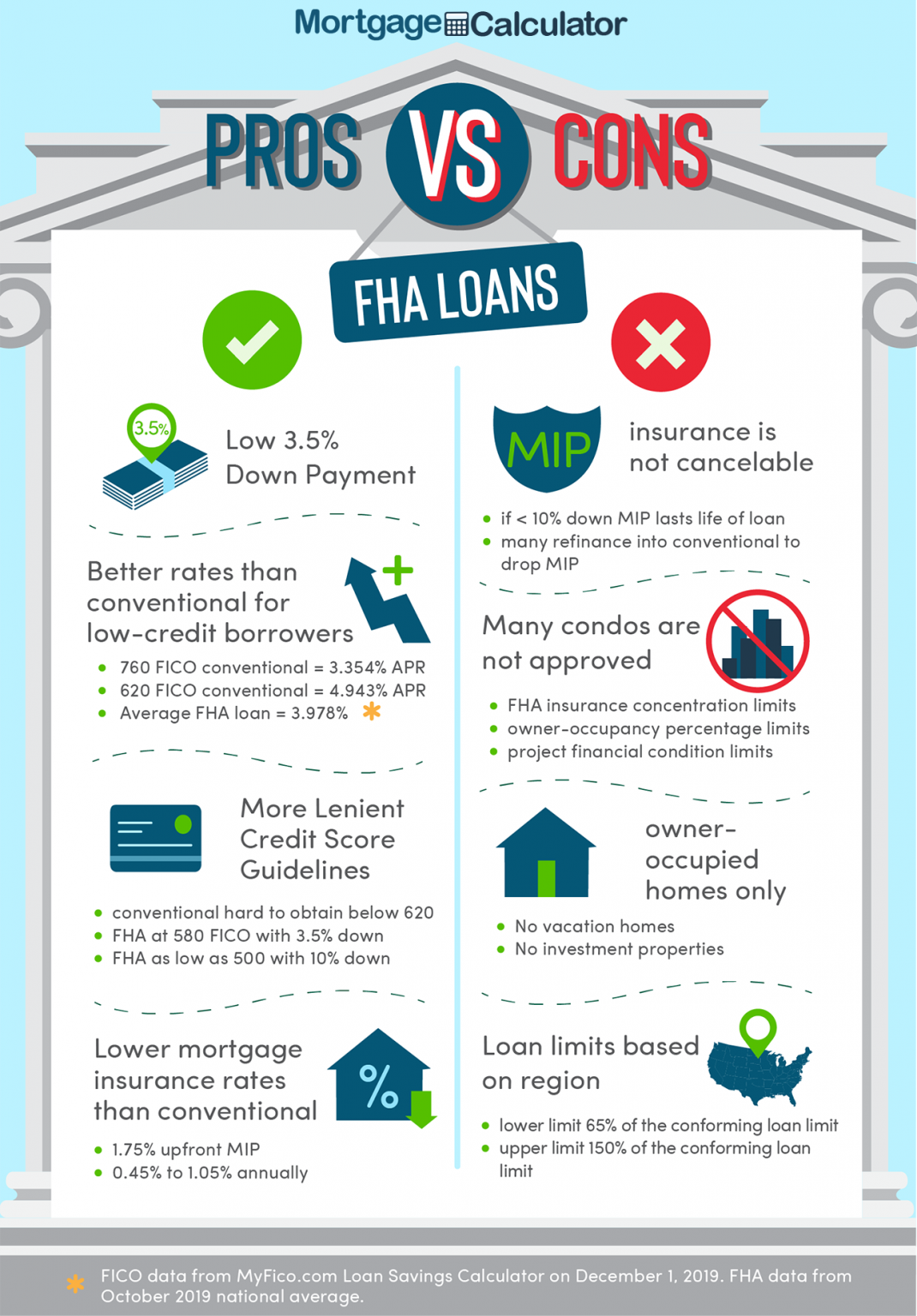

Do I Qualify For An FHA Loan 7 Sins Game

These 19 Plug In Electric Cars Qualify For Full 7 500 Tax Credit

Child Tax Credit 2021 Chart Earned Income Tax Credit Eic Basics

Child Tax Credit 2021 Chart Earned Income Tax Credit Eic Basics

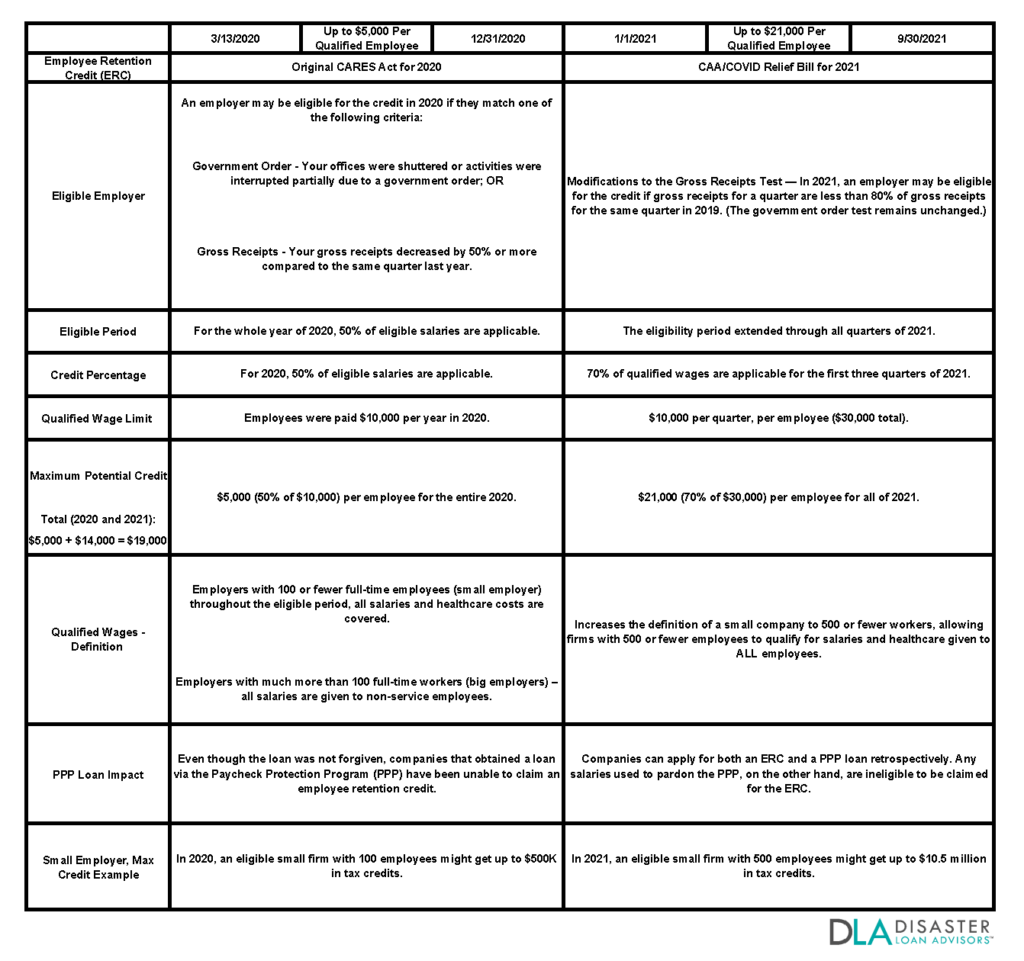

Can You Still Claim Employee Retention Credit For 2020 Leia Aqui What

Do I Qualify For A Home Loan Best Answers To Your Mortgage Questions

INFOGRAPHIC How To Qualify For A Mortgage Ashton Mortgage Solutions

How Do I Qualify For Ev Tax Credit - To claim the credit report an eligible EV purchase on IRS Form 8936 when you fill out your tax return The credits range from 2 500 to 7 500 depending on the battery s capacity and