How Do You Calculate Mileage For Self Employed Verkko 21 jouluk 2020 nbsp 0183 32 So for example if you ve driven 12 000 miles for business reasons over the course of a year you can claim back

Verkko How to use the mileage tax calculator When you re self employed and have to drive as part of your job you can claim back money for the miles you ve covered for work Verkko 25 syysk 2020 nbsp 0183 32 Contents 3 Minute Read Full Logbook Calculating Your Mileage Deduction Capital Cost Allowance When you re self employed or have self

How Do You Calculate Mileage For Self Employed

How Do You Calculate Mileage For Self Employed

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

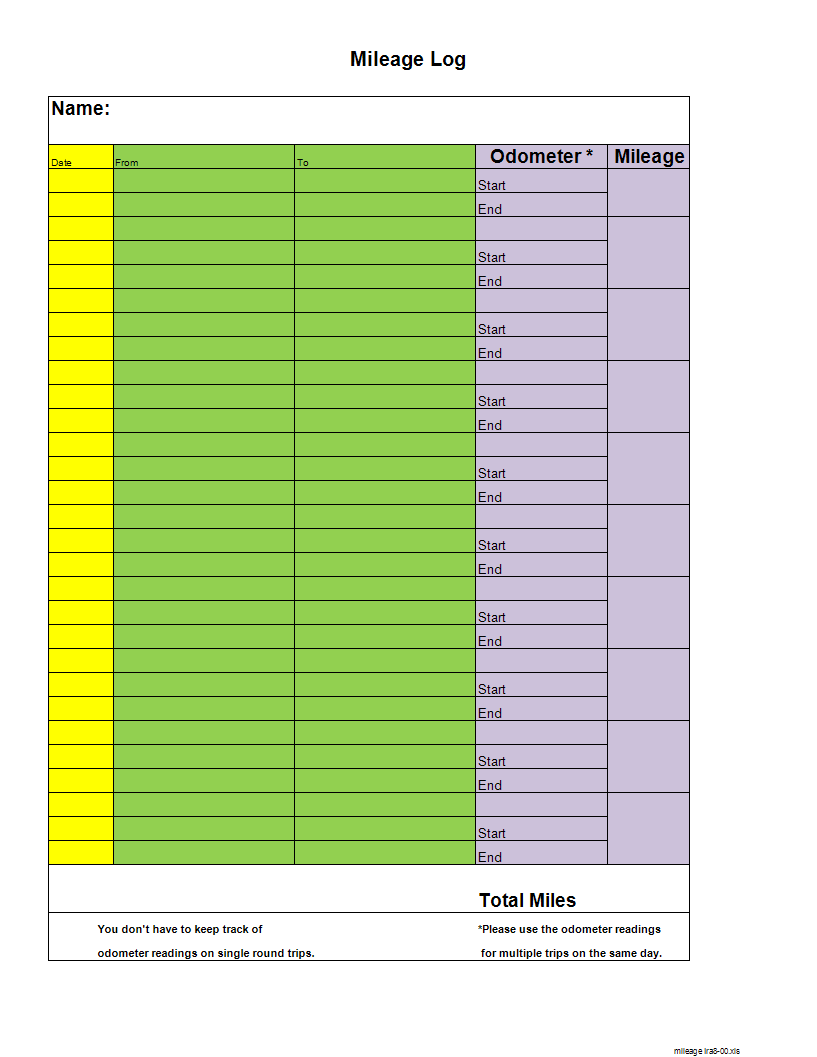

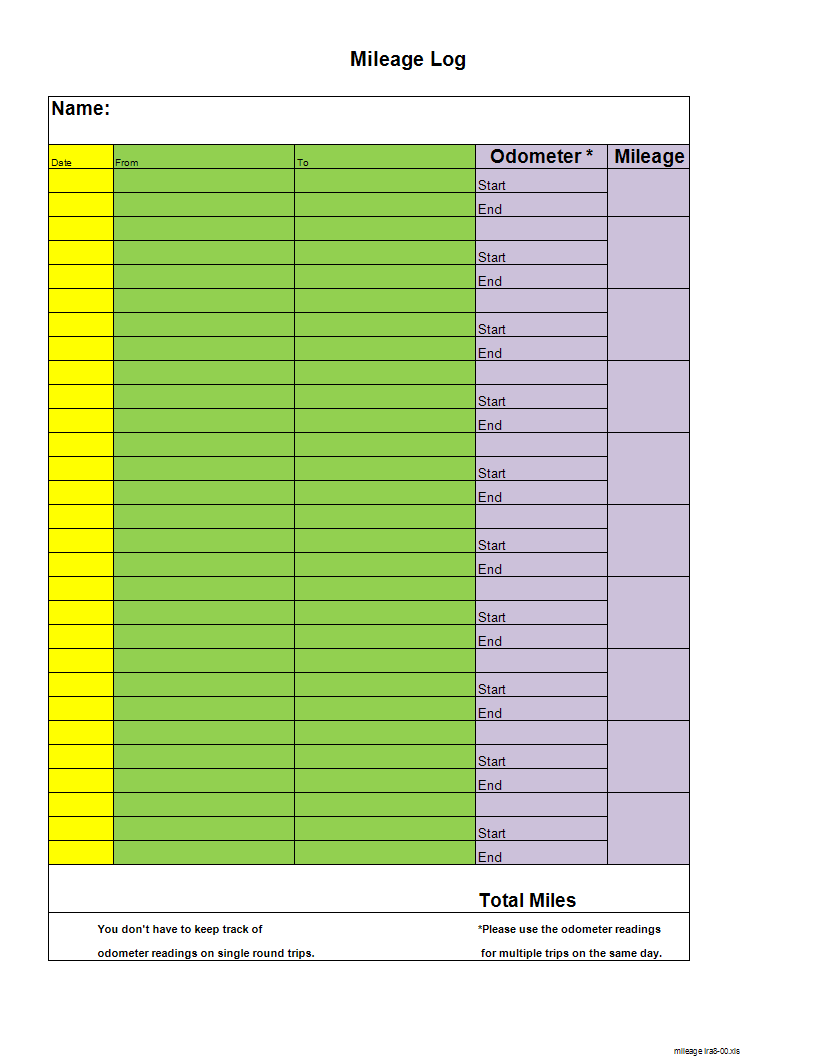

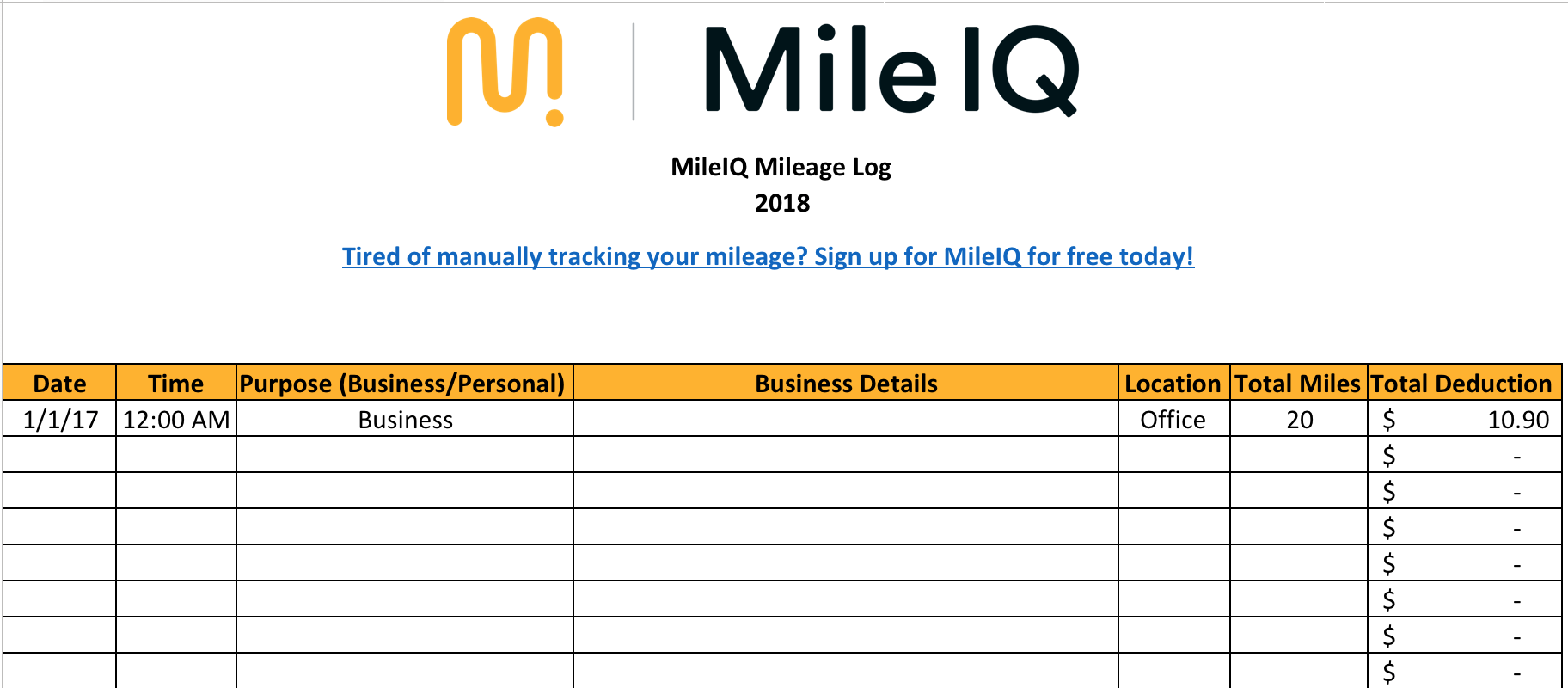

Mileage Log Template For Self Employed Templates At

https://www.allbusinesstemplates.com/thumbs/f526d8d7-0d8c-4865-b788-1be04b3e72cd_1.png

Self Employed Worker Mileage Deduction Guide 2024 Update

https://triplogmileage.com/wp-content/uploads/2021/02/calculate-mileage-for-self-employed-or-business-owners.jpg

Verkko 14 jouluk 2023 nbsp 0183 32 The IRS offers two ways of calculating the cost of using your vehicle in your business 1 The Actual Expenses method or 2 Verkko 24 lokak 2023 nbsp 0183 32 The standard mileage deduction is the most commonly chosen method for self employed persons it is set by the IRS for tax years usually each December for the upcoming year ahead and

Verkko In addition to providing the number of miles driven during the tax year you ll also need to answer a few questions about the vehicle including when it was placed into service for business As mentioned above the Verkko 22 helmik 2023 nbsp 0183 32 There are two ways to calculate your mileage for your tax return using the standard mileage rate or calculating your actual costs Standard Mileage

Download How Do You Calculate Mileage For Self Employed

More picture related to How Do You Calculate Mileage For Self Employed

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Printable Mileage Log Book Template Addictionary Office Log Book

https://i.pinimg.com/originals/66/f6/75/66f6756c72f9bd2dda58721bd1270cd0.jpg

How To Calculate Milage The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/How-to-Calculate-Mileage-in-Excel-3.png

Verkko Self employed individuals can use two different methods for calculating mileage expenses for tax deductions Related How to Calculate Your Mileage for Taxes or Verkko At tax time multiply your year s work mileage X the current standard mileage rate for business to calculate your deduction It s important to always use the mileage rate for

Verkko Multiply the number of miles in Step 1 by the HMRC mileage allowance rate per mile Here s an example You drive 11 000 business miles in the tax year 2023 24 using Verkko How much mileage allowance can you claim If you re self employed you can claim a mileage allowance of 45p per business mile travelled in a car or van for the first

How To Claim Mileage Allowance When You Are Self employed Tax Guides

https://listentotaxman.com/assets/img/library-1024/adding-up-receipts.jpg

Mileage Reimbursement Form Template Awesome Business Mileage Claim Form

https://i.pinimg.com/736x/15/09/12/15091254dbdb305b4b9533b1516baa88.jpg

https://blog.tapoly.com/self-employed-mileag…

Verkko 21 jouluk 2020 nbsp 0183 32 So for example if you ve driven 12 000 miles for business reasons over the course of a year you can claim back

https://taxscouts.com/calculator/mileage-tax-calculator

Verkko How to use the mileage tax calculator When you re self employed and have to drive as part of your job you can claim back money for the miles you ve covered for work

Standard Mileage Rate Method Archives

How To Claim Mileage Allowance When You Are Self employed Tax Guides

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

The Marvelous Free Mileage Log Templates Smartsheet With Regard To

How Do You Calculate Mileage Reimbursement

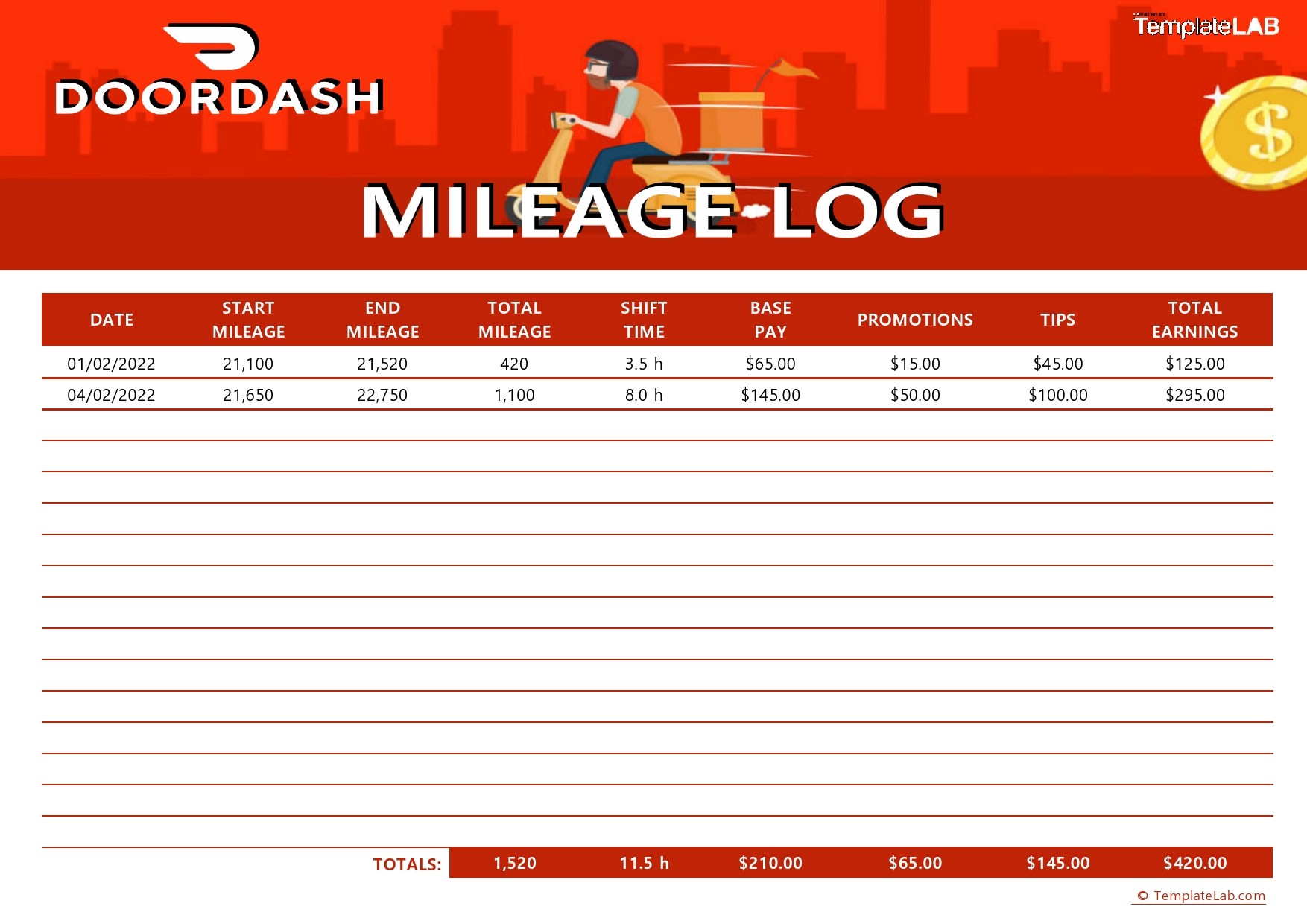

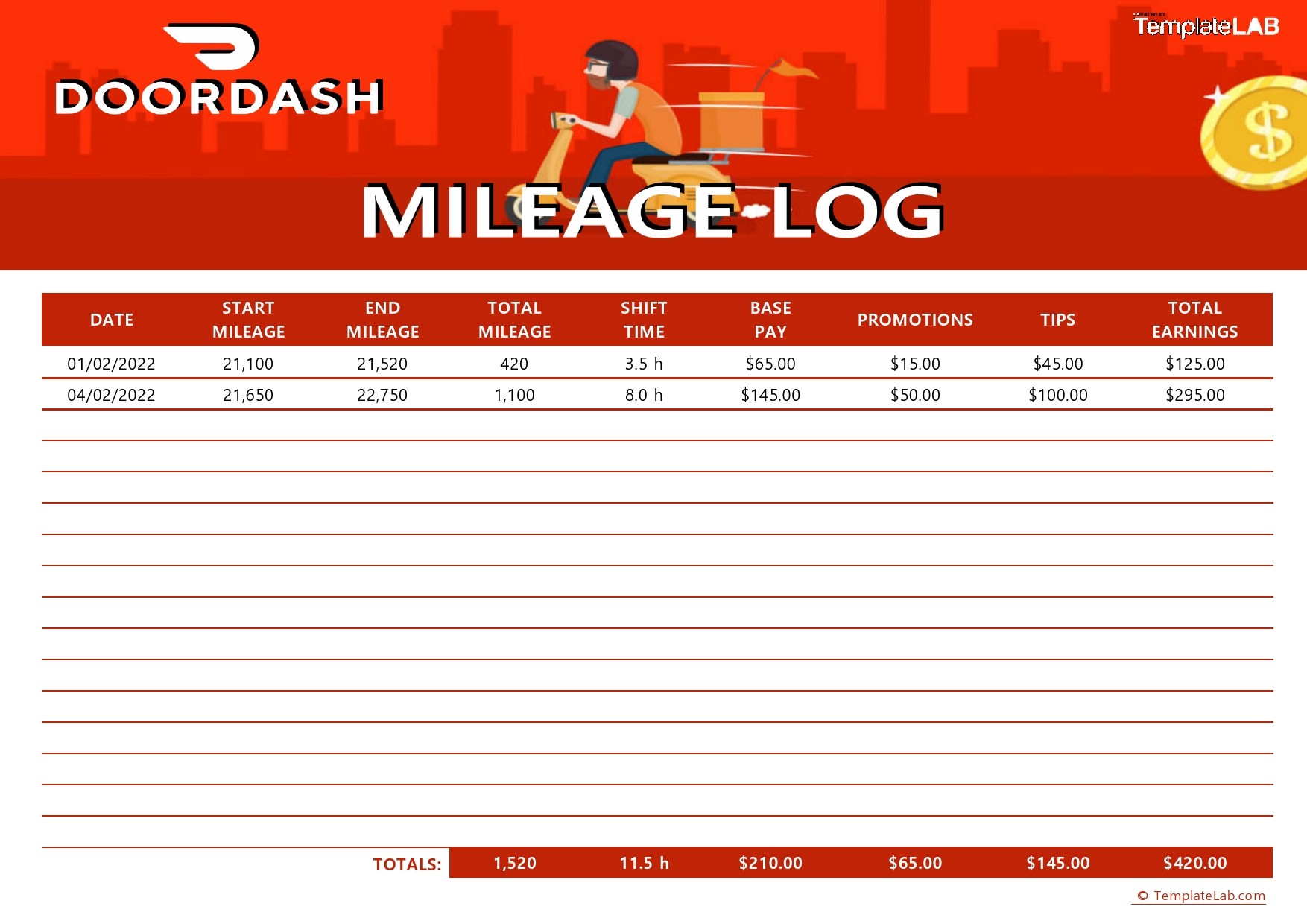

Doordash Spreadsheet Template

Doordash Spreadsheet Template

How To CALCULATE Numbers For IRS Taxes Pen And Paper Spreadsheets

Free Mileage Log Template Charlotte Clergy Coalition

50 Example Mileage Log For Taxes Ufreeonline Template Pertaining To

How Do You Calculate Mileage For Self Employed - Verkko Some self employed business owners simply estimate their business mileage by claiming for a percentage of their vehicle s total annual mileage So if your car does