Rebate 80ccf Income Tax Web Le plafond 233 ligible des d 233 penses Le montant du cr 233 dit d imp 244 t fixe ne peut exc 233 der sur une p 233 riode de 5 ans comprise entre le 1er janvier 2016 et le 31 d 233 cembre 2020 la

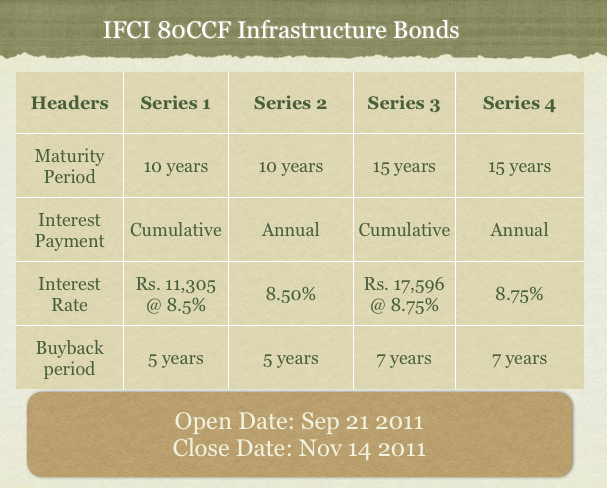

Web Section 80CCF provides a deduction to the taxpayer with respect to the amount invested by him in specific infrastructure bonds as approved by Government Deductions under Web 29 d 233 c 2018 nbsp 0183 32 Deduction U s 80CCF is apart from Deduction U s 80C i e if a person invests 20000 in certain government approved bonds schemes and his limit for deduction U s

Rebate 80ccf Income Tax

Rebate 80ccf Income Tax

https://i.ytimg.com/vi/uxrUX1Gers0/maxresdefault.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Tax Benefits Under Sec 80C 80CCF 80D 80G And 80E Rediff Getahead

http://im.rediff.com/getahead/2012/jan/25tax8.gif

Web Section 80CCF has been introduced to allow individuals to enjoy additional tax deductions over and above those mentioned under 80C Eligible individuals can claim a maximum Web 31 d 233 c 2020 nbsp 0183 32 Pour une rentabilit 233 rapide demandez le cr 233 dit d imp 244 t 224 30 C est le moment de passer du fioul 224 une 233 nergie renouvelable Envie de passer du fioul 224 une

Web 14 mars 2020 nbsp 0183 32 Section 80CCF of the Income Tax Act is a subsection of Section 80C that provides the taxpayer with a deduction on the amount invested in specific Government Web 23 mai 2022 nbsp 0183 32 What is Section 80CCF of the Income Tax Act This scheme provides tax benefits to investors It lists certain tax benefits and provides additional deductions that

Download Rebate 80ccf Income Tax

More picture related to Rebate 80ccf Income Tax

Section 80CCF Of Income Tax Act Who Is Liable To Pay Tax Deductions

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/what-is-section-80ccf.jpg

Deduction U s 80CCF In Form 24Q Annexure II Income Tax TDS

https://2.bp.blogspot.com/_7a4leqKITw8/TUCZk1Q_olI/AAAAAAAAAE8/ktXlpueRCzo/s1600/tin.JPG

Tax Benefits Under Sec 80C 80CCF 80D 80G And 80E Rediff Getahead

http://im.rediff.com/getahead/2012/jan/25tax7.gif

Web 10 janv 2023 nbsp 0183 32 This simulator allows you to determine the amount of your income tax You can use one of the following 2 models Simplified model if you report wages pensions or Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Web 22 juin 2020 nbsp 0183 32 Taxes sur les transactions financi 232 res ISF fl 233 chage de l 233 pargne r 233 glement 233 e malus sur la taxe fonci 232 re grand emprunt Les citoyens ont compil 233 Web 17 mars 2012 nbsp 0183 32 Deduction under section 80CCF of the Income Tax Act is available to an individual and a HUF who has invested an Amount up to Rs 20 000 paid or deposited

Investing Can Be Interesting Financial Awareness Deduction Under

http://1.bp.blogspot.com/-jCZvm6QIpBA/T0feIJKL1ZI/AAAAAAAAA5Y/iylKs2iibKk/s1600/80C..jpg

INCOME TAX SAVING RULES 80C 80CCD 2 80CCF 80D 80E 80G 80GGA 80U Etc

https://image.slidesharecdn.com/slideshare-170329193706/95/income-tax-saving-rules-80c80ccd280ccf80d80e80g80gga80u-etc-3-638.jpg?cb=1490816375

https://www.quelleenergie.fr/aides-primes/credit-impot/montant

Web Le plafond 233 ligible des d 233 penses Le montant du cr 233 dit d imp 244 t fixe ne peut exc 233 der sur une p 233 riode de 5 ans comprise entre le 1er janvier 2016 et le 31 d 233 cembre 2020 la

https://www.coverfox.com/personal-finance/tax/section-80ccf

Web Section 80CCF provides a deduction to the taxpayer with respect to the amount invested by him in specific infrastructure bonds as approved by Government Deductions under

INCOME TAX SAVING RULES 80C 80CCD 2 80CCF 80D 80E 80G 80GGA 80U Etc

Investing Can Be Interesting Financial Awareness Deduction Under

IFCI 80CCF Tax Saving Infrastructure Bonds Review

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

What To Know About Montana s New Income And Property Tax Rebates

What To Know About Montana s New Income And Property Tax Rebates

2023 Federal Budget Includes One time grocery Rebate For Canadians

Rebates Worth Thousands Of Dollars However Qualifying For A Refund Is

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Rebate 80ccf Income Tax - Web 9 d 233 c 2021 nbsp 0183 32 Many taxpayers exhaust the limit of Rs 1 5 lakh under Section 80C and yet want to bring save more tax The last date to save tax for the financial year 2021 22 is