How Do You Record A Rebate In Accounting While you re likely familiar with the concept of a rebate we are going to break down the different types of rebates to determine the proper accounting procedures From a vendor rebate accounting entry to customer rebates accounting this

How Do You Record Customer Rebates in Accounting Customer rebates are recorded by estimating the expected amount to be redeemed and setting this aside as a liability on the balance sheet As customers redeem their rebates actual expenses against these liabilities are recognized reducing both the liability account and I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I offset my COGS by the rebate received or just show it as its own revenue account

How Do You Record A Rebate In Accounting

How Do You Record A Rebate In Accounting

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

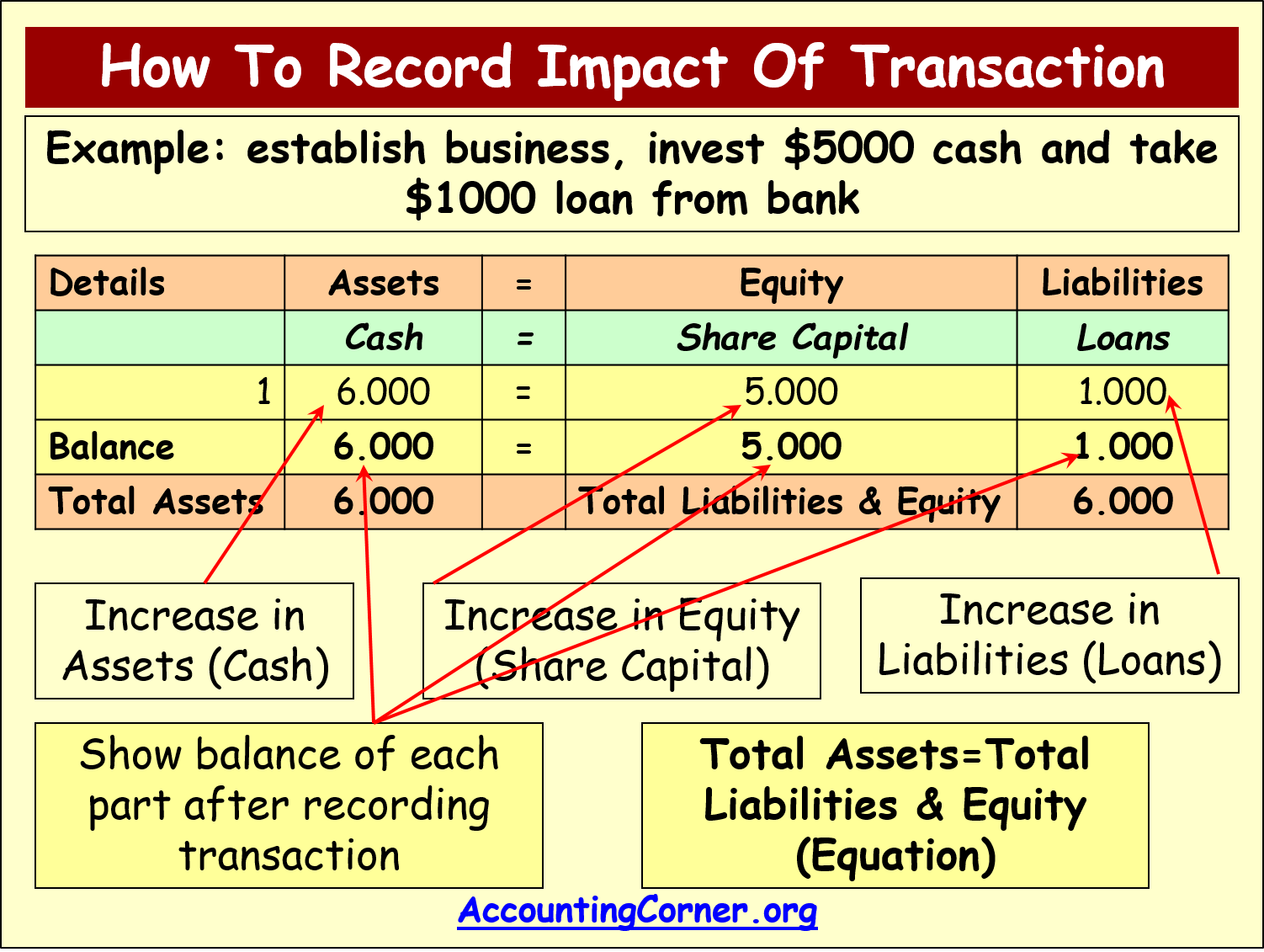

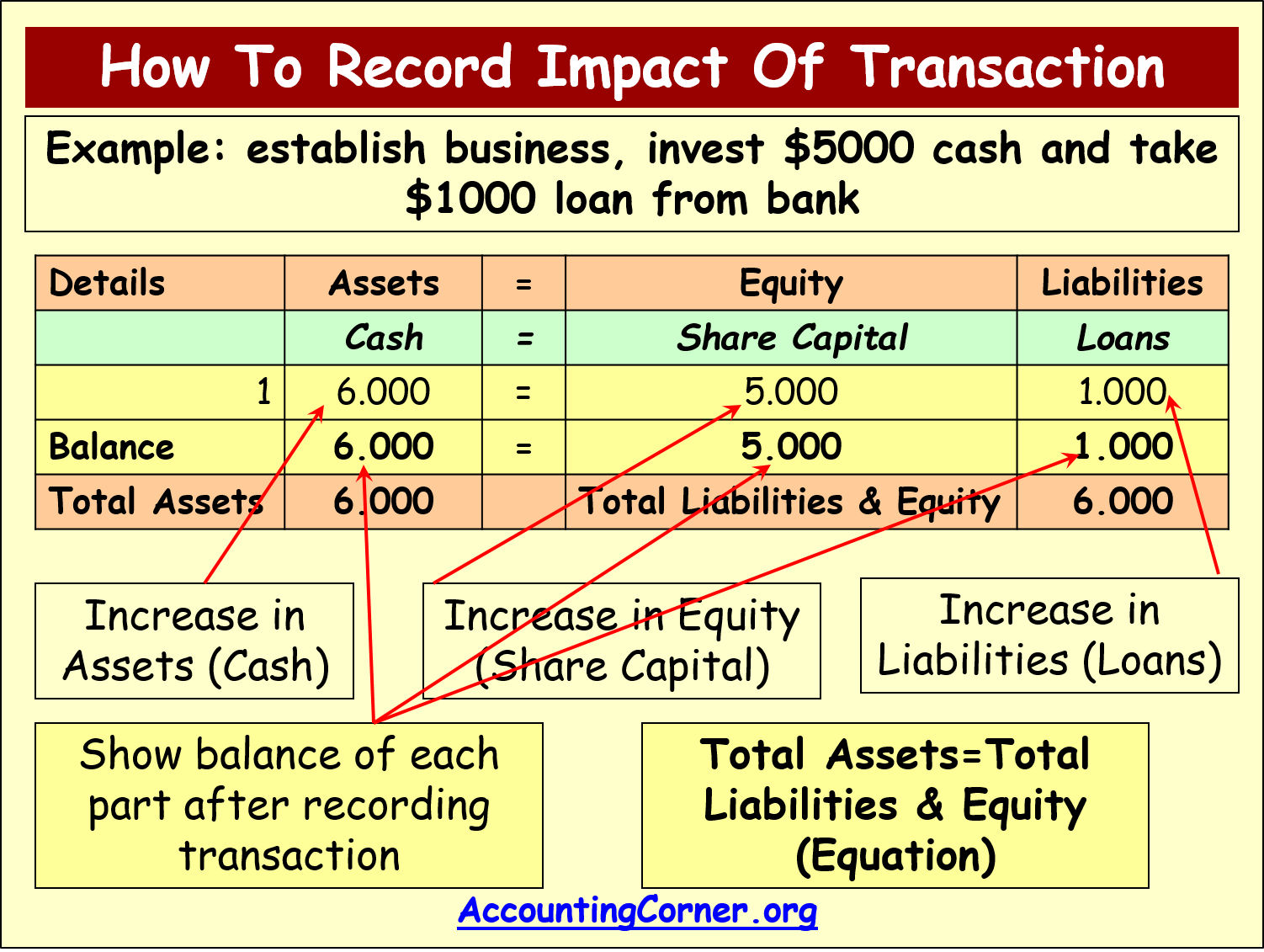

Accounting Equation Accounting Corner

http://accountingcorner.org/wp-content/uploads/2015/10/accounting-equation-12.png

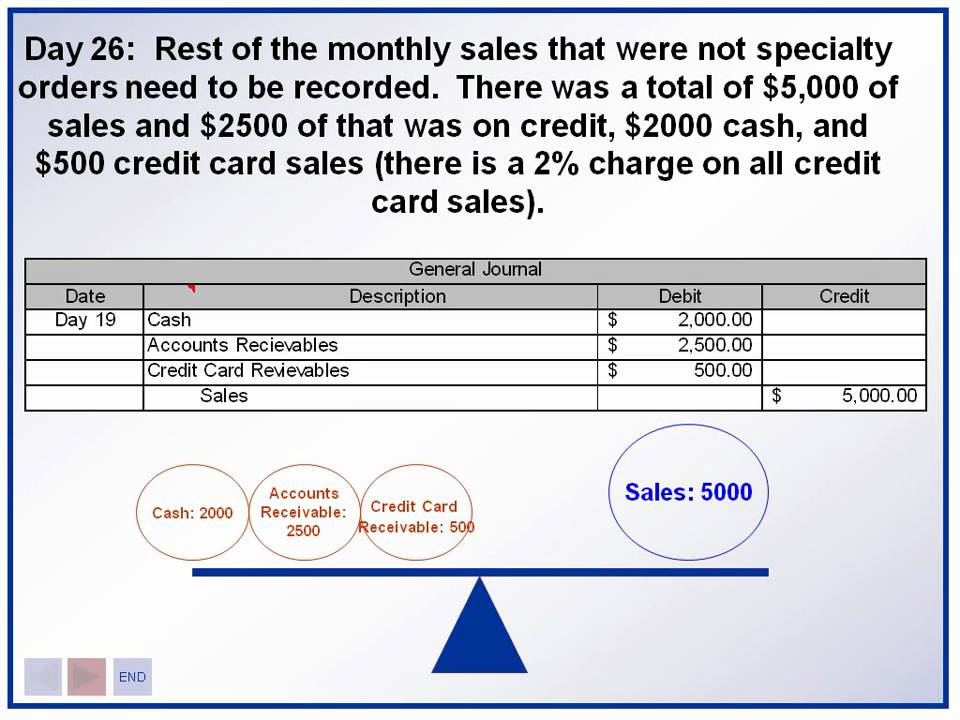

Accounting Introduction Recording Sales And Sales Returns YouTube

https://i.ytimg.com/vi/JifnCPrN1GA/maxresdefault.jpg

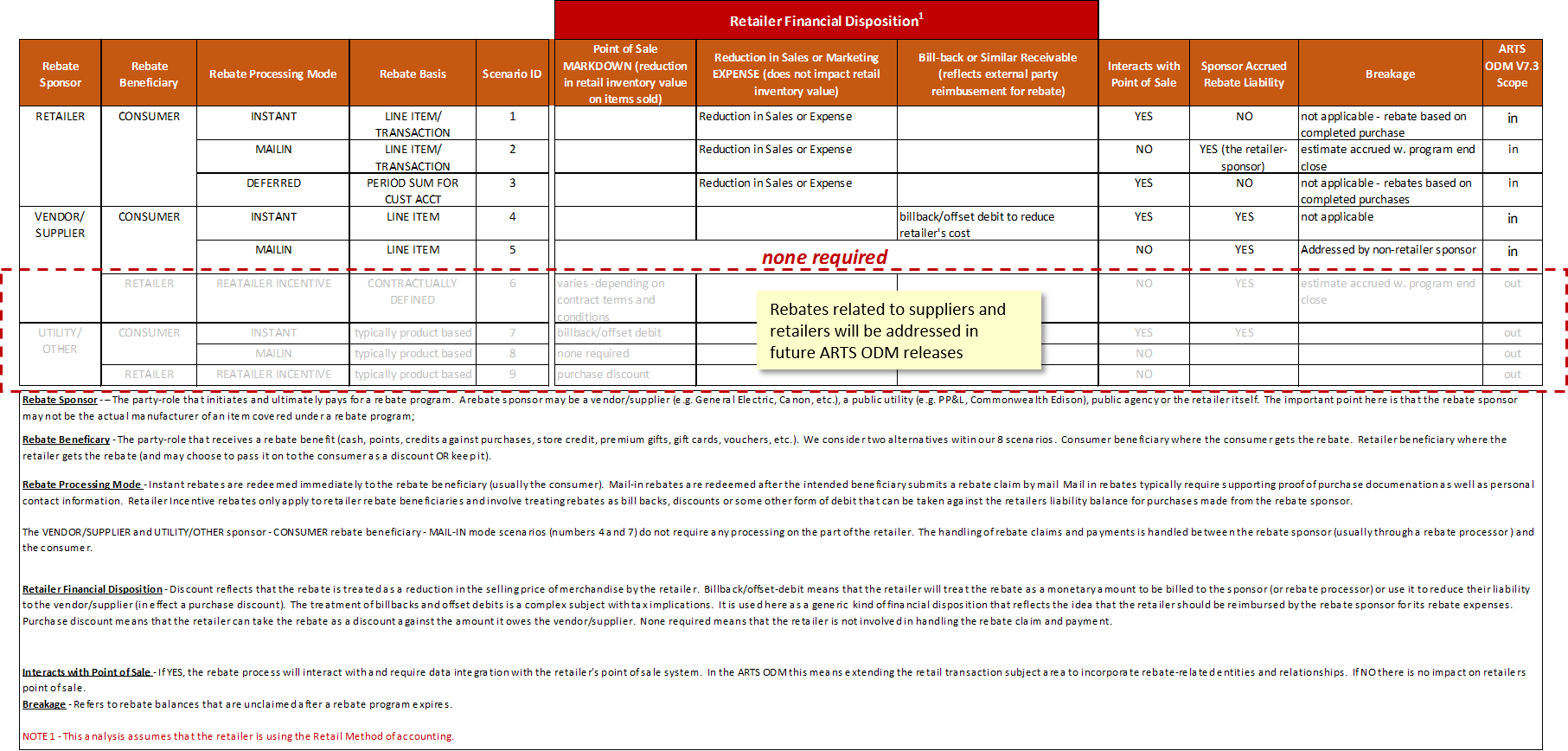

Please prepare an accounting record for a rebate on the purchase of car It is the rebate that the supplier payback to the customer only after the full payment is made The company has to record fixed assets car only 115 000 120 000 5 000 on balance sheet Accounting for vendor rebates can either be complex or easy To make it easy many organizations leverage the aid of financial automation tools Whether you choose to handle rebates accounting manually or automatically there are important things to know We ll cover all the bases in this article

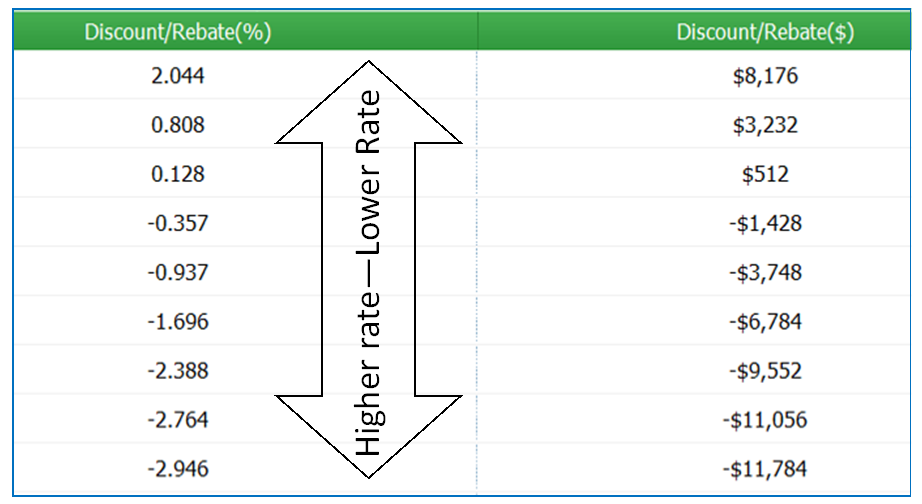

Accounting for rebates can be complex as they must be recorded in a way that reflects their impact on both revenue and expenses accurately The timing of rebate recognition is important as it can affect financial reporting and tax obligations What is Inventory Rebate Accounting The basic idea behind inventory rebate accounting is to determine the value of rebates held in your inventory of goods By recording rebate earnings at the point of sale rather than at the point of purchase you can better track your earnings and expenses

Download How Do You Record A Rebate In Accounting

More picture related to How Do You Record A Rebate In Accounting

How To Enter A Rebate From A Vendor In Quickbooks PEYNAMT

https://i.ytimg.com/vi/0OJrHpgBrpk/maxresdefault.jpg

Creditors Basics In Accounting Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/creditors-purchase-ledger.png

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

https://www.buyvia.com/i/2016/02/mobil-1-rebate-form.png

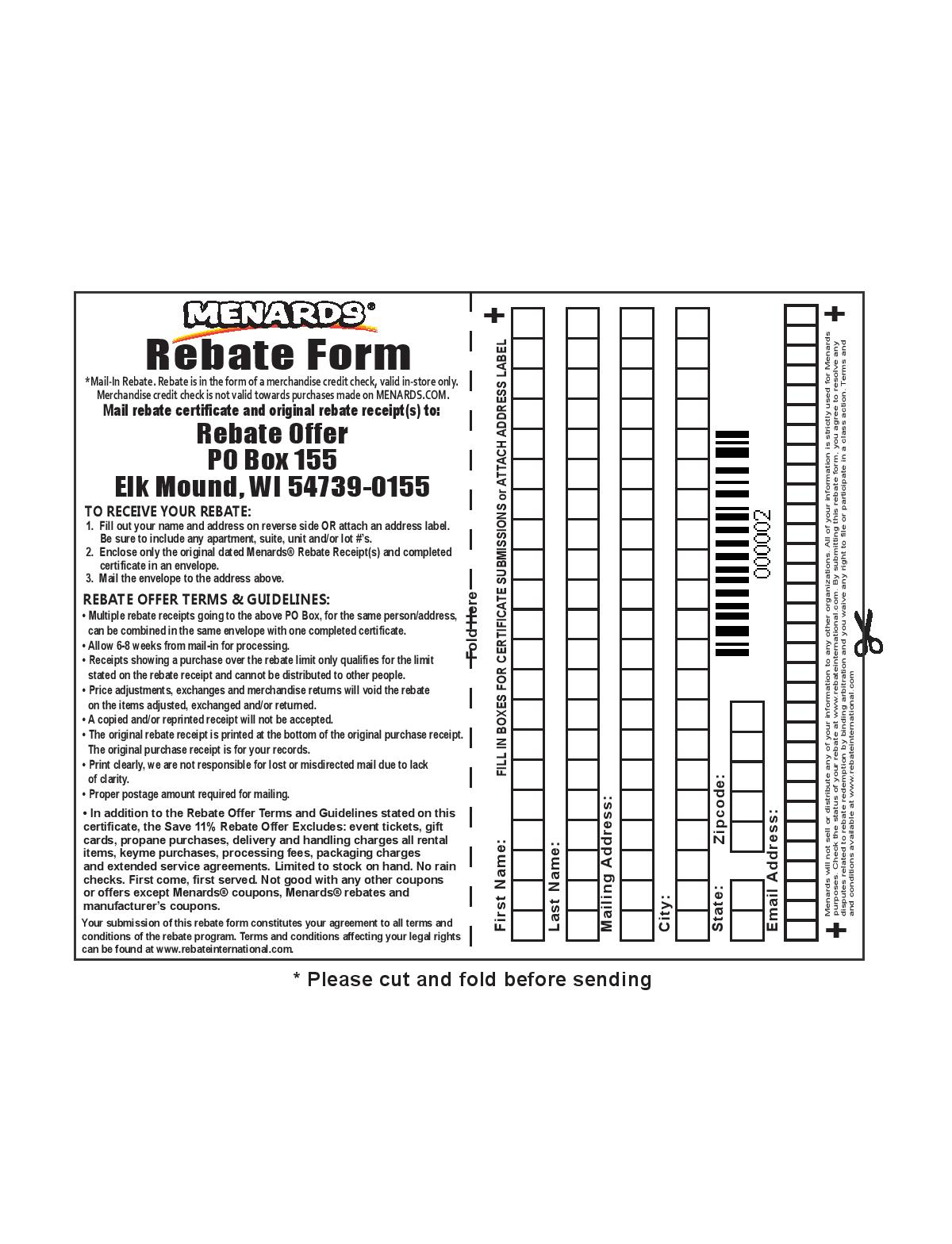

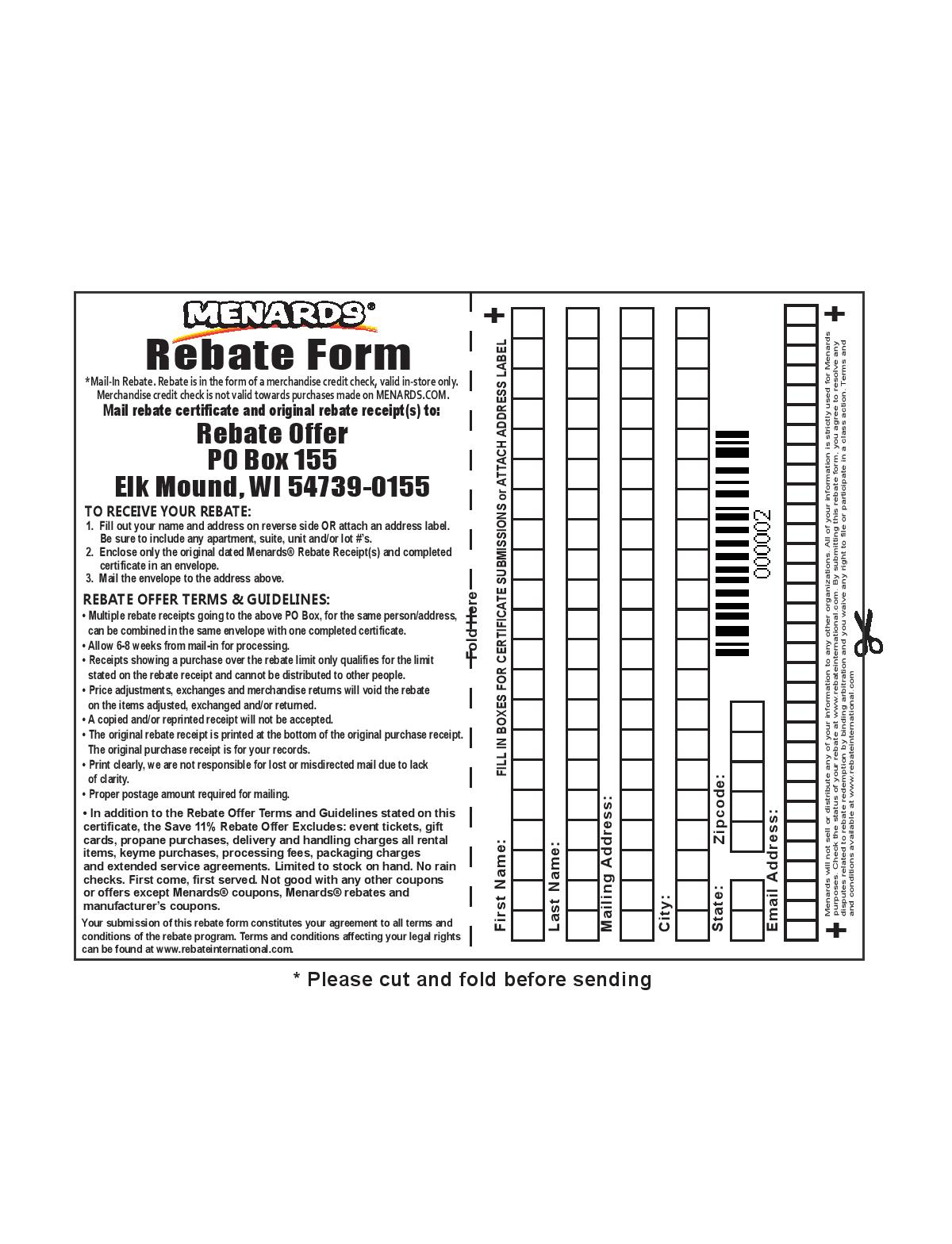

Any inventory related rebate your company receives should not be recorded until receipt is likely Once this occurs the rebate should be recorded as a reduction in the cost of the inventory If the rebate does not arrive when it s expected to it should be recorded as the gross amount Record them according to the rules you set forth for claimed rebates for that particular product or service Then report unclaimed rebates based on state commerce rules

What is the rebate s value and when should it be recorded When should the rebate be recognized in the profit loss account These questions are fundamental to understanding the intricate balance of rebate accounting and forming strong foundations for your accounting and compliance strategies GAAP vs IFRS What You Need to Know A rebate accrual is the amount of rebate that has been earnt but not yet received Learn about year end revenue recognition accrued rebates and more Learn about the importance of rebate accruals the dangers of poor accounting and how to effectively record year end revenue

What Is Rebate GETBATS Blog

https://blog.getbats.com/uploads/images/202104/image_750x_6076631b4a6c9.jpg

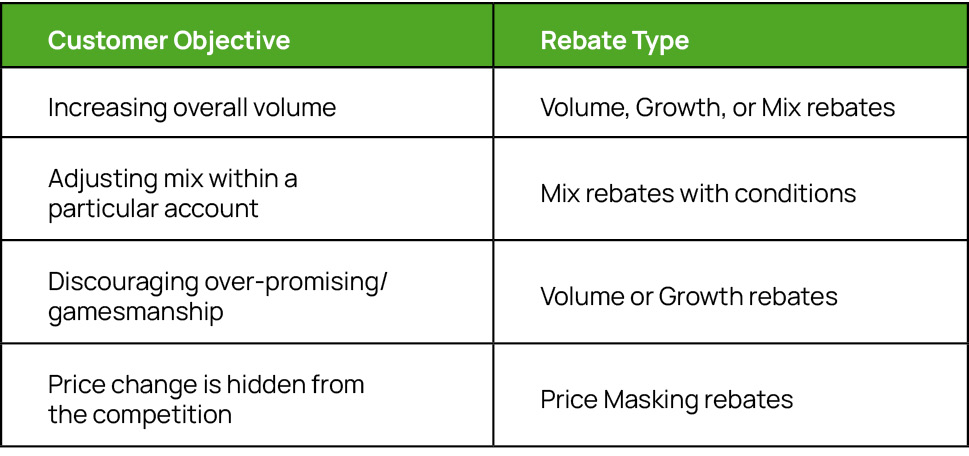

Best Practices For B2B Price Rebates And Incentives Vendavo

https://www.vendavo.com/wp-content/uploads/2022/08/Common-Customer-Objectives-and-Rebate-Types.jpg

https://www.solvexia.com/blog/rebate-accounting...

While you re likely familiar with the concept of a rebate we are going to break down the different types of rebates to determine the proper accounting procedures From a vendor rebate accounting entry to customer rebates accounting this

https://www.vendavo.com/rebates/accounting-for-rebates

How Do You Record Customer Rebates in Accounting Customer rebates are recorded by estimating the expected amount to be redeemed and setting this aside as a liability on the balance sheet As customers redeem their rebates actual expenses against these liabilities are recognized reducing both the liability account and

General Journal In Accounting Double Entry Bookkeeping

What Is Rebate GETBATS Blog

Understanding Customer Rebates

Sales Return Double Entry Bookkeeping

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

Printable Menards Rebate Form 2022 MenardsRebate Form

Printable Menards Rebate Form 2022 MenardsRebate Form

Supplier Rebate Agreement Template Awesome Template Collections

External Pair Maker Rebate Set To Form An External Door Pair Wooden

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

How Do You Record A Rebate In Accounting - I ve got the steps that you need in recording your sales rebate in QuickBooks Online You can create a refund for the rebate amount since this was given after the sales receipt was recorded This way you can track the discount that you gave