How Do You Record Rebates In Accounting Verkko 7 hein 228 k 2022 nbsp 0183 32 How do you record rebates in accounting Once recognised the rebate should be recorded as a reduction to the cost of the related inventory Other rebate A rebate that does not in substance relate to the inventory purchase for example contributions to promotional costs The appropriate accounting treatment will depend

Verkko Journal Entry for Rebate Received When the company receives a rebate from the supplier they will recognize cash received and the decrease in purchase items It is considered as the price adjustment over the purchase of the asset The company cannot record it as revenue Verkko 1 What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are Unclaimed Rebates 7 How to Account for Coupons 8 How to Pay Rebates to Vendors 9 What are Accounting Challenges

How Do You Record Rebates In Accounting

How Do You Record Rebates In Accounting

https://dahlheimerbeverage.com/wp-content/uploads/2021/11/Labatt-for-Web-scaled.jpg

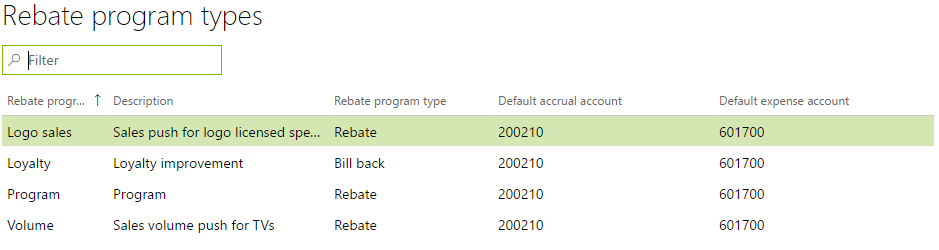

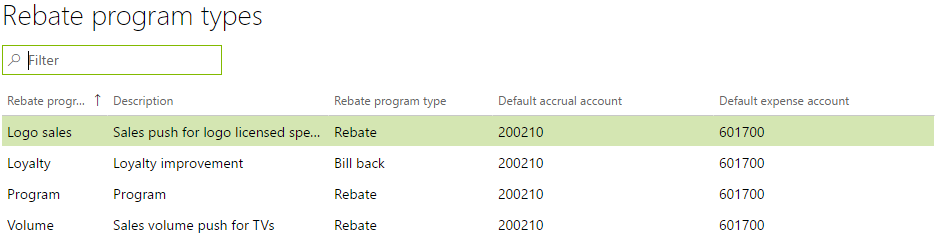

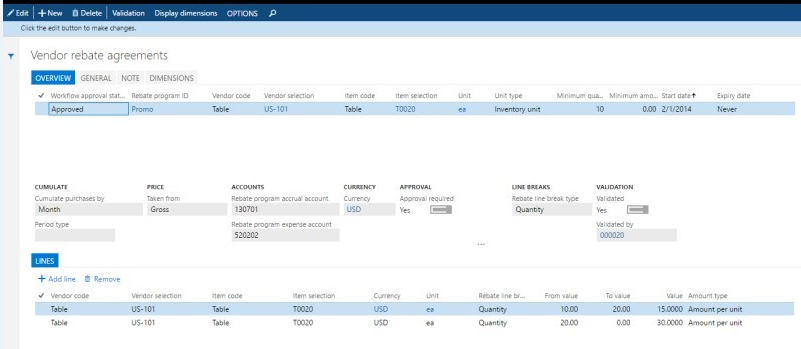

Managing Rebates In Dynamics 365 For Operations AXSource

https://www.axsource.com/wp-content/uploads/2017/03/1.png

Inventory Rebate Accounting YouTube

https://i.ytimg.com/vi/71a4k8QUX14/maxresdefault.jpg

Verkko What is Inventory Rebate Accounting The basic idea behind inventory rebate accounting is to determine the value of rebates held in your inventory of goods By recording rebate earnings at the point of sale rather than at the point of purchase you can better track your earnings and expenses Verkko based rebates Recognise once receipt is probable Once recognised the rebate should be recorded as a reduction to the cost of the related inventory Other rebate A rebate that does not in substance relate to the inventory purchase for example contributions to promotional costs The appropriate accounting treatment will

Verkko 6 toukok 2011 nbsp 0183 32 Keeping an accounting record of sales rebates is of help in tracking the effectiveness of a sales promotion campaign but also in identifying any problems arising with the offered rebates For example some types of rebates require some effort on the part of the customer in registering purchases and applying for the rebate Verkko 1 Understanding the rebate agreements Core business systems are often inadequate for capturing and representing agreed rebate deals When you add the subjectivity that rebate agreements can be viewed with into the mix the result can be a misaligned understanding and incorrect calculation of amounts due

Download How Do You Record Rebates In Accounting

More picture related to How Do You Record Rebates In Accounting

Do It Best Announces Record Member Rebates Do It Best

https://www.doitbestonline.com/wp-content/uploads/2020/08/75th-e1598014616873-1024x658.jpg

7 Common Problems With Accounting For Rebates Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/6260910834340727abf5d333_Key Articles41.jpg

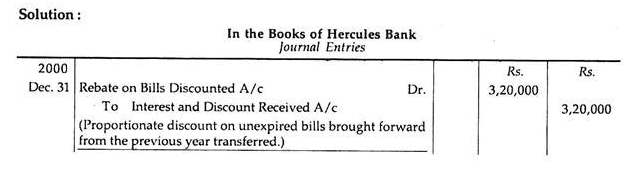

Rebate On Bills Discounted Banking Company Accounts Advanced

https://cdn3.edurev.in/ApplicationImages/Temp/1929415_df74beb8-99ec-40db-a1bc-05215d47894d_lg.PNG

Verkko To regain control over accrued rebates companies must take a hard look at their current rebate accounting processes and if necessary implement a rebate management solution to address the gaps that some accounting systems leave behind See how Enable can help you regain control Verkko 9 jouluk 2022 nbsp 0183 32 How To Use Rebates Accounting Procedures Challenges amp Solutions By Hashmicro December 9 2022 0 923 In today s fast paced markets rebates are used frequently particularly in retail businesses centred on e commerce Rebate accounting requires much knowledge There is a lot to know about rebate accounting to do it

Verkko 1 Spreadsheet replacement Manual rebate accounting processes such as calculating rebates in financial spreadsheets can t successfully do the job alone in large companies or in fact even in small companies if they re managing complex trade agreements with various combinations of rebate arrangements Verkko 29 marrask 2018 nbsp 0183 32 Record them according to the rules you set forth for claimed rebates for that particular product or service Then report unclaimed rebates based on state commerce rules

Free Online Screen Recorder Video Editor RecordCast Review 2022

https://www.letsbuymore.com/wp-content/uploads/2021/08/RecordCast.jpg

Accounting For Vendor Rebates Procedures Challenges

https://uploads-ssl.webflow.com/60e3caa50ec2a701bbf83598/624d0b0723154505a6bb1d1d_Untitled design-67-min.jpg

https://www.timesmojo.com/how-are-rebates-recorded-in-accounting

Verkko 7 hein 228 k 2022 nbsp 0183 32 How do you record rebates in accounting Once recognised the rebate should be recorded as a reduction to the cost of the related inventory Other rebate A rebate that does not in substance relate to the inventory purchase for example contributions to promotional costs The appropriate accounting treatment will depend

https://accountinginside.com/journal-entry-for-rebate-received

Verkko Journal Entry for Rebate Received When the company receives a rebate from the supplier they will recognize cash received and the decrease in purchase items It is considered as the price adjustment over the purchase of the asset The company cannot record it as revenue

Rebate Calculations 101 How Are Rebates Calculated Enable

Free Online Screen Recorder Video Editor RecordCast Review 2022

How To Find The Best Car Incentives And Rebates Capital One Auto

Ben Horowitz Quote If You Have Never Done The Job How Do You Know

Tax Credits Save You More Than Deductions Here Are The Best Ones

Rebates Management Accounting For Rebates Supply Chain Products

Rebates Management Accounting For Rebates Supply Chain Products

Printable Medication Administration Record Template Printable JD

Vendor Rebates Supply Chain Management Dynamics 365 Microsoft Learn

Working Capital Calculation Double Entry Bookkeeping My XXX Hot Girl

How Do You Record Rebates In Accounting - Verkko 6 toukok 2011 nbsp 0183 32 Keeping an accounting record of sales rebates is of help in tracking the effectiveness of a sales promotion campaign but also in identifying any problems arising with the offered rebates For example some types of rebates require some effort on the part of the customer in registering purchases and applying for the rebate