How Does Buying A Home Affect Your Income Tax Return How much you save from the tax benefits of owning a home depends largely on your filing status and income

Since certain closing costs and home improvements can increase the basis of your home it is important to keep your receipts to have proof of the increased basis Increasing In this article we ll break down how much money you can get back in taxes for buying a house based on a hypothetical homeowner to see if they ll get the most tax benefit from itemizing their taxes or taking

How Does Buying A Home Affect Your Income Tax Return

How Does Buying A Home Affect Your Income Tax Return

https://rupiko.in/wp-content/uploads/2019/07/2-Tax-Guide.jpg

Income Tax Return Filing These 14 Mistakes In ITR Can Fetch You A Tax

https://i0.wp.com/smartbuybuddy.com/wp-content/uploads/2020/11/Income-Tax-Return-Filing-These-14-mistakes-in-ITR-can-fetch-you-a-tax-notice.jpg

File Your Income Tax Return Before 31st July Avoid Penalties And

https://media.licdn.com/dms/image/D4D22AQHYs2sW8njWog/feedshare-shrink_2048_1536/0/1688451839032?e=1696464000&v=beta&t=qyRgq8hyyaxEFvjW2gS5wVny9zxOWtObhTZBRO6YDpU

Buying Your First Home Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 December 11 2023 11 02 AM Each point that you buy generally costs 1 of the total loan and lowers your interest rate by 0 25 For example if you paid 300 000 for your home each point would equal 3 000 300 000 1

What does buying a home mean for my taxes Congrats on your new home There are deductions available to you as a homeowner that can reduce your tax bill Here are This change could add a tax credit to the breaks that some homebuyers can claim The First Time Homebuyer Act of 2021 provides for a credit equal to 10 of the purchase price of your home up to a

Download How Does Buying A Home Affect Your Income Tax Return

More picture related to How Does Buying A Home Affect Your Income Tax Return

Hecht Group The Difference Between Rent And Property Taxes For

https://img.hechtgroup.com/1663757236783.png

Income Tax Return Translation Services

https://farsitranslatehouston.files.wordpress.com/2016/12/how-to-file-my-own-taxes.jpg?w=1400

Tax TDS Return Service Income Tax Return Filing Service Service

https://5.imimg.com/data5/SELLER/Default/2021/8/AG/HU/SJ/5567237/income-tax-return-filing-service-500x500.png

Homefinity can help There s no way around it buying a home is expensive Mortgage debt and interest payments not to mention saving for a down payment can be daunting But by taking advantage of Yes in some ways you ll see that buying a home will help with taxes However taxes as a homeowner are a bit more complicated than what you may be used

Taxes 8 minute read File your taxes with confidence Your max tax refund is guaranteed Start Your Return Updated for tax season 2021 and 2022 Buying a home can help The standard deduction is a flat dollar amount you can deduct from your taxable income for the year The amount you can deduct is based on your filing status

What Is The Method Required To E File Income Tax Return

https://s3.amazonaws.com/lms24x7/gsktestimonials/uploads/2022/04/14164253/e-File-Income-Tax-Return-1024x512.jpg

Analysis Of Provisions Of Income Tax Notices Issued

https://carajput.com/blog/wp-content/uploads/2015/09/section-143-1-of-income-tax.-1024x707.jpg

https://www.forbes.com/advisor/mortga…

How much you save from the tax benefits of owning a home depends largely on your filing status and income

https://www.hrblock.com/tax-center/filing/personal...

Since certain closing costs and home improvements can increase the basis of your home it is important to keep your receipts to have proof of the increased basis Increasing

Non Filers Asked To Submit Income Tax Returns Within 21 Days Advisory

What Is The Method Required To E File Income Tax Return

Pin On Income Tax Filing

Everything You Need To Know About Filing Your Income Tax Return Online

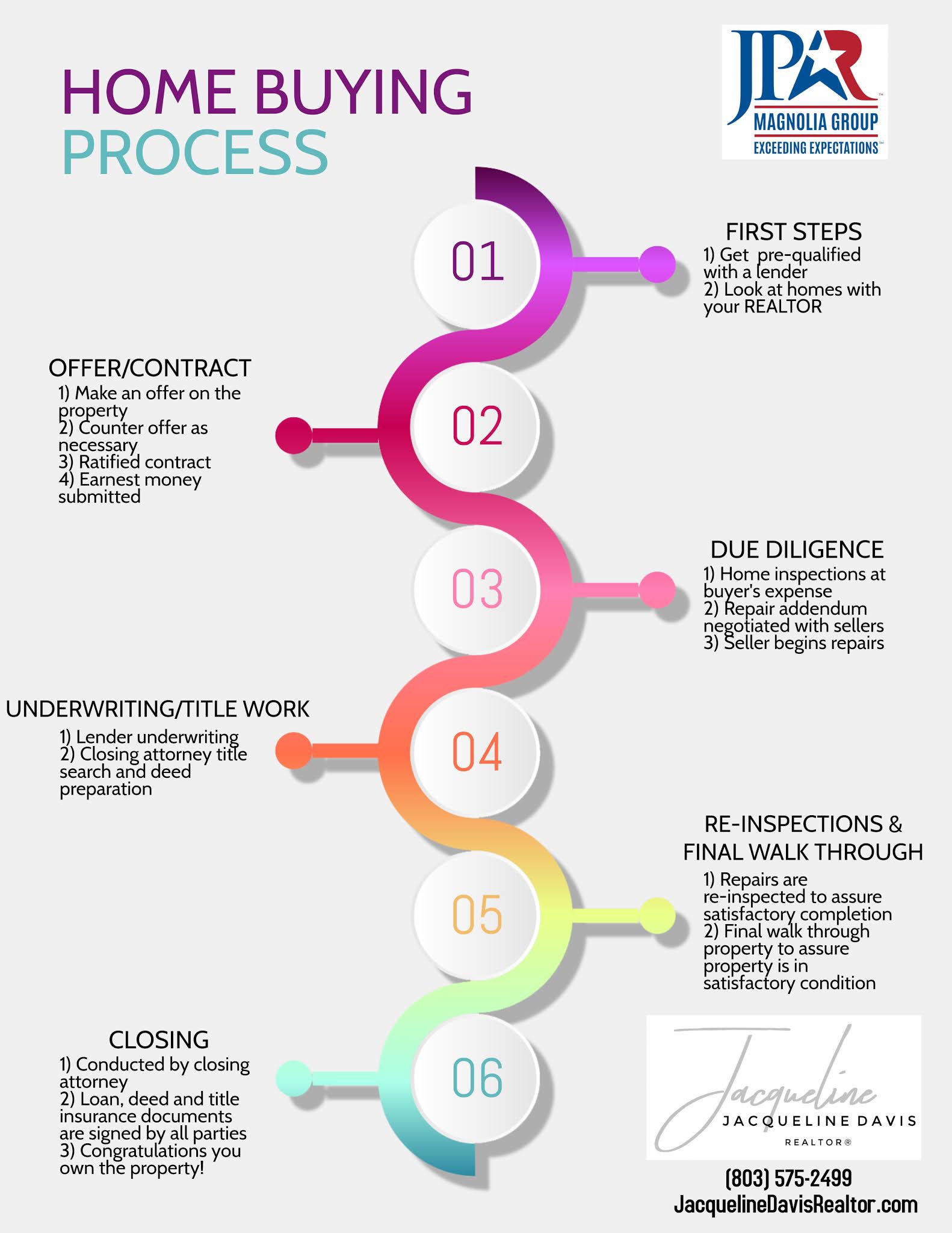

The Home Buying Process

Income Tax EFiling Advalyze

Income Tax EFiling Advalyze

Income Tax No ITR Refund Till You Verify It Here s How To Do It

Extension Of Timelines For Filing Of Income tax Returns And Various

The Triangle Home Buying Process The Jim Allen Group

How Does Buying A Home Affect Your Income Tax Return - This change could add a tax credit to the breaks that some homebuyers can claim The First Time Homebuyer Act of 2021 provides for a credit equal to 10 of the purchase price of your home up to a