How Does Owning A House Affect Your Taxes 1 Mortgage points 2 Moving expenses 4 Mortgage interest 5 Property tax 6 Home equity debt 7 Mortgage insurance PMI 10 Mortgage credit certificate 11 Home improvements Taxes and buying a house or discount points because the figure is calculated as a percentage point of your loan

In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine how to take advantage for your own tax situation Here s what you need to know A The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed Although that income is not taxed homeowners still may deduct mortgage interest and property tax payments as well as certain other expenses from their federal taxable income if they itemize their deductions

How Does Owning A House Affect Your Taxes

How Does Owning A House Affect Your Taxes

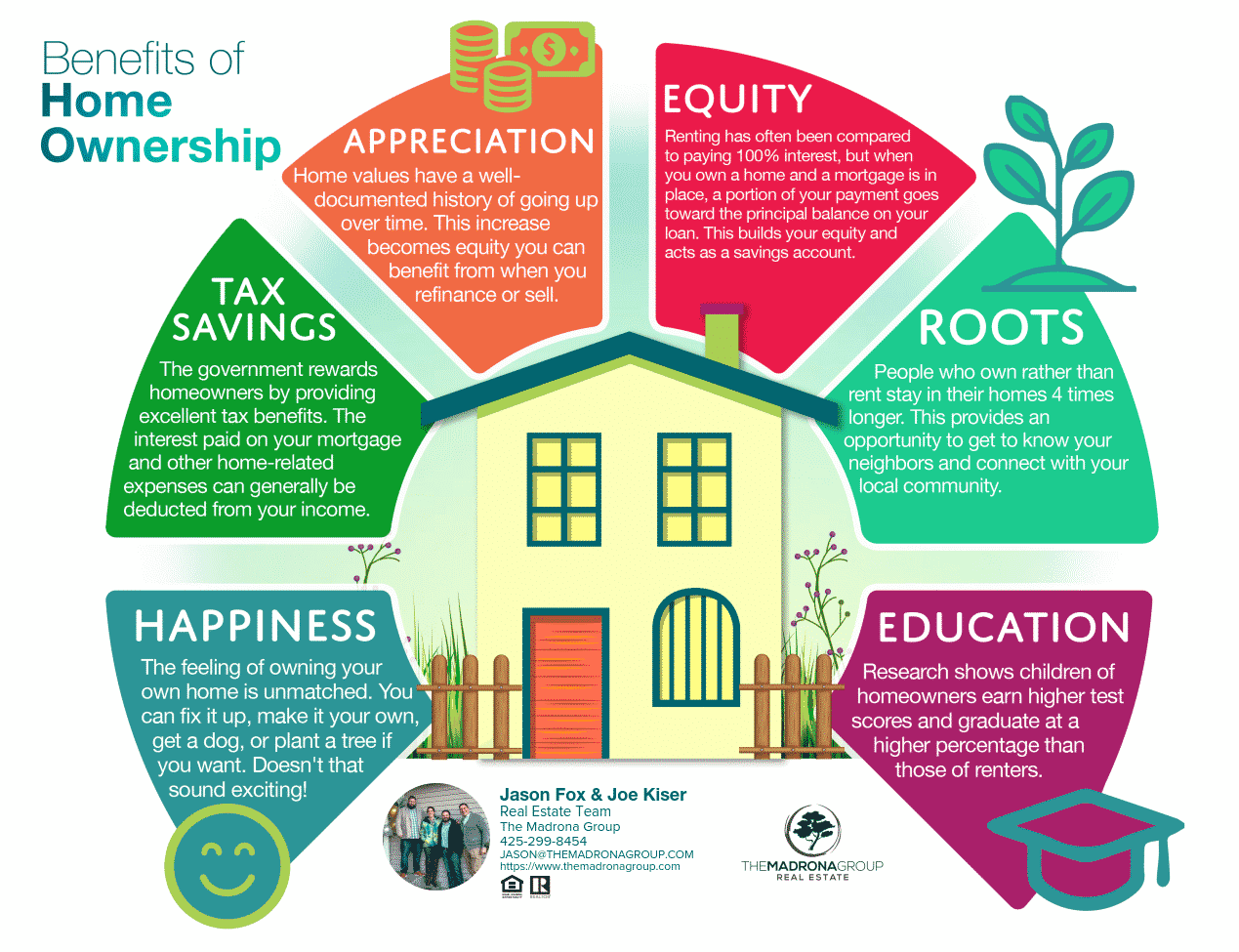

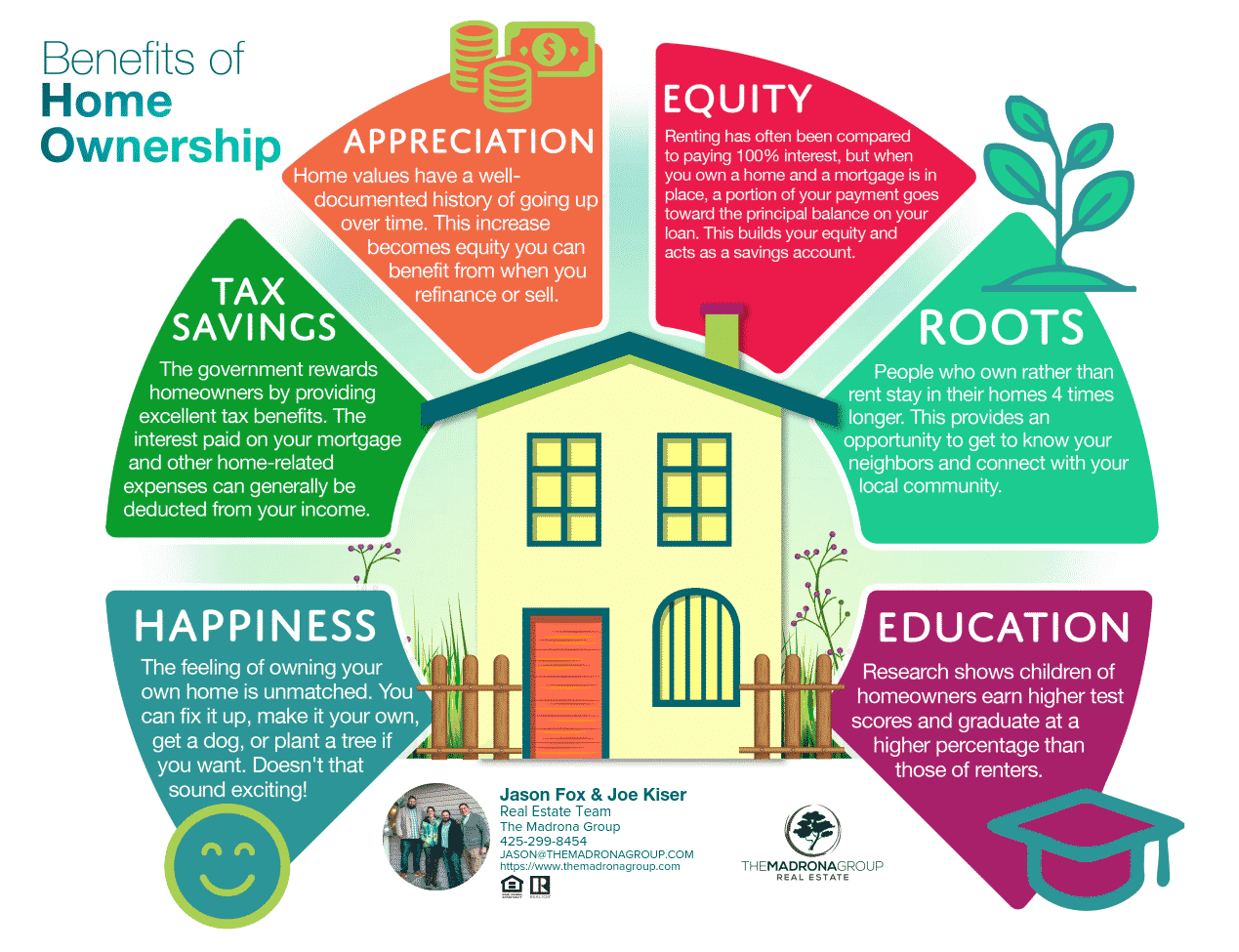

https://www.themadronagroup.com/wp-content/uploads/2019/02/6-Benefits-of-Home-Ownership.png

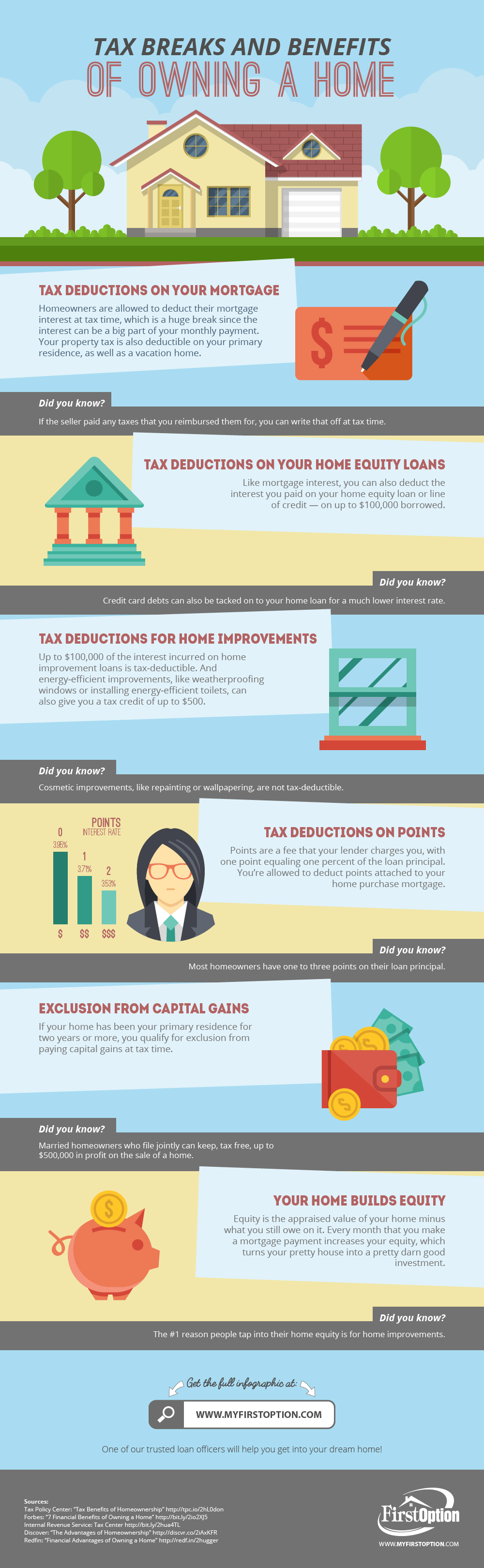

Tax Benefits Of Buying Owning A Home In 2012 2013

http://www.letsdotaxes.com/wp-content/uploads/2012/10/Tax-benefits-of-owning-a-house.png

How Does Buying A House Affect Taxes Better Mortgage

https://images.ctfassets.net/bxq7a6k69auc/2GNiROCjUrHHUB4QfMWoUv/3c8d23aaa138ff660b5b18f360cfa913/1185___How_does_buying_a_house_affect_taxes_Blog_800x420_Final_mockup.jpg

The tax code grants tax benefits that reduce your costs of buying owning fixing up and selling a home Here are brief descriptions of tax benefits of owning a home the deductions Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize Non deductible payments and expenses Homeowners can t deduct any of the following

Tax Implications of Buying or Selling a House Whether you are buying or selling a house the process can be quite stressful especially when thinking about potential tax implications Let s look at the documents you need to For most people the biggest tax break from owning a home comes from deducting mortgage interest For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve your home

Download How Does Owning A House Affect Your Taxes

More picture related to How Does Owning A House Affect Your Taxes

How Does Buying A House AFFECT Your TAXES YouTube

https://i.ytimg.com/vi/J8srR8ZF8pQ/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYSSBIKGUwDw==&rs=AOn4CLDBKTMEHwrGmkDHWisjVAY4rumM4w

Tax Breaks And Benefits Of Owning A Home

https://www.firstoptiononline.com/wp-content/uploads/2017/01/Taxes-and-Home-ownership.png

What You Should Know When Buying A Home Perfect Agent

https://perfectagent.com.au/wp-content/uploads/2018/06/Buying-a-Home.jpg

Property tax deduction and mortgage interest deduction Your house payment includes both interest and principal payments You may also pay insurance and property tax payments to an escrow account managed by your mortgage holder Your mortgage holder in turn pays your home insurance and property taxes when they re due The Tax Benefits of Owning a Home Mortgage interest Property taxes Energy efficiency upgrades A home office Home improvements to age in place Interest on a home equity line of credit How To

Owning a home can offer some unique financial benefits including appreciation and a potentially lower monthly cost compared to renting But you might be wondering Does buying a house help with taxes The short answer is yes there are numerous tax benefits associated with homeownership Buying a house could reduce your federal tax bill if you pay a significant amount of interest on your mortgage But you ll have to itemize deductions to benefit Pay off high rate debt with a personal loan and save thousands

How Does Selling Your House Affect Your Taxes

https://cosmic-s3.imgix.net/296aeb60-cb3c-11e9-afa5-994980bbf461-how_does_selling_your_house_affect_your_taxes-ogid-33975.jpg?auto=format&w=768&q=50

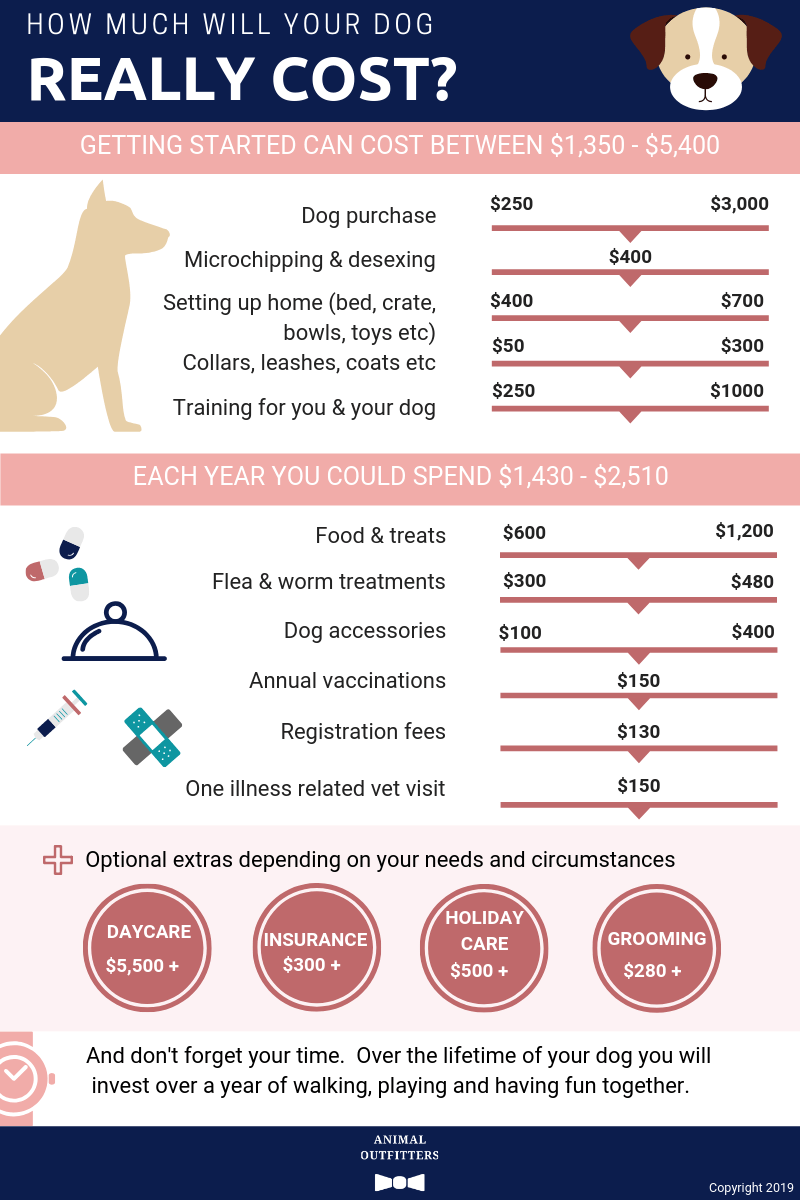

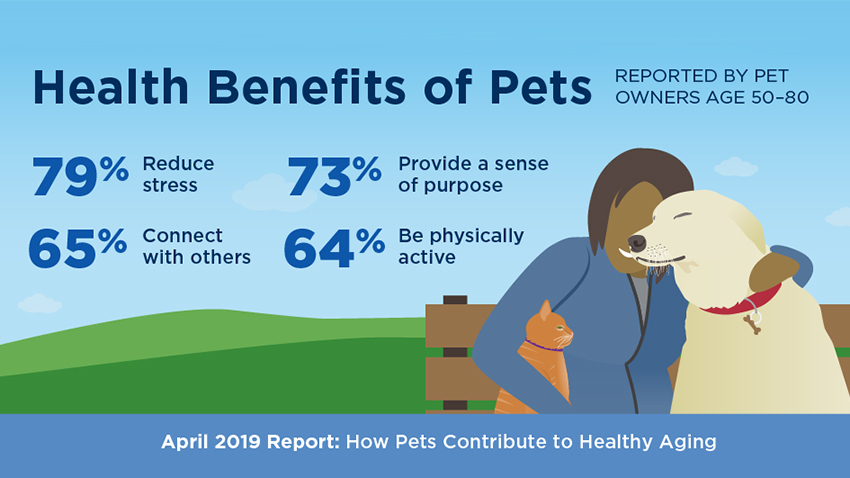

Benefits Of Owning A Pet Infographic Animal Infographic Save A Dog Dogs

https://i.pinimg.com/originals/6c/24/19/6c24195fb0ec8c13c9fff80098f3e6f6.jpg

https://better.com/content/how-does-buying-a-house-affect-taxes

1 Mortgage points 2 Moving expenses 4 Mortgage interest 5 Property tax 6 Home equity debt 7 Mortgage insurance PMI 10 Mortgage credit certificate 11 Home improvements Taxes and buying a house or discount points because the figure is calculated as a percentage point of your loan

https://smartasset.com/taxes/tax-benefits-of-owning-a-home

In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine how to take advantage for your own tax situation Here s what you need to know

What Are The Costs Of Owning A Dog Animal Outfitters Cat Dog

How Does Selling Your House Affect Your Taxes

How Does Owning A Pet Affect Physical Health 2022 Animalia life club

Taxes Are Almost Due File On Time With These Helpful Homeownership Tax

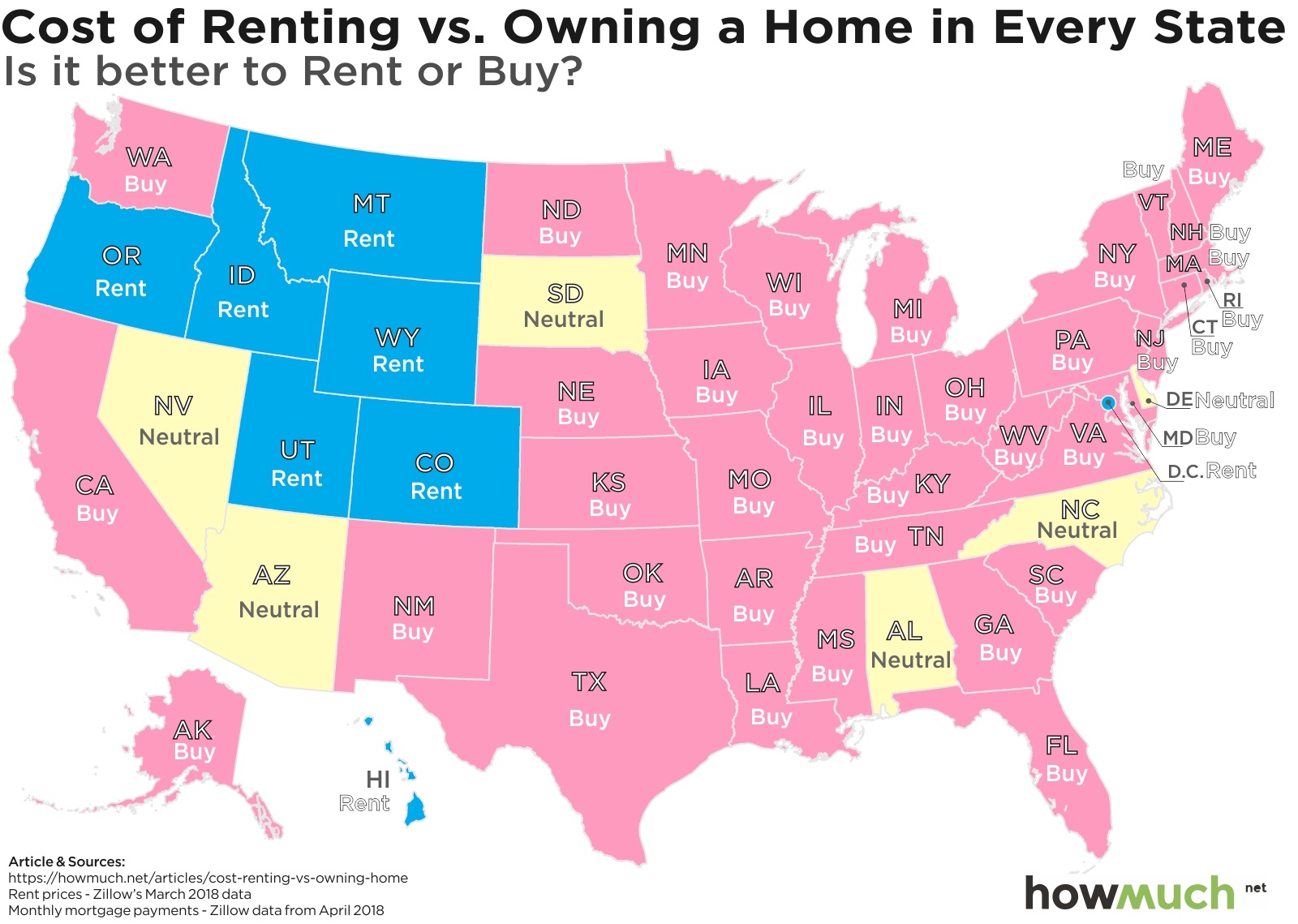

Cost Of Renting Vs Buying A Home

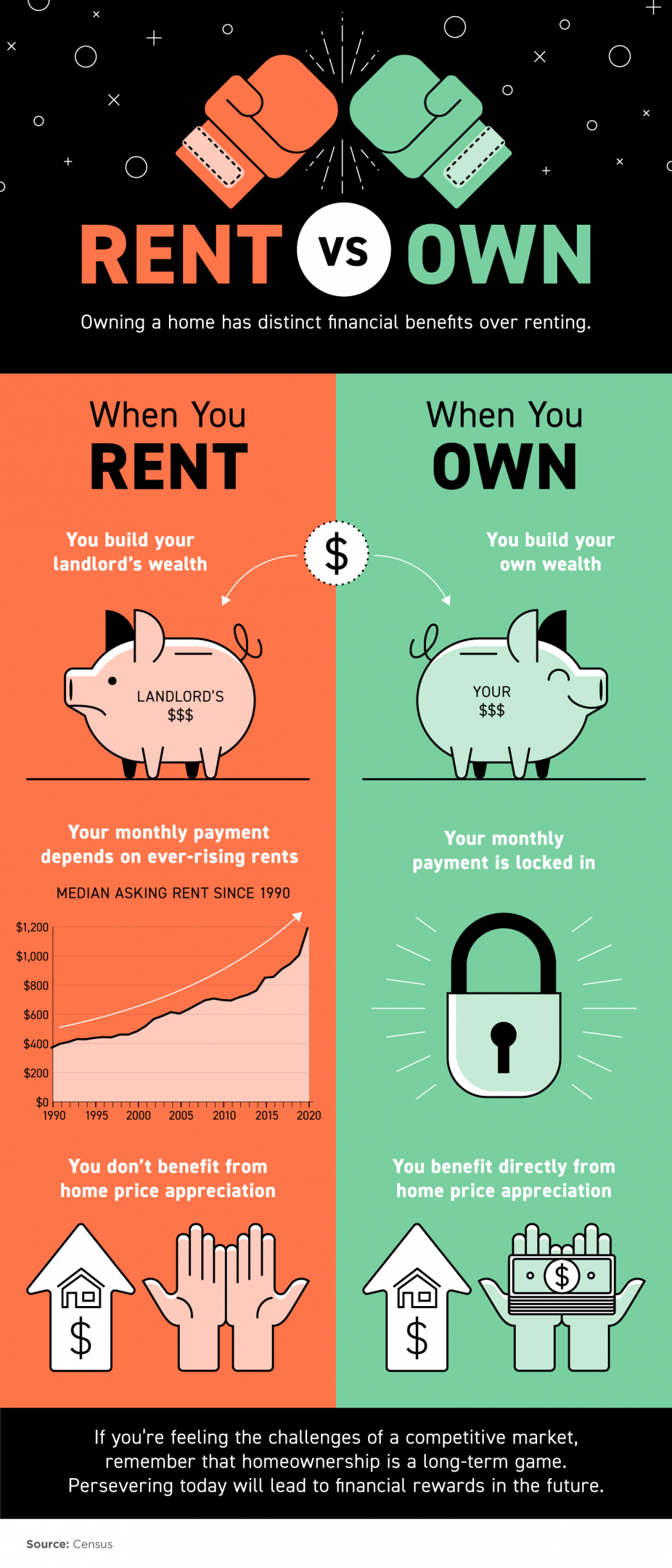

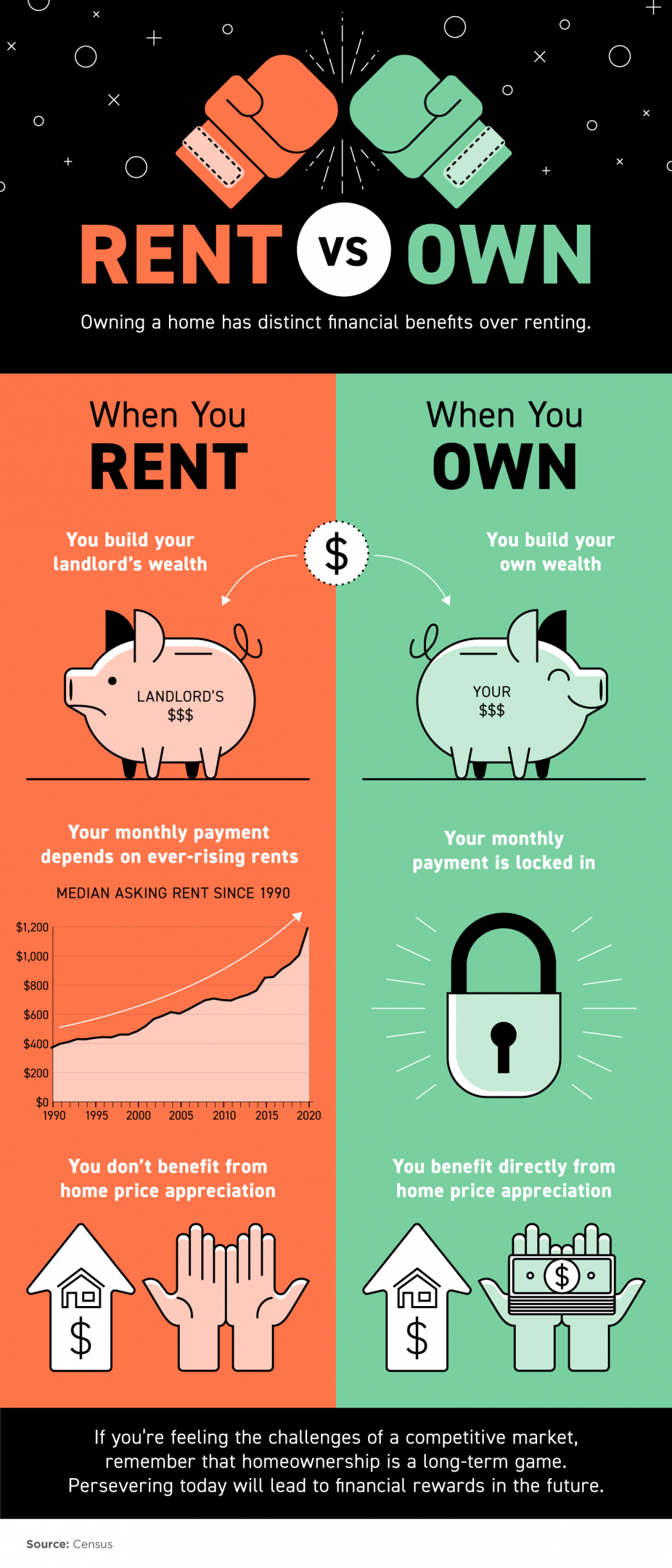

Owning A Home Has Distinct Financial Benefits Over Renting INFOGRAPHIC

Owning A Home Has Distinct Financial Benefits Over Renting INFOGRAPHIC

The Cost Of Renting Vs Buying A Home In Every State

What Are The Benefits Of Owning A Home

Benefits Of Owning A Home Conrad Real Estate

How Does Owning A House Affect Your Taxes - The tax code grants tax benefits that reduce your costs of buying owning fixing up and selling a home Here are brief descriptions of tax benefits of owning a home the deductions