How Does Parenthood Tax Rebate Work Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent child The child must be a The Parenthood Tax Rebate PTR scheme is a one time tax abatement that can be claimed in the year following a child s birth though any child born after 2008 is currently

How Does Parenthood Tax Rebate Work

.png?sfvrsn=d0aa2658_3)

How Does Parenthood Tax Rebate Work

https://www.iras.gov.sg/images/default-source/assets/example-on-sharing-of-parent-relief-(staying).png?sfvrsn=d0aa2658_3

What Is Parenthood Tax Rebate In 2023 Heads Up Mom

https://headsupmom.com/wp-content/uploads/2022/12/What-is-Parenthood-Tax-Rebate-1024x576.jpg

All About The Parenthood Tax Rebate In Singapore 2023

https://www.smartparents.sg/sites/default/files/styles/fbimage/public/2021-07/Mother and newborn baby.jpg?itok=q1-OJ2zD

Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth SCHEME HIGHLIGHTS Tax rebate of up to 20 000 per child for eligible parents Parenthood Tax Rebate PTR may be shared between parents based on an

The Parenthood Tax Rebate serves as an essential support mechanism for Singaporean families aiming to alleviate the financial burdens associated with raising The Parenthood Tax Rebate PTR is a one time tax abatement that can be claimed in the year following your child s birth Each qualifying child entitles you to a rebate of up to 20 000 making it a fantastic incentive to

Download How Does Parenthood Tax Rebate Work

More picture related to How Does Parenthood Tax Rebate Work

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i2.wp.com/www.theastuteparent.com/wp-content/uploads/2016/03/p-e1459570743699.jpg?fit=800%2C568&ssl=1

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Qualifying Child Relief QCR and Child Relief Disability are given to parents to recognise their efforts in supporting their children On this page Qualifying for relief Determining Parenthood Tax Rebate PTR You and your spouse may share the rebate based on an apportionment agreed by both of you

The Parenthood Tax Rebate PTR is easily the most available tax rebate for most parents in Singapore The PTR was implemented to encourage families to have What Parenthood Tax Rebate PTR Who can claim Parents Married divorced or widowed Singaporeans Eligibility Your child has to be born a Singapore citizen or become one within the 12 months from birth

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/rent-rebate-form-1-free-templates-in-pdf-word-excel-download-15.png?fit=768%2C1024&ssl=1

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

https://cdn-blog.seedly.sg/wp-content/uploads/2022/09/27154053/Baby-Bonus-Parenthood-Tax-Rebate-More_-Perks-For-Making-Babies-768x403.png

.png?sfvrsn=d0aa2658_3?w=186)

https://parentology.sg/complete-guide-t…

Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

https://www.madeforfamilies.gov.sg/sup…

If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent child The child must be a

A Complete Guide To The Parenthood Tax Rebate PTR Parentology

Form For Renters Rebate RentersRebate

How Does Uniform Tax Rebate Work Tax Refund Tax Rebates

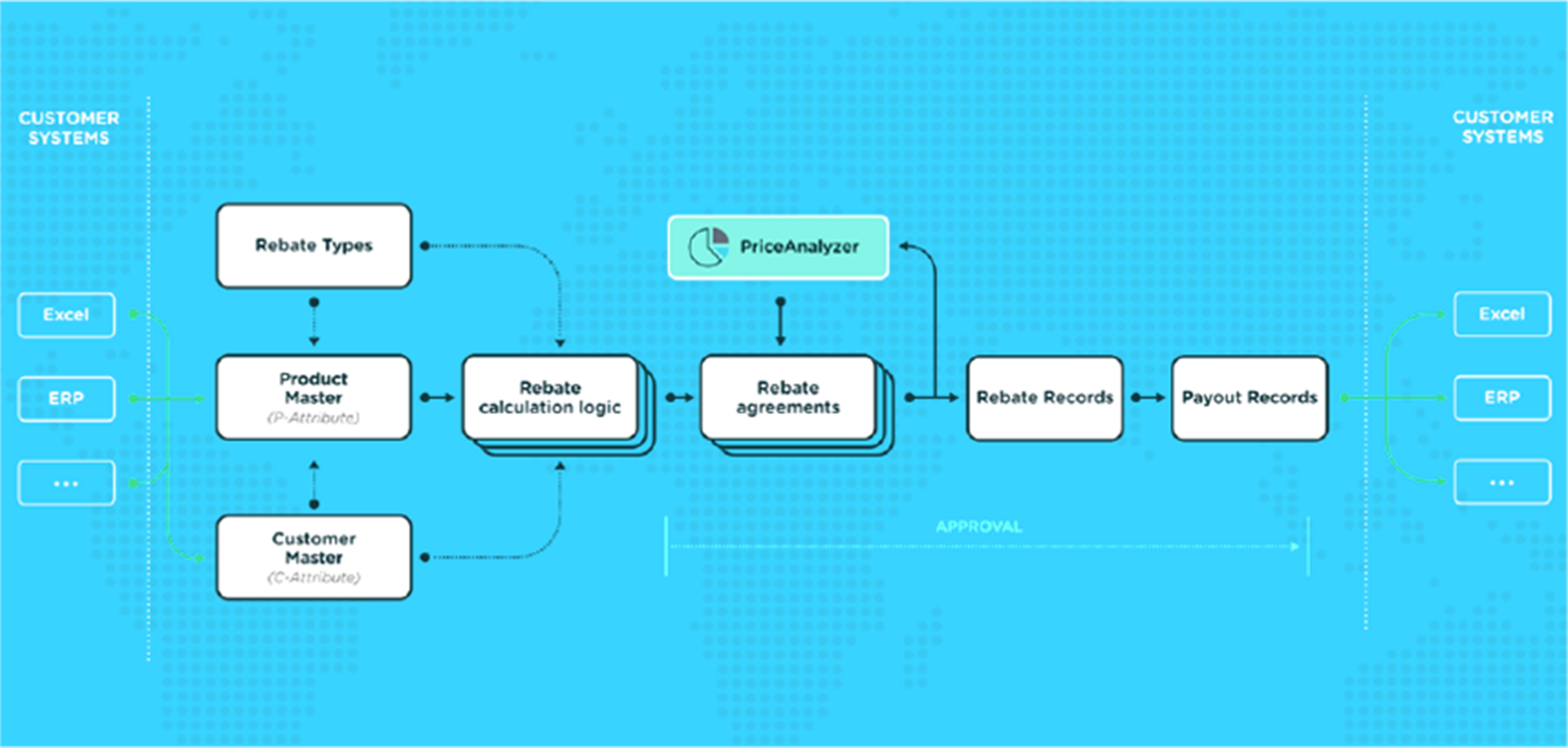

RebateManager Don t Get Stuck In Rebate Management Hell Pricefx

Tax Rebate Service No Rebate No Fee MBL Accounting

Take A Look What The Cast Of Parenthood Look Like Now

Take A Look What The Cast Of Parenthood Look Like Now

Parenthood Pays Off Singapore s Tax Rebate For Families

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

How Does Parenthood Tax Rebate Work - The Parenthood Tax Rebate serves as an essential support mechanism for Singaporean families aiming to alleviate the financial burdens associated with raising