How Does The Solar Tax Credit Work The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

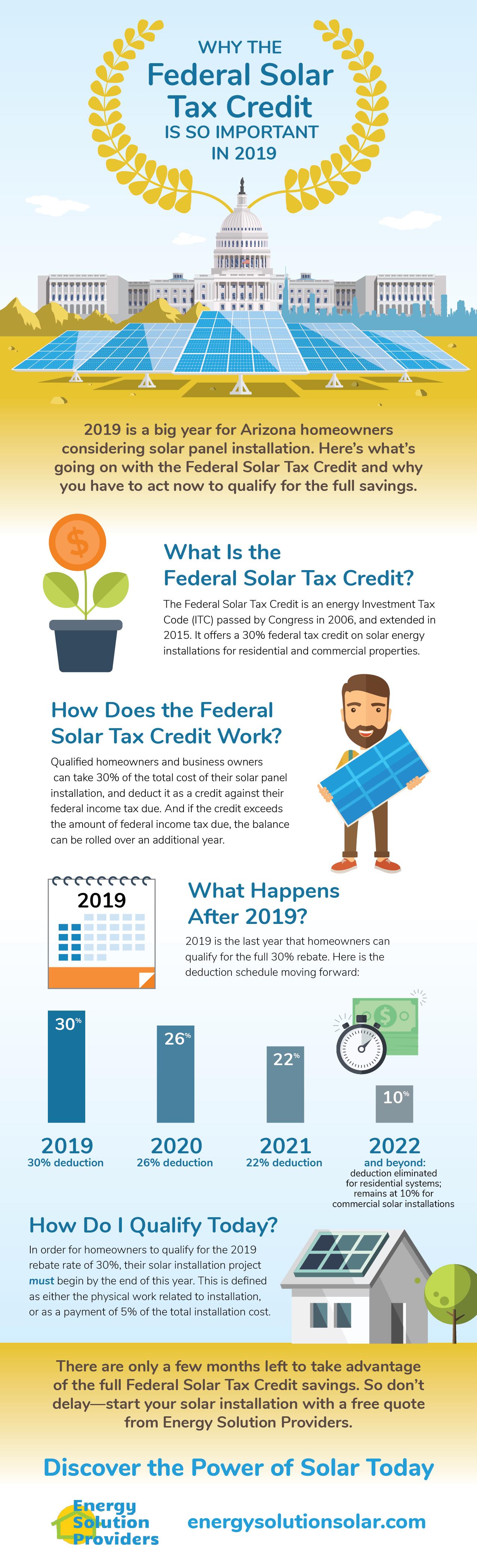

How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

How Does The Solar Tax Credit Work

How Does The Solar Tax Credit Work

https://njsolarpower.com/wp-content/uploads/2021/05/iStock-697170112.jpg

How Does The Solar Tax Credit Work Solar Energy Solutions

https://www.sesre.com/wp-content/uploads/2023/09/how-does-the-solar-tax-credit-work.webp

How Does The Solar Tax Credit Work Find Solar Installers Near Me

https://findsolarinstallersnearme.com/wp-content/uploads/2021/11/how-does-the-solar-tax-credit-work-scaled-1-2048x1367.jpg

For example if you installed solar panels on your home in 2024 and paid 10 000 you could claim 30 or 3 000 So if you owe 2 000 in taxes you can apply 2 000 of your solar tax credit to How Does The Federal Solar Tax Credit Work Dollar for dollar the federal solar tax credit is the greatest economic incentive for homeowners to invest in solar panels and or battery storage With a Read More

How does the solar tax credit work Once you ve completed your eligible solar project you can claim this credit the next time you file your federal income taxes Tax credits give you a dollar for dollar reduction in your tax bill The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for

Download How Does The Solar Tax Credit Work

More picture related to How Does The Solar Tax Credit Work

How Does The Solar Tax Credit Work A1A Solar

https://a1asolar.com/wp-content/uploads/2021/09/Solar_Tax_Credit_Work-1536x1024.jpg

How Do I Claim The Solar Tax Credit EnergySage

http://news.energysage.com/wp-content/uploads/2015/10/10.2015-claim-solar-tax.png

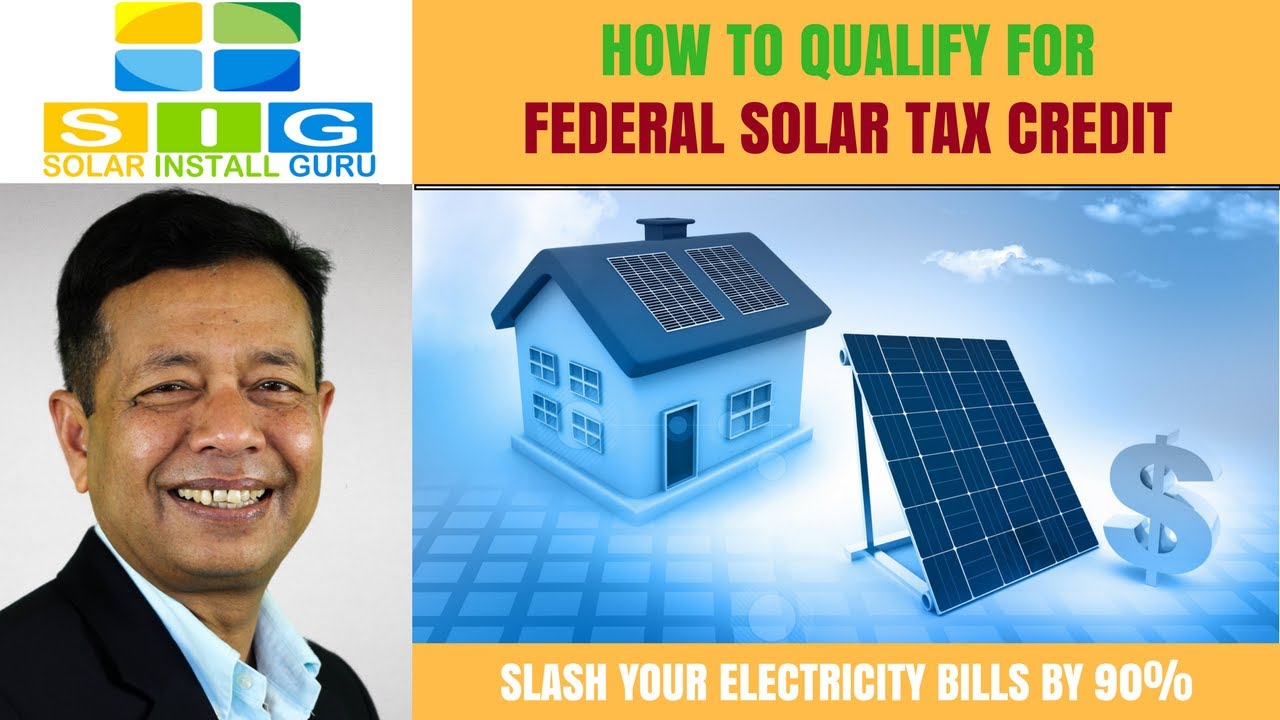

How Does The Federal Solar Tax Credit Work YouTube

https://i.ytimg.com/vi/HoPwzGYYsgM/maxresdefault.jpg

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of Get multiple binding quotes today What is the Federal Solar Tax Credit The Residential Clean Energy Credit formerly known as the ITC is a tax credit worth 30 of the gross cost of your solar project parts labor the whole chalupa with no maximum incentive amount

The solar credit is just one of the tax credit and rebate programs in the Inflation Reduction Act The legislation s incentives can also save you money on electric vehicles EV chargers and Published on July 26 2024 The Federal Solar Tax Credit also known as the Investment Tax Credit ITC provides an up to 30 tax credit for the costs of adopting solar energy in the United States The credit applies to new solar photovoltaic PV systems and expansions of existing ones reducing the overall installation cost by nearly a third

How Does The Solar Tax Credit Work Sun Source Energy

https://sunsourceusa.com/wp-content/uploads/2022/12/8927507.jpg

How Does The Solar Tax Credit Work Sunlight Solar

https://sunlightsolarvirginia.com/wp-content/uploads/2020/08/solarblog.jpg

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

https://www.solar.com/learn/how-does-federal-solar-tax-credit-work

How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000

How Does The Solar Tax Credit Work A M Sun Solar

How Does The Solar Tax Credit Work Sun Source Energy

How Does The Solar Investment Tax Credit Work

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

How Does The Federal Solar Tax Credit Work

How Does The Federal Solar Tax Credit Work

How Does The Solar Tax Credit Work How To Claim Solar Tax Credit

How Does The Solar Tax Credit Work For Homeowners GreenBrilliance

The Federal Solar Tax Credit In 2019 Arizona Energy Solution Providers

How Does The Solar Tax Credit Work - How Does The Federal Solar Tax Credit Work Dollar for dollar the federal solar tax credit is the greatest economic incentive for homeowners to invest in solar panels and or battery storage With a Read More