How Employers Should Handle Mlr Rebates Employers who sponsor a fully insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for

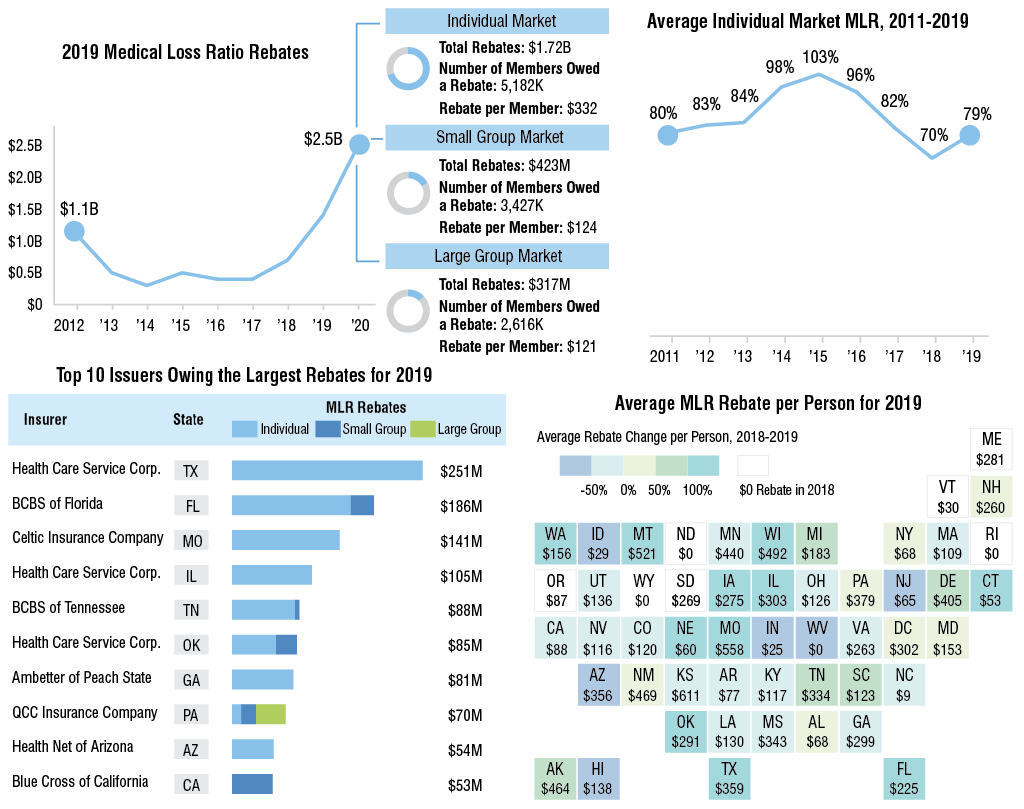

For the sixth year in a row employers who sponsor an insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self funded medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for employers including For the sixth year in a row employers who sponsor an insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self funded medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for employers

How Employers Should Handle Mlr Rebates

How Employers Should Handle Mlr Rebates

https://s3.studylib.net/store/data/009223871_1-094dc07274c6e2ac82fa1c72bf493e69-768x994.png

ACA Overview How Employers Should Handle MLR Rebates Penniall

https://www.penniallinsuranceservices.com/wp-content/uploads/2019/10/ACA-Overview-10-19.jpg

Helping Employers Understand How To Use MLR Rebates

https://brokerblog.wordandbrown.com/wp-content/uploads/2022/05/iStock-1270623471-2-scaled.jpg

How Employers Should Handle Overview MLR Rebates The Affordable Care Act ACA established medical loss ratio MLR rules to help control health care coverage costs and ensure that enrollees receive value for their premium dollars Employers who sponsor a fully insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for employers including How much if any of the rebate must be distributed to plan

Employers that receive an MLR rebate should follow the following four step process to determine the proper use of that rebate Step 1 Employers must determine the plan s to which the MLR rebate applies MLR rebates generally apply only to a specific plan option such as an HMO PPO or an HDHP The insurer s MLR rebate How an employer should handle any MLR rebate it receives from an issuer depends on the type of group health plan an ERISA plan a non federal governmental group health plan or a non ERISA non governmental plan and whether the rebate is considered a plan asset

Download How Employers Should Handle Mlr Rebates

More picture related to How Employers Should Handle Mlr Rebates

How Employers Should Handle MLR Rebates Parker Smith Feek

https://www.psfinc.com/wp-content/uploads/psfinc/2018/10/benefit-alert.jpg

MLR Rebates A Guide For Employers The Bailey Group Blog

https://mbaileygroup.com/wp-content/uploads/2012/12/5269255075_7f18c3949a_b-728x500.jpg

Employers Must Follow Guidelines When Issuing MLR Rebates

https://insights.bukaty.com/hs-fs/hubfs/iStock-931061716.jpeg?width=1500&name=iStock-931061716.jpeg

HOW EMPLOYERS SHOULD HANDLE MLR REBATES Employers who sponsor a fully insured group health plan may soon be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical benefit plans are not subject to these requirements Notices regarding the Medical Loss Ratio MLR insurance rebates are being provided under a provision in the Affordable Care Act that requires insurance companies to provide a rebate related to insurance premiums in certain situations

How Should the Rebate Be Used Once an employer determines that all or a portion of an MLR rebate is a plan asset it must decide how to use the rebate for the exclusive benefit of the plan s participants and beneficiaries DOL TR 2011 4 identifies the following methods for applying the rebates Insurers including HMOs must rebate refund any excess premiums to the policyholder by September 30 of the following year Employers that receive MLR rebates must handle the funds in accordance with applicable plan terms and federal guidance

Did You Receive An MLR Rebate Check From Your Insurance Carrier BBG

http://bbginc.net/wp-content/uploads/2014/07/rebate_check-image.jpg

What Is Medical Loss Ratio MLR And How Do You Handle MLR Rebates

https://www.onedigital.com/wp-content/uploads/2019/07/Thumbnail_MLR-Infobrief.png

https://www.amwinsconnect.com/sites/default/files/...

Employers who sponsor a fully insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for

https://woodruffsawyer.com/sites/default/files/wp...

For the sixth year in a row employers who sponsor an insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self funded medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for employers including

What Is Medical Loss Ratio MLR And How Do You Handle MLR Rebates

Did You Receive An MLR Rebate Check From Your Insurance Carrier BBG

2022 MLR Rebate Checks To Be Issued Soon To Fully Insured Plans

Guide To Medical Loss Ratio MLR Rebates Precision Benefits Group

What Is Medical Loss Ratio MLR And How Do You Handle MLR Rebates NWB

How Employers Should Handle Medical Loss Ratio Rebates

How Employers Should Handle Medical Loss Ratio Rebates

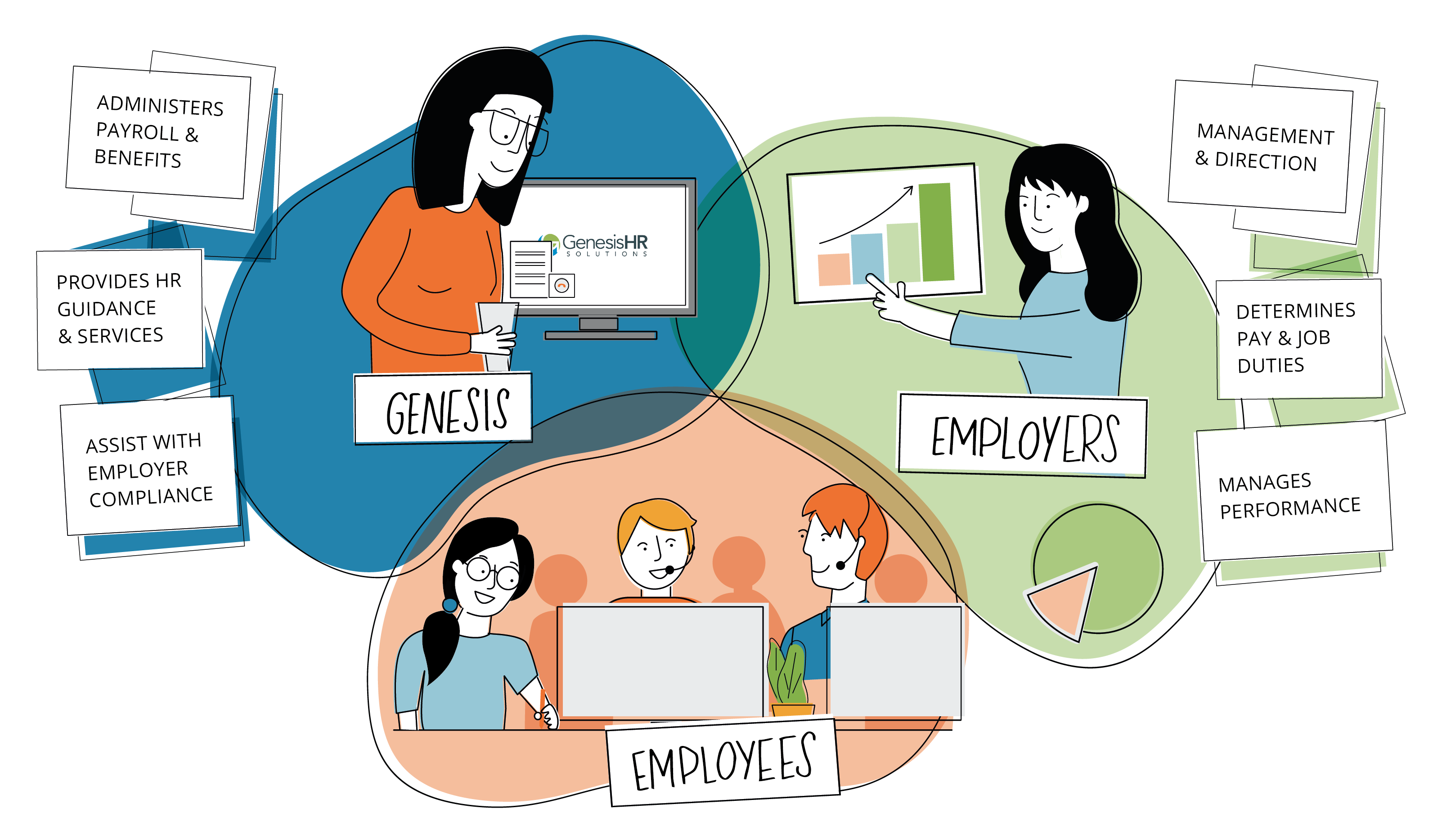

Employer Responsibilities And PEO Responsibilities GenesisHR Solutions

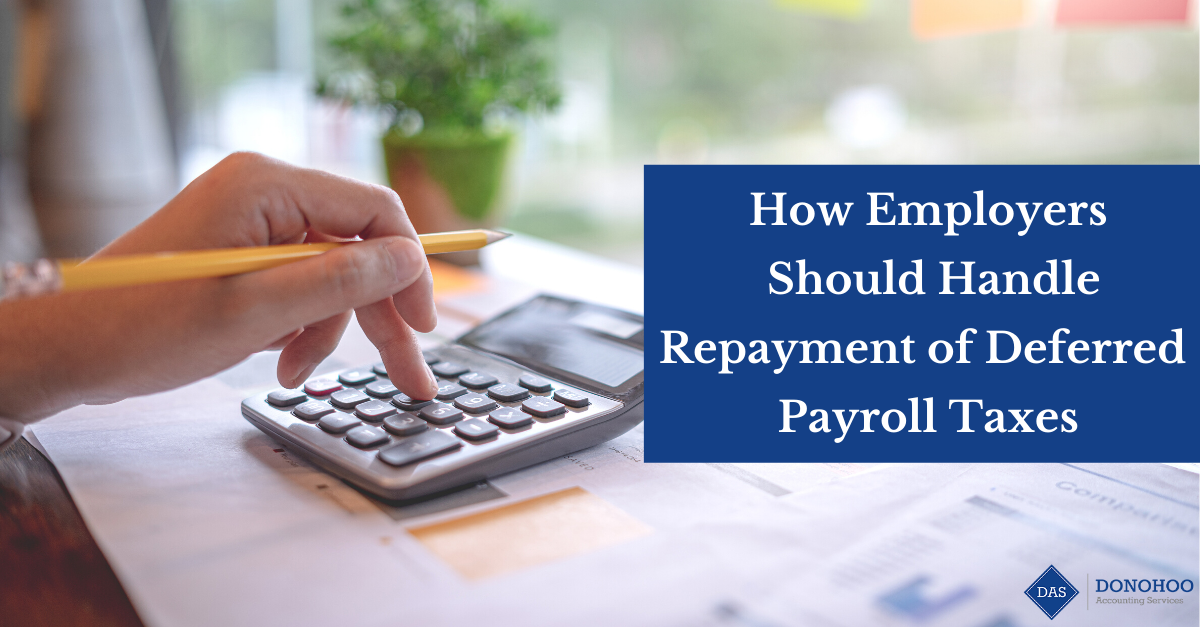

How Employers Should Handle Repayment Of Deferred Payroll Taxes

Medicare Agent News Health Insurers Owe 2 5 Billion In MLR Rebates

How Employers Should Handle Mlr Rebates - Medical Loss Ratio MLR rebate from their insurers Self funded medical benefit plans are not subject to these requirements The rebates raise several fundamental questions for employers including How much if any of the rebate must be distributed to plan participants How quickly must I distribute the participants share