How Far Back Can You Claim Eis Tax Relief Learn how to claim Income Tax relief under the Enterprise Investment Scheme a UK government scheme that encourages investment in small businesses Find the latest

If you completed a tax return for the year you wish to claim the relief for you can amend the tax return or if that can no longer be done you would need to submit an Learn about the tax reliefs available for investing in companies social enterprises or Venture Capital Trusts through venture capital schemes Find out how to claim relief when

How Far Back Can You Claim Eis Tax Relief

How Far Back Can You Claim Eis Tax Relief

https://static-web-wealthclub.s3.amazonaws.com/images/Online_Self-Assessment_Fill_your_return-min.width-500.jpg

.jpg)

EIS Tax Relief EIS Scheme Explained

https://uploads-ssl.webflow.com/5bf8086dc176116541ad2553/6194c0966ddf308b44f64258_Get advanced assurance from HMRC (2).jpg

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.syndicateroom.com/images/EIS3-claim-form.jpg

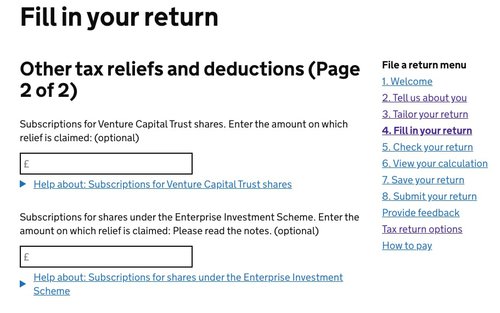

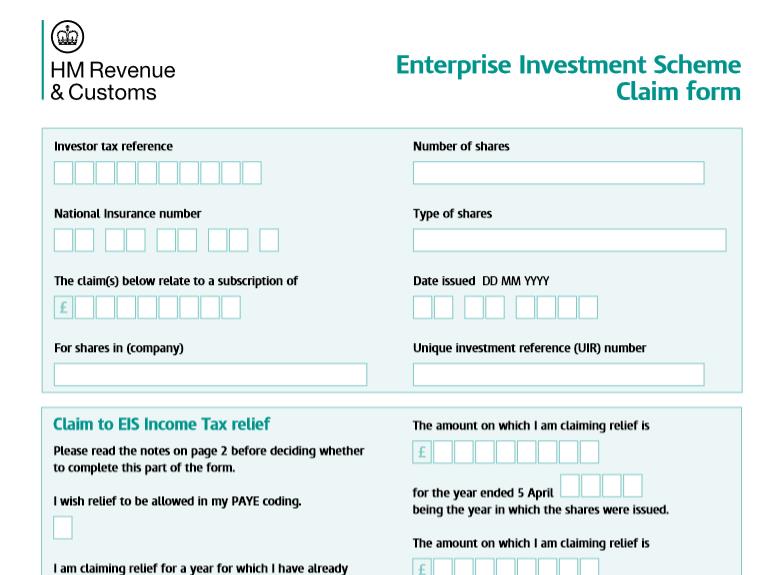

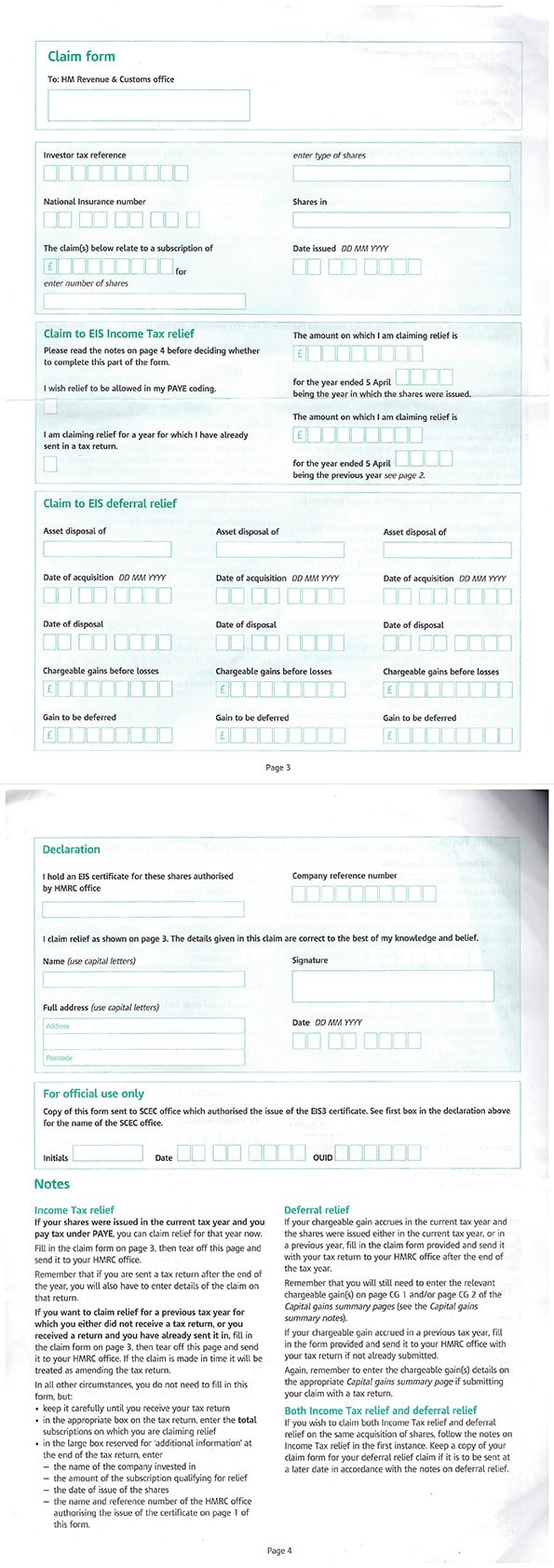

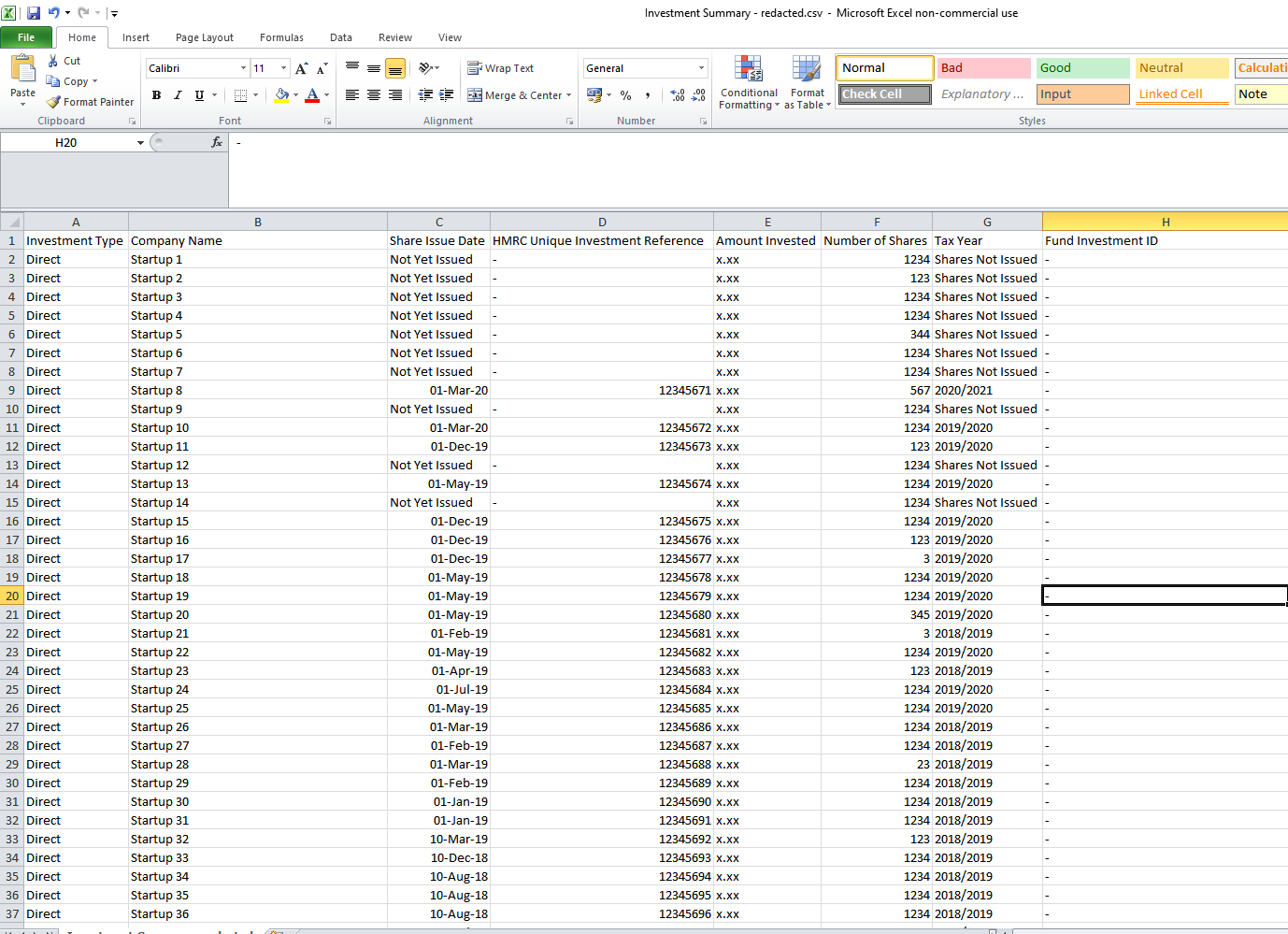

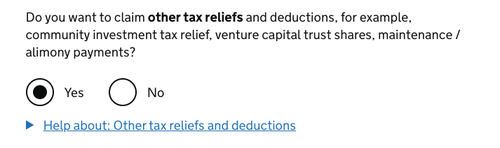

Utilizing Carry Back Provision The EIS allows investors to carry back their claim to the previous tax year which can be beneficial if you had a higher tax liability in that year This strategic use Learn how to claim up to 30 income tax relief and capital gains deferral on your EIS investments Find out what you need when you can claim and how to complete the forms for unapproved and approved EIS portfolios funds

If you wish to carry back tax relief on shares that have already been issued this current tax year and you have an EIS3 form you can include this on your tax return for the previous year and state that this is carried back EIS shares must be held for a minimum of 3 years however you can claim your income tax sooner than that Don t invest unless you re prepared to lose all the money you invest This is

Download How Far Back Can You Claim Eis Tax Relief

More picture related to How Far Back Can You Claim Eis Tax Relief

How To Claim EIS Income Tax Relief A Step by step Guide

https://static-web-wealthclub.s3.amazonaws.com/images/EIS_claim_form-min.original.jpg

How To Claim EIS Tax Relief WIS Accountancy

https://wisaccountancy.co.uk/wp-content/uploads/2022/12/claiming-eis-tax-relief.jpg

How Far Back Can You Claim EIS Relief

https://wisaccountancy.co.uk/wp-content/uploads/2023/02/how-far-back-to-claim-eis-relief.jpg

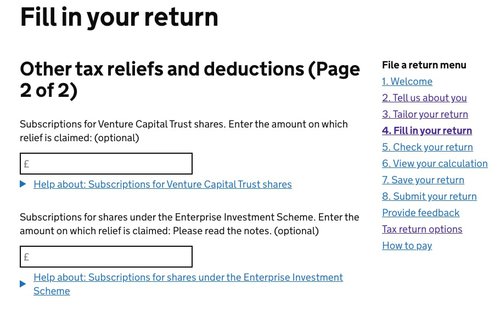

Hi one of the companies I invested in under EIS ceased trading last year and I would like to claim EIS loss relief against my income tax for the 22 23 tax year Is it possible When claiming relief under EIS SEIS and VCTs there are two types of relief available Income tax relief Capital gains tax relief Depending on which you intend to claim will depend on where the entries are required for

Investors can claim up to 30 income tax relief on EIS investments which gives an incentive for some of the risk normally associated with funding small companies The maximum investment Learn how to calculate your capital gains tax on EIS shares including Disposal Relief and Deferral Relief Find out the conditions exceptions and examples of these reliefs

How To Claim EIS Tax Relief Key Business Consultants

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/01/How-To-Claim-EIS-Tax-Relief-1.jpg

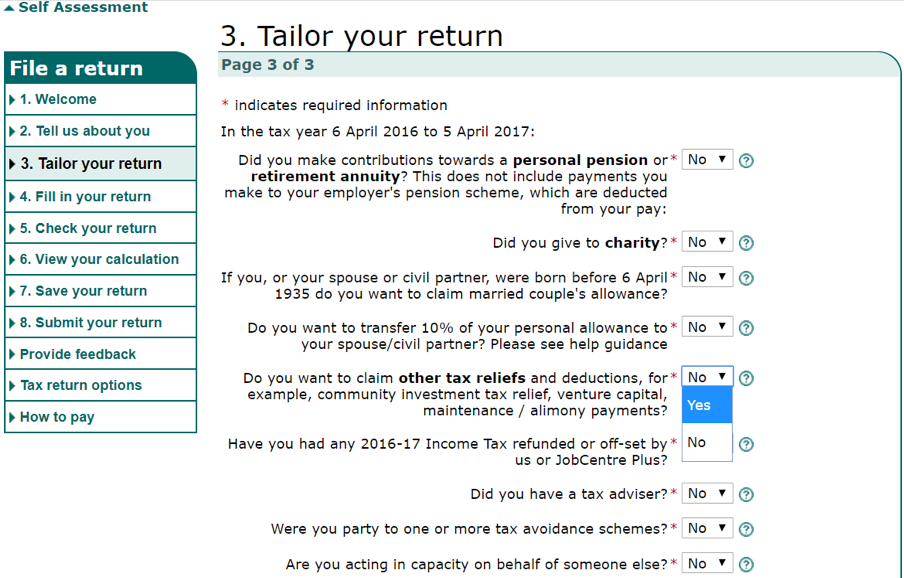

How To Claim EIS Income Tax Relief During HMRC Self assessment

https://www.syndicateroom.com/images/eis-to-pdf-1.png

https://www.gov.uk › government › publications › ...

Learn how to claim Income Tax relief under the Enterprise Investment Scheme a UK government scheme that encourages investment in small businesses Find the latest

.jpg?w=186)

https://community.hmrc.gov.uk › customerforums › sa

If you completed a tax return for the year you wish to claim the relief for you can amend the tax return or if that can no longer be done you would need to submit an

How To Claim EIS Income Tax Relief Step by step Guide

How To Claim EIS Tax Relief Key Business Consultants

How To Claim EIS Income Tax Relief During HMRC Self assessment

Claiming EIS Tax Relief For Investors Sleek

How To Claim Your EIS Tax Relief TaxScouts

Guide To Claiming EIS Relief

Guide To Claiming EIS Relief

.png)

How To Claim EIS SEIS VCT Relief Knowledge Base TaxCalc

How To Claim Eis Income Tax Relief Malayansal

EIS Income Tax Relief Restriction For Connected Parties Thompson

How Far Back Can You Claim Eis Tax Relief - With Enterprise Investment Scheme EIS investments you can claim up to 30 income tax relief potentially as much as 600 000 a year or more if investing in Knowledge Intensive