How Far Back Can You Claim Medical Expenses On Income Tax Web When can I deduct medical expenses for tax purposes What is the reasonable burden for medical expenses Top When can I deduct medical expenses for tax purposes Medical expenses are considered an extraordinary burden This means that you can claim your special expenses in your income tax return if they exceed a certain amount

Web Yes you can claim any eligible medical expenses if they occurred in a 12 month period that ends in the current tax year After you enter your medical expenses TurboTax will prompt you to choose your 12 month claim period Web 12 Jan 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about taking the deduction that you should know before filing your taxes Key Takeaways You can deduct medical expenses across a wide

How Far Back Can You Claim Medical Expenses On Income Tax

How Far Back Can You Claim Medical Expenses On Income Tax

https://polishtax.com/wp-content/uploads/2023/01/How-far-back-can-you-claim-VAT-on-expenses-in-UK.jpg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

Can You Claim Medical Expenses On Taxes Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/217/16/162441921.jpg

Web 30 Okt 2019 nbsp 0183 32 You can claim medical expenses for a 12 month period only each year If you have previous amounts you haven t claimed from past years you may file an amendment to your previous returns https turbotaxmunity intuit ca replies 2647801 View solution in original post October 30 20191 34 AM 0 Web You can claim eligible medical expenses paid in any 12 month period ending in 2022 and not claimed by you or anyone else in 2021 For a person who died in 2022 a claim can be made for expenses paid in any 24 month period that includes the date of death if the expenses were not claimed for any other year

Web 15 Nov 2023 nbsp 0183 32 Key Takeaways The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses instead of taking the standard deduction Web 23 Aug 2023 nbsp 0183 32 The short answer is yes but there are some limitations Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdles to

Download How Far Back Can You Claim Medical Expenses On Income Tax

More picture related to How Far Back Can You Claim Medical Expenses On Income Tax

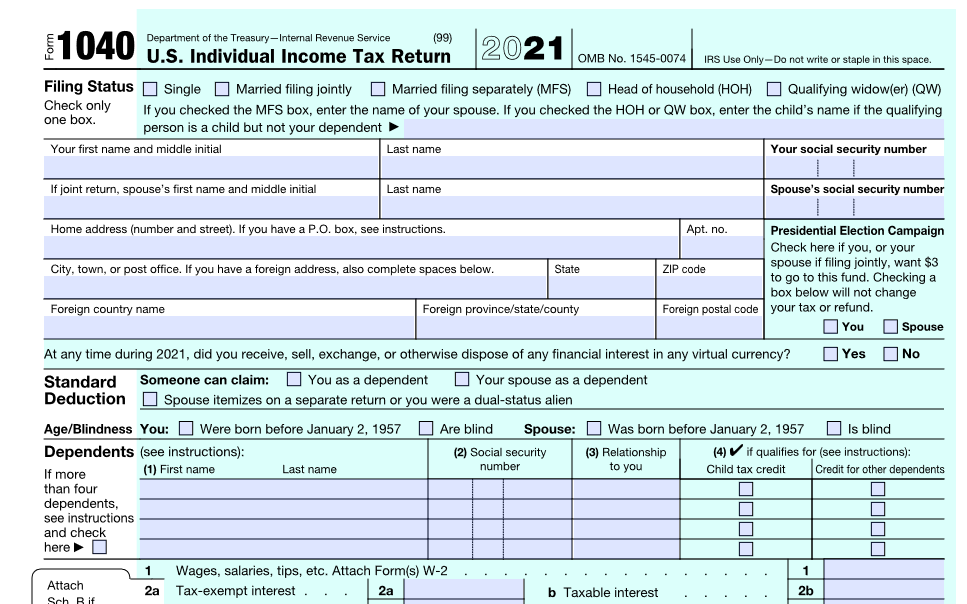

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

When Can You Claim Medical Expenses On Your Tax Return Objective

https://i0.wp.com/objectivefinancialpartners.com/wp-content/uploads/2022/04/medical-expenses-on-tax-return-canada-900x550-1.jpg?fit=1000%2C611&ssl=1

You May Be Able To Claim Medical Expenses On Your Tax Return Greater

https://gg.myggsa.co.za/1661673801479.png

Web 16 Nov 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year Web 31 M 228 rz 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income

Web 27 M 228 rz 2023 nbsp 0183 32 The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little Web You can claim only eligible medical expenses on your tax return if you or your spouse or common law partner paid for the medical expenses in any 12 month period ending in 2022 did not claim them in 2021

TCS Health Insurance Hospitalisation Claim Reimbursement Guidelines

https://image.isu.pub/201206163643-168d62aae50c453c7345f15b084c9154/jpg/page_1.jpg

Can You Claim Medical Expenses On Tax

https://peoplepledge.com.au/blog/wp-content/uploads/2016/01/write-593333_1280-1024x604.jpg

https://www.ottonova.de/en/expat-guide/deduct-medical-expenses-f…

Web When can I deduct medical expenses for tax purposes What is the reasonable burden for medical expenses Top When can I deduct medical expenses for tax purposes Medical expenses are considered an extraordinary burden This means that you can claim your special expenses in your income tax return if they exceed a certain amount

https://turbotax.community.intuit.ca/turbotax-support/en-ca/help...

Web Yes you can claim any eligible medical expenses if they occurred in a 12 month period that ends in the current tax year After you enter your medical expenses TurboTax will prompt you to choose your 12 month claim period

How To Claim Medical Expenses On Your Taxes Liu Associates Edmonton

TCS Health Insurance Hospitalisation Claim Reimbursement Guidelines

How Much Can You Claim For Medical Expenses On Taxes In Ontario 27F

Squeezing Under The Medical Deduction Threshold CPA Practice Advisor

A Guide On Health Insurance Claim Process HDFC Sales Blog

How To Claim Medical Expenses On Your Tax Return

How To Claim Medical Expenses On Your Tax Return

How To Maximize Medical Tax Deductions Freeland Insurance Solutions

Can I Claim Medical Expenses On My Taxes TMD Accounting

KolkataTimes

How Far Back Can You Claim Medical Expenses On Income Tax - Web 23 Aug 2023 nbsp 0183 32 The short answer is yes but there are some limitations Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdles to