How Is Foreign Tax Credit Carryover Calculated How to Calculate Your Foreign Tax Credits Carryover With Examples Katelynn Minott CPA CEO Published August 23rd 2022 Get to know the author Connect on LinkedIn The US is one of the only countries in the world that imposes citizenship based taxation

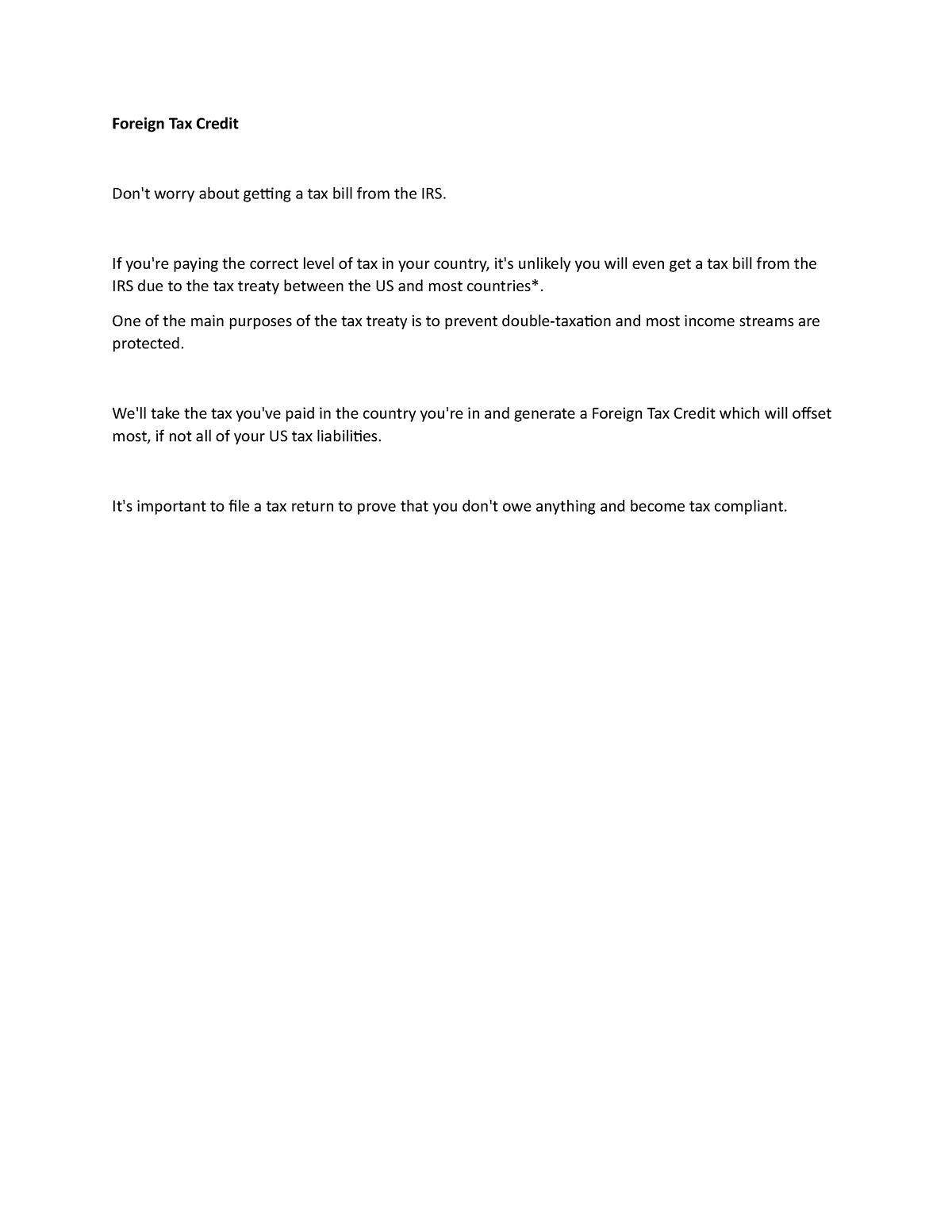

Foreign Tax Credit FTC carryover also known as foreign tax credit carryovers is a provision that allows US taxpayers to use unused foreign tax credits that couldn t be used in the current year This mechanism helps reduce double taxation on foreign income by allowing you to carry forward or carry back excess foreign taxes Figuring the credit You can claim a foreign tax credit only for foreign taxes on income war profits or excess profits or taxes in lieu of those taxes In addition there is a limit on the amount of the credit that you can claim

How Is Foreign Tax Credit Carryover Calculated

How Is Foreign Tax Credit Carryover Calculated

https://cdn2.storyasset.link/b98fb9ca-aa81-404d-a063-f53cda74128b/ftc1-ms-lvtejdztqb.jpg

1116 Schedule B Foreign Tax Carryover Reconciliation Schedule

https://kb.drakesoftware.com/Site/Uploads/Images/17563 image 2.jpg

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

Foreign taxes withheld on income or gain other than dividends from property if you haven t held the property for at least 16 days within the 31 day period that begins 15 days before the date on which the right to receive the payment arises See section 901 l or Publication 514 Key Takeaways The foreign tax credit is a U S tax break that offsets income tax paid to other countries The credit is available to U S citizens and residents who earn income abroad

Accrual method of accounting You may have to post a bond Cash method of accounting Choosing to take credit in the year taxes accrue Credit based on taxes paid in earlier year Contesting your foreign tax liability Election to claim a provisional credit for contested taxes Translating foreign currency into U S dollars Advertiser disclosure Foreign Tax Credit What It Is How to Claim It The United States taxes citizens on their income no matter where it s earned Here s how to lower the tax bill

Download How Is Foreign Tax Credit Carryover Calculated

More picture related to How Is Foreign Tax Credit Carryover Calculated

Foreign Tax Credit Carryover 6 Answers To FAQs

https://taxsamaritan.com/wp-content/uploads/2022/08/6-Answers-to-FAQs-About-Foreign-Tax-Credit-Carryover.jpg

Capital Loss Carryover Worksheet Example Educational Worksheets Tax

https://i.pinimg.com/originals/e9/af/47/e9af47a8b0f95b7a903d92168e31d60d.jpg

Foreign Tax Credit Eligibility Limits Form 1116 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiGVYW453n0rJ9HYr-WXTuCc_WbHgGJWBCYnfCvgMCYM2kOSi3Mdhn_in3bsrltNXQIKQUe0yhET4vk19FZxJ0BZCYG-av-JnS8vbDxBC2d6ofxaHs3xjcxYX4HsnMWKOSo-3vtJo5vItO1VTWWxSAFNP3Pnfbczcr50ZyDgHE_LerNoBR33vy44mQC/s928/ftc.jpg

The Foreign Tax Credit FTC is a tax provision that allows U S taxpayers to reduce their U S income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States The main purpose of the FTC is to prevent double taxation of income by both the U S and the foreign country where the income is sourced Calculating your foreign tax credit begins by grouping your income into passive and general income Passive income is regular earnings from sources independent of a contractor or employer Investment income such as interest rent and dividends fall under the passive income category

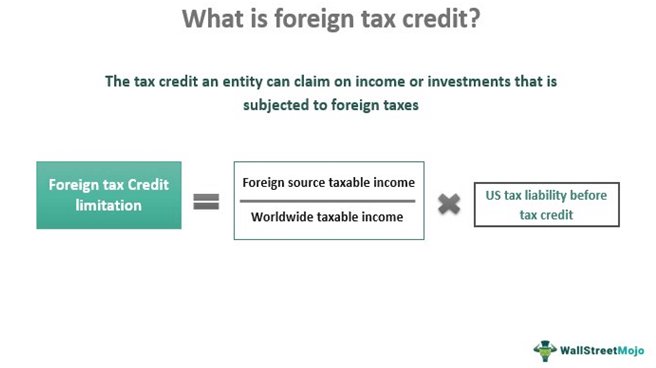

How Is the Foreign Tax Credit Calculated Before we dive in to the Foreign Tax Credit carryover let s review how to calculate the Foreign Tax Credit First you must allocate your Foreign Tax Credit into categories of income Passive income includes investment income such as dividends interest and rent To get your maximum credit amount and income limit you ll divide your foreign sourced taxable income amount by your total taxable income then multiply that result by your U S tax liability There are four stipulations to be able to claim the credit The tax must be imposed on you You must have paid or accrued the tax

What Is Foreign Tax Credit foreigntaxcredit llc taxcredit ustaxes

https://i.ytimg.com/vi/HgM6nGiH9qc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4EgAKACIoCDAgAEAEYZSBZKDswDw==&rs=AOn4CLBBeUSxqhbDJxO8e9rxQHNtVu9lEg

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

https://brighttax.com › blog › how-to-calculate...

How to Calculate Your Foreign Tax Credits Carryover With Examples Katelynn Minott CPA CEO Published August 23rd 2022 Get to know the author Connect on LinkedIn The US is one of the only countries in the world that imposes citizenship based taxation

https://1040abroad.com › blog › foreign-tax-credit...

Foreign Tax Credit FTC carryover also known as foreign tax credit carryovers is a provision that allows US taxpayers to use unused foreign tax credits that couldn t be used in the current year This mechanism helps reduce double taxation on foreign income by allowing you to carry forward or carry back excess foreign taxes

Foreign Tax Credit Carryover Worksheet

What Is Foreign Tax Credit foreigntaxcredit llc taxcredit ustaxes

1116 Schedule B Foreign Tax Carryover Reconciliation Schedule

Tax Credit Everything You Need To Know BetterPlace

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

Claiming The Foreign Tax Credit With Form 1116 TurboTax Tax Tips Videos

Claiming The Foreign Tax Credit With Form 1116 TurboTax Tax Tips Videos

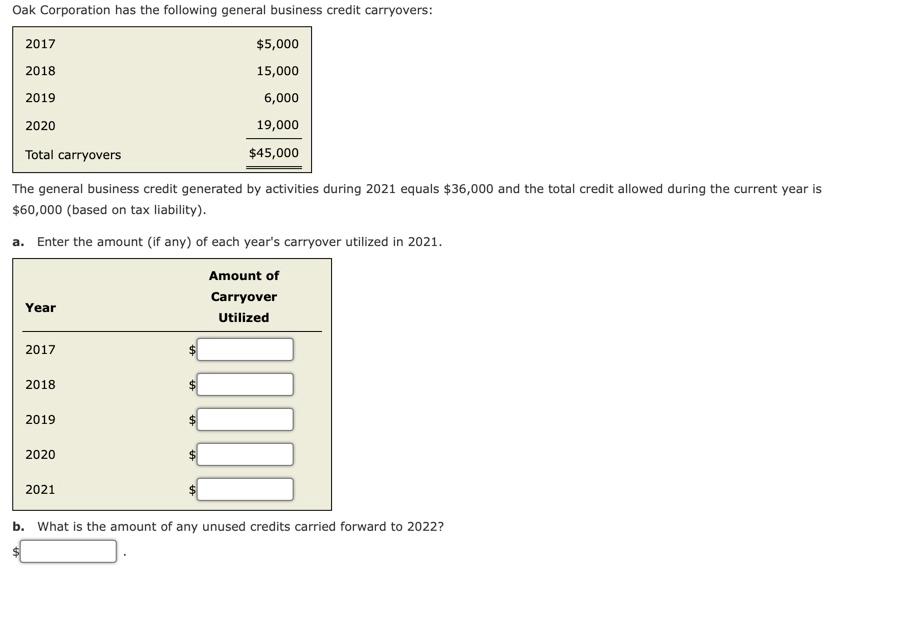

Solved Oak Corporation Has The Following General Business Chegg

How To Enter 2022 Foreign Tax Credit Form 1116 In H R Block

Casual What Is Form 1116 Explanation Statement Proprietor Capital

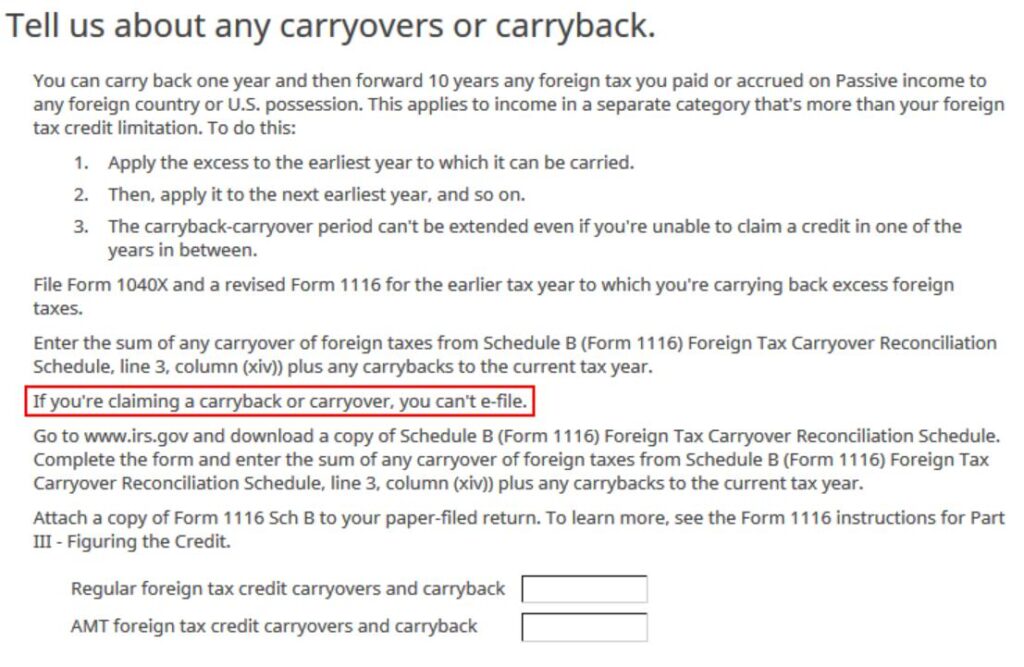

How Is Foreign Tax Credit Carryover Calculated - Choosing to accrue taxes Even if you use the cash method of accounting you can choose to take a credit for foreign taxes in the year they accrue You make the choice by checking the box in Part II of Form 1116 Once you make that choice you must follow it in all later years and take a credit for foreign taxes in the year they accrue