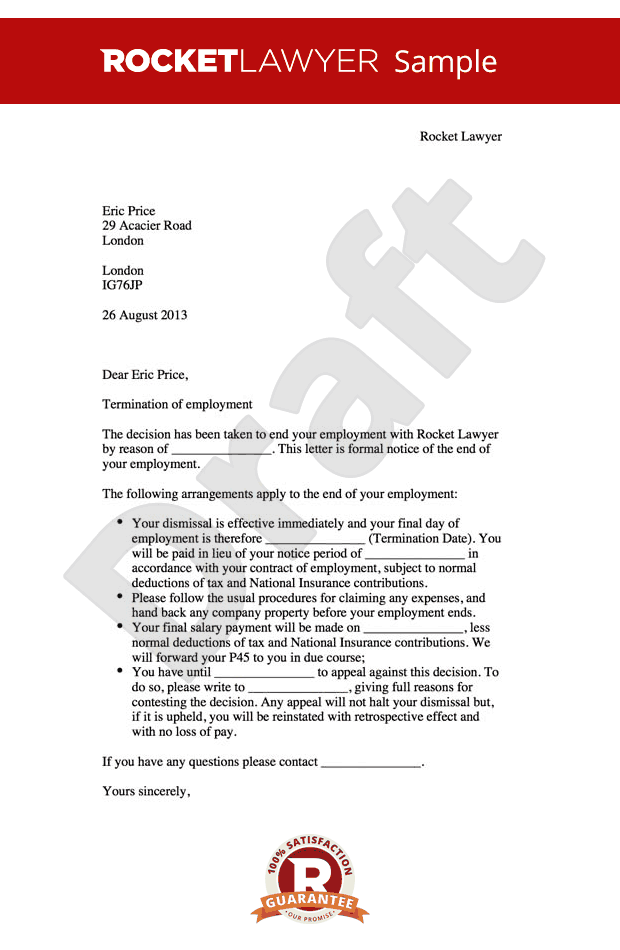

How Is Redundancy Taxed Uk Verkko Redundancy pay is treated differently to income and up to 163 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

Verkko 12 huhtik 2023 nbsp 0183 32 Given statutory redundancy pay is capped at 163 19 290 you won t pay any tax if you just receive the legal minimum Any portion of your redundancy pay above 163 30 000 is treated as income and will be Verkko 11 jouluk 2023 nbsp 0183 32 Is redundancy pay taxed The first 163 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard

How Is Redundancy Taxed Uk

How Is Redundancy Taxed Uk

https://res.cloudinary.com/picked/image/upload/ar_16:9,c_crop/q_60,h_600,f_auto/v1680258453/cms/redundancy-pay-in-the-uk-1680258452

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

How Is Redundancy Pay Calculated UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2022/03/How-is-statutory-redundancy-pay-calculated_.jpg

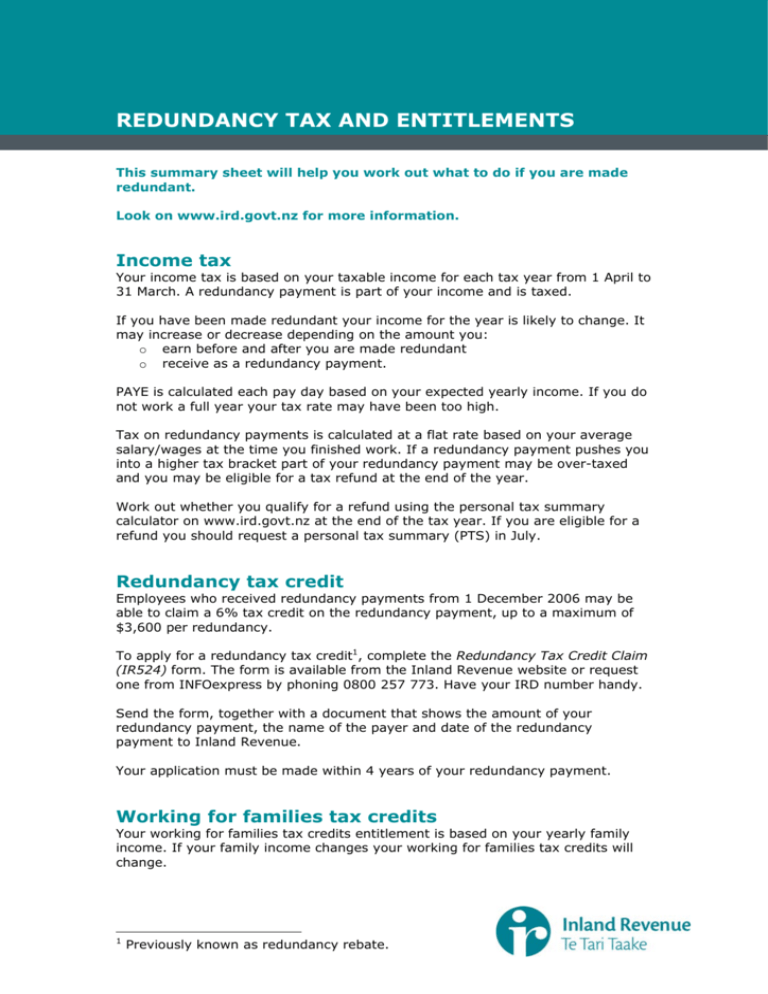

Verkko If you were made redundant on or after 6 April 2023 your weekly pay is capped at 163 643 and the maximum statutory redundancy pay you can get is 163 19 290 Verkko Basic rules Employees can receive up to 163 30 000 as a qualifying termination payment free of tax and National insurance This amount includes any statutory redundancy

Verkko 26 kes 228 k 2018 nbsp 0183 32 Redundancy payments are payments compensating an individual for the loss of their job They can be made in cash or benefits in kind The payment Verkko What you need to know The first 163 30 000 of any redundancy payment for compensation for loss of office is free of income tax and National Insurance Not all payments made

Download How Is Redundancy Taxed Uk

More picture related to How Is Redundancy Taxed Uk

Redundancy Calculator How Much Are Employees Entitled To Factorial

https://factorialhr.co.uk/wp-content/uploads/2022/04/27174159/InfographicRedundancyPay.-scaled.jpg

Is Redundancy Pay Taxable Essential Knoweldge UK 2023

https://www.askyourfinanceguy.com/wp-content/uploads/2021/08/Is-Redunacy-Pay-Taxable.png

Pay Tax Redundancy Pay Tax Calculator Uk

http://www.landaulaw.co.uk/wp-content/uploads/2015/02/Satellite.jpeg

Verkko 16 elok 2021 nbsp 0183 32 is Statutory Redundancy Taxed You only qualify for statutory redundancy if you have worked for the company for over two years I ll explain how to calculate it further in the post although the Verkko 17 tammik 2018 nbsp 0183 32 If your redundancy pay is higher than 163 30 000 you will normally have to pay tax on the excess This money will be treated as income and so may

Verkko 16 tammik 2023 nbsp 0183 32 The first 163 30 000 of a redundancy settlement is usually untaxed although this figure can reduce in certain circumstances The rest of the money is Verkko You can see how much redundancy pay you d get using the redundancy pay calculator on GOV UK Redundancy pay is based on your earnings before tax called gross

What Are The Five Stages Of The Redundancy Process

https://brittontime.com/wp-content/uploads/2021/02/Redundancy-consultation-process-flowchart-1-1280x989.png

Redundancy Letter Template Uk Why Is Redundancy Letter Template Uk So

https://www.ah-studio.com/wp-content/uploads/2020/07/uk-employee-redundancy-notice-form-legal-forms-and-redundancy-letter-template-uk.jpeg

https://www.moneyhelper.org.uk/en/work/losing-your-job/do-you-hav…

Verkko Redundancy pay is treated differently to income and up to 163 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

https://www.which.co.uk/money/tax/income …

Verkko 12 huhtik 2023 nbsp 0183 32 Given statutory redundancy pay is capped at 163 19 290 you won t pay any tax if you just receive the legal minimum Any portion of your redundancy pay above 163 30 000 is treated as income and will be

The Redundancy Process For Employers What Is A Fair Redundancy

What Are The Five Stages Of The Redundancy Process

What Is Redundancy Definition And Meaning Market Business News

What Is Redundancy Definition And Meaning Market Business News

Furlough And Redundancy How Is Redundancy Affected If You Are On

What Is Redundancy In Computer Science IONOS CA

What Is Redundancy In Computer Science IONOS CA

Redundancy Letter Template Uk Printable Receipt Template

How Is Voluntary Redundancy Pay Calculated The 11 Top Answers

Do You Get Taxed On Redundancy Pay The Accountancy Partnership

How Is Redundancy Taxed Uk - Verkko Up to 163 30 000 of redundancy pay is tax free You may not be eligible for statutory redundancy pay if your employer offers you a suitable alternative job and you turn it