How Is Tax Calculated On Interest Earned Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA You won t pay tax on those types of

Key Takeaways Interest on bonds mutual funds CDs and demand deposits of 10 or more is taxable Taxable interest is taxed just like ordinary income Payors must file Form 1099 INT and You pay tax on any interest over your allowance at your usual rate of Income Tax If you re employed or get a pension HMRC will change your tax code so you pay the tax

How Is Tax Calculated On Interest Earned

How Is Tax Calculated On Interest Earned

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

How To Calculate Your Property Taxes YouTube

https://i.ytimg.com/vi/oLpqH7w8cS8/maxresdefault.jpg

The interest income you earn on bank accounts money market funds and certain bonds must be reported on your tax return as ordinary income Here s how it works In a nutshell Taxable interest income is simply the money you earn on investments for which you re required to pay taxes In most cases your tax rate on earned interest income is the same rate as the rest of your income Bonds mutual funds and interest bearing accounts are all types of interest income that are taxable

Interest income is taxed at your usual income tax rate How is interest reported Interest on individual securities is reported to you and to the IRS on Form 1099 INT Typically most interest is taxed at the same federal tax rate as your earned income including Interest on deposit accounts such as checking and savings accounts Interest on the value of gifts given for opening an account

Download How Is Tax Calculated On Interest Earned

More picture related to How Is Tax Calculated On Interest Earned

How Your Commercial Property Tax Is Calculated Five Stone Tax Advisers

https://www.fivestonetax.com/wp-content/uploads/2021/01/BLOG-CommercialCalculated-01-1-1024x535.jpg

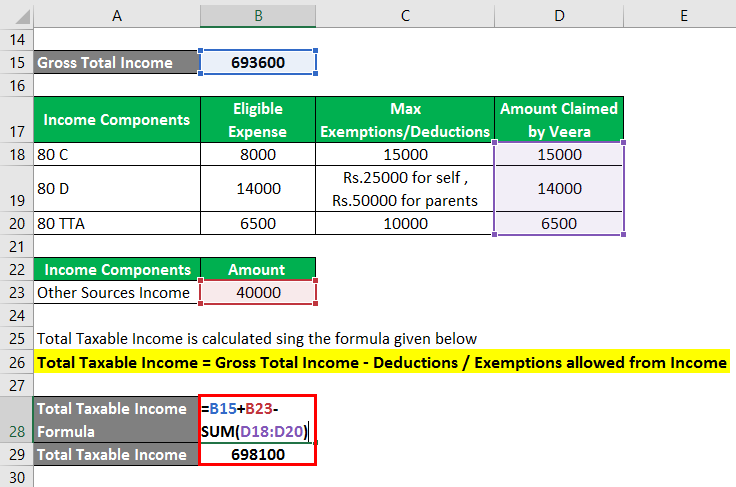

How To Calculate Gross Income Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-2.7.png

How To Calculate My Credit Score The Fancy Accountant

https://fancyaccountant.com/wp-content/uploads/2020/06/calculate-credit-score.png

The earned interest on savings accounts is taxed but you do not have to pay taxes on the full balance in your account The original money that you deposit will have already been taxed Return to homepage If you earned interest on CDs money market accounts high yield savings accounts and bonds this year prepare to pay taxes on them

[desc-10] [desc-11]

How Is Tax Calculated On Sale Of A Property Mint

https://images.livemint.com/img/2022/08/28/1600x900/inv_1661709273267_1661709294599_1661709294599.jpg

Federal Income Tax FIT Payroll Tax Calculation YouTube

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

https://smartasset.com/taxes/how-much-interest-from-interest-is...

Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA You won t pay tax on those types of

https://www.investopedia.com/articles/tax/10/interest-income.asp

Key Takeaways Interest on bonds mutual funds CDs and demand deposits of 10 or more is taxable Taxable interest is taxed just like ordinary income Payors must file Form 1099 INT and

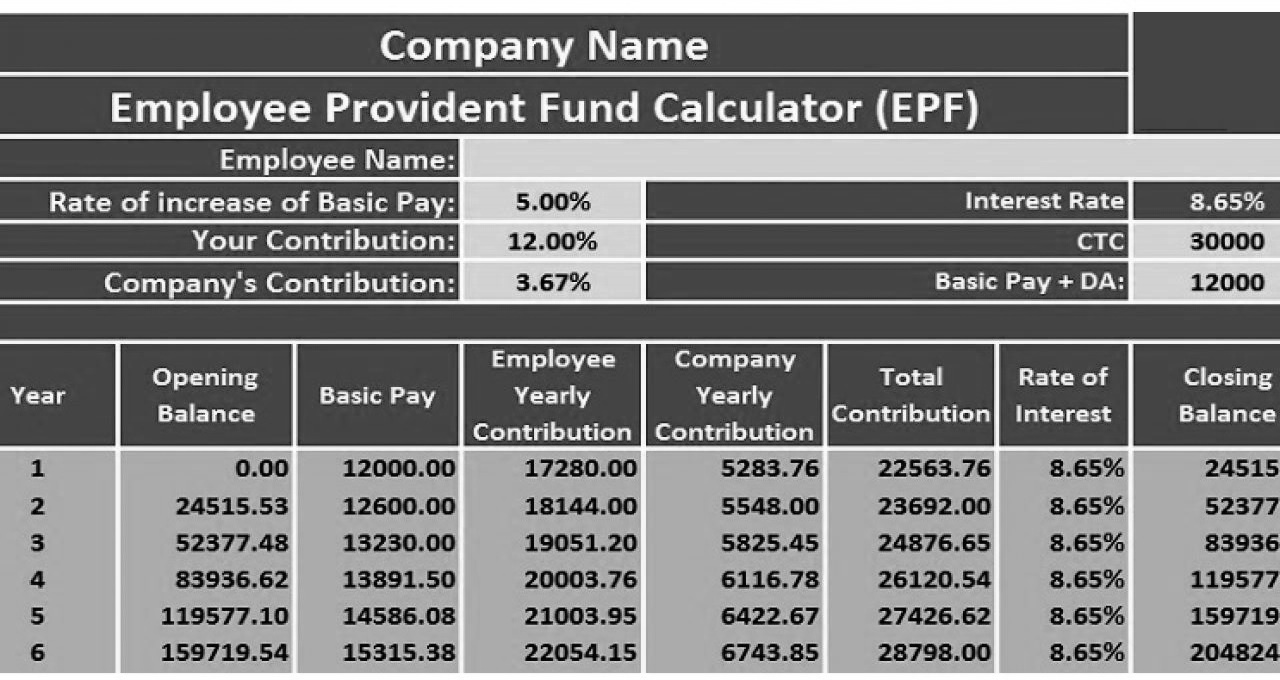

EPF India PF Balance Check Without UAN Number UAN Login Status

How Is Tax Calculated On Sale Of A Property Mint

Q A How Is Income Tax Calculated J P Accountants

How Is Tax Calculated Databuzz Knowledge Base

How Is Agricultural Income Tax Calculated With Example Updated 2022

How Is Tax Calculated On Your Delaware Statutory Trust Diversified

How Is Tax Calculated On Your Delaware Statutory Trust Diversified

How Is Tax Calculated On Commercial Property

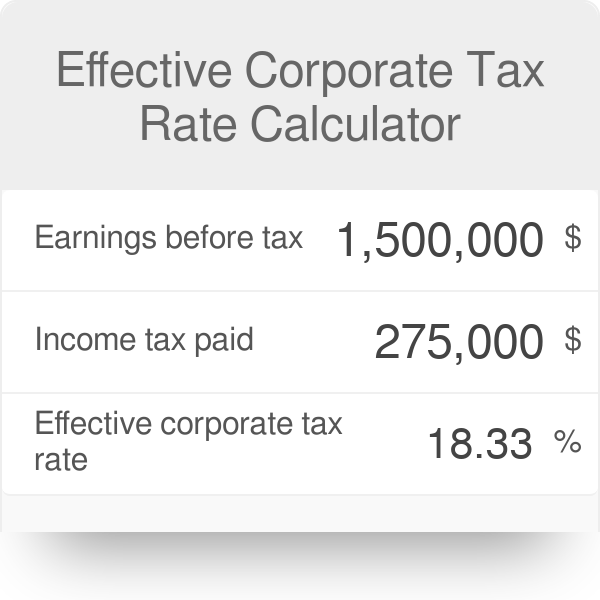

Effective Tax Rate Formula AnnaliseRene

Here s Where Your Federal Income Tax Dollars Go NBC News

How Is Tax Calculated On Interest Earned - [desc-12]