How Is Tax Refund Calculator Philippines Calculation of Refund Tax Withheld PHP 25 000 Tax Due PHP 20 000 PHP 5 000 Tax Refund Leah is eligible for a PHP 5 000 tax refund from her Philippine income

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator Philipines 2024 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag IBIG Monthy Contribution Tables for the computation Use this income tax in the Philippines calculator to help you quickly determine your income tax as a Filipino citizen your benefits contributions and your net pay after tax and deductions

How Is Tax Refund Calculator Philippines

How Is Tax Refund Calculator Philippines

https://www.tmsfinancial.com.au/wp-content/uploads/2023/01/Australian-Tax-Refund-Calculator.jpg

How To Claim Tax Refund In Philippines For Income Tax YouTube

https://i.ytimg.com/vi/CRf9VCwiBgY/maxresdefault.jpg

Tax Calculator Estimate 2015 Tax Refunds For 2014 Taxes

https://i2.wp.com/www.gottabemobile.com/wp-content/uploads/Tax-Calculator-2015-Tax-Refund-Estimate.jpg?fit=1000%2C1000&ssl=1

1 How to Compute Your Income Tax Using the New BIR Tax Rate Table 2 How To Compute Your Income Tax Based on an 8 Preferential Tax Rate Sample income tax computation for the taxable year 2020 3 How To Compute Tax on Passive Income 4 How to Compute Your Income Tax Using an Online Tax Calculator Frequently Asked A simpler method of determining your tax due is to use an online tax calculator ideally one from an official government source like the BIR Errors are minimized because you don t have to refer to a tax table which may look convoluted for the mathematically challenged when computing your tax

You just need to enter your monthly income and then use the calculator to compute your taxable income monthly tax due and Net Pay after deductions The calculator uses a simple formula based on the Philippines Latest Tax Table which determines the rate of taxes depending on one s taxable income Tax Calculator Philippines simplifies the process of computing taxes using the latest BIR income tax table It provides accurate calculations including monthly deductions and net pay after taxes Understanding tax law changes like those under the TRAIN Law is crucial for accurate tax computation

Download How Is Tax Refund Calculator Philippines

More picture related to How Is Tax Refund Calculator Philippines

The IRS Tax Refund Schedule 2023 Where s My Refund Irs Taxes

https://i.pinimg.com/736x/5f/5e/0f/5f5e0f1c9fdd61fa87df5215e135f24d.jpg

How Much Is My Tax Refund Calculator Tax Walls

https://www.easytaxfree.com/src/Frontend/Files/Pages/UserTemplate/calculator-168219-190.jpg

2022 Tax Refund Estimator CeiranAhsun

https://www.etax.com.au/wp-content/uploads/2021/02/Calculate-your-tax-refund.jpg

The free online 2023 Income Tax Calculator for Philippines Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results 2017 Philippine Capital Income and Financial Intermediation Statistics Philippine Public Finance and Related Statistics 2020 Tax Information Tax Laws Issuances Republic Acts Income Tax Calculator FAQs Sitemap Find

[desc-10] [desc-11]

Tax Refund Calculator 2023 Philippines 2023 Printable Calendar

https://i2.wp.com/4.bp.blogspot.com/-wl38od7nLRA/Wk2lXlTURXI/AAAAAAAAAH0/D-ctdDAAmNAumM0Fbt5_hnZpX5pmMWZkwCEwYBhgL/s640/Personal%2BIncome%2BTax%2B-%2BTRAIN%2B2018.jpg

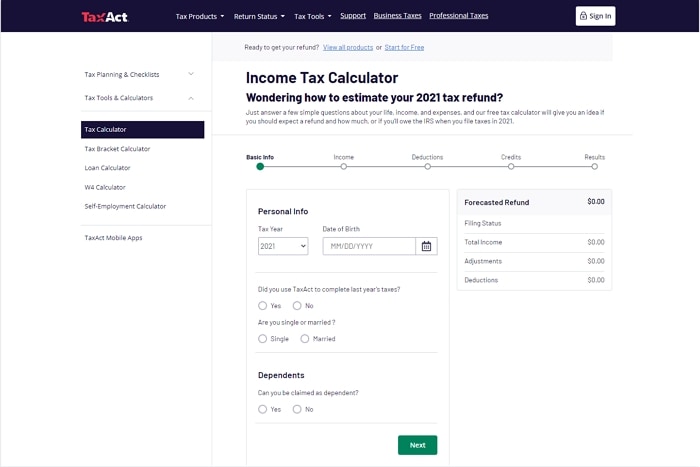

Estimate Your Tax Refund With TaxAct s Tax Calculator TaxAct

https://blog.taxact.com/wp-content/uploads/Estimate-tax-refund-tax-calculator-1253877758-blog.jpg

https://www.philippinetaxationguro.com/tax-refund

Calculation of Refund Tax Withheld PHP 25 000 Tax Due PHP 20 000 PHP 5 000 Tax Refund Leah is eligible for a PHP 5 000 tax refund from her Philippine income

https://taxcalculatorphilippines.com

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator Philipines 2024 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag IBIG Monthy Contribution Tables for the computation

Excel Income Tax Calculator How To Make Income Tax SexiezPix Web Porn

Tax Refund Calculator 2023 Philippines 2023 Printable Calendar

How To Compute Income Tax Refund In The Philippines A Definitive Guide

Key Steps Toward Genuine Tax Reform In PH Inquirer Business

Estimated Refund Calculator

Quick Tax Refund Calculator AntoineJosie

Quick Tax Refund Calculator AntoineJosie

IRS Refund Schedule When To Expect Your Tax Refund

Tax Return Low And Middle Income Tax Offset LMITO Ending

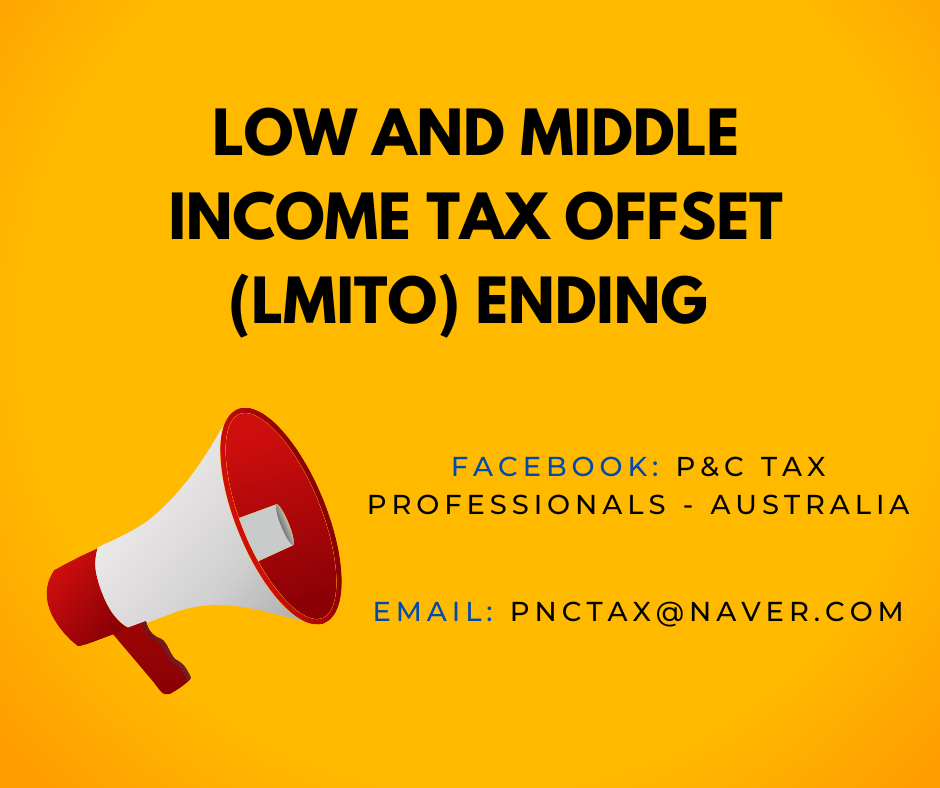

Tax Refund Calculator APK Para Android Download

How Is Tax Refund Calculator Philippines - [desc-13]