How Long Do State Taxes Usually Take You will need to enter the exact amount of your refund to check its status According to the state refunds generally take up to two weeks to process if you e file If you file a paper return your refund

How long does a state refund take The amount of time it takes to receive your state refund can vary state by state and whether or not you submitted a complete and accurate return The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

How Long Do State Taxes Usually Take

How Long Do State Taxes Usually Take

https://dyernews.com/wp-content/uploads/taxmap-1.png

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Tax card and tax counseling If you are working and receiving pay or if you are an entrepreneur you need a Finnish tax card verokortti At International House Helsinki The IRS traditionally sends most federal tax refunds in 21 days but every state processes returns at its own pace

We issue most refunds in less than 21 calendar days However if you mailed your return and expect a refund it could take four weeks or more to process your The claim centers on how long it took to activate the Minnesota National Guard during the riots Our fact check team lays out the timeline

Download How Long Do State Taxes Usually Take

More picture related to How Long Do State Taxes Usually Take

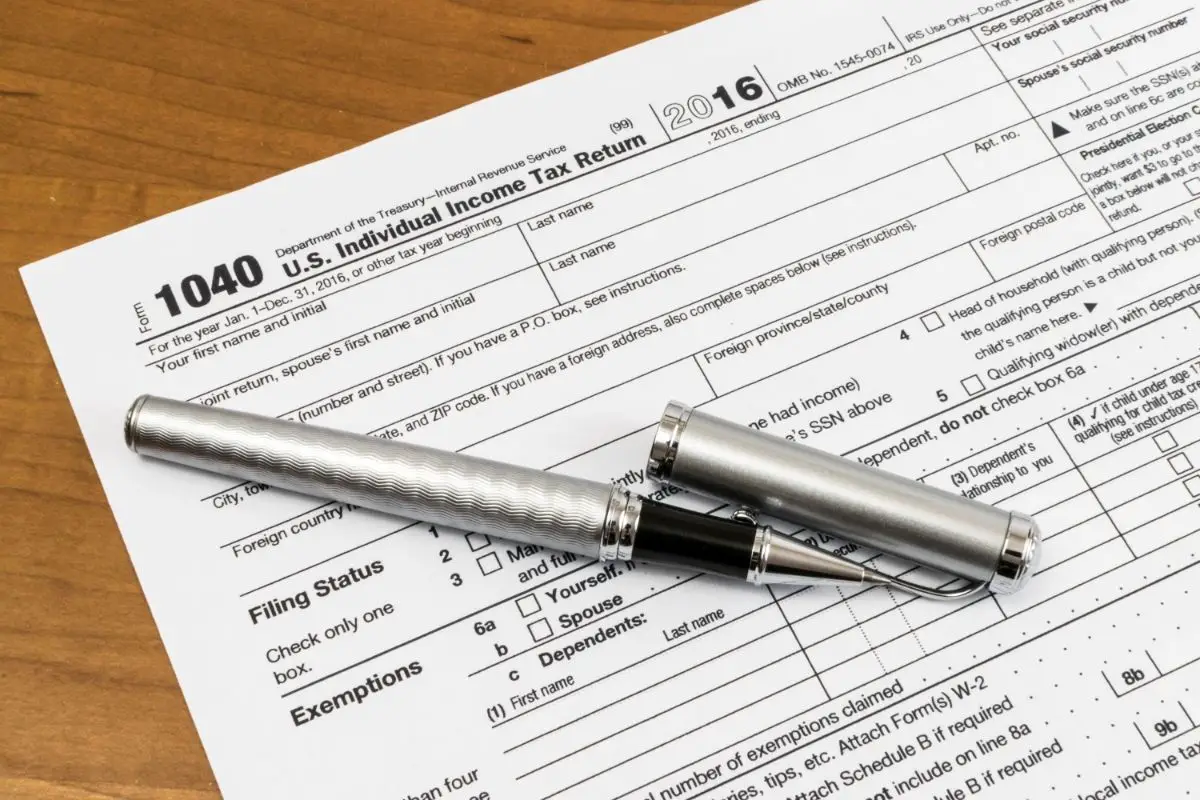

How Long Does It Take To File Taxes

https://www.freshbooks.com/wp-content/uploads/2022/03/duration-to-file-taxes.jpg

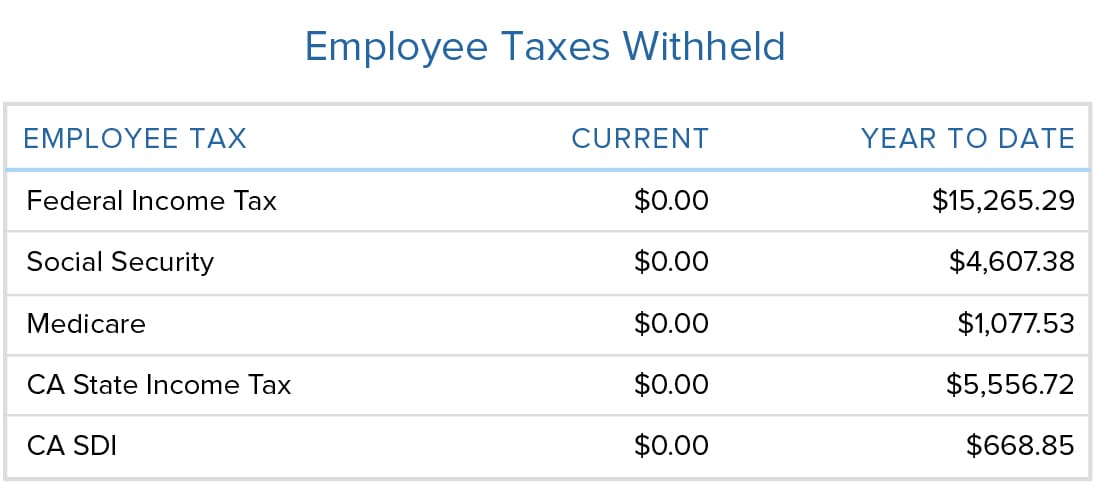

Where Can I Find My Year to date Federal And State Withholding Amount

https://support.joinheard.com/hc/article_attachments/4788931701143/Paystub-employee-taxes-withheld.jpeg

How Long Does It Take To Do Taxes

https://taxsaversonline.com/wp-content/uploads/2022/07/How-Long-Does-It-Take-To-Do-Taxes.jpg

Fact Checking Trump s Mar a Lago News Conference The former president took questions from reporters for more than hour We examined his claims attacks and You can use the tool to check the status of your return 24 hours after e filing a tax year 2023 return 3 or 4 days after e filing a tax year 2022 or 2021 return 4 weeks

The IRS starts tracking your tax refund within 24 hours after e filing and updates the tool daily If you filed your tax return by mail expect longer processing times Child tax credit Many lower income Minnesota families can access a state child tax credit which Walz signed into law last year

How Long Do I Have To File My Workers Compensation Claim YouTube

https://i.ytimg.com/vi/8TZhfIuyUFU/maxresdefault.jpg

How Much To State Taxes Matter To Corporations

https://www.palmbeachpost.com/gcdn/authoring/2016/09/21/NPPP/ghows-LK-c02c6014-3c91-48cc-805c-3c03b7d90f1d-683335ab.jpeg?crop=746,421,x0,y0&width=746&height=421&format=pjpg&auto=webp

https://smartasset.com/taxes/wheres-my-stat…

You will need to enter the exact amount of your refund to check its status According to the state refunds generally take up to two weeks to process if you e file If you file a paper return your refund

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg?w=186)

https://blog.taxact.com/wheres-my-state-refu…

How long does a state refund take The amount of time it takes to receive your state refund can vary state by state and whether or not you submitted a complete and accurate return

State Taxes An Overlooked Aspect Of All Cash Sales

How Long Do I Have To File My Workers Compensation Claim YouTube

Where Do Your Tax Dollars Go Tax Foundation

How High Are Property Taxes In Your State American Property Owners

How Long Do Late Payments Stay On Credit Reports PointCard

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

What s Up With Indiana s Personal Income Tax

Tax Friendly States For Retirees Best Places To Pay The Least

Filing Multiple Nonresident State Tax Returns F1 J1 Visa Holders

How Long Do State Taxes Usually Take - Realtors across the country are bracing for a seismic shift in the way they do business Starting August 17 new rules will roll out that overhaul the way Realtors get