How Long Does Hmrc Take To Process A Tax Return Once you submit your Self Assessment tax return you might wonder how long it will take for HMRC to process it The processing times can vary depending on whether you

Did you know that some UK taxpayers have reported waiting nearly 4 months to receive their tax refunds after submitting their returns online This unexpected delay highlights the critical need for clarity on HMRC s Her Use HMRC s service dashboard to check current performance and service levels processing dates You can find out about our service levels for agent services Corporation

How Long Does Hmrc Take To Process A Tax Return

How Long Does Hmrc Take To Process A Tax Return

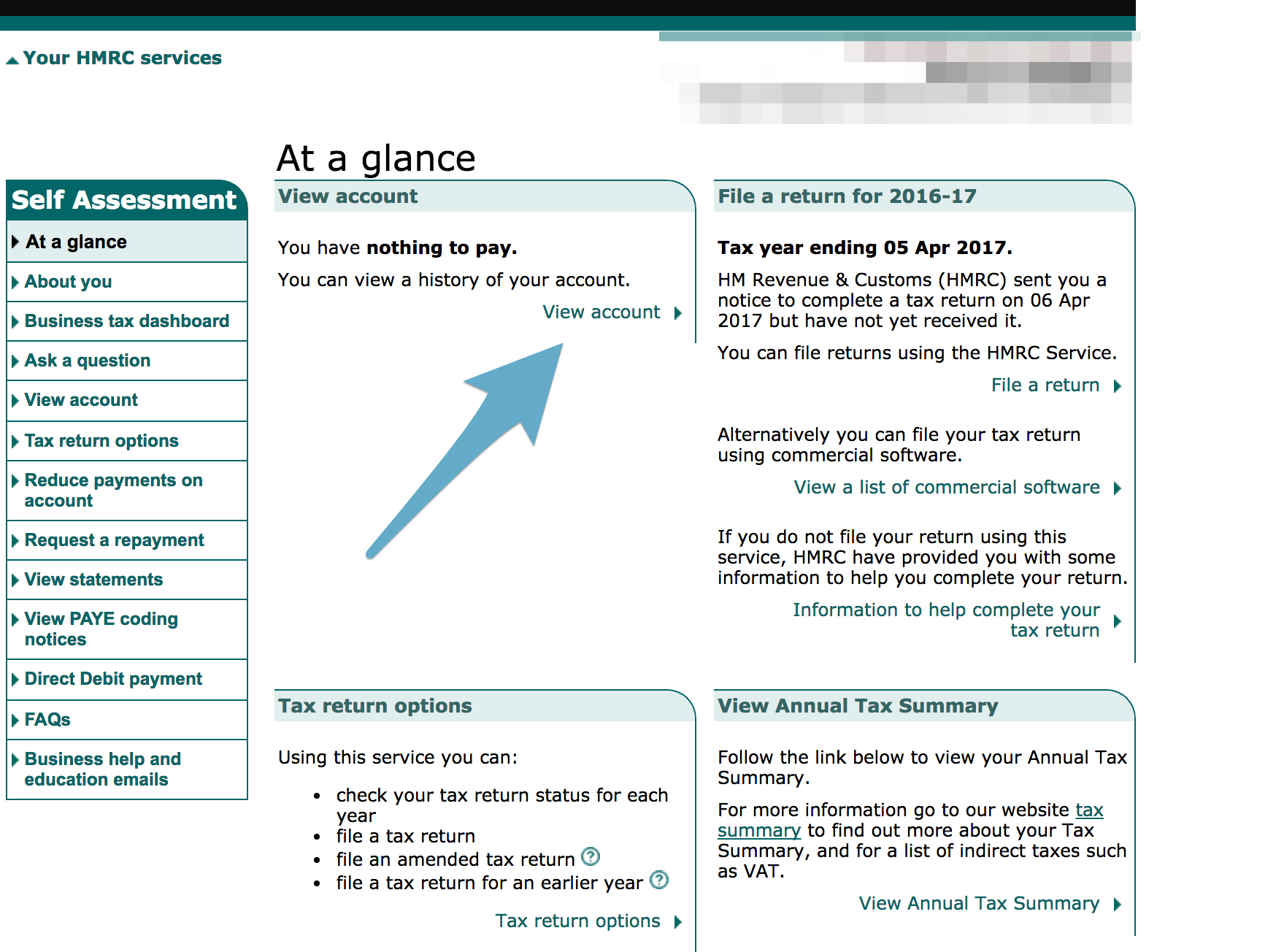

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_15.png

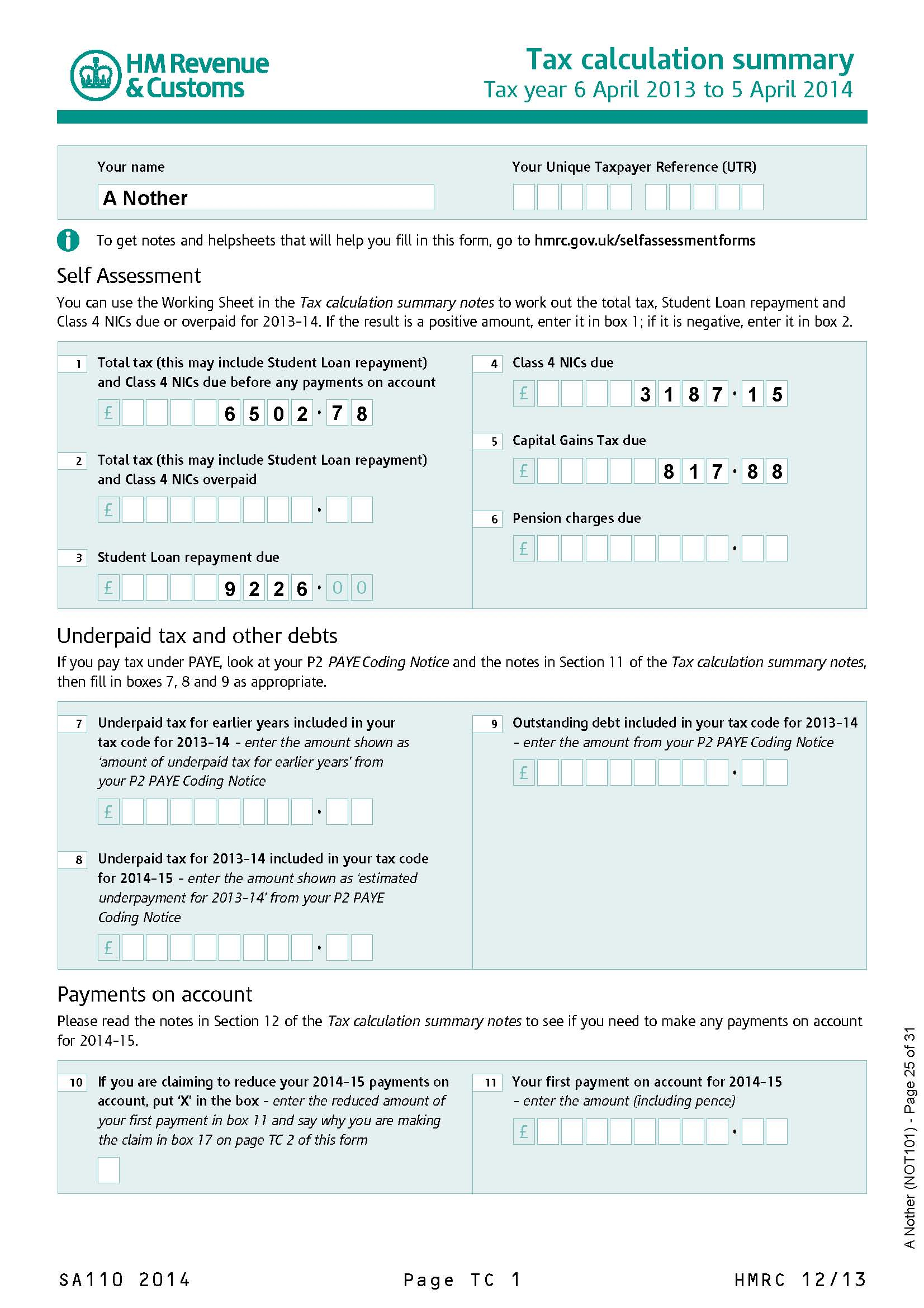

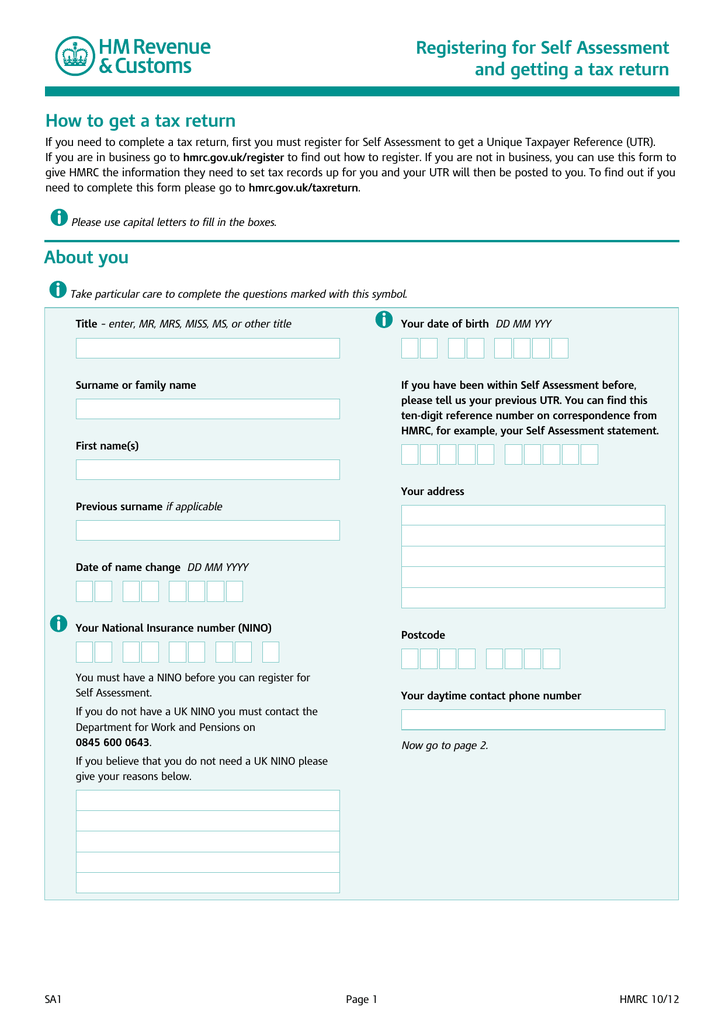

Self Assessment Tax Return Form Employment Pages Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-assessment-tax-return-form-employment-pages.jpg

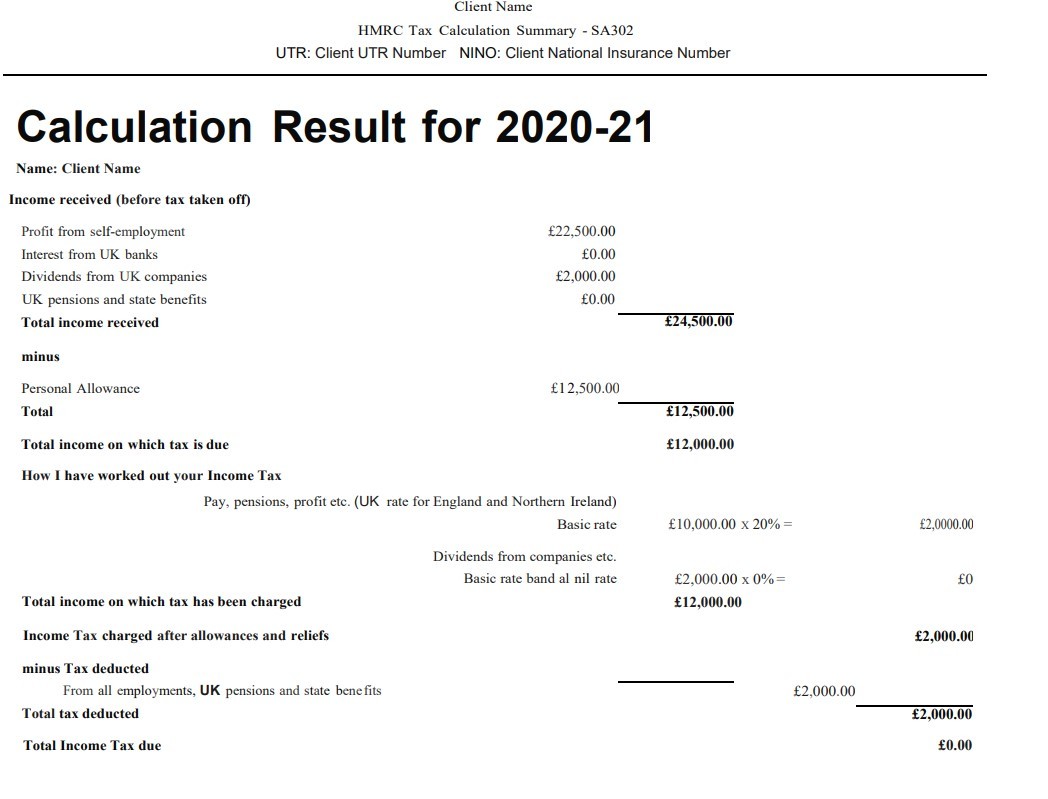

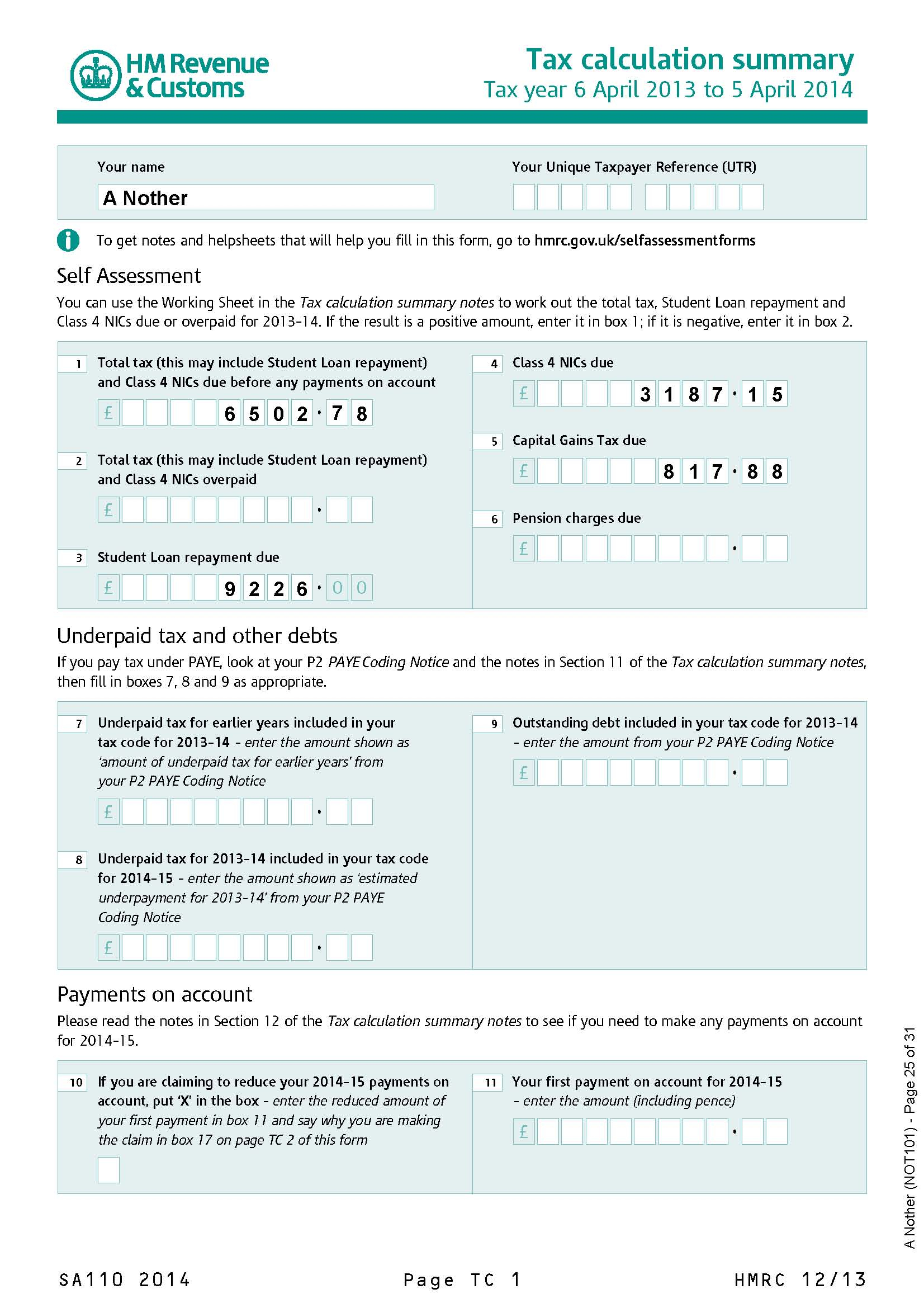

How To Print Your Tax Calculations Better co uk formerly Trussle

https://images.ctfassets.net/bed00l8ra6lf/1c8O9gTiS0yPCj2IORQRha/83df0441e65fdafc9ed02bc52c484409/7._FC_tyoprintyourtaxyo.png

HMRC aims to process online tax returns within 48 hours of submission although paper returns generally take longer due to manual processing And if you re waiting for a If you then requested online to have your repayment refunded to your bank account this can take up to 10 working days If you have not received your repayment after 10

Currently HMRC are not reporting any delay to the processing of paper Self Assessment tax returns on their service dashboard At the moment the service dashboard says that all paper tax returns received before 31 Generally HMRC aims to process your tax return within Online Submissions Up to 72 hours for acknowledgment However the full processing can take up to 2 weeks especially during peak times Paper Submissions

Download How Long Does Hmrc Take To Process A Tax Return

More picture related to How Long Does Hmrc Take To Process A Tax Return

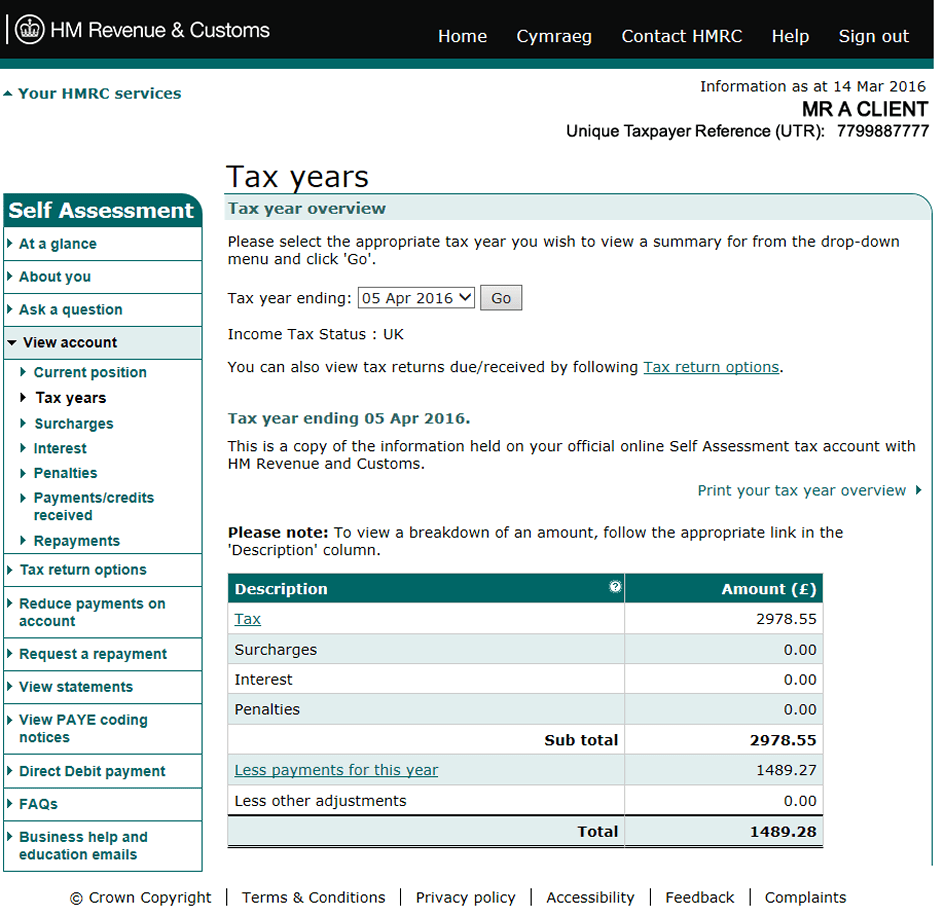

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

https://www.trinityfinancialgroup.co.uk/images/pdf/tax-overview-1.jpg

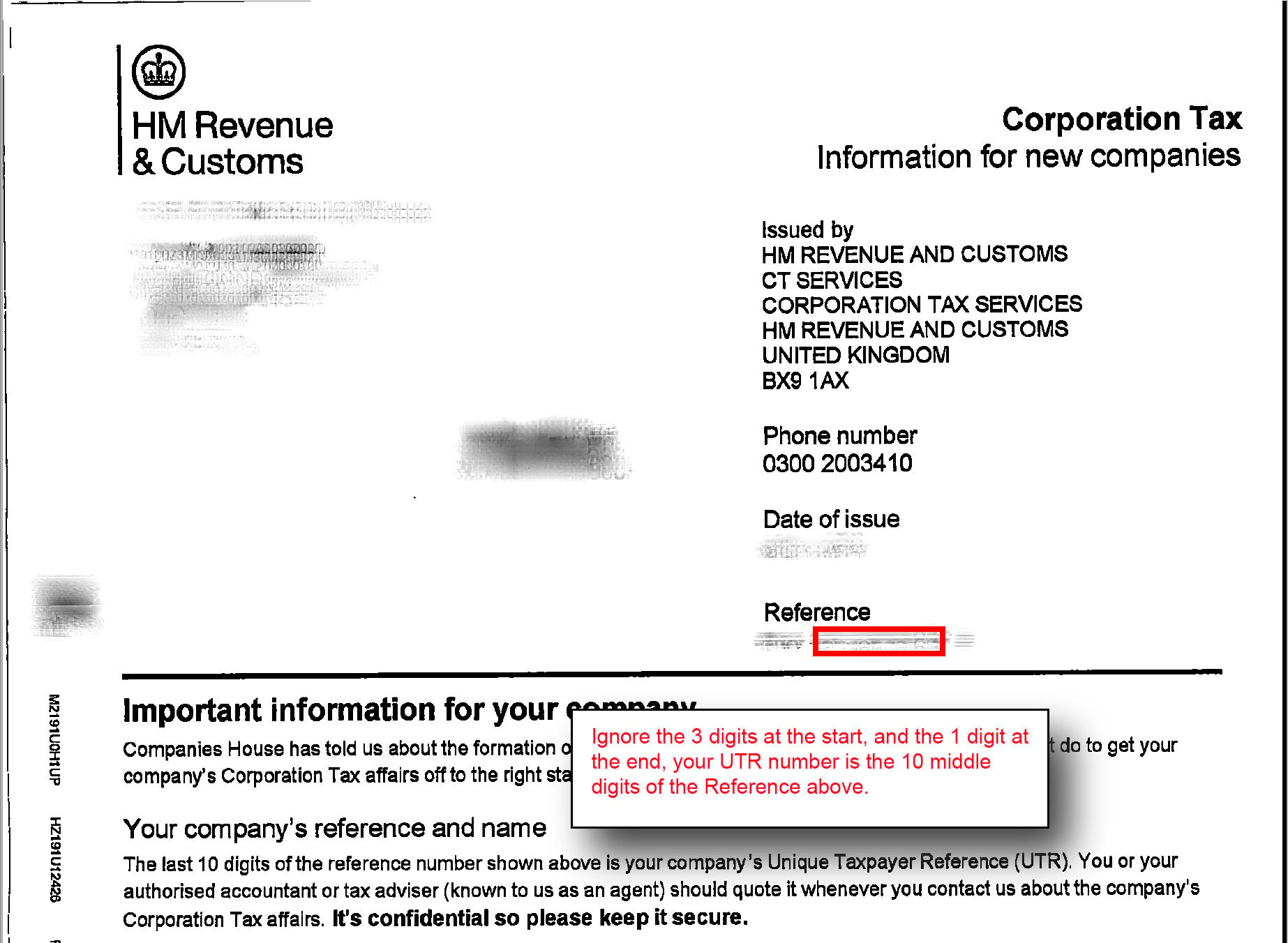

Unique Taxpayer Reference UTR Number What Is How To 44 OFF

https://help.seedlegals.com/hubfs/Knowledge Base Import/downloads.intercomcdn.comio1083385712bfa941c695d48b4a75f640fScreen+Shot+2019-03-12+at+12.37.04+PM-1.jpg

HMRC Self Assessment tax return SPICe Spotlight Solas Air SPICe

https://spice-spotlight.scot/wp-content/uploads/2016/02/hmrc_self_assessment_tax_return.jpg

HMRC aims to process returns within 30 days although it may take longer during busier periods It also depends on the complexity of checks required on the VAT Return and whether You may not get a refund if you have tax due in the next 45 days for example for a payment on account Instead the money will be deducted from the tax you owe You can check when you

How long does HMRC take to process my tax return Online returns typically take about 15 working days while paper returns can take up to 40 days If you don t hear back at this time it s a good idea to check the status Tax refund times can range significantly based on the type of claim and the method by which it is processed Generally HMRC aims to process tax refunds within 8 to 12

How To Complete HMRC s Online Self Assessment Filing Crunch Self

https://i.pinimg.com/736x/6b/2a/3c/6b2a3c5b2f6f4485832571651040901e--online-self-self-assessment.jpg

Malaysian Customs Declaration Forms DeclarationForm

https://www.declarationform.com/wp-content/uploads/2023/03/cash-declaration-hm-revenue-customs-hmrc-gov-fill-and-sign.png

https://pi-accountancy.co.uk › has-hmrc-processed-my-tax-return

Once you submit your Self Assessment tax return you might wonder how long it will take for HMRC to process it The processing times can vary depending on whether you

https://www.aftertaxblog.co.uk › how-long-…

Did you know that some UK taxpayers have reported waiting nearly 4 months to receive their tax refunds after submitting their returns online This unexpected delay highlights the critical need for clarity on HMRC s Her

Bx91as 2020 2024 Form Fill Out And Sign Printable PDF Template

How To Complete HMRC s Online Self Assessment Filing Crunch Self

Useful Information R D Claim Process Overview Roger Hopkins

HMRC Legislation And Letters Explained IR35 Compliance Checks

RobustClaims Innovation Funding R D Tax Credit RobustClaimsUk

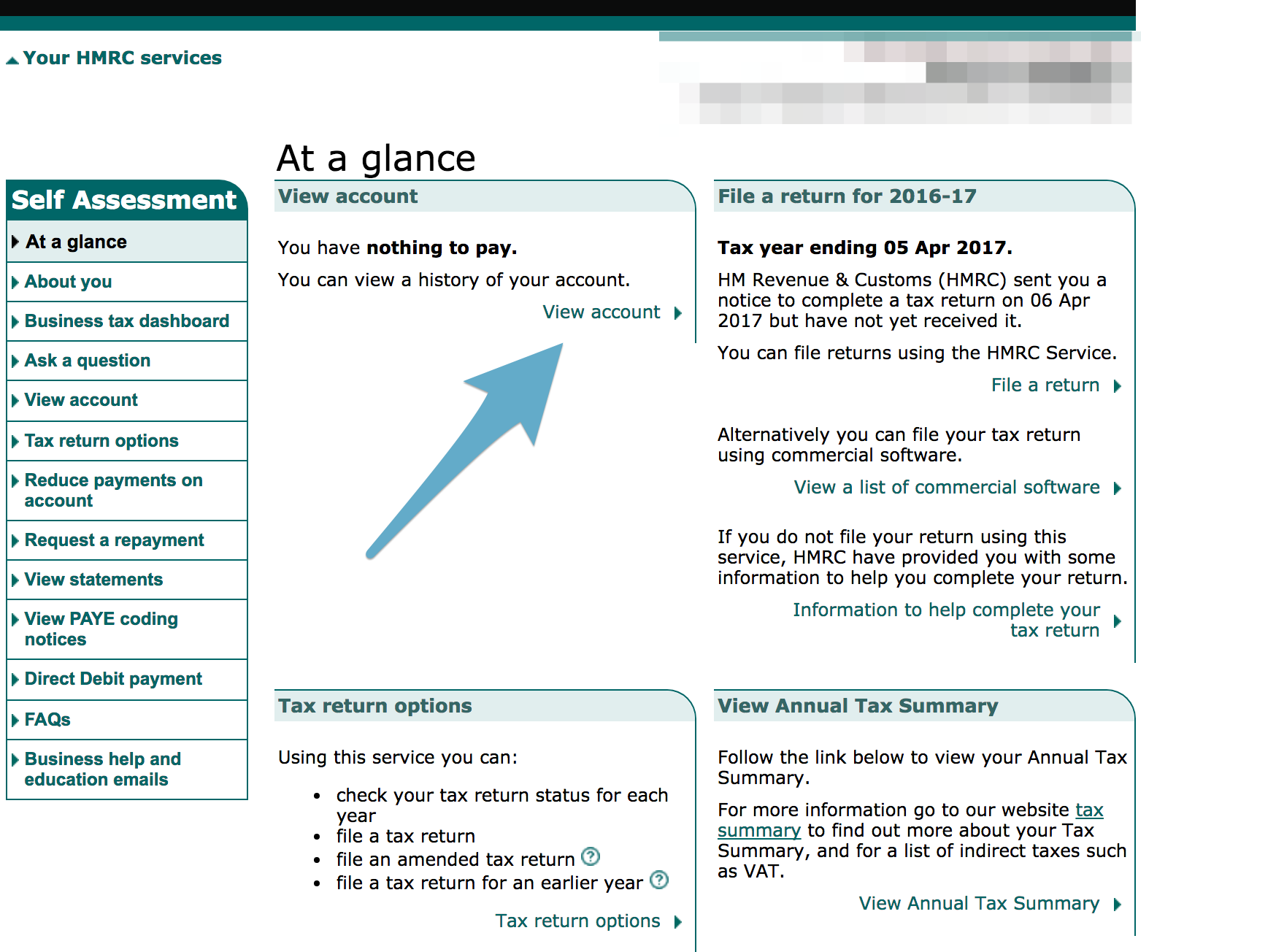

How To Print Your SA302 Or Tax Year Overview From HMRC Love

How To Print Your SA302 Or Tax Year Overview From HMRC Love

HMRC Completes Open Banking Rollout And Sets Out New Priorities

Register And File Your Self Assessment Tax Return Tabitomo

HMRC s Tax Take Falls By Billions Due To Pandemic SKS Bailey Group

How Long Does Hmrc Take To Process A Tax Return - If you then requested online to have your repayment refunded to your bank account this can take up to 10 working days If you have not received your repayment after 10