How Long For State Tax Refund 2024 The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

You will need to enter the exact amount of your refund to check its status According to the state refunds generally take up to two weeks to process if you e file If you file a paper return your refund The IRS expects to issue most refunds via direct deposit within 21 days according to the agency but some returns require additional review that take longer to

How Long For State Tax Refund 2024

How Long For State Tax Refund 2024

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/36056/tax_refund_2_.58ad2540b4575.5e063e880c538.png

How Long To Get Colorado Tax Refund Coots Nathan

https://i.pinimg.com/originals/25/84/14/258414a9ba63687de99d431af3bce628.png

Refund Schedule 2023 R IRS

https://preview.redd.it/refund-schedule-2023-v0-i3bi7qw6pfia1.jpg?width=1080&crop=smart&auto=webp&s=f4eb33a25148030a3bd95b47a532675f61f16c80

Once the IRS acknowledges receipt of a return refund status information is typically available within 24 hours after receipt of a taxpayer s e filed tax year 2023 Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year

The average 2024 tax refund is 3 8 higher than a year ago at 2 948 according to the latest IRS data Luckily there are a few easy ways to track the status of We issue most refunds in less than 21 calendar days However if you mailed your return and expect a refund it could take four weeks or more to process your

Download How Long For State Tax Refund 2024

More picture related to How Long For State Tax Refund 2024

2024 Tax Due Date Calendar Damara Robinetta

https://thecollegeinvestor.com/wp-content/uploads/2024/01/TCI_-_2024-TAX-REFUND-CALENDAR-Updated-1.png

5 Ways To Make Your Tax Refund Bigger The Motley Fool

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

Irs 2024 Refund Schedule For Eitc Andie Blancha

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/08/tax_refund_2_.58ad2540b4575.jpg

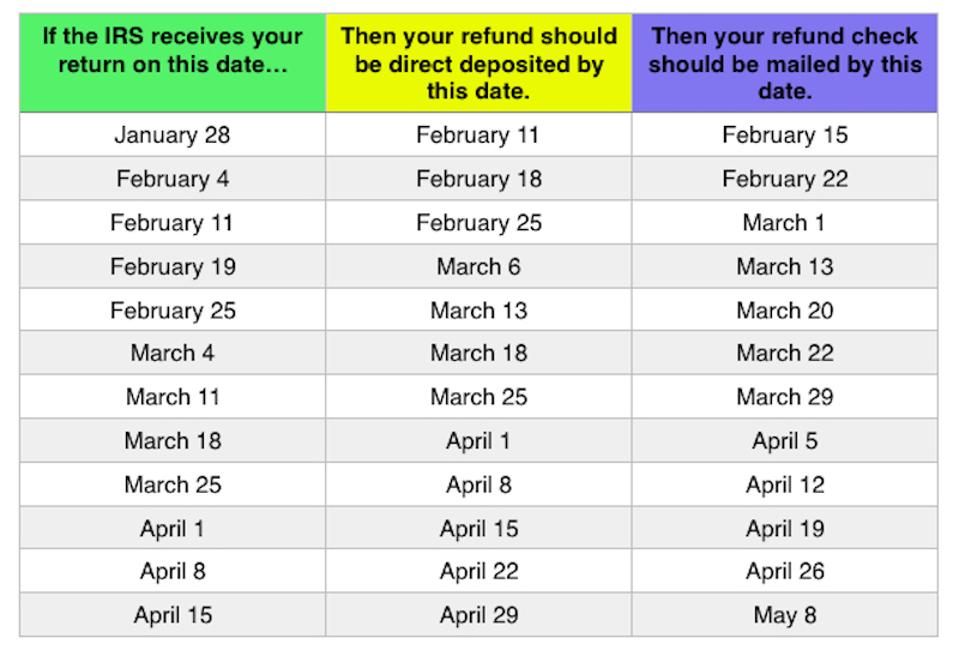

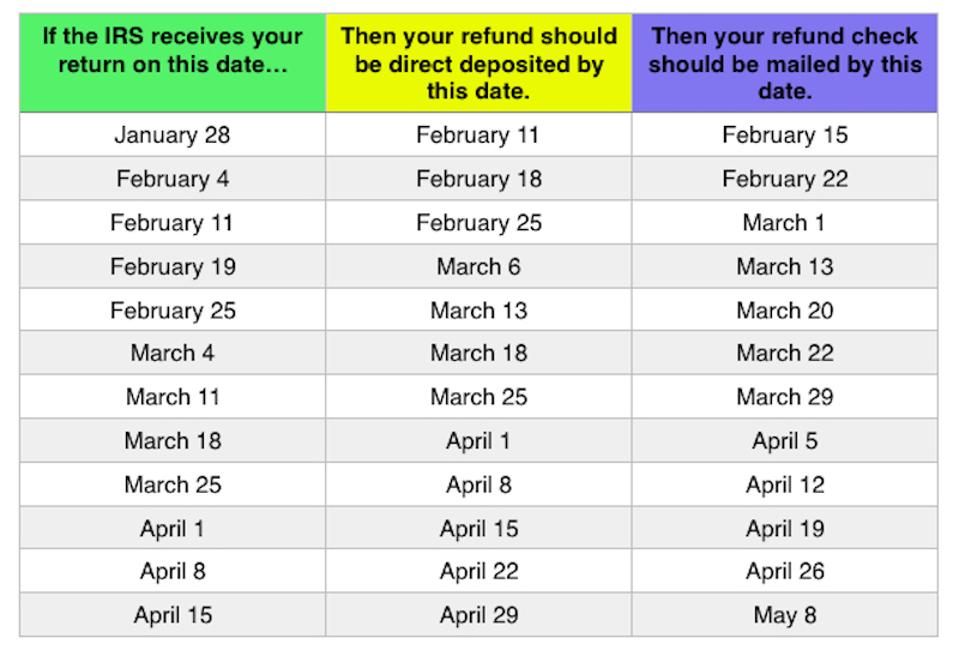

How to track the status of your federal tax refund and state tax refund in 2024 plus tips about timing Tax refund schedule Here s when you ll get your 2024 refund With filing season underway here are two tips for getting your refund ASAP The IRS typically tells

When are taxes due in 2024 The deadline for most taxpayers to file a federal tax return was Monday April 15 2024 Because of the observances of Patriot s Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically If you filed a paper tax return it may take as

State And Local Tax Refund Worksheet

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

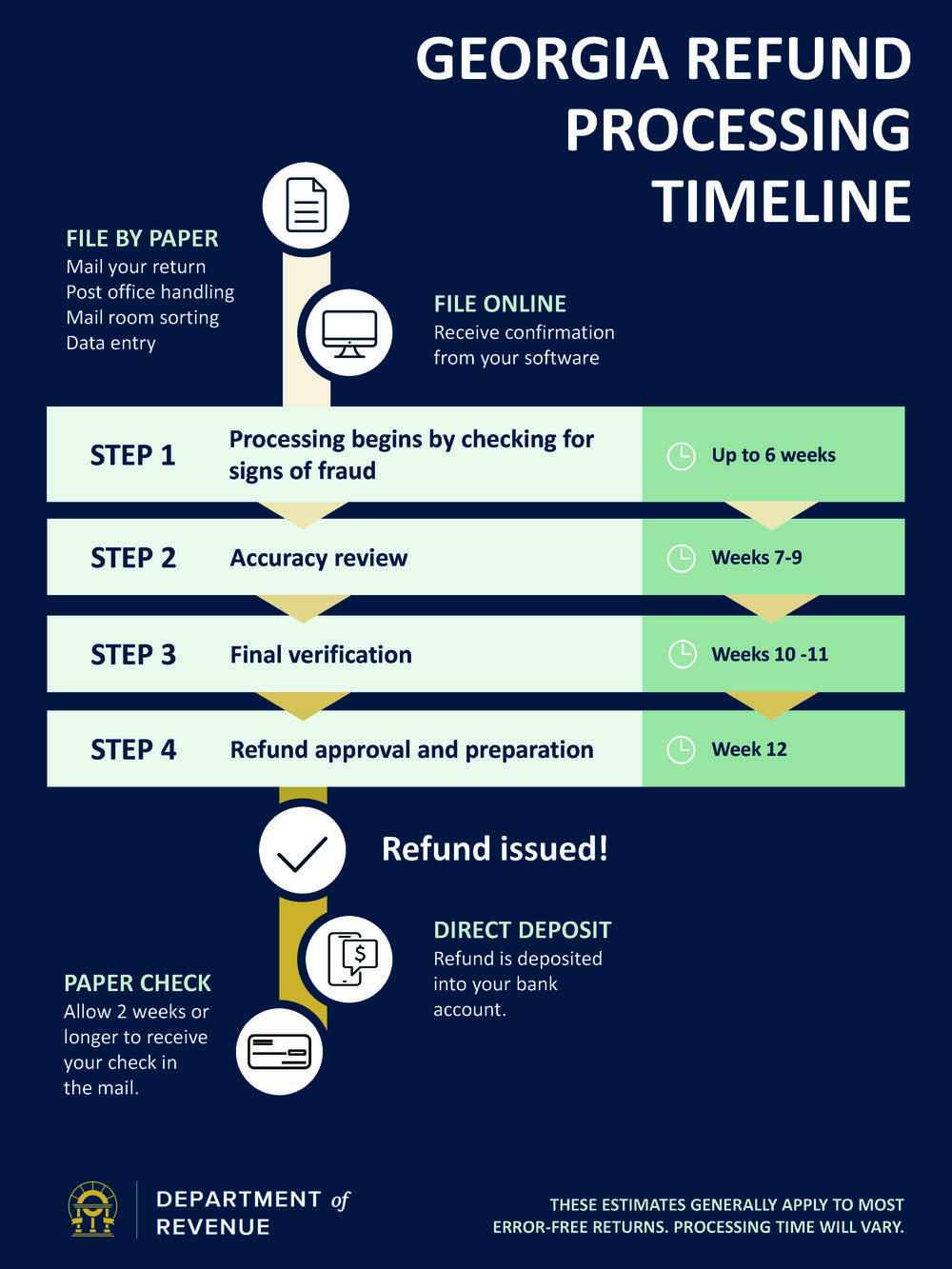

Ga State Tax Refund 2024 Shara Delphine

https://www.taxuni.com/wp-content/uploads/2023/03/Tax-Refund-Cycle-Chart-1536x864.jpg

https://www.usa.gov/check-tax-status

The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

https://smartasset.com/.../wheres-my-st…

You will need to enter the exact amount of your refund to check its status According to the state refunds generally take up to two weeks to process if you e file If you file a paper return your refund

Georgia State Tax Refund 2024 Vikki Orelle

State And Local Tax Refund Worksheet

Tax Refund Calender 2023 Printable Word Searches

How To Check State Return Flatdisk24

How Long Does It Take To Get Taxes Back 2024 2025 Year Halli Kerstin

2019 Tax Refund Chart Can Help You Guess When You ll Receive Your Money

2019 Tax Refund Chart Can Help You Guess When You ll Receive Your Money

Tax Refunds And The IRS What You Need To Know

Mississippi State Tax Refund 2024 Gaynor Gilligan

Utah State Tax Refund Calendar Nina Teresa

How Long For State Tax Refund 2024 - The average 2024 tax refund is 3 8 higher than a year ago at 2 948 according to the latest IRS data Luckily there are a few easy ways to track the status of