How Many Tax Credits Can I Claim What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before

If you re 18 or over you can use the Turn2us benefits calculator to check if it s worth claiming tax credits You ll need to enter details of the other benefits you claim If You may be able to claim additional tax credits depending on your personal circumstances Tax credit amounts for this year are listed in the Tax rates bands and

How Many Tax Credits Can I Claim

How Many Tax Credits Can I Claim

https://naickercpa.ca/wp-content/uploads/2019/09/shutterstock_520623100-1.jpg

What Tax Credits Can I Qualify For Lavish Green

https://lavishgreen.com/img/articles/shutterstock_1494689156_1024x1024.jpg

How Many Uears Of Tax Teturs For Home Loan

https://www.manishanilgupta.com/public/assets/upload/blog/5f6af0338d718_Income Tax.jpeg

Tax credits have been replaced by Universal Credit You can only make a claim for Child Tax Credit or Working Tax Credit if you already get tax credits Tax credits reduce the amount of tax you pay You must have paid tax due to your employment in order to use tax credits You can claim additional tax credits you

How much can I claim on my tax return In one year you can claim a maximum of 75 of your net income The ability to carry forward charitable donation credits means if you reach the maximum claim amount this To qualify the fees you paid to attend each educational institution must be more than 100 For example if you attended two educational institutions in the year the amount on

Download How Many Tax Credits Can I Claim

More picture related to How Many Tax Credits Can I Claim

Employee Retention Credit The Basics FRSCPA PLLC

https://www.frscpa.com/wp-content/uploads/2021/01/Tax-Credits-scaled-1.jpeg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Tax Credits Claim Form Concept Stock Photo Alamy

https://c8.alamy.com/comp/HBEAJN/tax-credits-claim-form-concept-HBEAJN.jpg

IRS Tax Tip 2024 72 Aug 26 2024 The IRS recently shared five new warning signs of incorrect claims by businesses for the Employee Retention Credit The new list To claim the CTM ITC you must be a taxable Canadian corporation including a taxable Canadian corporation that is a member of a partnership The labour

Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay If your children were born on or after 6 April 2017 you can only claim Tax Credits for up to two children But you can still claim Child Benefit for all of them If your children were

What Happens If You Don t File A Tax Return Tax Time Tax Refund

https://i.pinimg.com/originals/1c/5d/43/1c5d43cf691b7dda6440f821e65c2fa9.jpg

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

https://www.greenbacktaxservices.com/wp-content/uploads/2023/01/Screen-Shot-2023-01-24-at-12.18.53-PM-1024x978.png

https://www.gov.uk › claim-tax-credits › what-counts-as-income

What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before

https://www.citizensadvice.org.uk › benefits › help-if...

If you re 18 or over you can use the Turn2us benefits calculator to check if it s worth claiming tax credits You ll need to enter details of the other benefits you claim If

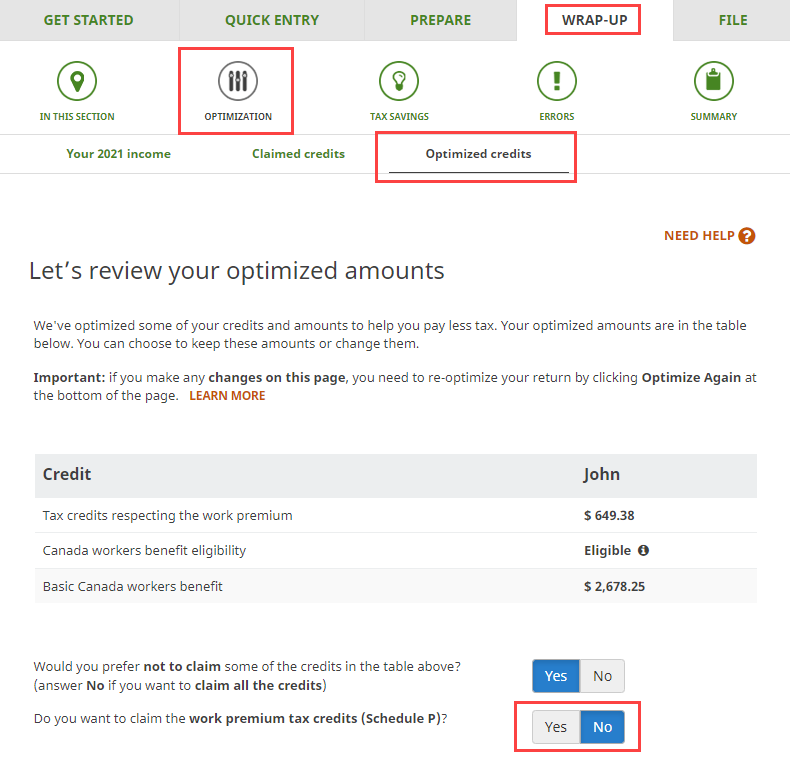

Schedule P Tax Credits Respecting The Work Premium

What Happens If You Don t File A Tax Return Tax Time Tax Refund

Who Can I Claim As A Dependent

These Tax Credits Can Mean A Refund For Individual Taxpayers

What Tax Credits Can I Qualify For This Year

What Tax Credits Can I Qualify For This Year

What Tax Credits Can I Qualify For This Year

The Complete List Of Tax Credits For Individuals

2022 Education Tax Credits Are You Eligible

Investing With Insight Maximizing Tax Credit Benefits

How Many Tax Credits Can I Claim - How much can I claim on my tax return In one year you can claim a maximum of 75 of your net income The ability to carry forward charitable donation credits means if you reach the maximum claim amount this