Not Married 2 Dependants Tax Rebates Web 28 f 233 vr 2021 nbsp 0183 32 Divorced and never married co parents have the chance to pick up an extra 1 100 per dependent child when they file their 2020 returns It requires trust

Web 4 janv 2016 nbsp 0183 32 Ajout Modification 04 01 2016 3 r 233 actions Imp 244 ts gt Exemple gt Couple mari 233 sans enfant revenus modestes Couple mari 233 sans enfant revenus modestes Web 1 400 while married taxpayers who file a joint return that claims two qualifying dependents will have a maximum credit of 5 600 Qualifying dependents expanded

Not Married 2 Dependants Tax Rebates

Not Married 2 Dependants Tax Rebates

https://i.ytimg.com/vi/45_-tXWYoIc/maxresdefault.jpg

Itemize Your Taxes dependants coronavirus covid19 sidehoediaries

https://i.ytimg.com/vi/KmtrmN6CWq0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AGMAoAC4AOKAgwIABABGHIgSigzMA8=&rs=AOn4CLC_O1vvK7rUcOXmGhe2TjEv4VL0Og

UK BAN On International Student s Dependants Is Not EmdeeTiamiyu Fault

https://i.ytimg.com/vi/J5amy_K2auI/maxresdefault.jpg

Web 5 janv 2023 nbsp 0183 32 Imp 244 t de Mme 1 5 part 0 Soit un total pour le couple de 2 371 Dans cette situation les concubins vont 233 conomiser 500 d imp 244 t en mettant l enfant 224 charge Web Enfants mineurs ou handicap 233 s quel que soit leur 226 ge Si vous avez des enfants mineurs ou handicap 233 s quel que soit leur 226 ge avec votre concubin et qu ils sont reconnus par

Web 3 mai 2023 nbsp 0183 32 vous b 233 n 233 ficiez de 2 parts couple sans enfant pour le calcul de votre imp 244 t A noter l ann 233 e du mariage vous devez souscrire une d 233 claration d imp 244 t commune Web 30 mars 2023 nbsp 0183 32 OVERVIEW The Internal Revenue Service IRS allows you to potentially reduce your tax by claiming a dependent child on a tax return If you do not file a joint

Download Not Married 2 Dependants Tax Rebates

More picture related to Not Married 2 Dependants Tax Rebates

IRS Payroll Tax Rebates For 2020 2021 2022 Free ERTC Eligibility Test

https://i.pinimg.com/originals/e2/db/66/e2db66d275f5ed0f7f7e858563b8fa87.jpg

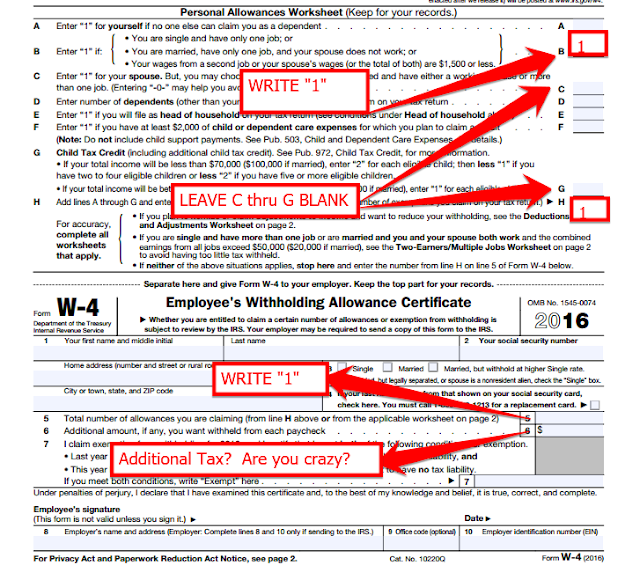

Official Tax Season Thread Vol Splash Out M8 Page 17 NikeTalk

https://4.bp.blogspot.com/-HVpK_UpYK9Q/VwcL19EP3PI/AAAAAAAA2xU/n2ACgfiLW_Upm9XUvJNE_La7-4wNKUf3g/s640/w4.png

Letter About Submitting The Proposals Of Teacher s Dependants Medical

https://lh3.googleusercontent.com/-t_wcoxLzrs0/XzqHvre2dGI/AAAAAAAAodg/en4g-iYp6O0stvNYsgxiw_epUYe6mtLtACLcBGAsYHQ/w1200-h630-p-k-no-nu/1597671152703274-0.png

Web If you live with your partner and the mortgage is in just one partner s name only the listed partner can claim a deduction for mortgage payments and interest even if the unnamed Web 11 f 233 vr 2021 nbsp 0183 32 The credit begins to phase out when the taxpayer s income is more than 200 000 This phaseout begins for married couples filing a joint tax return at 400 000

Web 28 avr 2021 nbsp 0183 32 Here are five tax breaks parents can take on their tax return and potentially lower their tax bill or increase their refund Web 24 janv 2023 nbsp 0183 32 If you have one child and your adjusted gross income was 43 492 if you re filing a return alone or 49 622 if you re filing a joint return with a spouse you could

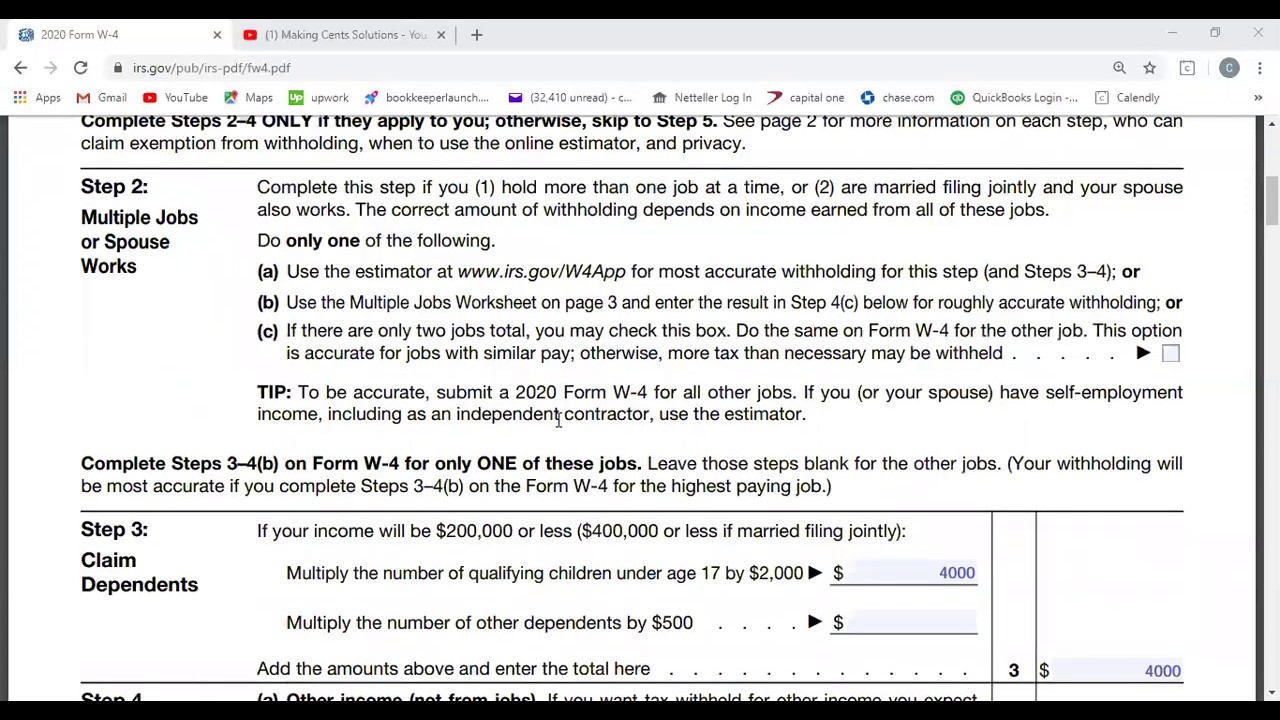

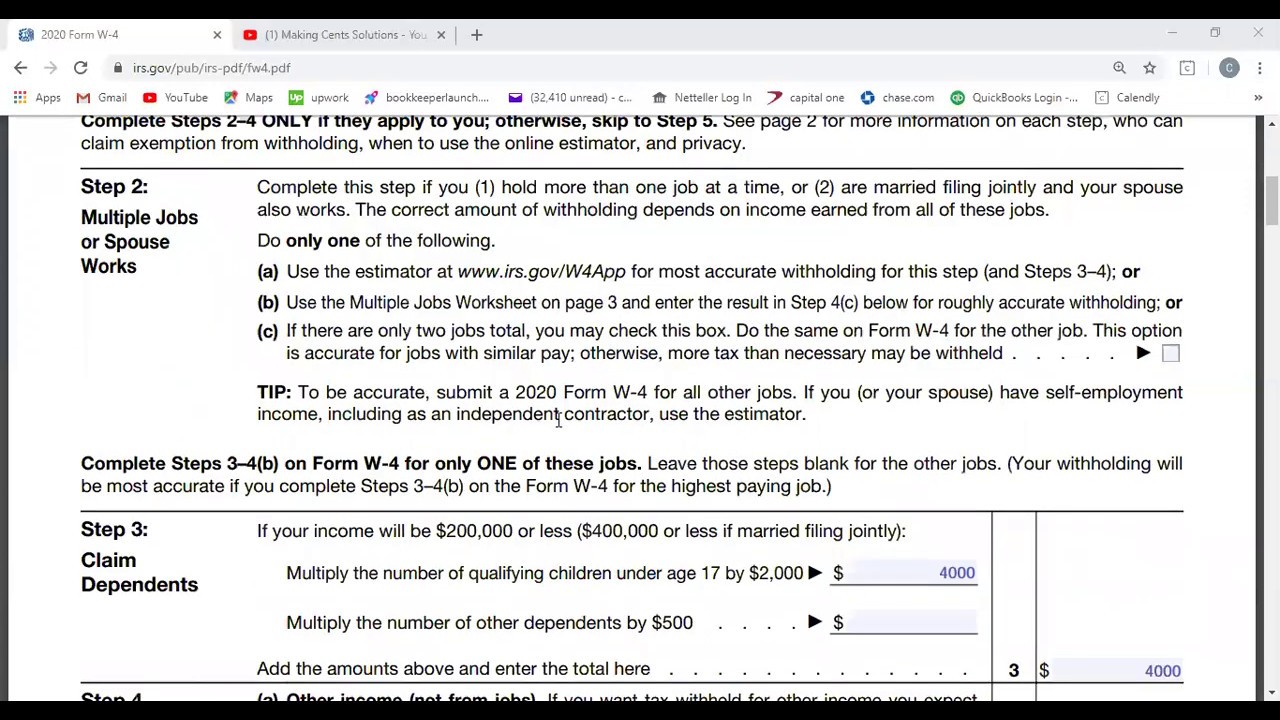

W4 Form 2 Dependents New Form

https://thelawdictionary.org/wp-content/uploads/2020/08/w-4.jpg

Flores Team Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=456576403154379

https://www.forbes.com/sites/peterjreilly/2021/02/27/the-1100-per...

Web 28 f 233 vr 2021 nbsp 0183 32 Divorced and never married co parents have the chance to pick up an extra 1 100 per dependent child when they file their 2020 returns It requires trust

https://impotsurlerevenu.org/exemple/126-couple-marie-sans-enfant-re...

Web 4 janv 2016 nbsp 0183 32 Ajout Modification 04 01 2016 3 r 233 actions Imp 244 ts gt Exemple gt Couple mari 233 sans enfant revenus modestes Couple mari 233 sans enfant revenus modestes

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

W4 Form 2 Dependents New Form

W4 Estimator ClaudeKeelin

2021 W 4 Guide How To Fill Out A W 4 This Year Gusto

TV Licence Scam As Action Fraud Reports A Surge In Cases Here s How To

TV Licence Scam As Action Fraud Reports A Surge In Cases Here s How To

Gimme The Loot Giving Yourself A Raise Open Mouths Get Fed

How Many Allowances To Claim If Married Filing Jointly 3pointsdesign

How To Fill Out W2 Claiming 0 New Form

Not Married 2 Dependants Tax Rebates - Web 30 mars 2023 nbsp 0183 32 OVERVIEW The Internal Revenue Service IRS allows you to potentially reduce your tax by claiming a dependent child on a tax return If you do not file a joint