How Many Times Can You Claim Federal Solar Tax Credit Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

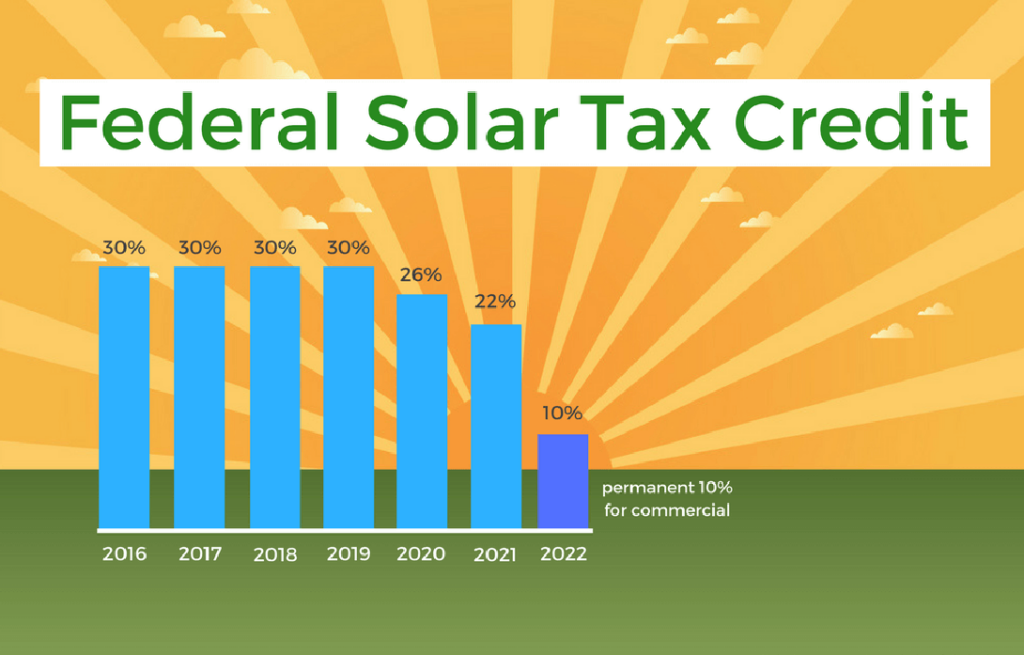

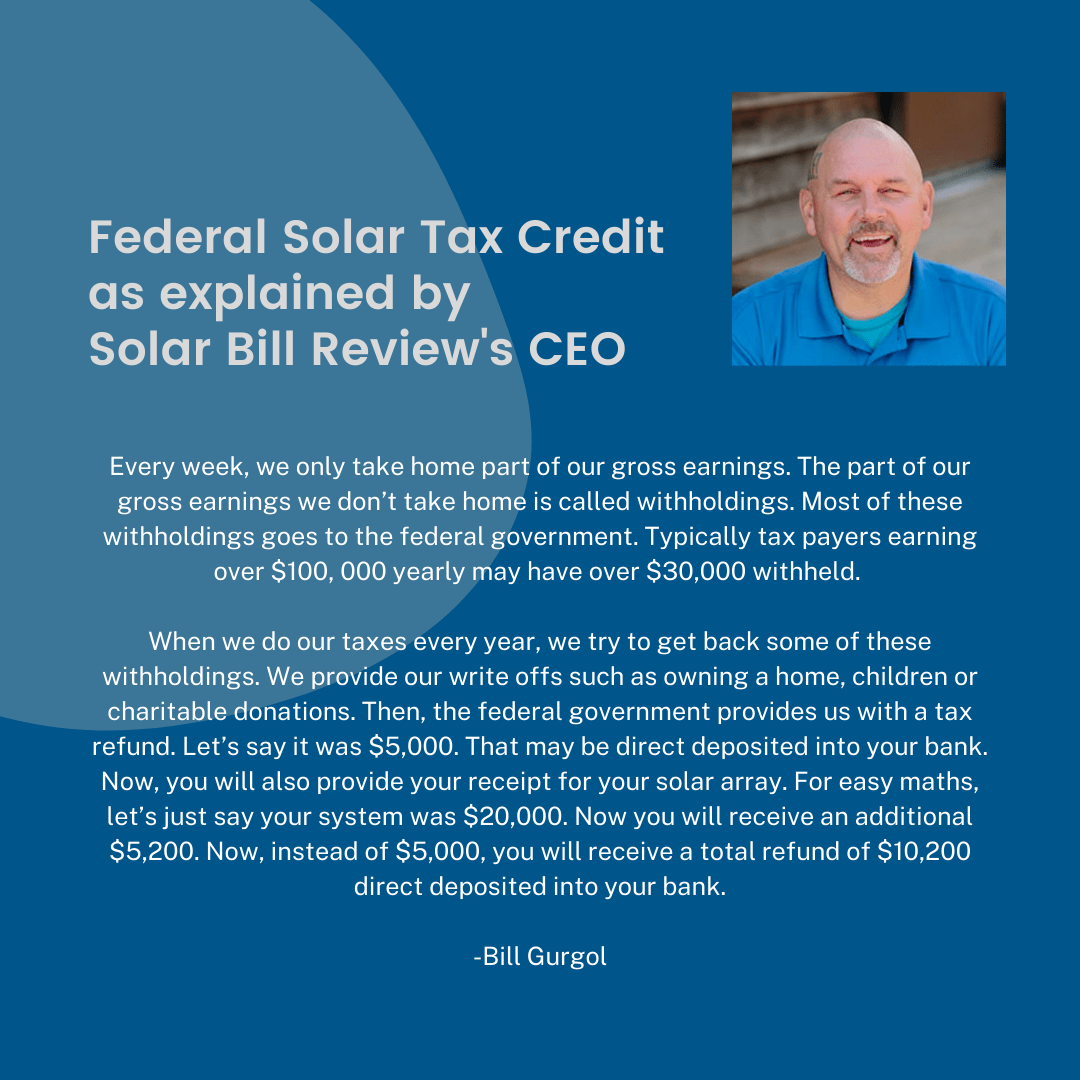

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Verkko 27 syysk 2023 nbsp 0183 32 Table of Contents show What is the Federal Solar Tax Credit Here is a quick word on what the solar tax credit means for all those readers who just learned about the solar tax credits Solar Tax Credit is also called ITC It s worth a 26 federal tax credit of the total cost of your solar energy system

How Many Times Can You Claim Federal Solar Tax Credit

How Many Times Can You Claim Federal Solar Tax Credit

https://www.goadtsolar.com/wp-content/uploads/2022/08/Solar-Tax-Credit_graph-01.png

Your Guide To Solar Tax Credits

https://www.usersadvice.com/wp-content/uploads/2023/03/Screenshot_15-1024x655.png

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

Verkko 22 jouluk 2022 nbsp 0183 32 There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Verkko 30 marrask 2023 nbsp 0183 32 An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence Verkko If the system cost 10 000 the 30 credit would be 3 000 and you could claim 25 of that or 750 10 000 system cost x 0 30 30 credit 3 000 full credit amount 3 000 credit amount x 0 25 25 of the year 750 partial credit amount

Download How Many Times Can You Claim Federal Solar Tax Credit

More picture related to How Many Times Can You Claim Federal Solar Tax Credit

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

Federal Tax Credit For Installing Solar Panels Tax Walls

https://www.solarreviews.com/content/images/blog/SR-claiming-solar-tax-credit.jpg

How To File The Federal Solar Tax Credit A Step By Step Guide

https://blog.pickmysolar.com/hs-fs/hubfs/pkms-blog-federal-tax-credit.jpg?width=1305&name=pkms-blog-federal-tax-credit.jpg

Verkko The federal solar investment tax credit ITC now referred to as the residential clean energy credit is a tax credit that can be claimed on federal income taxes for 30 of the cost of a solar photovoltaic PV system Verkko Guides Solar Federal Solar Tax Credit Guide for Homeowners 2024 Read our guide to learn about how much you can save with the federal solar tax credit in 2024 Get My Free

Verkko Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023 Verkko 20 kes 228 k 2023 nbsp 0183 32 If your tax liability is greater than 6 000 you ll be able to claim the entire credit in one year If your tax liability is lower than 6 000 you can roll the remaining credit into future tax years Always consult a licensed tax professional with questions about your tax liability and claiming tax credits

Solar Tax Credit Explained For 2022

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1536x864.png

Your Guide To The Solar Investment Tax Credit SunFarm Energy

https://sunfarmenergy.net/wp-content/uploads/2022/06/Federal-ITC-blog-graphics-fb-cover-08-2.png

https://www.energy.gov/sites/default/files/2021/02/f82/Guid…

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Everything You Need To Know About The Federal Solar Tax Credit

Solar Tax Credit Explained For 2022

Solar Tax Credit Extended 2 More Years SunWork

Federal Solar Tax Credit Eligibility Benefits Form 5695 How To

How To Claim Your Solar Tax Credit ITC

How Do I Claim The Solar Tax Credit EnergySage

How Do I Claim The Solar Tax Credit EnergySage

Your Guide To Solar Federal Tax Credit

Federal Investment Solar Tax Credit Guide Learn How To Claim The

30 Solar Tax Credit What Is It And How Much Can You Actually Save

How Many Times Can You Claim Federal Solar Tax Credit - Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit