Invite to Our blog, a room where curiosity fulfills information, and where everyday topics end up being engaging discussions. Whether you're looking for understandings on way of life, modern technology, or a bit of whatever in between, you've landed in the appropriate location. Join us on this exploration as we study the realms of the ordinary and extraordinary, understanding the world one post at a time. Your journey into the fascinating and diverse landscape of our How Many Years Can Corporation Tax Losses Be Carried Forward starts below. Explore the fascinating content that awaits in our How Many Years Can Corporation Tax Losses Be Carried Forward, where we decipher the ins and outs of numerous topics.

How Many Years Can Corporation Tax Losses Be Carried Forward

How Many Years Can Corporation Tax Losses Be Carried Forward

Corporation Tax And Trading Losses Debitam

Corporation Tax And Trading Losses Debitam

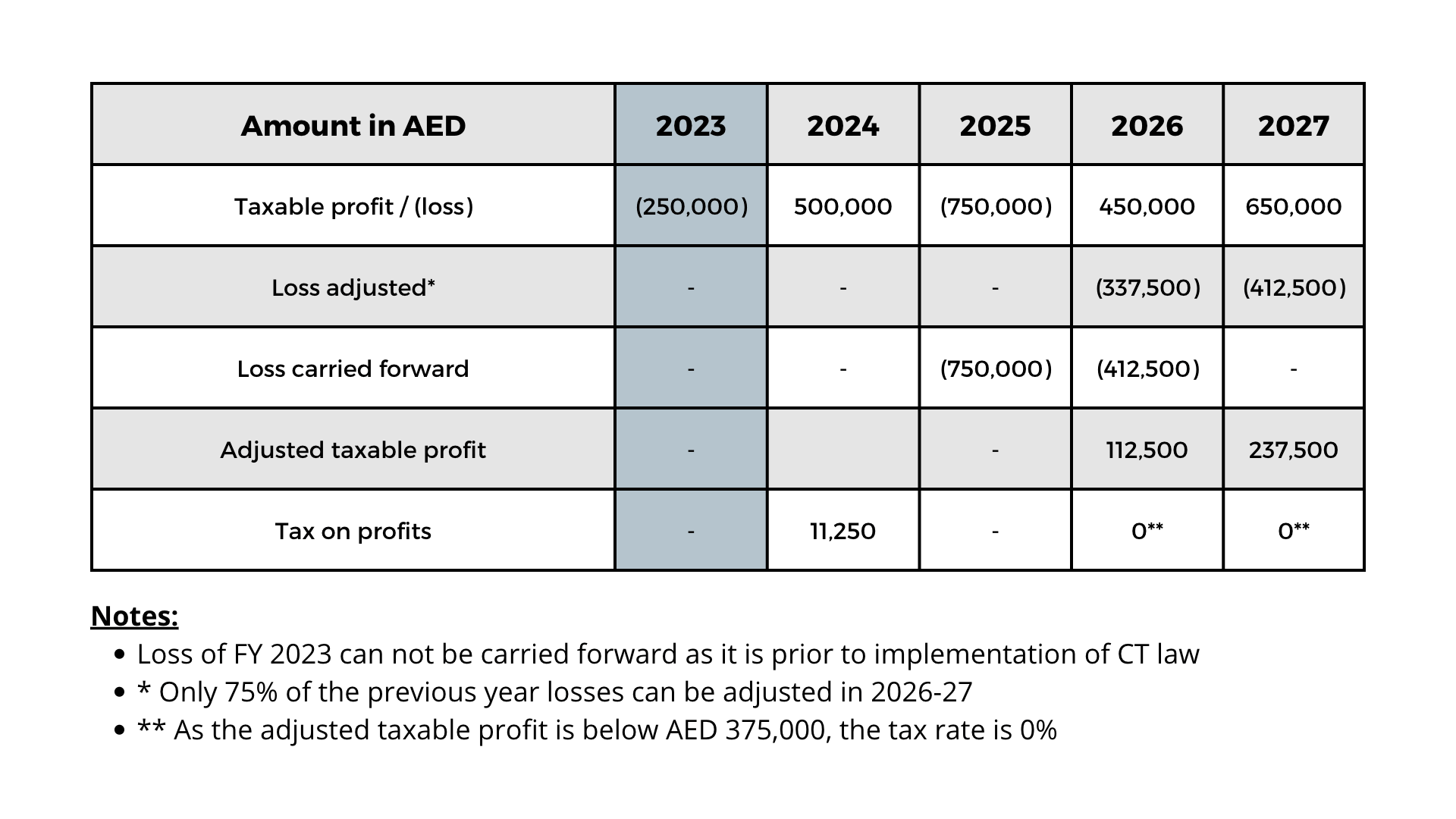

Corporate Tax Loss Carry Forward What When And How Much

Corporate Tax Loss Carry Forward What When And How Much

Gallery Image for How Many Years Can Corporation Tax Losses Be Carried Forward

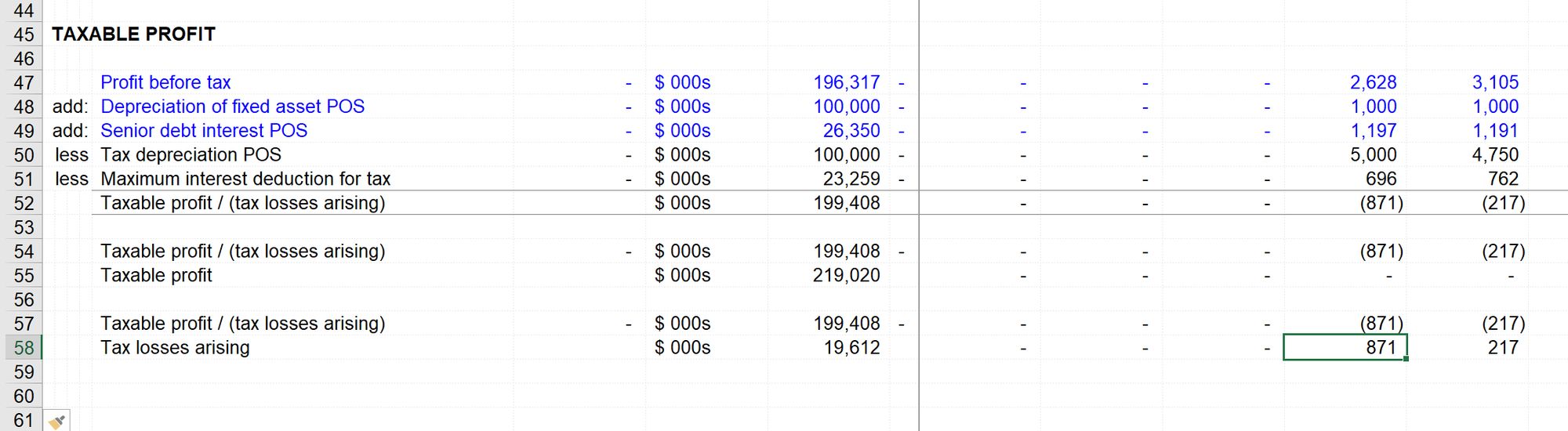

Modelling Tax Loss Carry Forward

To Set Off

Tax Loss Carry Forward Balance Sheet Financial Statement Alayneabrahams

Set Off And Carry Forward Of Losses Rules Restrictions

Claiming Corporation Tax Losses GLX

The Truth About Can Trading Losses Be Carried Forward Is About To Be

The Truth About Can Trading Losses Be Carried Forward Is About To Be

How Long Can Capital Losses Be Carried Forward In Australia

Thank you for selecting to explore our site. We sincerely wish your experience surpasses your assumptions, and that you uncover all the details and resources about How Many Years Can Corporation Tax Losses Be Carried Forward that you are seeking. Our dedication is to provide an user-friendly and interesting system, so do not hesitate to browse via our pages easily.