How Much Amount Fd Interest Is Tax Free 2023 The best way to determine your exact tax liability from your FD interest is to consult a tax advisor However if you want to estimate how much you ll have to pay in taxes then

Yes the interest income earned on bank post office Fixed Deposits or Recurring deposits is a taxable income The interest income is taxable as per individual s tax slab rate for AY 2024 25 The slab rate is How much FD interest is tax free Section 80TTA allows a tax deduction of up to Rs 10 000 against the FD interest to an individual taxpayer Moreover for a senior citizen the tax free interest is much

How Much Amount Fd Interest Is Tax Free 2023

How Much Amount Fd Interest Is Tax Free 2023

https://navi.com/blog/wp-content/uploads/2023/04/SBI-FD-Interest-Rate.jpg

How To Calculate Interest Using Apr Haiper

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

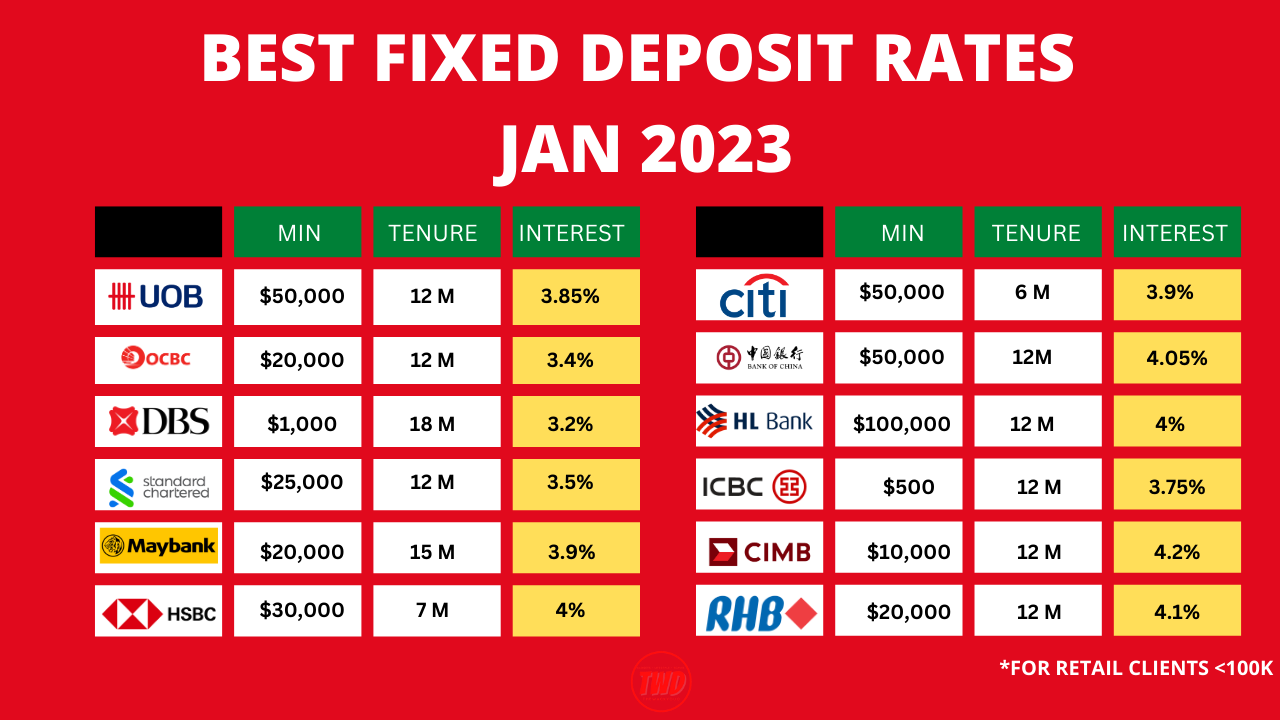

Best Fixed Deposit Rates Jan 2023 The Wacky Duo Helpfulpraise

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi2AhkouyKzerwiaPjANHXMbul8lqvUh2JZAJFgqiZt-1ftSQ21HaxZhxLE8vdyHf1fTTcCzKTj7m0Lcyat_2-TkZ0zeHOXmV4MVNQwsdILRtBghlTh6tUMaf1tfwkTMYZdDR4SmCJY4WsyawpUb55YtzOHIs8dXAOD8D-qOarXsevj2FhvhmHDaC7HWg/s1280/AMOUNT.png

Minimum Amount Rs 100 in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly payout Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against

Tax saving FDs have an interest rate ranging from 5 5 to 7 75 and a lock in period of 5 years Comparing them with other tax saving investments like ELSS funds The calculation of TDS Tax Deducted at Source on fixed deposit FD interest is based on the following factors Applicable TDS Rate The TDS rate for FD interest is

Download How Much Amount Fd Interest Is Tax Free 2023

More picture related to How Much Amount Fd Interest Is Tax Free 2023

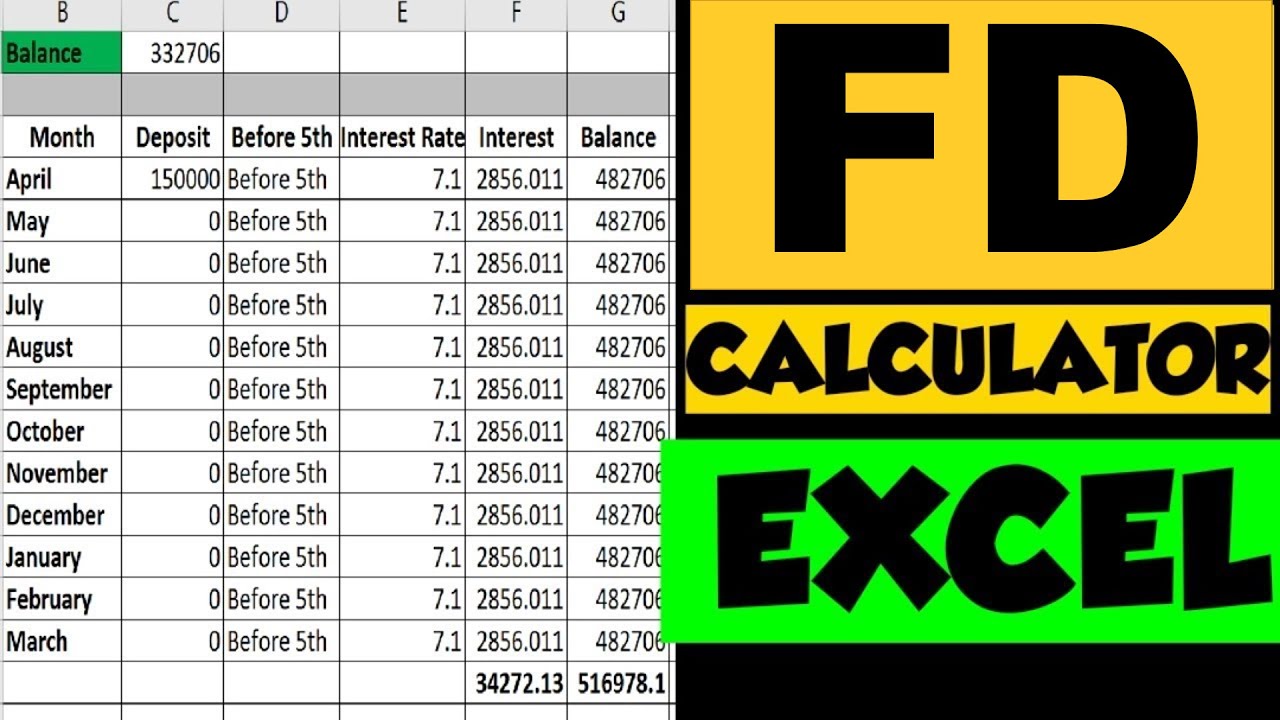

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

https://i.ytimg.com/vi/fZ0XcrgOmOk/maxresdefault.jpg

Want A Pile Of Tax Free Money Thanks To A Cash Out Refinance Who Doesn

https://i.pinimg.com/originals/c5/a8/28/c5a8283aaf2e717e58a6d33ce6fa6182.png

Know More About Highest FD Interest Rates In India In 2020

http://softrop.com/wp-content/uploads/2020/08/FD-Interest-Rates.jpg

Like other fixed deposits senior citizens enjoy 0 25 to 0 5 higher returns on their tax saving fixed deposit investments than regular customers Tax saver FD scheme is eligible for deduction under If a senior citizen is investing Rs 1 20 546 in a tax saver bank FD at 7 per cent per annum interest on a quarterly compounding basis at the end of the first year

How large amount FD is tax free The amount of Fixed Deposit FD that is tax free depends on the type of FD and the investor s tax slab For individuals and Hindu TDS on FD interest Learn the tax implications deduction rates and special rules for calculating and paying tax on FD interest earnings TDS or Tax Deducted at

6 Ways You Can Pay Less In Taxes This Year

https://s42016.pcdn.co/wp-content/uploads/2021/03/kelly-sikkema-tQQ4BwN_UFs-unsplash-768x512.jpg

FD RD PPF Tax Hello Maharashtra

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

https://www.omnicalculator.com › finance › fixed-deposit

The best way to determine your exact tax liability from your FD interest is to consult a tax advisor However if you want to estimate how much you ll have to pay in taxes then

https://www.relakhs.com › fixed-deposit-int…

Yes the interest income earned on bank post office Fixed Deposits or Recurring deposits is a taxable income The interest income is taxable as per individual s tax slab rate for AY 2024 25 The slab rate is

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

6 Ways You Can Pay Less In Taxes This Year

FD Interest Rates High Fixed Deposit Interest Rates Jan 2024

Recently India Has Signed Line Of Credit LOC Agreement With Sri

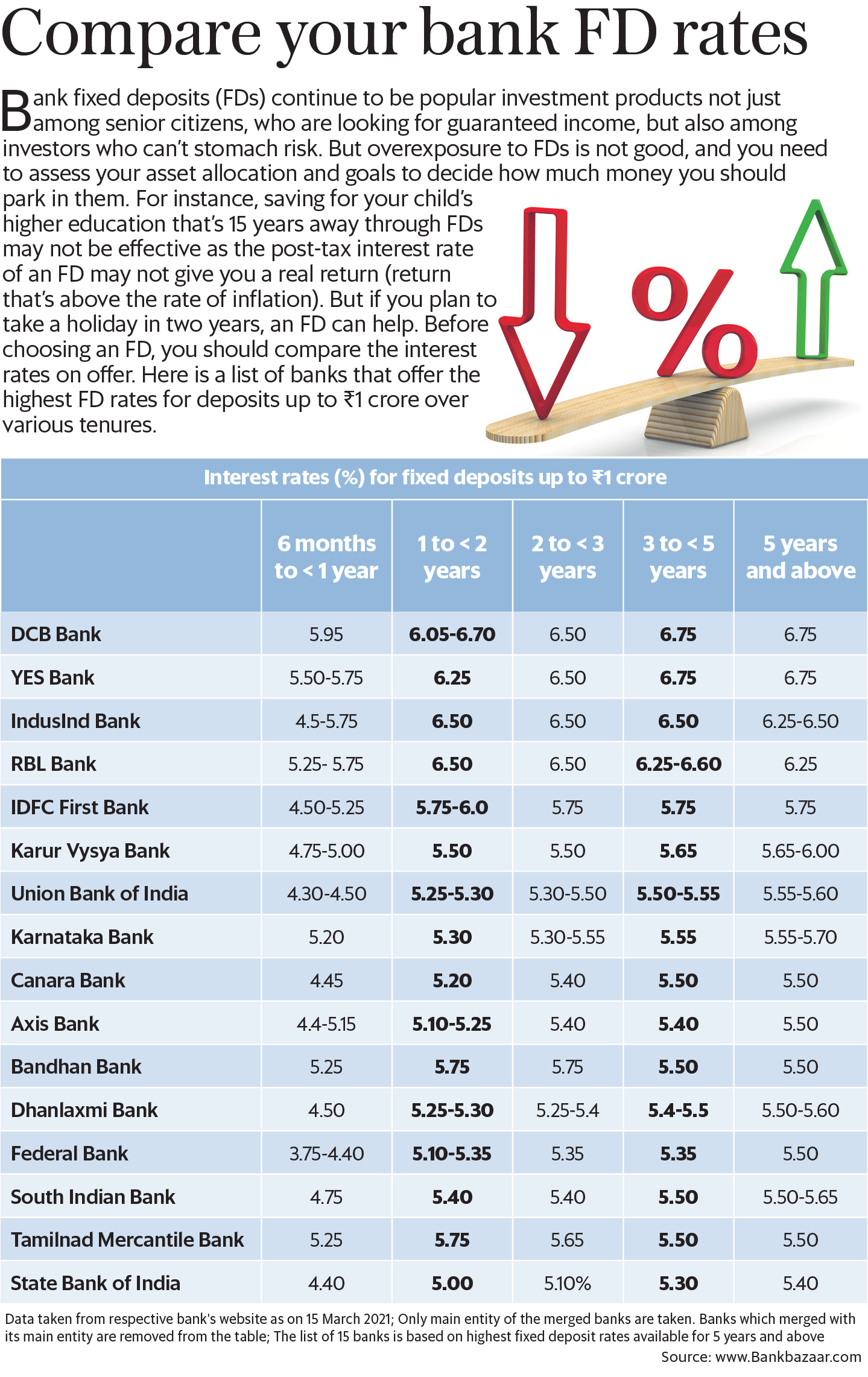

Compare Your Bank FD Rates Mint

What Can You Buy During Tax free Weekend Here s A Complete List The

What Can You Buy During Tax free Weekend Here s A Complete List The

What Is The Difference Between Compounding Of Interest And Penalty

This Question Uses Matlab R2018a Retirement m Is Function MyCont

Investment Mantras How To Make Most Of Your Idle Cash Wealthfund

How Much Amount Fd Interest Is Tax Free 2023 - Tax saving FDs have an interest rate ranging from 5 5 to 7 75 and a lock in period of 5 years Comparing them with other tax saving investments like ELSS funds