How Much Can I Claim For Home Office Expenses What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell goods or negotiate contracts typically have an income amount in box 42 on their T4 slip can claim some expenses that salaried employees cannot Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction The simplified option has a rate of 5 a square foot for business use of the home The maximum size for this option is 300 square feet The maximum deduction under this method is 1 500

How Much Can I Claim For Home Office Expenses

How Much Can I Claim For Home Office Expenses

https://www.afirmo.com/nz/wp-content/uploads/2023/03/03-how-to-claim-home-office-expenses-1.jpg

Claim Home Office Expenses Karis Tax

https://www.karistax.com.au/wp-content/uploads/2021/03/3.png

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

From 1 July 2022 there are 2 methods available to calculate your claim Revised fixed rate method an amount per work hour for additional running expenses separate amount for expenses not covered by the revised fixed rate such as the decline in value of depreciating assets you no longer need a dedicated home office Key Takeaways The self employed are eligible for the home office tax deduction if they meet certain criteria The workspace for a home office must be used exclusively and regularly for

State Filing Fee 64 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 57 95 State Filing Fee 44 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area

Download How Much Can I Claim For Home Office Expenses

More picture related to How Much Can I Claim For Home Office Expenses

How To Claim For Home Office Expenses YouTube

https://i.ytimg.com/vi/2hqy8e8_-DE/maxresdefault.jpg

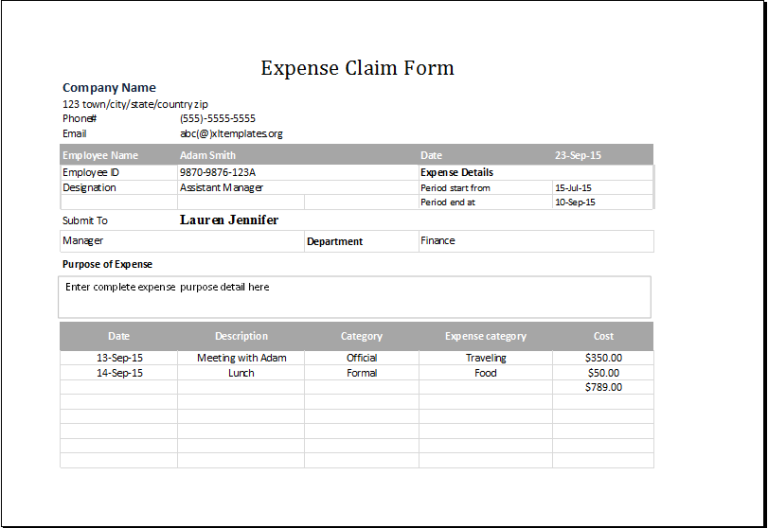

Expense Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

For example if you have a 300 square foot home office the maximum size allowed for this method and you work from home for three months 25 of the year your deduction is 375 300 x To qualify for the deduction you need to meet four tests You can deduct the expenses related to your home office if your use is Exclusive Regular For your business and Either you principal place of business used regularly to meet with customers or a separate structure Return to top

Our Home office calculator will take between 5 and 20 minutes to use What you can do with this calculator This calculator covers the 2013 14 to 2022 23 income years You can use either the revised fixed rate method or actual cost method to work out your deduction For the tax year that you re claiming business expenses for make sure you re using the correct square metre rate Tax year Square metre rates 2017 2018 41 10 per square metre 2018 2019 41 70 per square metre 2019 2020 42 75 per square metre

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Home Office Expenses And CGT Implications

https://media.licdn.com/dms/image/C4D12AQEsoaMgPBr2PA/article-cover_image-shrink_720_1280/0/1596066005540?e=2147483647&v=beta&t=gRMnmlj4KP8o-oRPngRrcld1sUPCnpKoK2CqquLbzH4

https://www.nerdwallet.com/article/taxes/home-office-tax-deduction

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

https://www.canada.ca/.../expenses-can-claim.html

If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell goods or negotiate contracts typically have an income amount in box 42 on their T4 slip can claim some expenses that salaried employees cannot

(1).png)

Home Office Expenses For Employees

Expense Claim Form Template Excel Printable Word Searches

Updated Home Office Expense Claim Methods For 2023 FY Oceans Accounting

HOW TO CLAIM HOME OFFICE EXPENSES HOME OFFICE RULES

Home Office Expenses For Employees COVID 19 Radix Accounting

How Much Can I Claim For Home Office 2024 Updated RECHARGUE YOUR LIFE

How Much Can I Claim For Home Office 2024 Updated RECHARGUE YOUR LIFE

EXCEL Of Expense Claim Form xlsx WPS Free Templates

Tax Year End Tip How To Claim For Home Office Expenses Sage Advice

Home Office Expenses Tax Deductions

How Much Can I Claim For Home Office Expenses - Someone working 23 3 hours a week or more will be able to claim 312 per year towards use of home as office If this amount does not fairly represent the value your business benefits from by operating from your home taking into account the actual expenditure and maintaining sufficient records will be necessary