How Much Can You Claim For Food Allowance You cannot claim expenses if you use your 1 000 tax free trading allowance Contact the Self Assessment helpline if you re not sure whether a business cost is an allowable expense

HMRC s rules around subsistence do mean you can claim food and drink bought on a business trip as an expense This is because it classes this kind of expenditure as wholly and exclusively for business purposes If you re self employed you can claim a self employed food allowance for daily food expenses as part of your allowable expenses This HMRC food allowance allows you to recover costs incurred while conducting business provided they are necessary and directly related to your work

How Much Can You Claim For Food Allowance

How Much Can You Claim For Food Allowance

https://i.ytimg.com/vi/BGSybyuKbLY/maxresdefault.jpg

How Much Can You Make Selling Options YouTube

https://i.ytimg.com/vi/3JCihbtQ8xc/maxresdefault.jpg

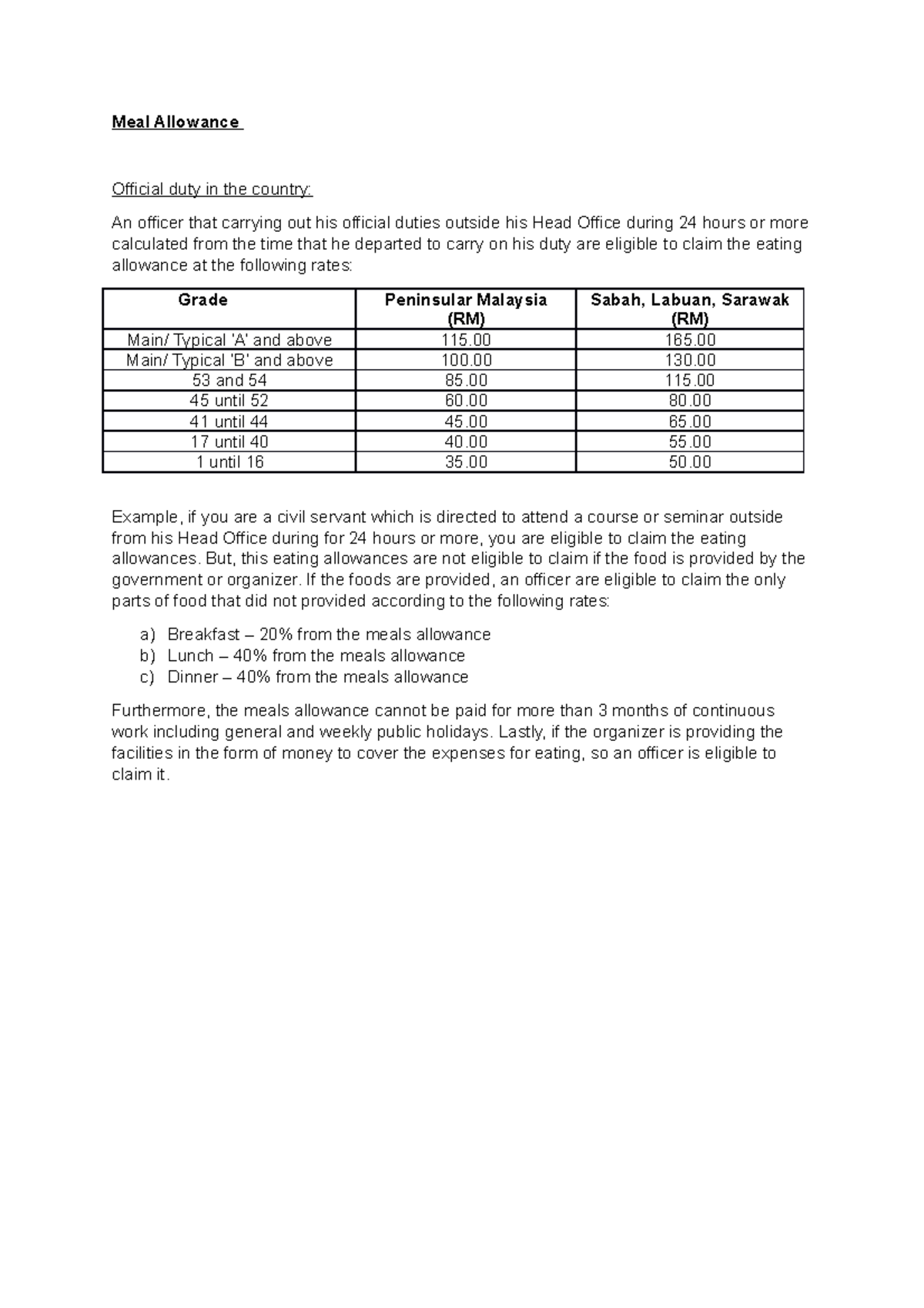

Meal Allowance General Order In Malaysia Meal Allowance Official Duty

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/877be2bcd3e4ec7fb9b19bb0c9a386f8/thumb_1200_1698.png

One of these expenses is the food allowance offered by HMRC where self employed people can claim their daily food expenses As a self employed while preparing your self assessment tax return you can apply for the food allowance offered by HMRC as tax relief Did you know that you may be able to claim self employed daily food allowance for the cost of some meals and also overnight stays This handy guide contains everything you need to know to get started with claiming your allowances

As an employer providing meals for your employees you have certain tax National Insurance and reporting obligations What s included What you have to report and pay depends on the value HMRC provides standard meal allowance rates for employees who are required to work away from their usual place of work As of 2024 the rates are as follows Breakfast Allowance Up to 6 00 This is eligible if the employee leaves home before 6 00 AM and buys breakfast away from their home or workplace One Meal Allowance 5 hours Up to 5 00

Download How Much Can You Claim For Food Allowance

More picture related to How Much Can You Claim For Food Allowance

How Much Can You Make In A Franchise YouTube

https://i.ytimg.com/vi/Kg2kQ6LhCTI/maxresdefault.jpg

Why Is Recommended Dietary Allowance Important In Nutrition Of Human

https://celebrites.tn/wp-content/uploads/2021/12/How-can-recommended-allowances-be-used.png

HOW MUCH MONEY DO TRADERS MAKE HOW MUCH MONEY CAN YOU MAKE TRADING

https://bikotrading.com/uploads/how_much_money_traders_make3_5d18679743.jpg

From what I can tell it s either A he can claim the 2 meal allowance of 10 a day B he can claim everything he has receipts for basically 2000 of mainly McDonalds subway fuel station sandwiches not exactly nutritious but convenient I suppose C he can claim 5 a day breakfast allowance as he leaves before 6am If you choose the simplified method claim in Canadian or US funds a flat rate of 23 per meal for the 2024 tax year to a maximum of 69 per day sales tax included per person without receipts

[desc-10] [desc-11]

How Much Compensation Can You Claim For Food Poisoning In The UK

https://rechargevodafone.co.uk/wp-content/uploads/2023/04/pexels-photo-5313158.jpeg

Request Letter For Allowance Increase Sample Letter Requesting For

https://i0.wp.com/www.lettersinenglish.com/wp-content/uploads/request-letter-for-allowance-increase.jpg?fit=1920%2C1080&ssl=1

https://www.gov.uk › expenses-if-youre-self-employed

You cannot claim expenses if you use your 1 000 tax free trading allowance Contact the Self Assessment helpline if you re not sure whether a business cost is an allowable expense

https://finmo.co.uk › sole-trader-what-food-drink-expenses-can-i-claim

HMRC s rules around subsistence do mean you can claim food and drink bought on a business trip as an expense This is because it classes this kind of expenditure as wholly and exclusively for business purposes

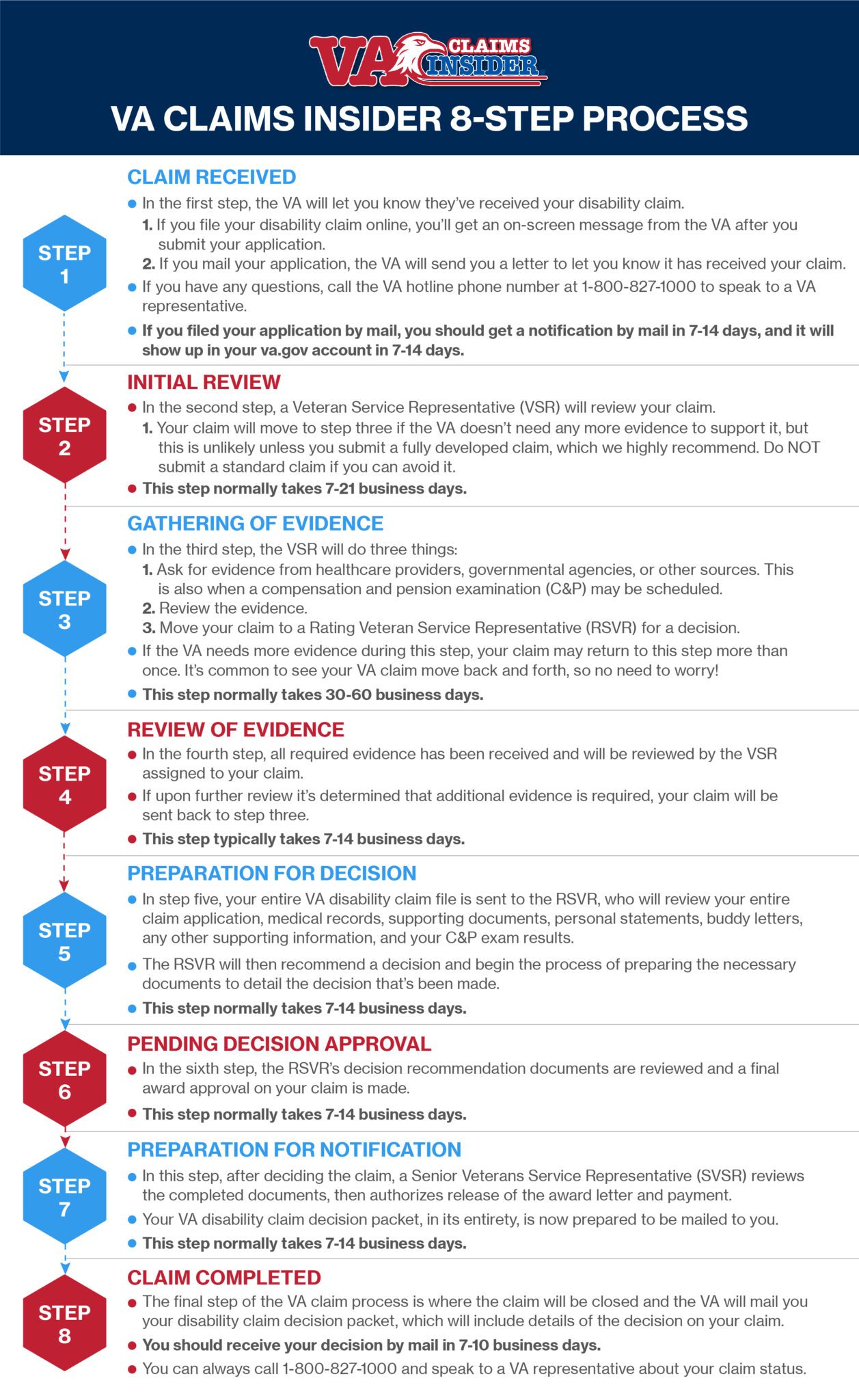

VA Claims Process Flowchart

How Much Compensation Can You Claim For Food Poisoning In The UK

How Much Can You Earn Before Paying Income Tax

Offer Letter Employment Template Pdf Example By Caco Offer Letter

How Much Can You Make Day Trading With 1000

How Does The Medical Expense Tax Credit Work In Canada

How Does The Medical Expense Tax Credit Work In Canada

How Much Will It Cost To Buy A House RE MAX Canada

Request Letter For Allowance

Acting Allowance Letter PDF

How Much Can You Claim For Food Allowance - As an employer providing meals for your employees you have certain tax National Insurance and reporting obligations What s included What you have to report and pay depends on the value