How Much Can You Claim For Moving Expenses On Your Taxes Most taxpayers can t deduct moving expenses for tax years 2018 2025 However if you moved prior to 2018 you may be able to amend a previous return to deduct your moving expenses

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit storage and insurance You must first determine if you qualify to deduct moving expenses either as an individual who is employed or self employed or as a full time student If you qualify you can claim most amounts that you paid for moving yourself your family and your household items

How Much Can You Claim For Moving Expenses On Your Taxes

How Much Can You Claim For Moving Expenses On Your Taxes

https://i.pinimg.com/originals/b4/75/e9/b475e9e5e0b3f8d4aef72b98db7a62f8.jpg

Your Guide To Self Employed HGV Driver Expenses Countingup

https://countingup.com/wp-content/uploads/2022/08/Copyofmaking-tax-digital-and-vat-hero1_8cd9a1ddc294707f88cf4d46c631e8ab_2000.png

When Can You Claim Moving Expenses As A Tax Deduction UNITS Moving

https://unitsstorage.com/northeast-kansas/wp-content/uploads/sites/103/2023/05/tax-deductions.png

You can take the standard deduction if you choose and still add moving expense deductions However like most things IRS there are always some restrictions limitations and qualifications on who can claim a tax deduction To claim the cost of moving expenses as federal income tax deductions members of the Armed Forces can use IRS Form 3903 Within certain limits you can claim deductions for moving storage

You are eligible to claim a deduction for moving expenses Complete Form T1 M Moving Expenses Deduction to calculate the moving expenses deduction that you are eligible to claim on line 21900 of your return Read Eligible moving expenses and Ineligible moving expenses Prior to passing the Tax Cuts and Jobs Act TCJA you could qualify for the moving expense deduction if Your employer didn t pay or reimburse the moving costs and exclude the payment or reimbursement from your income Your new work location was a certain distance from your former home

Download How Much Can You Claim For Moving Expenses On Your Taxes

More picture related to How Much Can You Claim For Moving Expenses On Your Taxes

When Can You Claim Moving Expenses As A Tax Deduction

https://herculesmoversinc.com/wp-content/uploads/2022/08/moving-expenses-1170x650.jpeg

How To Pay For Moving Expenses With No Money In 2020 Moving Expenses

https://i.pinimg.com/originals/43/d1/91/43d191f39d38e831163b854322a31351.jpg

Business Expenses What Can You Claim

https://www.uhyhn.co.nz/wp-content/uploads/2016/04/Business-expenses-pic.jpg

Information for those who moved to or from Canada or between two locations outside Canada Completing your tax and benefit return How to calculate and claim your moving expenses deduction IRS Form 3903 is a critical tool for claiming moving expense deductions on your federal tax return This form helps calculate the deductible amount by considering eligible moving expenses The form requires detailed information about the expenses such as transportation storage and travel costs

If you moved for work in 2017 and meet the requirements you can claim the deduction on your 2017 tax return The moving expense deduction can help lower your taxable income and help lessen your tax obligation while allowing you to recoup some of the costs of your move The Tax Deduction for Moving Expenses In This Article Rules for Military Members Expenses That Don t Qualify Rules for Other Taxpayers How To Claim the Deduction for Previous Years Claiming the Deduction in 2021 Photo Zen Sekizawa Getty Images Was this page helpful

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

https://i.pinimg.com/736x/b0/f7/a8/b0f7a8d1266429db15ed66c2cd568360.jpg

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

https://images.squarespace-cdn.com/content/v1/5f5f8431b160b93d425d20f0/3e25a53e-15b0-40d5-98eb-dc8158d6d3b2/tax+cheat+sheet+landing+page+(1).png

https://turbotax.intuit.com/tax-tips/jobs-and...

Most taxpayers can t deduct moving expenses for tax years 2018 2025 However if you moved prior to 2018 you may be able to amend a previous return to deduct your moving expenses

https://www.irs.gov/instructions/i3903

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit storage and insurance

How To Create A Simple Expenses Claim Form Template Free Sample

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

Can You Claim Moving Expenses The Storage Box

Deductible Business Expenses For Independent Contractors Financial

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

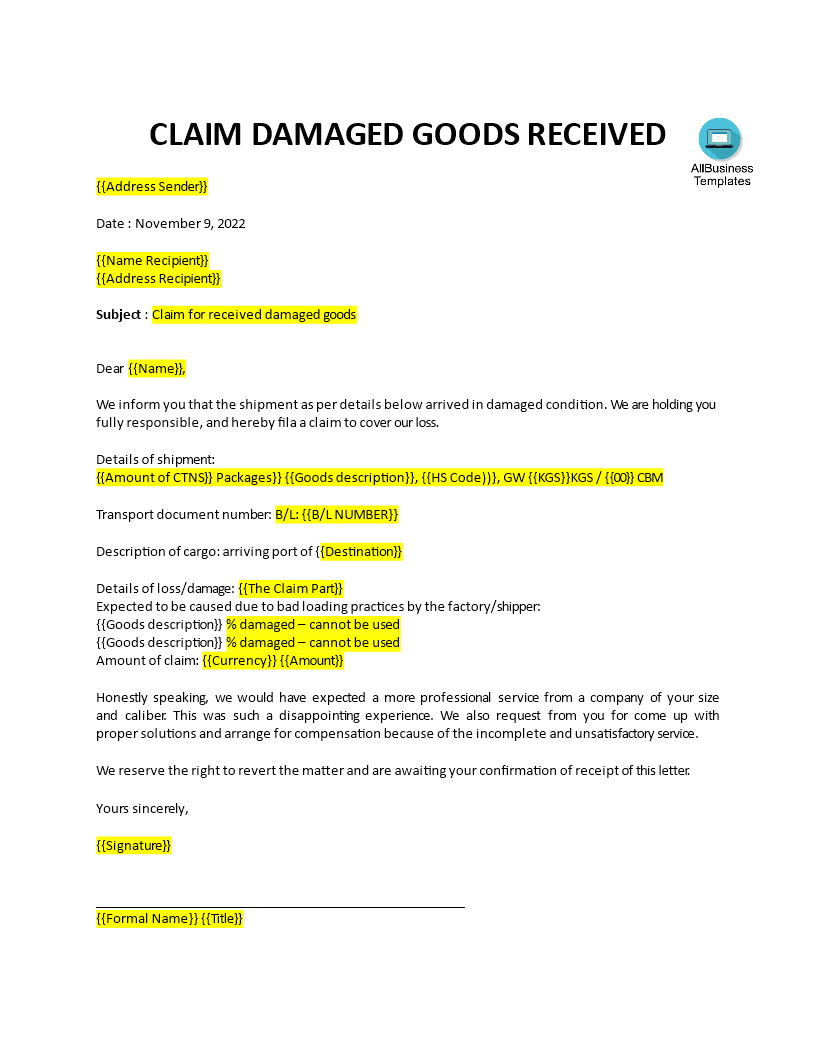

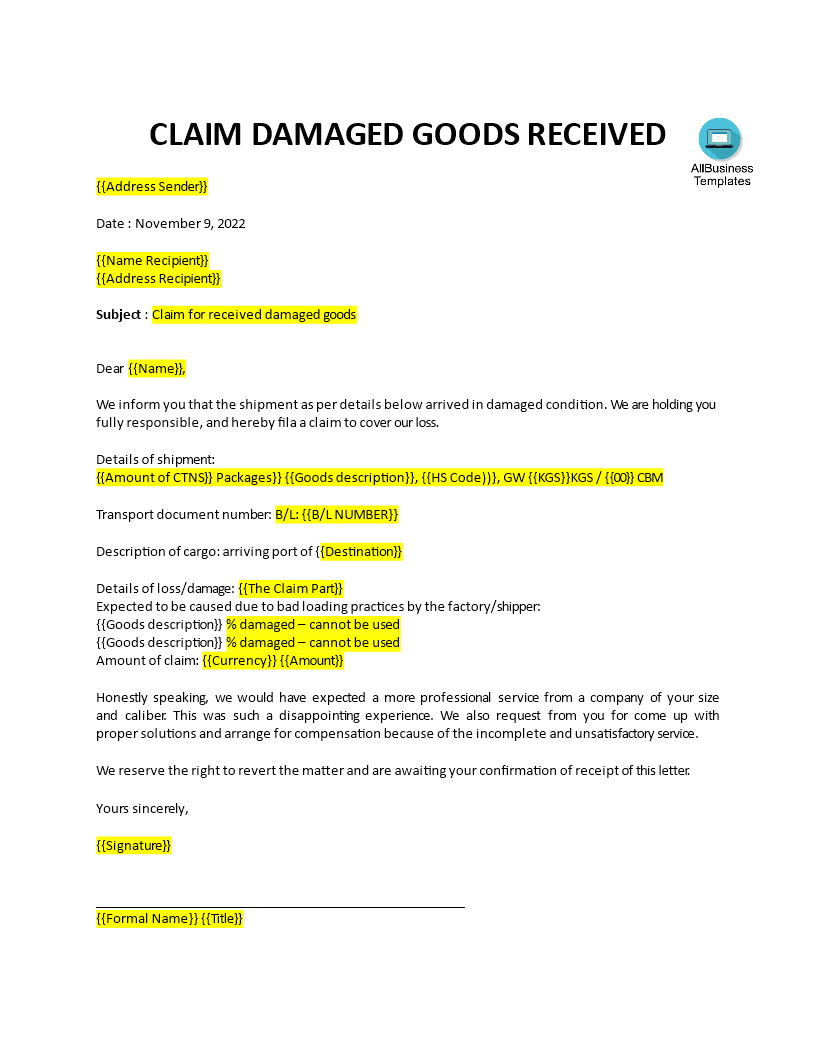

Damaged Goods Claim Letter Template Templates At Allbusinesstemplates

Damaged Goods Claim Letter Template Templates At Allbusinesstemplates

What Are Expenses Its Types And Examples TutorsTips

Moving Expenses Tax Deductions Where d They Go YouTube

How Does The Medical Expense Tax Credit Work In Canada

How Much Can You Claim For Moving Expenses On Your Taxes - When your moving costs are less than the reimbursement you cannot deduct any moving expenses For example if it costs 10 000 for your move and your employer provides reimbursement of 8 000 your maximum deduction would be 2 000