How Much Can You Deduct On Taxes For Medical Expenses Web 19 Aug 2019 nbsp 0183 32 Overview of limits up to 15 340 childless unmarried 5 childless married 4 with 1 or 2 children 2 3 children and or more 1 starting at 15 341 to 51 130 childless unmarried 6 childless married 6 with 1 or 2 children 3 3 children and or more 1

Web 51 130 Euro 15 340 Euro 35 790 Euro 6 of 35 790 Euro 2 147 40 Euro Now we have reached the third stage The already calculated income will be deducted again 65 000 Euro 51 130 Euro 13 870 Euro 7 of 13 870 Euro 970 90 Euro All together 767 Euro 2 147 40 Euro 970 90 Euro we now come to 3 885 30 Euro Web 22 Aug 2023 nbsp 0183 32 So if your AGI is 50 000 and your total medical expenses are 5 000 you can deduct 2 500 the amount which exceeds 7 5 of 50 000 What qualifies as a qualified medical expense There are a few different types of medical expense tax deductions that may be tax deductible

How Much Can You Deduct On Taxes For Medical Expenses

How Much Can You Deduct On Taxes For Medical Expenses

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c77d0216b33b8f1e2141_610ddbcacd1825de3e368a96_How-to-deduct-toll-expenses-on-your-taxes.jpeg

Medical Expenses You Can Deduct From Your Taxes

https://www.iluvmoney.com/wp-content/uploads/2016/01/TAXESSSSS.jpg

Taxes What You Need To Know To Deduct Medical Expenses

https://www.philly.com/resizer/T5LaLqviiE93Qv0Fvvuz4BxHDw4=/1400x932/smart/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/GT4VK2HLE5GVHDLPQOPXDLWW5M.jpg

Web 31 M 228 rz 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is Web 15 Nov 2023 nbsp 0183 32 The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses instead of taking the standard deduction

Web 16 Nov 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year Web 8 Okt 2021 nbsp 0183 32 If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical expenses that exceed 7 5

Download How Much Can You Deduct On Taxes For Medical Expenses

More picture related to How Much Can You Deduct On Taxes For Medical Expenses

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

IRS How Much Can You Deduct For Medical Expenses Fingerlakes1

https://www.fingerlakes1.com/wp-content/uploads/2022/05/medical-expenses.jpg

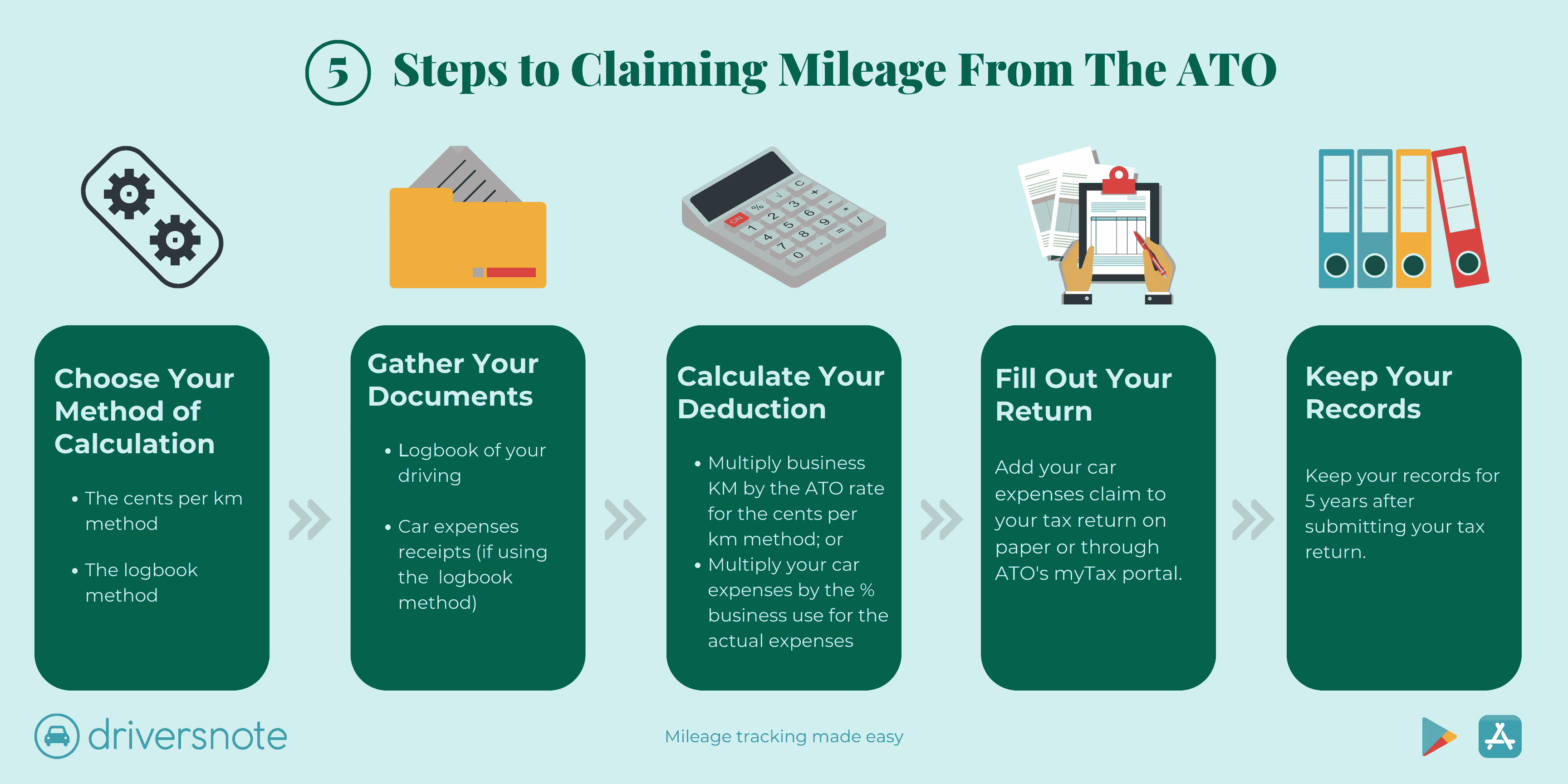

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Web 24 Feb 2011 nbsp 0183 32 Luckily medical insurance premiums co pays and uncovered medical expenses are deductible as itemized deductions on your tax return and that can help defray the costs But before you breathe a sigh of relief read on You can deduct only those medical expenses that exceed 7 5 of your adjusted gross income Web 27 Dez 2023 nbsp 0183 32 You can get your deduction by taking your AGI and multiplying it by 7 5 If your AGI is 50 000 only qualifying medical expenses over 3 750 can be deducted 50 000 x 7 5 3 750 If your total medical expenses are 6 000 you can deduct 2 250 of it from your taxes

Web 29 Apr 2023 nbsp 0183 32 You can deduct unreimbursed qualified medical and dental expenses that exceed 7 5 of your AGI Say you have an AGI of 50 000 and your family has 10 000 in medical bills for the Web 21 Jan 2021 nbsp 0183 32 Your medical expense deduction will only begin to count after it surpasses 10 percent or more of your adjusted gross income or AGI this is your total pre tax income before certain non itemized deductions such as health savings account spending Think of this 10 percent as your medical expense deduction threshold

How Much Can You Deduct For Medical Expenses Naturalhigh design

https://www.gannett-cdn.com/-mm-/15c2ce3e0bbadba03bbcdc762ff5c40c4a915fec/c=0-29-580-355/local/-/media/2016/12/04/USATODAY/usatsports/health-savings-accounts-flexible-spending-tax-tips-money_large.jpg?width=3200&height=1680&fit=crop

How Much Mortgage Interest Can You Deduct On Your Taxes CBS News

https://assets3.cbsnewsstatic.com/hub/i/r/2022/12/12/e5f84804-03be-46fe-8dcd-eac03c599d84/thumbnail/1200x630/1e99185630694916ba6faa25791d2220/gettyimages-157400723.jpg

https://germantaxes.de/tax-tips/medical-expenses-tax-return

Web 19 Aug 2019 nbsp 0183 32 Overview of limits up to 15 340 childless unmarried 5 childless married 4 with 1 or 2 children 2 3 children and or more 1 starting at 15 341 to 51 130 childless unmarried 6 childless married 6 with 1 or 2 children 3 3 children and or more 1

https://www.ottonova.de/en/expat-guide/deduct-medical-expenses …

Web 51 130 Euro 15 340 Euro 35 790 Euro 6 of 35 790 Euro 2 147 40 Euro Now we have reached the third stage The already calculated income will be deducted again 65 000 Euro 51 130 Euro 13 870 Euro 7 of 13 870 Euro 970 90 Euro All together 767 Euro 2 147 40 Euro 970 90 Euro we now come to 3 885 30 Euro

How To Deduct Medical Expenses On Taxes 11 Steps with Pictures

How Much Can You Deduct For Medical Expenses Naturalhigh design

List Of Tax Deductions Here s What You Can Deduct

Do You Have A Lot Of Medical Expenses In The US Learn How To Deduct

What You Can t Deduct On Your Taxes

How S corp Owners Can Deduct Health Insurance

How S corp Owners Can Deduct Health Insurance

SSS SALARY LOAN Authority To Deduct Form PDF

Solved How Much Can She Deduct Were You Being A Tax Professional

Do You Have A Lot Of Medical Expenses In The US Learn How To Deduct

How Much Can You Deduct On Taxes For Medical Expenses - Web 23 Aug 2023 nbsp 0183 32 42 95 State Filing Fee 39 95 1 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 2 Cash App Taxes Learn More On Cash App Taxes