How Much Do Companies Have To Pay For Mileage In this guide we ll cover the key facts about employee mileage reimbursement including the rules IRS rates taxation and effective tools Nic De Bonis

California Illinois and Massachusetts require companies to reimburse their employees for business related mileage and expenses You should check the laws Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes Companies can choose to

How Much Do Companies Have To Pay For Mileage

How Much Do Companies Have To Pay For Mileage

https://www.popoptiq.com/wp-content/uploads/2022/04/Ross-Geller-04232022.jpg

What Companies Pay The Highest Dividends StocksProGuide

https://www.stocksproguide.com/wp-content/uploads/what-companies-pay-the-best-dividends-designedbyrazz-1024x957.png

How And Why To Leverage Content In Your Law Firm s Paid Advertising

https://www.lawasabusiness.com/wp-content/uploads/2021/09/how-to-leverage-paid-advertising-for-your-firm.jpg

The IRS sets a standard mileage reimbursement rate For 2020 the federal mileage rate is 0 575 cents per mile Reimbursements based on the federal mileage rate aren t Whatever you decide determine a reimbursement rate have your employees submit their mileage and then use that mileage to calculate how much to reimburse them You can

How much can you get reimbursed if you drive your own car for work It depends on your employer and the law in your state Federal law doesn t require Employers can pay employees for mileage using an allowance or reimbursing expenses Both payment methods are discussed and compared

Download How Much Do Companies Have To Pay For Mileage

More picture related to How Much Do Companies Have To Pay For Mileage

Content Marketing Content Marketing Infographic Marketing Budget

https://i.pinimg.com/originals/52/43/ec/5243ec98d484f4b3d55d66c9d17b7b1a.png

Interpreting AI Compute Trends AI Impacts

https://aiimpacts.org/wp-content/uploads/2018/07/cash-coins-currency-40140-1.jpg

The Hunt For Funding Lunatic Laboratories

https://loonylabs.files.wordpress.com/2021/05/funding.jpg

For reimbursements to be tax free companies need to use standard mileage rates provided by the IRS In 2024 it means that companies can issue tax free reimbursements at the Mileage reimbursement is employer set compensation for work related use of your personal vehicle Some companies pay monthly car allowances while others

Mileage reimbursement is the compensation businesses provide employees for using personal vehicles for work related travel The Internal Revenue Service IRS regulates Tax rates per business mile Your employee travels 12 000 business miles in their car the approved amount for the year would be 5 000 10 000 x 45p plus 2 000 x 25p It does

How Much To Pay For A Survey

https://knowhowcommunity.org/wp-content/uploads/2023/02/883937c6e8deb034b3e0b799c5182553.png

How Much Companies Spend On Employee Training LearnExperts

https://learnexperts.ai/wp-content/uploads/2022/04/Success-Story-Banner-10.jpg

https://www.workyard.com/blog/employee-mileage-reimbursement

In this guide we ll cover the key facts about employee mileage reimbursement including the rules IRS rates taxation and effective tools Nic De Bonis

https://www.uschamber.com/co/run/finance/employee...

California Illinois and Massachusetts require companies to reimburse their employees for business related mileage and expenses You should check the laws

Build Credit In Just 24 Hours AD experian New Product EXPERIAN GO

How Much To Pay For A Survey

States Won t Have To Pay For Vaccines PM Modi Latest News India

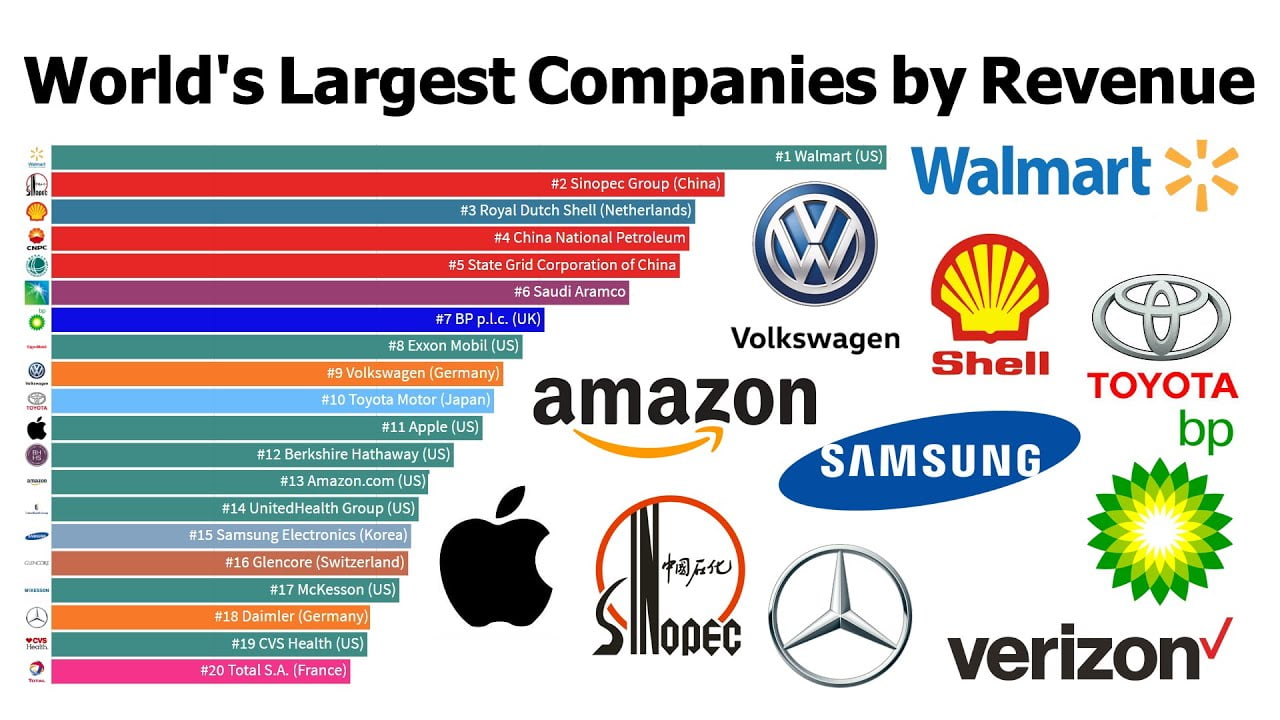

Biggest Companies In The World By Market Capitalization Wiselancer Top

Goldman Sachs Strategies For A High Valuation Market

I SERIOUSLY Have To Pay For A Membership To Go To The Gym This Summer

I SERIOUSLY Have To Pay For A Membership To Go To The Gym This Summer

Hiring A React js Developer How Much Do You Need To Pay For It

How To Grow Your Business By Expanding Into New Markets

50 Largest Marketing Companies In The World Leadership Insights

How Much Do Companies Have To Pay For Mileage - A CompanyMileage analysis found that in 2023 our customers on average reimburse at a rate of 0 589 The middle 90 of our customers have an average rate of