How Much Do You Get Back For Daycare On Taxes 2023 You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

But the value of these tax credits ranges from 2 000 to 2 500 The Adoption Credit helps parents who adopted a child in the tax year Any child under 18 or children with special needs who cannot care for themselves are eligible In 2023 the maximum adoption credit is 15 950 per qualifying child For tax years 2022 and 2023 there is a limit of 3 000 for one qualifying person or 6 000 for two or more qualifying persons The credit is not refundable Your credit amount is dependent on your income and can be between 20 and 35 600

How Much Do You Get Back For Daycare On Taxes 2023

How Much Do You Get Back For Daycare On Taxes 2023

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-money-do-you-need-to-live-comfortably-UK.jpeg

Paying Taxes 101 What Is An IRS Audit

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time.jpeg

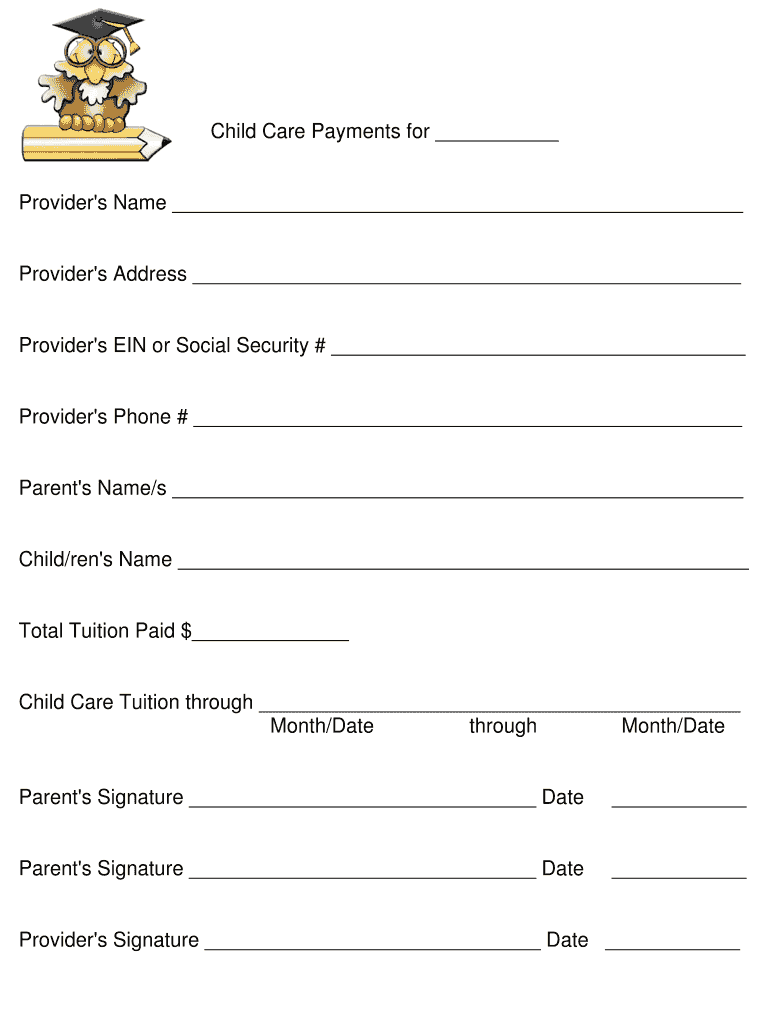

Parent Reminders Infant Daycare Daycare Curriculum Starting A Daycare

https://i.pinimg.com/736x/7b/94/19/7b94195cbbd7176622bf2e8f16e2d238--parents-menu.jpg

Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4 000 for one qualifying person and 8 000 for two or more qualifying persons and potentially refundable so you might not have to owe taxes to claim the credit so long as you meet the other requirements

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit 6 min read If you re a parent or caretaker of disabled dependents or spouses listen up you may qualify for a special tax credit used for claiming child care expenses It s called the Child and Dependent Care Credit and with it you might be able to get back some of the money you spent on these expenses by claiming it

Download How Much Do You Get Back For Daycare On Taxes 2023

More picture related to How Much Do You Get Back For Daycare On Taxes 2023

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Daycare Business Income And Expense Sheet To File childcare

https://i.pinimg.com/originals/de/09/f5/de09f5c78c889823cfbf86690091fee6.jpg

Daycare Permanent Closure Letter To Parents Daycare Closing Notice

https://i.etsystatic.com/14383503/r/il/9d7f80/4572791799/il_1588xN.4572791799_7d77.jpg

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint You could expect a 1440 tax credit on your return based on these rough parameters This is a significant credit which is different than a tax deduction Essentially this money will go back into your pocket or directly reduce the amount of taxes you owe for the year Can I Claim Child and Dependent Care if I Have a Higher Income

Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

How To File Back Taxes SDG Accountants

https://sdgaccountant.com/wp-content/uploads/2021/06/File-Back-Taxes.jpg

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/315/100315789/large.png

https://turbotax.intuit.com/tax-tips/family/the...

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

https://www.care.com/c/daycare-tax-credit-what-is-it-benefits

But the value of these tax credits ranges from 2 000 to 2 500 The Adoption Credit helps parents who adopted a child in the tax year Any child under 18 or children with special needs who cannot care for themselves are eligible In 2023 the maximum adoption credit is 15 950 per qualifying child

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To File Back Taxes SDG Accountants

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

MARKETING Childcare Poster Home Daycare Kids Brochures Daycare

Tourattraction Drop In Child Care Center Visits

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

How To Find Out If You Are Owed Money From The IRS Unpaid Taxes

CI Post 2 Do Immigrants Pay Taxes

Daycare Income And Expense Worksheet

How Much Do You Get Back For Daycare On Taxes 2023 - Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or