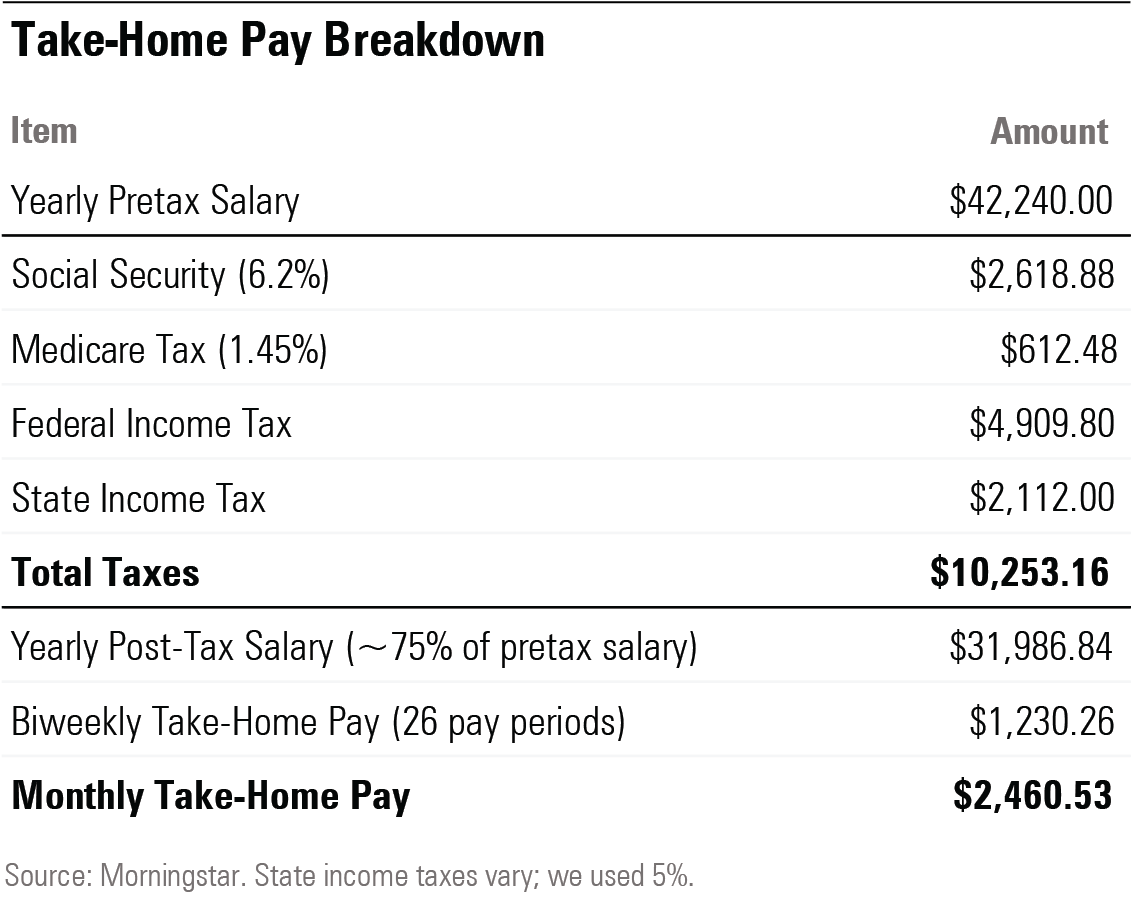

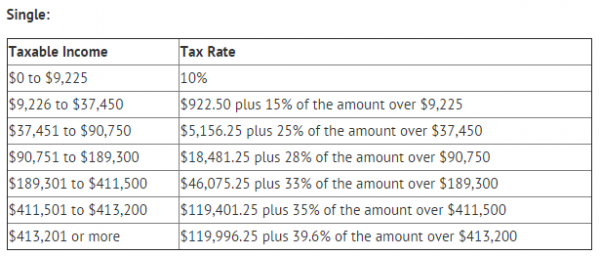

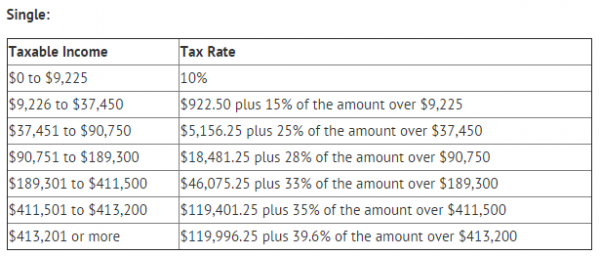

How Much Do You Get Back In Taxes For Goodwill Donations How much can you deduct for donations For the 2023 tax year you can generally deduct up to 60 of your adjusted gross income AGI in monetary gifts In 2021 the IRS temporarily allowed taxpayers to deduct up to 100 of their AGI in charitable gifts

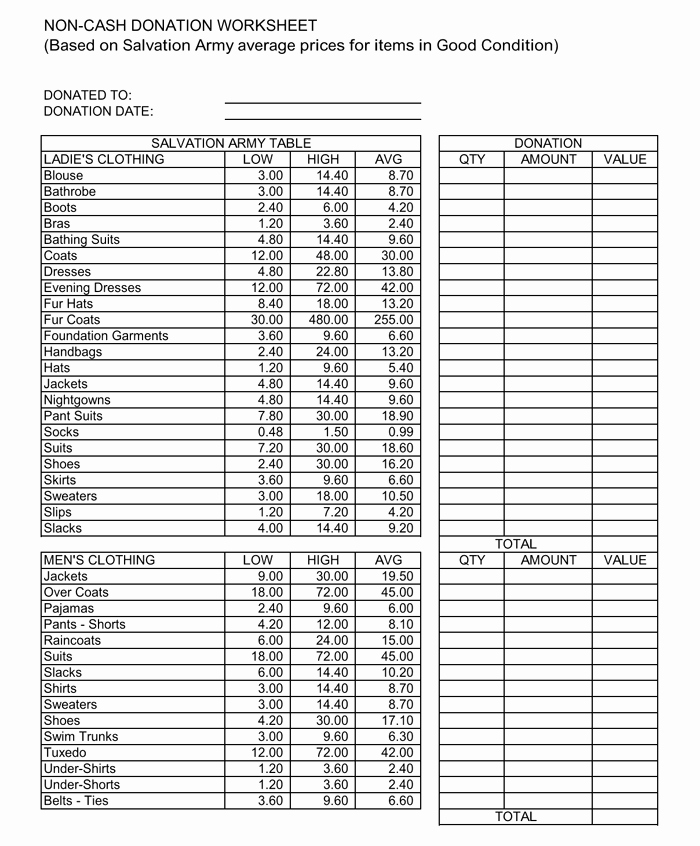

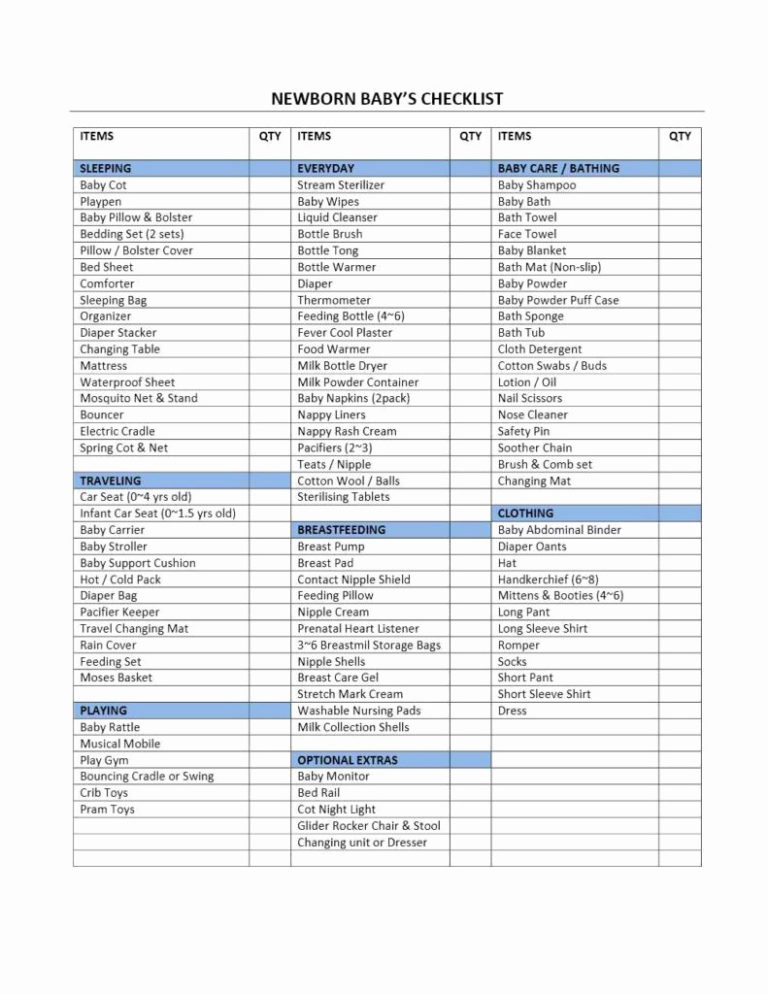

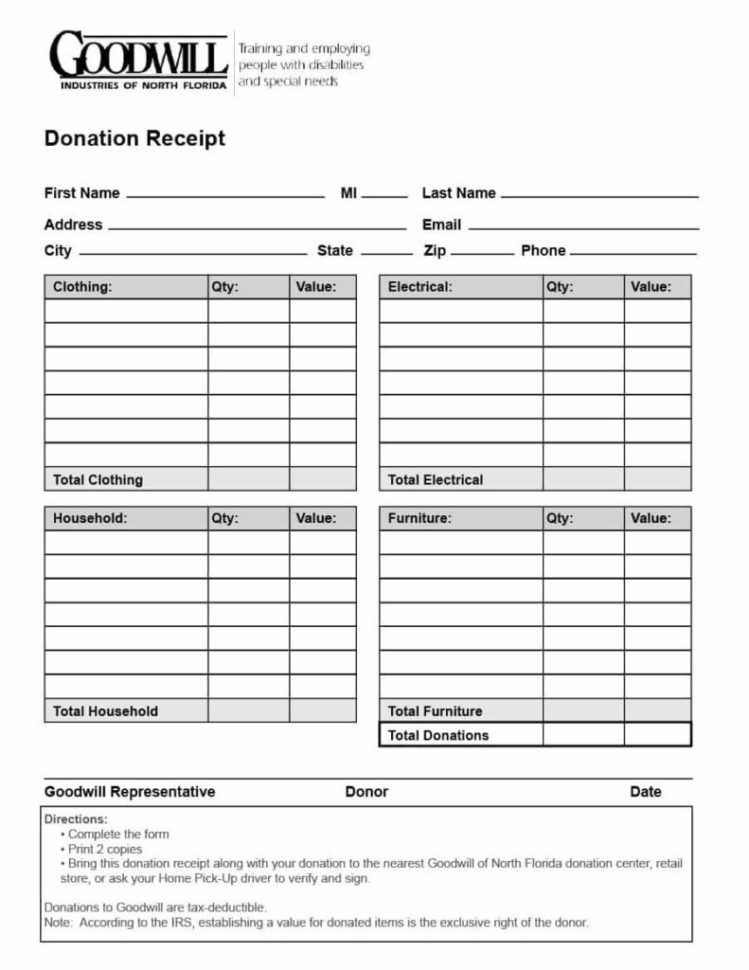

IRS Guidelines If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations According to the Internal Revenue Service IRS a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth The Internal Revenue Service requires that all charitable donations be itemized and valued Use the list of average prices below as a guide for determining the value of your donation Values are approximate and are based on items in good condition It s a good idea to check with your accountant or read up on the rules before you file you return

How Much Do You Get Back In Taxes For Goodwill Donations

How Much Do You Get Back In Taxes For Goodwill Donations

https://cloudfront-us-east-1.images.arcpublishing.com/morningstar/FMENQYIIVBCKDIIIWAAPXQI5RM.png

How To Get Tax Deductions On Goodwill Donations 15 Steps

http://www.wikihow.com/images/c/c8/Get-Tax-Deductions-on-Goodwill-Donations-Step-15-Version-2.jpg

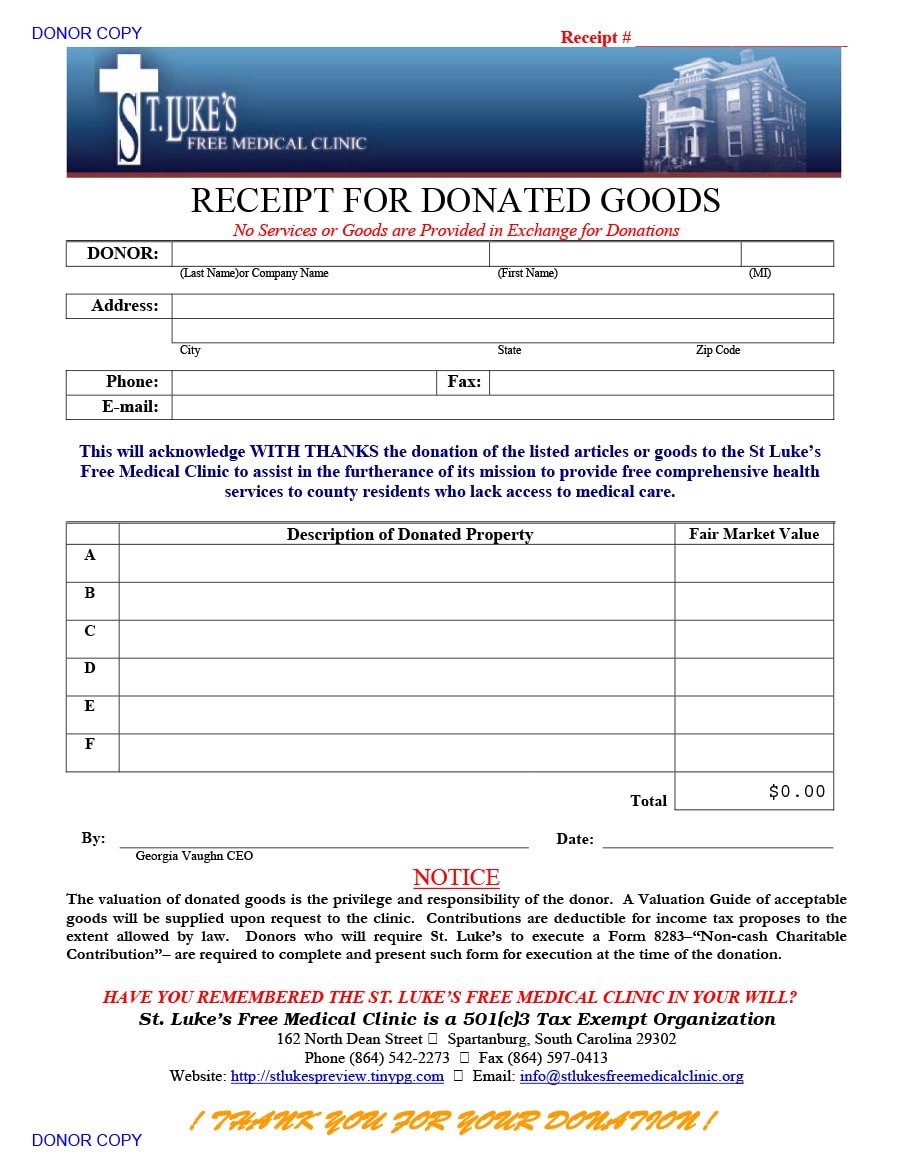

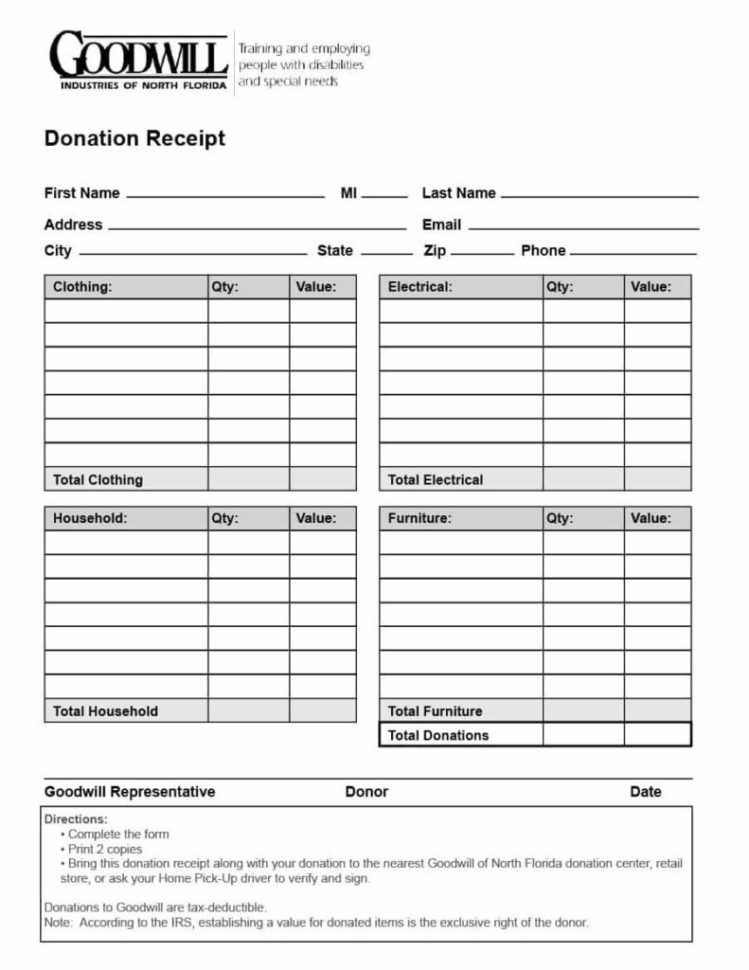

Free Goodwill Donation Receipt Template PDF EForms

https://i1.wp.com/eforms.com/images/2018/05/Goodwill-Donation-Receipt.png?resize=550%2C825&ssl=1

Important information about this tool Calculate savings The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving Use our interactive tool to see how giving can help you save on taxes and how the bunching strategy may help you save even more The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash donations for qualified

The IRS requires an item to be in good condition or better to take a deduction Our donation value guide displays prices ranging from good to like new To determine the fair market value of an item not on this list below use this calculator or 30 of the item s original price In that case you d claim charitable donations on Schedule A Form 1040 As a general rule you can deduct donations totaling up to 60 of your adjusted gross income AGI

Download How Much Do You Get Back In Taxes For Goodwill Donations

More picture related to How Much Do You Get Back In Taxes For Goodwill Donations

How Much Can You Donate To Goodwill For Tax Purposes

https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg

How Do I Write Off Taxes For Goodwill Donations Safe Smart Living

https://i.pinimg.com/originals/7b/0f/1a/7b0f1a8d132d2965f8ee88849e5aa73b.jpg

50 Keep Track Of Charitable Donations

https://ufreeonline.net/wp-content/uploads/2019/04/keep-track-of-charitable-donations-awesome-goodwill-donation-excel-spreadsheet-template-of-keep-track-of-charitable-donations.png

To get started Download the Goodwill Donation Valuation Guide which features estimates for the most commonly donated items Donation Calculator The Donation Impact Calculator is a great way to see how your donations Your donation may be tax deductible Browse Goodwill tax deduction resources to learn more and see if your donation qualifies

GOODWILL DONORS The U S Internal Revenue Service IRS requires donors to value their items To help guide you Goodwill Industries International has compiled a list providing price ranges for items commonly sold in Goodwill stores Assume the following items are in good condition and remember prices are only estimated values Donations to Goodwill can be indeed valuable and to claim deductions on your tax returns it s vital that you assess the fair market value of your donated items Thus keeping detailed donation receipts is essential for accurate documentation

Tax Donation Spreadsheet Pertaining To Irs Donation Values Spreadsheet

https://db-excel.com/wp-content/uploads/2019/01/tax-donation-spreadsheet-pertaining-to-irs-donation-values-spreadsheet-donation-spreadsheet-749x970.jpg

Donation Estimates For Taxes Goodwill Donations Goodwill Store

https://i.pinimg.com/originals/8a/05/88/8a058813d99cc7ddc5a114cb07aaa533.png

https://www.keepertax.com/posts/goodwill-donations-tax-deduction

How much can you deduct for donations For the 2023 tax year you can generally deduct up to 60 of your adjusted gross income AGI in monetary gifts In 2021 the IRS temporarily allowed taxpayers to deduct up to 100 of their AGI in charitable gifts

https://www.amazinggoodwill.com/donating/IRS-guidelines

IRS Guidelines If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations According to the Internal Revenue Service IRS a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth

Goodwill Donation Worksheet Db excel

Tax Donation Spreadsheet Pertaining To Irs Donation Values Spreadsheet

Here s What Really Happens To Your Goodwill Donations

How To Get Tax Deductions On Goodwill Donations 15 Steps

Donation Value Guide 2022 Spreadsheet Fill Out Sign Online DocHub

How To Calculate How Much Money You Will Get Back In Taxes How Much

How To Calculate How Much Money You Will Get Back In Taxes How Much

2 Easy Ways To Get Tax Deductions On Goodwill Donations

How To Calculate How Much Money You Will Get Back In Taxes Reverasite

How To File Back Taxes SDG Accountants

How Much Do You Get Back In Taxes For Goodwill Donations - To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI