How Much Do You Get From Centrelink For Family Tax Benefit For the 2023 24 financial year it s a payment of up to 879 65 for each eligible child The amount we ll pay you depends on all of the following how many children you have in your care if you share care your family s income the

Payment and Service Finder can help you work out how much money you may get It can work out amounts of Centrelink payments including pensions and allowances Family Tax Benefit child care fee assistance To use the Payment and Service Finder answer the questions and choose a payment you want to estimate Family Tax Benefit Part A can also include a supplement at the end of the financial year This is calculated after Centrelink balances your family assistance payments How much you get depends on how many children you have in your care if you share care with someone else your family s income

How Much Do You Get From Centrelink For Family Tax Benefit

How Much Do You Get From Centrelink For Family Tax Benefit

https://nixer.com.au/wp-content/uploads/2021/07/image.png

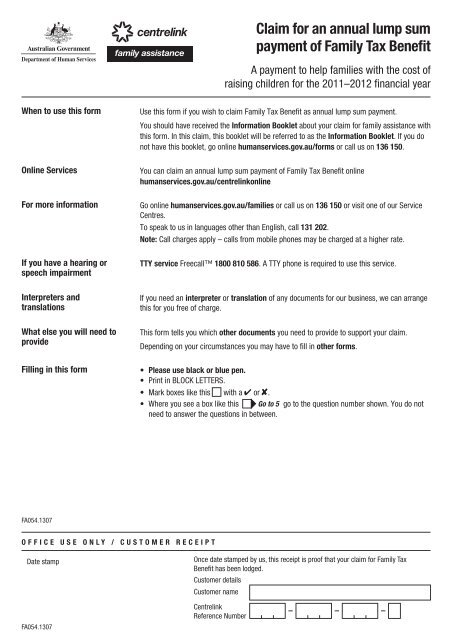

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Shared Care And Family Tax Benefit

https://flast.com.au/s/bx_posts_photos_resized/qzcn8hzfsz5nrttexf4rngmdepayyzfb.png

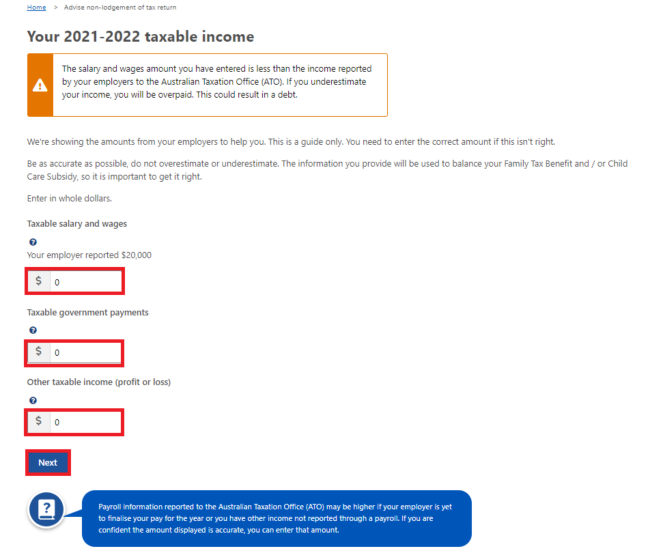

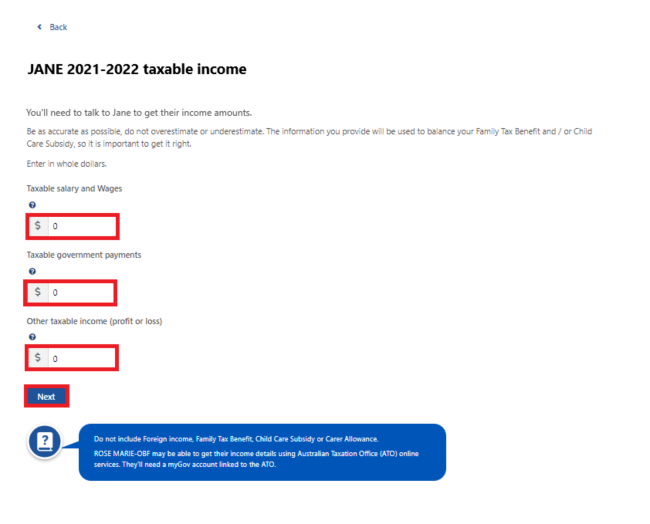

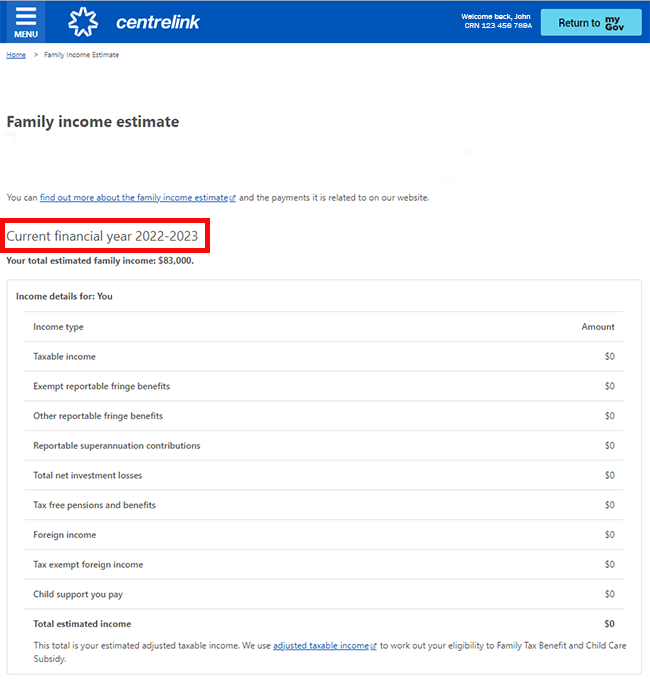

For every 1000 your actual annual family income is higher than your estimate you may have an overpayment of Family Tax Benefit of up to 500 All overpayments need to be paid back Overpayments of Family Tax Benefit and Child Care Benefit may be recovered from your future family assistance payments and from tax Family Tax Benefit Financial year The financial year is the period from 1 July to 30 June Current financial year is a financial year that has started and not yet finished A past financial year is a financial year that finished before the current financial year started Taxable income

Family Tax Benefit FTB is a payment from Services Australia To get this you must There are 2 parts to FTB Find out more about eligibility on the Services Australia website how much you can get on the Services Australia website This is a 2 part payment that helps with the cost of raising children Meet residency and vaccination requirements To find out the eligibility criteria and amount you may be entitled to claim go to Child Care Subsidy 2 Family Tax Benefit The Family Tax Benefit FTB is a payment to help you with the cost of raising your children

Download How Much Do You Get From Centrelink For Family Tax Benefit

More picture related to How Much Do You Get From Centrelink For Family Tax Benefit

Do You Get A Centrelink Payment You Need To Ensure You re Not Being

https://blogs.deakin.edu.au/deakinlife/wp-content/uploads/sites/63/2022/09/Avoiding-Centrelink-debt_blog-banner.jpg

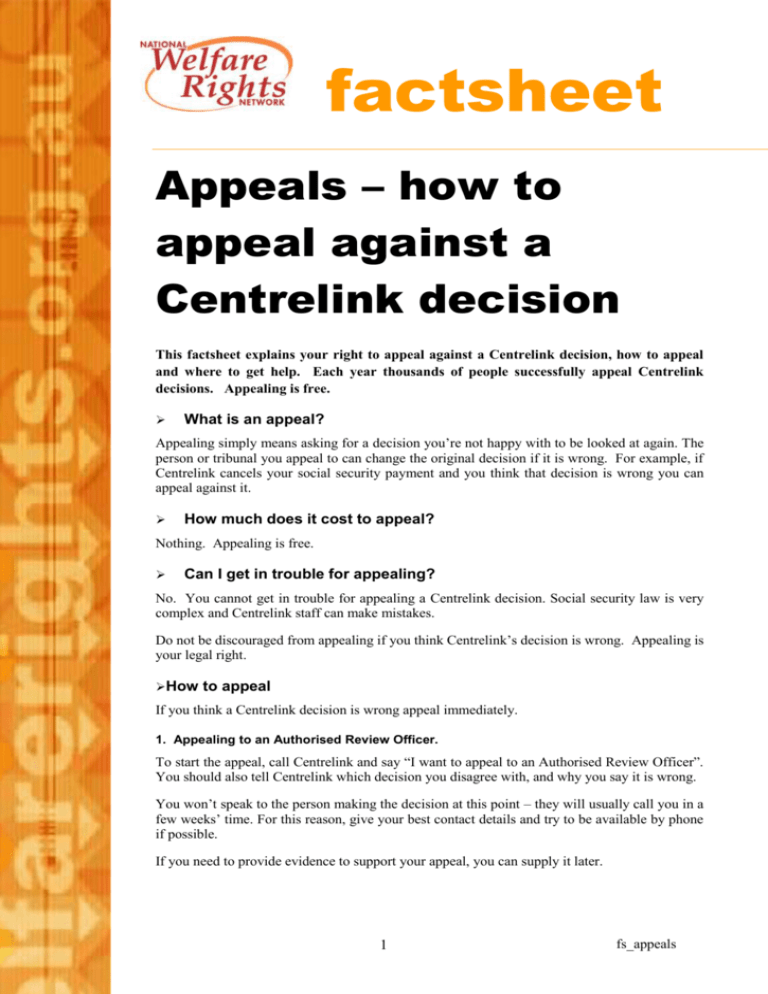

Appeals How To Appeal Against A Centrelink Decision

https://s3.studylib.net/store/data/008561466_1-5bc84634076eb2a03babdf2e597444ab-768x994.png

Lease Agreement Free Printable Pirate Maps Doterra Diffuser Legal

https://i.pinimg.com/originals/1e/a9/36/1ea9365a7739133663ca48d9c283f706.jpg

Family Tax Benefit is made up of several components FTB Part A is paid at a maximum base rate of 1 529 35 per child per year FTB Part A supplement is an additional lump sum of 751 90 per child that is paid after the end of the financial year if your family has a combined adjusted taxable income less than or equal to 80 000 Family Tax Benefit Part A Family Tax Benefit Part A is worked out on your family s combined annual income and the ages and number of dependent children in your care It is paid for eligible children up to the age of 21 and full time students aged 21 24 Children aged 16 20 will need to meet education training requirements Close Window

Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances FTB Part B is paid per family and gives extra help to single parents and some couple families with one main income This information is provided by the Australian Government You may get part of your income support payment or Family Tax Benefit Part A early This is an advance payment For more Personal Finance related news and videos check out Personal Finance You pay it back later out of your payments Who can apply

Claiming Centrelink Benefits Explained For New Parents From Family Tax

https://images.7news.com.au/publication/C-1285031/7613be0447af6cbe91d048b135cbfb061d7309c0-16x9-x0y0w1304h734.jpg?imwidth=1200

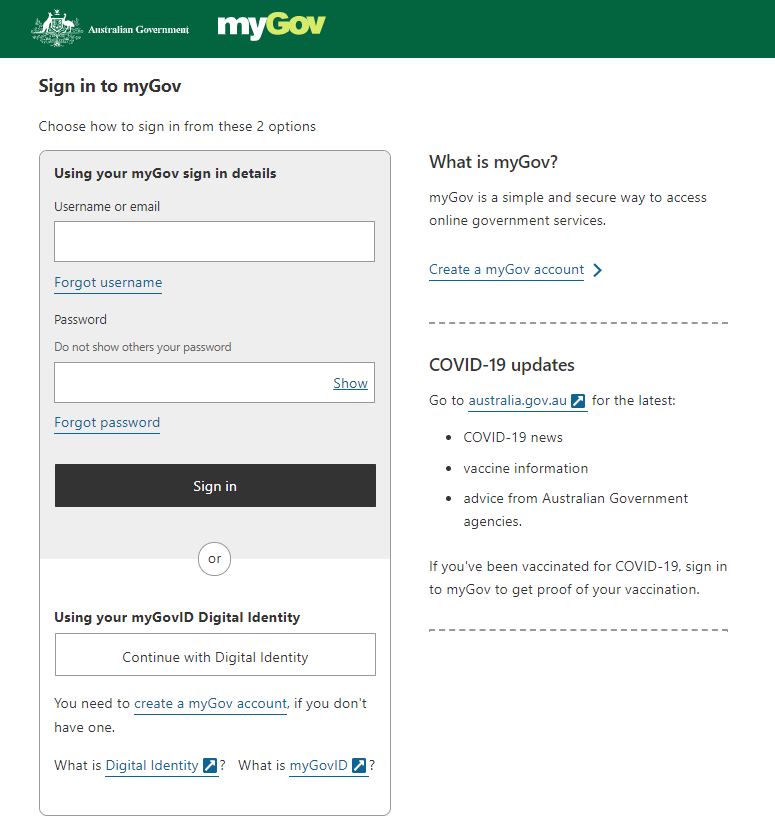

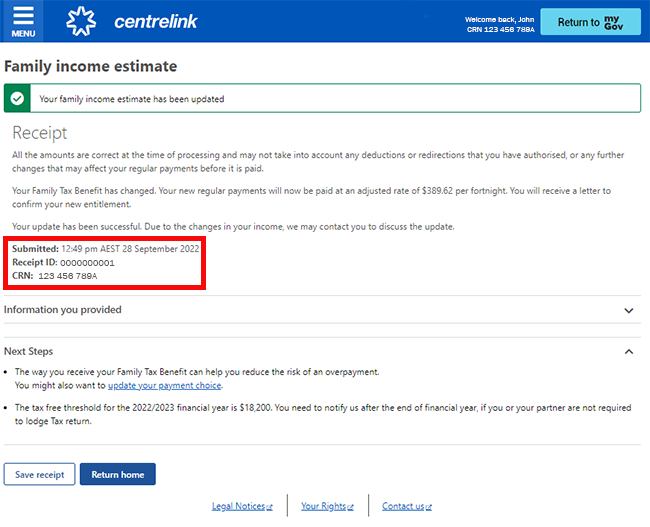

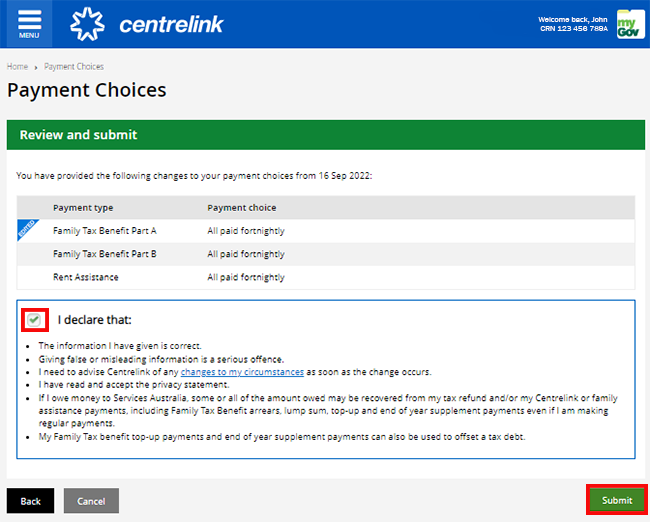

Centrelink Online Account Help Update Your Family Income Estimate And

https://www.servicesaustralia.gov.au/sites/default/files/2022-11/coa-family-income-estimate-and-payment-choice-step3h-301122.png

https://www.servicesaustralia.gov.au/family-tax...

For the 2023 24 financial year it s a payment of up to 879 65 for each eligible child The amount we ll pay you depends on all of the following how many children you have in your care if you share care your family s income the

https://www.servicesaustralia.gov.au/online-estimators

Payment and Service Finder can help you work out how much money you may get It can work out amounts of Centrelink payments including pensions and allowances Family Tax Benefit child care fee assistance To use the Payment and Service Finder answer the questions and choose a payment you want to estimate

Family Tax Benefit PART A PART B Care For Kids

Claiming Centrelink Benefits Explained For New Parents From Family Tax

Centrelink Online Account Help Advise Non lodgement Of Tax Return

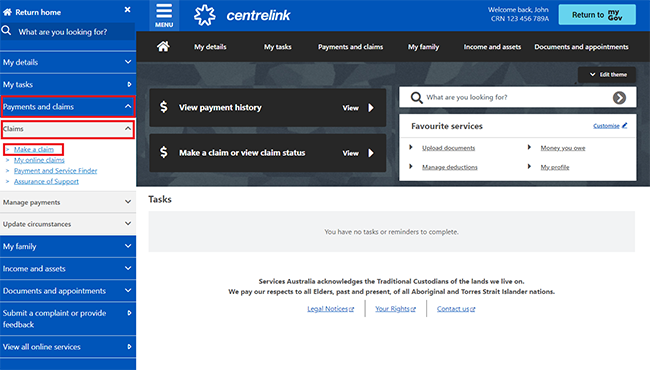

Centrelink Online Account Help Claim A Payment Online Services

Express Plus Centrelink Mobile App Help Update Your Family Income

MyGov myGovau Twitter Tweets TwiCopy

MyGov myGovau Twitter Tweets TwiCopy

Centrelink Online Account Help Advise Non lodgement Of Tax Return

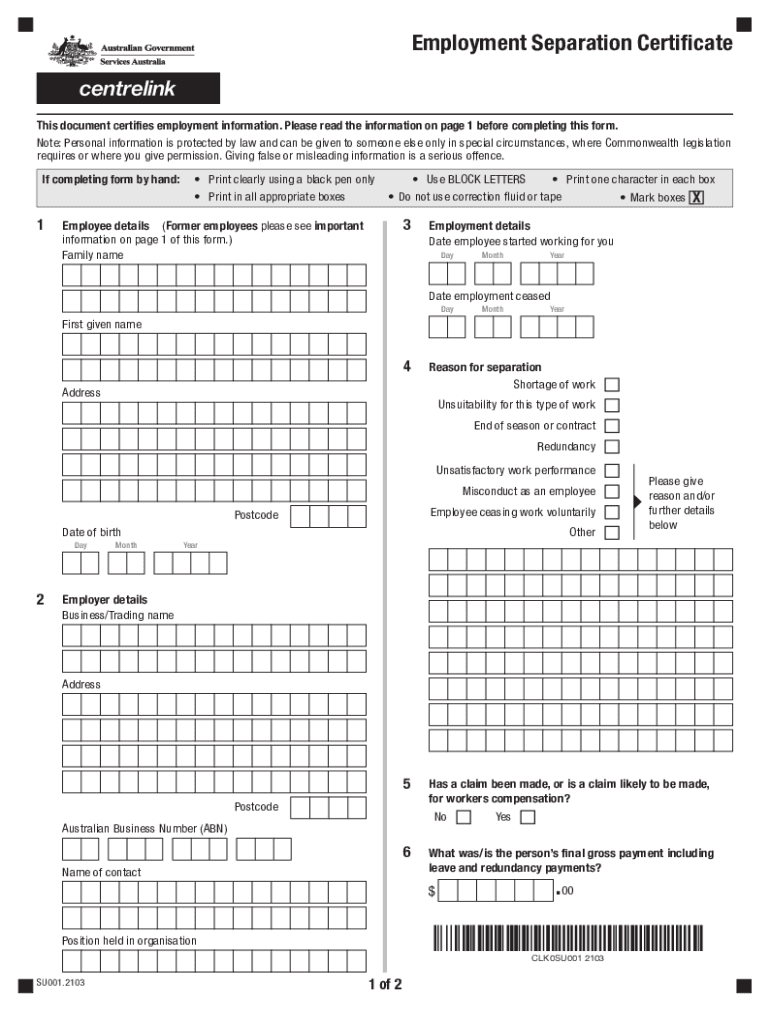

Su001 Form Fill Out And Sign Printable PDF Template SignNow

Centrelink Online Account Help Update Your Family Income Estimate And

How Much Do You Get From Centrelink For Family Tax Benefit - Depending on your family income and how many children you have you can get either FTB A or FTB B or both You can find all the gory details here https www humanservices gov au individuals services centrelink family tax benefit payment rates