How Much Does A Tax Depreciation Schedule Cost Depreciation Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear For instance a widget making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty

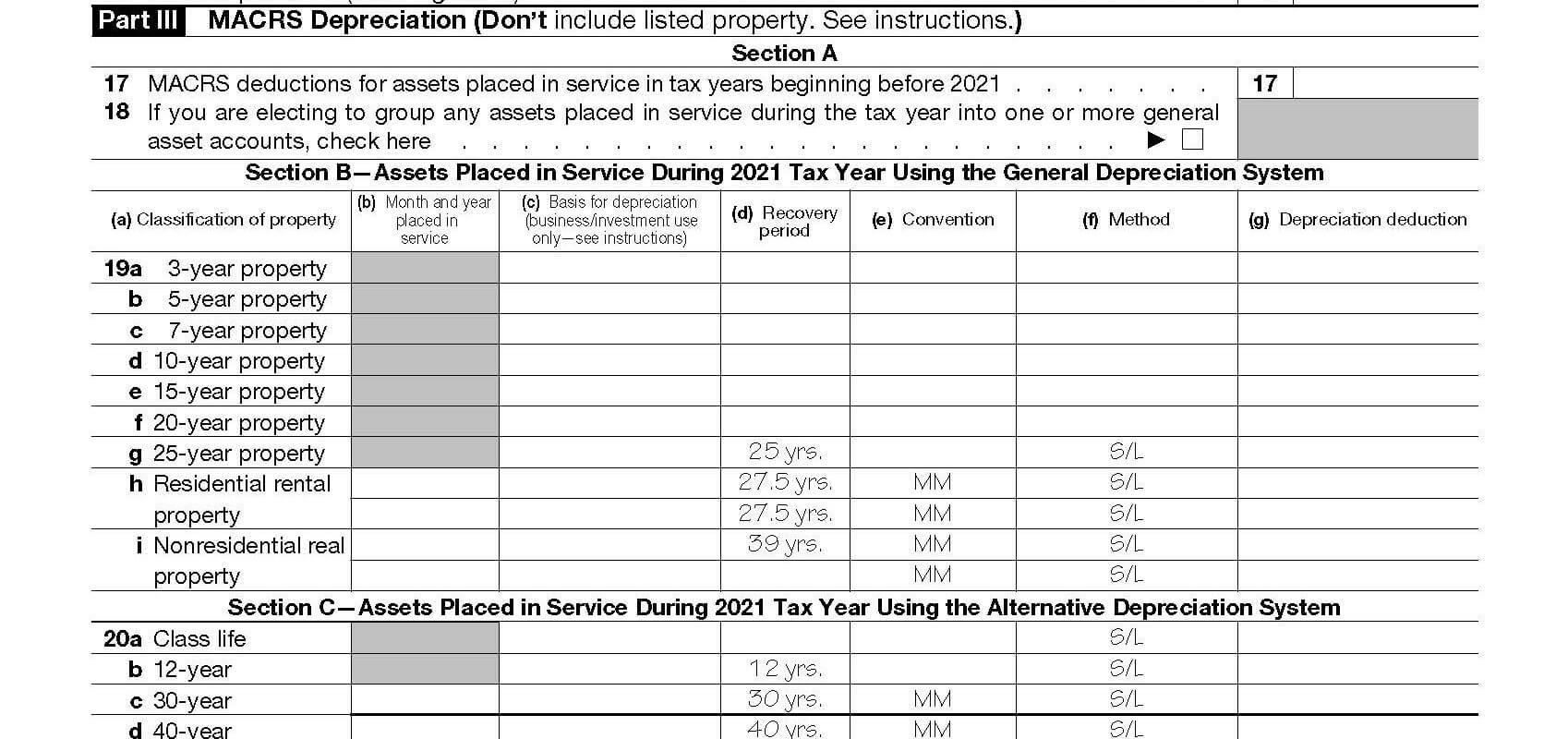

This publication explains how you can recover the cost of business or income producing property through deductions for depreciation for example the special depreciation allowance and deductions under the Modified Accelerated Cost In short tax depreciation is the depreciation expense that can be reported by a business for a given reporting period It is the recovery of an asset cost over a number of years or in other words the asset s useful life When businesses deduct the declining value of assets used in their income generating activities it reduces the amount

How Much Does A Tax Depreciation Schedule Cost

How Much Does A Tax Depreciation Schedule Cost

https://www.resiinspect.com.au/wp-content/uploads/2021/12/52894902_presentation-wide-e1642456326404-1536x826.jpg

Hecht Group How To Read A Depreciation Schedule

https://img.hechtgroup.com/how_to_read_depreciation_schedule_for_commercial_properties.jpg

Annual Depreciation Cost Formula AmieAntonio

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20034320/Simple-Example.jpg

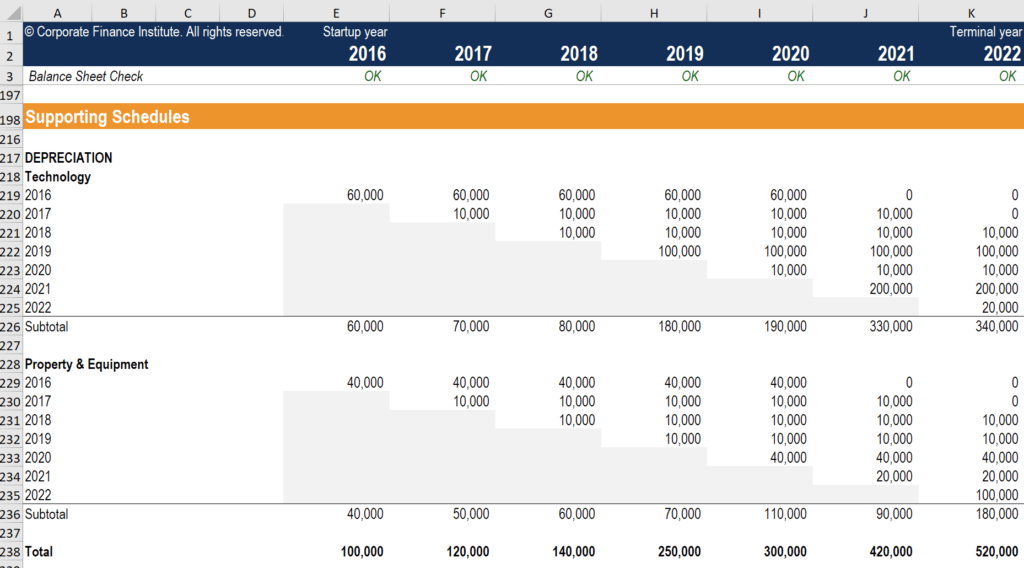

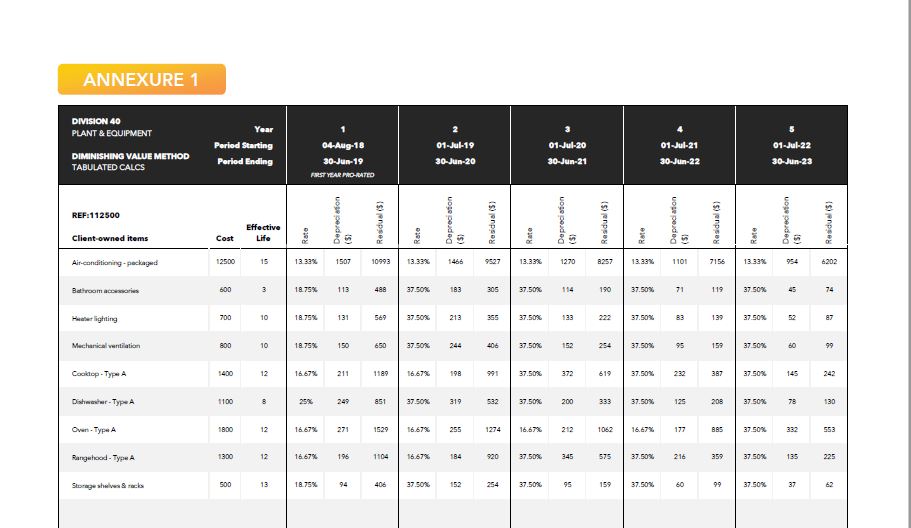

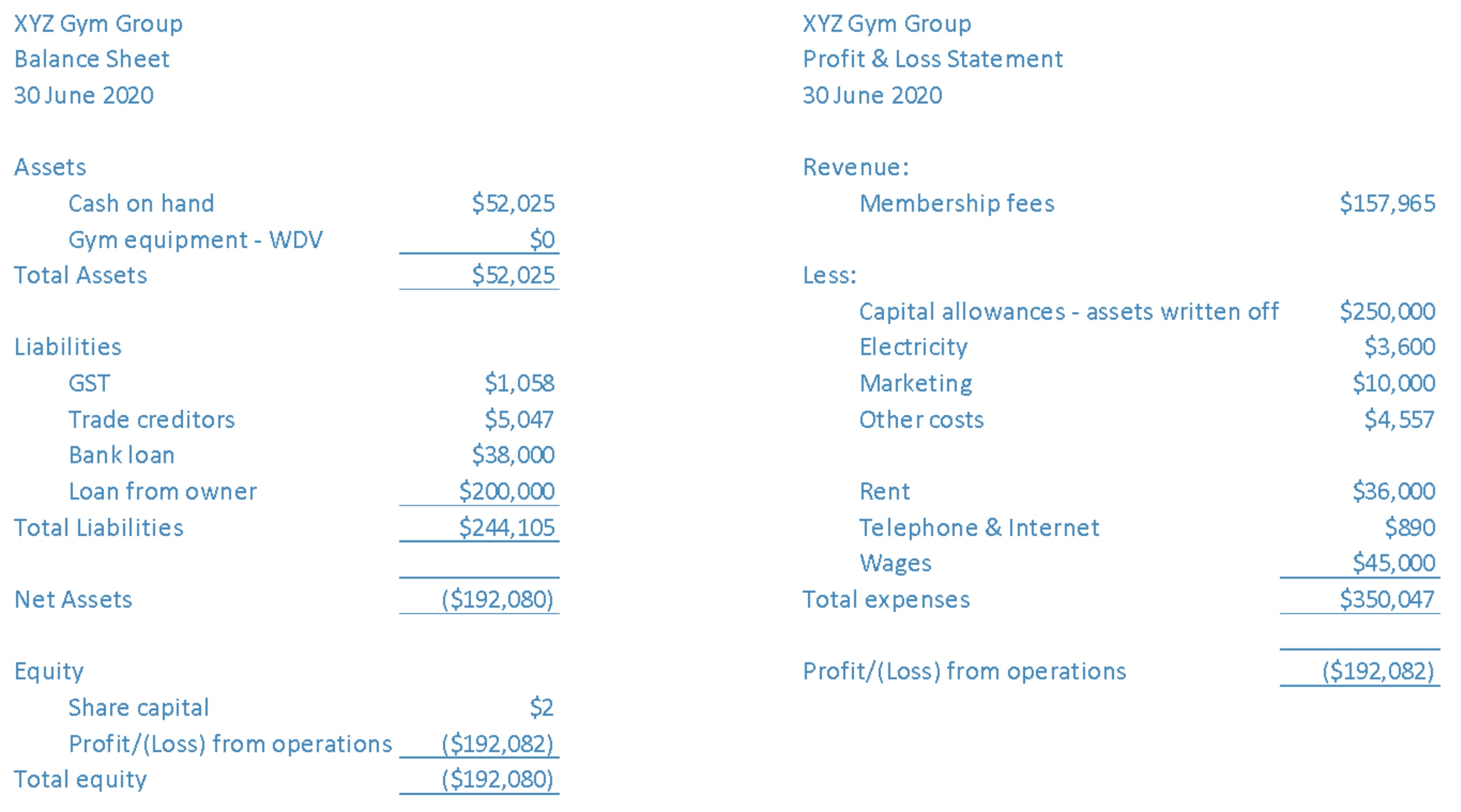

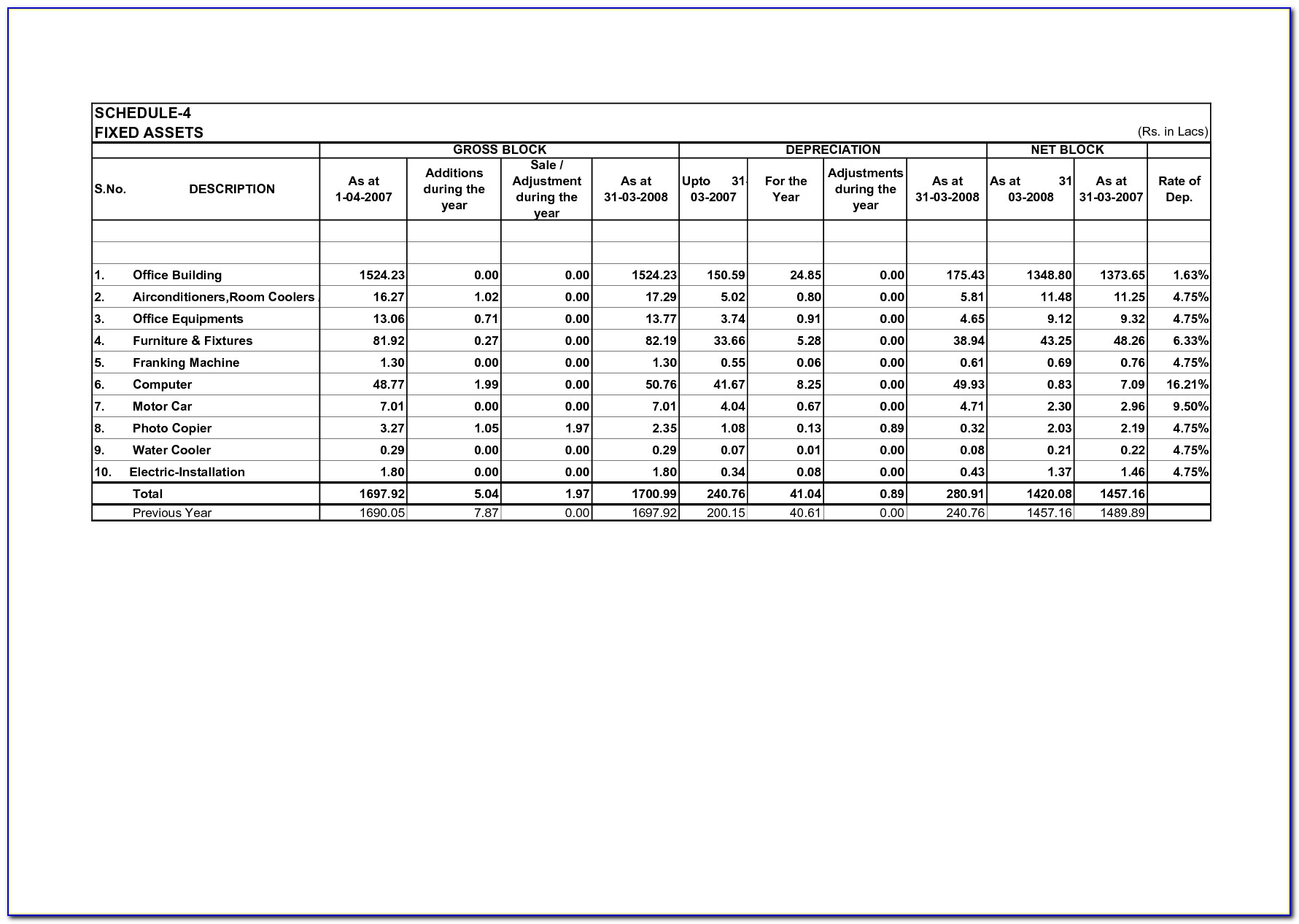

The depreciation schedule is the table that keeps track of the depreciation expense over the years It includes elements such as the date of purchase cost of the asset estimated expected useful life salvage value current year depreciation accumulated depreciation the depreciation method used and the net book value Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes Here are the different depreciation methods and how they work

What is a depreciation schedule A depreciation schedule is a table that shows you how much each of your assets will be depreciated over the years It typically includes the following information A description of the asset Date of purchase The total price you paid for the asset Expected useful life Depreciation method used To calculate depreciation using the straight line method subtract the salvage value from the asset s purchase price then divide that figure by the projected useful life of the asset

Download How Much Does A Tax Depreciation Schedule Cost

More picture related to How Much Does A Tax Depreciation Schedule Cost

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

Negative Gearing And Depreciation

https://www.capitalclaims.com.au/wp-content/uploads/2022/06/Table-1-for-handbook-tax-depreciation.jpg

Gesch ft Supermarkt W tend Fixed Asset Roll Forward Strukturell

https://cdn.corporatefinanceinstitute.com/assets/depreciation-schedule-model-1024x568.png

The annual straight line depreciation would be 2 000 10 000 5 years The straight line rate is 20 2 000 annual depreciation 10 000 depreciable value meaning the double declining rate In year two the depreciation is 1 000 5000 2000 1000 x 0 5 In the final year the depreciation for the last year of the useful life is calculated with this formula net book

Depreciation is the recovery of the cost of the property over a number of years You deduct a part of the cost every year until you fully recover its cost You may be able to elect under Section 179 to recover all or part of the cost of qualifying property up to a certain determinable dollar limit in the taxable year you place the qualifying TABLE OF CONTENTS Special Bonus Depreciation and Enhanced Expensing for 2023 Types of Depreciation Why use regular depreciation Key Takeaways Business assets such as computers copy machines and other equipment can be written off or depreciated over time for tax advantage

Tax Depreciation Schedule House BPI

https://housebpi.com.au/wp-content/uploads/2020/01/slide2-1.jpg

WHY DO I NEED A TAX DEPRECIATION SCHEDULE Mckay Business Services

https://www.mckaybusiness.com.au/wp-content/uploads/2022/11/tax-depreciation-pherrus.webp

https://www.calculator.net/depreciation-calculator

Depreciation Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear For instance a widget making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty

https://www.irs.gov/publications/p946

This publication explains how you can recover the cost of business or income producing property through deductions for depreciation for example the special depreciation allowance and deductions under the Modified Accelerated Cost

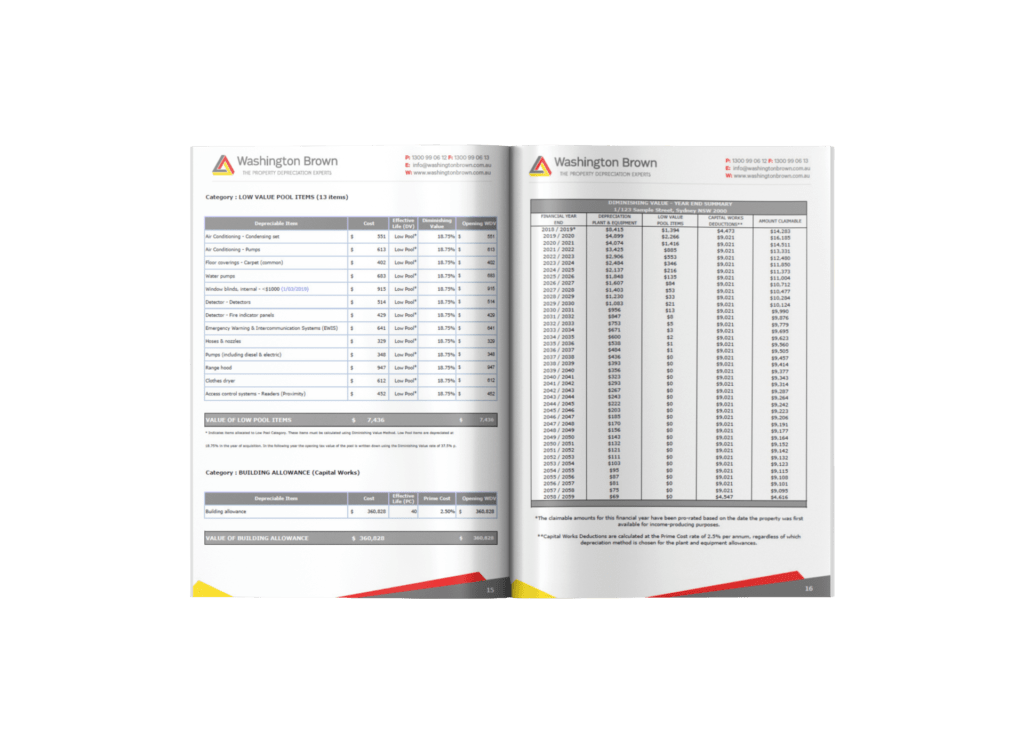

Tax Depreciation Schedules For Property Investors Washington Brown

Tax Depreciation Schedule House BPI

How Much Does A Tax Depreciation Schedule Cost

What Is A Depreciation Schedule What You Need To Know

Accounting Vs Tax Depreciation Why Do Both QuickBooks

What Is A Tax Depreciation Schedule Virtualize Your Biz

What Is A Tax Depreciation Schedule Virtualize Your Biz

Irs Macrs Depreciation Table Excel Review Home Decor

Depreciation Schedule Template

Depreciation Rates For Intangible Assets Download Table

How Much Does A Tax Depreciation Schedule Cost - The depreciation schedule is the table that keeps track of the depreciation expense over the years It includes elements such as the date of purchase cost of the asset estimated expected useful life salvage value current year depreciation accumulated depreciation the depreciation method used and the net book value