Income Tax Rebate On Personal Loan Interest Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal

Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances Web 3 juil 2022 nbsp 0183 32 Answer No tax benefits are available for repayment of a personal loan However interest paid on a personal loan can be

Income Tax Rebate On Personal Loan Interest

Income Tax Rebate On Personal Loan Interest

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web The limit on Income Tax reliefs restricts the total amount of qualifying loan interest relief and certain other reliefs in each year to the greater of 163 50 000 and 25 of adjusted total Web 10 f 233 vr 2023 nbsp 0183 32 If you paid interest on a personal loan can you claim it as a tax deduction While the IRS lets you deduct interest paid on loans the same rule may not apply to

Web One can avail tax benefits from their personal loan if they have used the personal loan money for the purchase or construction of a residential property The borrower can avail Web 23 janv 2020 nbsp 0183 32 Your income tax return can include your personal loan Personal loans for tax deductible purposes like higher education home remodeling or business expansion can be deducted Sections 80C and

Download Income Tax Rebate On Personal Loan Interest

More picture related to Income Tax Rebate On Personal Loan Interest

NVDA Nvidia Short Interest And Earnings Date Annual Report Jul 2021

https://financeai.com/stock/securities/nasdaq-nvda/chart?ts=loan-rebate-rate

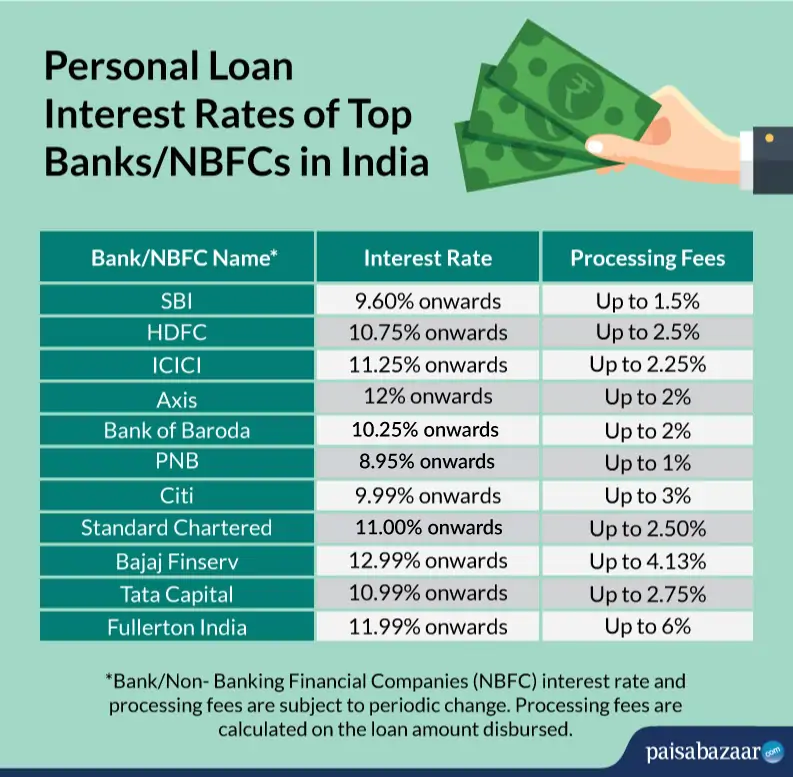

Compare Personal Loan Interest Rates 2020 All Banks

https://www.paisabazaar.com/wp-content/uploads/2020/08/PL-1.jpg

Bi Weekly Auto Loan Calculator

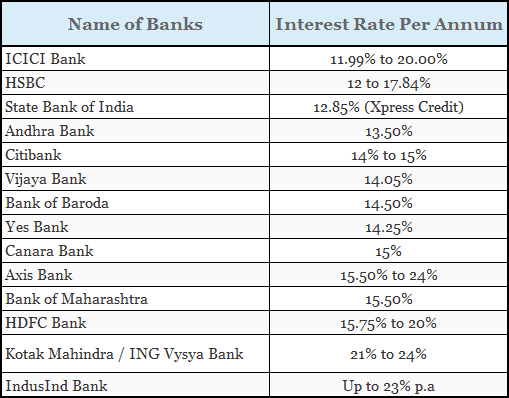

http://simpleinterest.in/wp-content/uploads/2015/06/Personal-Loans-Interest-Rates.png

Web If you have availed a personal loan to invest in your business and have repaid the same the interest paid on that personal loan can be claimed as an expense by the borrower Web Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your income from

Web 24 f 233 vr 2023 nbsp 0183 32 Is interest on a personal loan tax deductible You might already benefit from other loan tax deductions on interest for your mortgage or student loans In most Web 25 mai 2021 nbsp 0183 32 Interests up to Rs 2 lakh can be deducted for a self owned house However the entire interest paid on the personal loan would be eligible for tax benefits for a

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

TLRY Tilray Short Interest And Earnings Date Annual Report Aug 2021

https://financeai.com/stock/securities/nasdaq-tlry/chart?ts=loan-rebate-rate

https://www.investopedia.com/ask/answers/11…

Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal

https://www.forbes.com/advisor/personal-loa…

Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

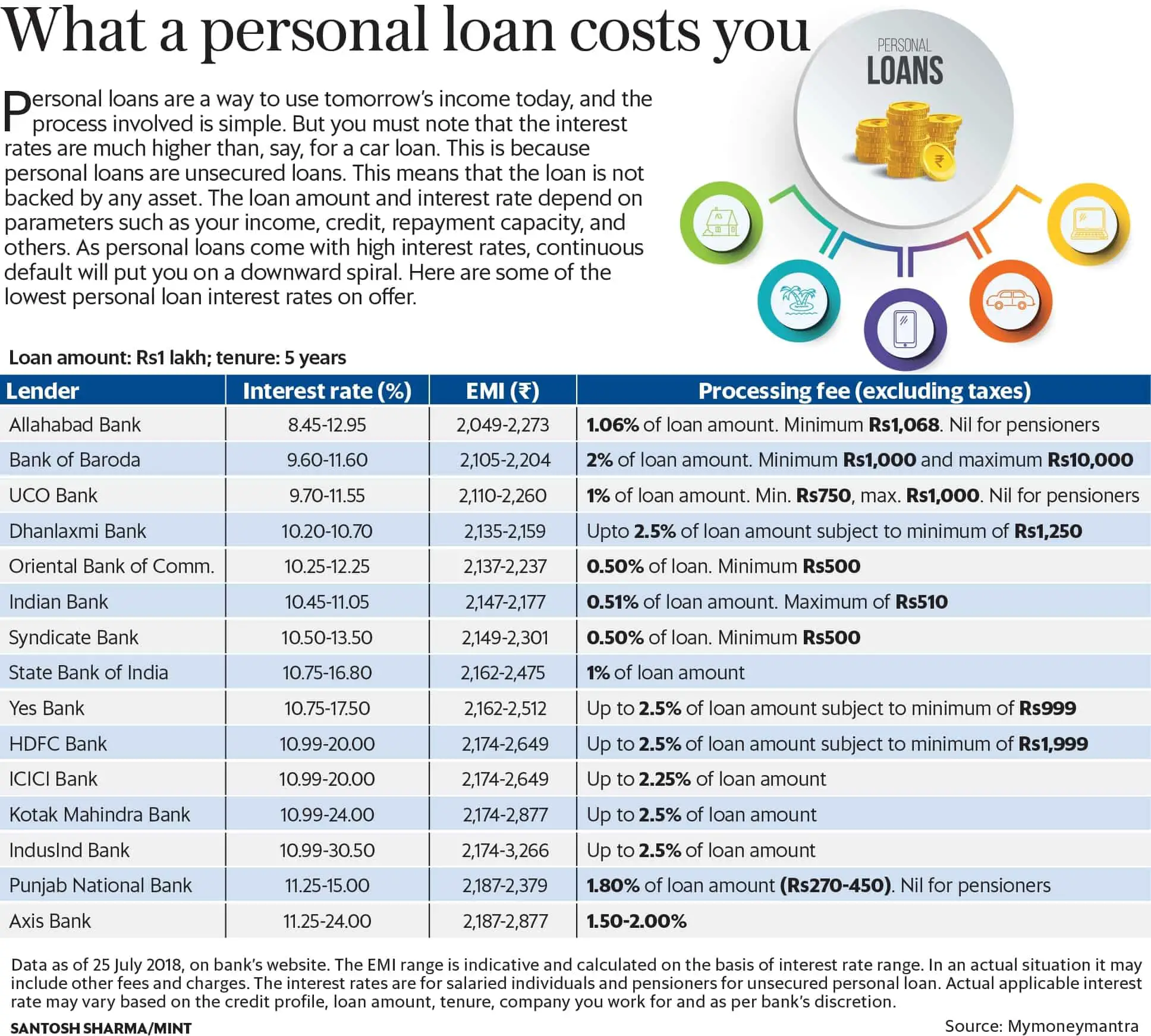

Interest Rates For Personal Loans UnderstandLoans

DEDUCTION UNDER SECTION 80C TO 80U PDF

What Does Rebate Lost Mean On Student Loans

Personal Loan Interest Rates 2020 Compare All Banks Calculation

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

2007 Tax Rebate Tax Deduction Rebates

INCOME TAX REBATE ON HOME LOAN

Pin On Tigri

Income Tax Rebate On Personal Loan Interest - Web 10 f 233 vr 2023 nbsp 0183 32 If you paid interest on a personal loan can you claim it as a tax deduction While the IRS lets you deduct interest paid on loans the same rule may not apply to