How Much For Tax Credit A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax return Most tax credits can reduce your tax only until it reaches 0

A tax credit is a dollar for dollar reduction of a taxpayer s bill This can reduce the tax they owe or in some cases increase their refund amount This differs from a tax deduction which is A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

How Much For Tax Credit

How Much For Tax Credit

https://www.advancegroupkh.com/wp-content/uploads/2021/04/Tax.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year

The earned income tax credit is a refundable credit for low to middle income workers For the 2024 tax year the tax credit ranges from a max of 632 to 7 830 depending on tax filing The new child tax credit will provide 3 000 for children ages 6 to 17 and 3 600 for those under age 6 Here s how to calculate how much you ll get

Download How Much For Tax Credit

More picture related to How Much For Tax Credit

Reminder To Look Out For Tax Credit Renewal Packs

https://www.streetsweb.co.uk/media/cache/2a/1b/2a1b459163605b5f268c2d0978e909a1.jpg

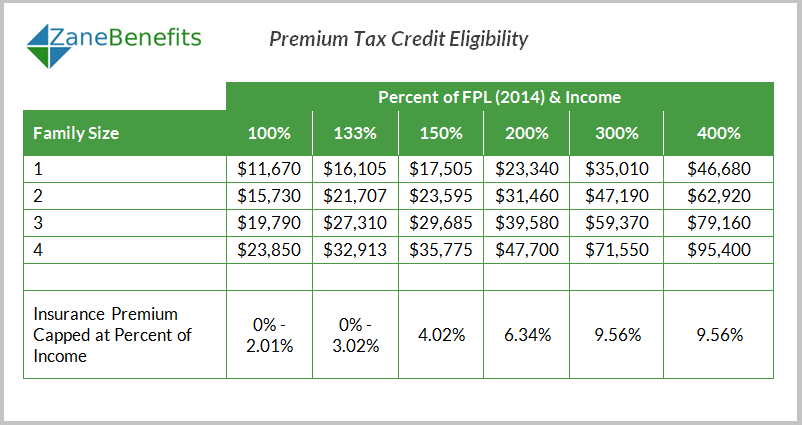

Premium Tax Credit Charts 2015

http://www.peoplekeep.com/hs-fs/hub/149308/file-1445968346-png/tax_credit_eligibility.png

TAX CREDITS EXPLAINED Business Works

https://www.businessworksuk.co.uk/wp-content/uploads/2014/05/Seamstress-BW.png

For the 2023 tax year you can get a maximum tax credit of 2 000 for each qualifying child under age 17 although there is an income limit of 400 000 for married couples and 200 000 for individuals 1 A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000

Enacted in 1997 the credit currently provides up to 2 000 per child to about 40 million families every year The American Rescue Plan made historic expansions to the Child Tax Credit CTC Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to receive payments and how to calculate how much you ll get

Article Basics 8 Moving On Up Tax Credit Household Transfer Rules

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147483915/images/qJTynKdzQM6DAaIk9rO8_file.jpg

Car Donation Tax Deduction Tax Benefits Of Donating A Car

https://www.goodwillcardonation.org/wp-content/uploads/2016/06/auto-goodwill-car-donation--1536x1024.jpg

https://www.irs.gov/credits-deductions/individuals/refundable-tax-credits

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax return Most tax credits can reduce your tax only until it reaches 0

https://www.nerdwallet.com/article/taxes/what-tax-credits-can-i-qualify-for

A tax credit is a dollar for dollar reduction of a taxpayer s bill This can reduce the tax they owe or in some cases increase their refund amount This differs from a tax deduction which is

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Article Basics 8 Moving On Up Tax Credit Household Transfer Rules

Dallas Low Income Tax Credit Apartments Pay 30 In Rent Each Month

So Much For tax The Rich 9GAG

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

See The EIC Earned Income Credit Table Income Tax Return Income

See The EIC Earned Income Credit Table Income Tax Return Income

How Much Do Small Businesses Pay In Taxes Entrepreneurs Break

Missed The Tax Return Deadline Do It By 30 April Before Further Charges

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

How Much For Tax Credit - Because tax credits are subtracted directly from your tax bill there aren t very many of them Knowing what tax credits you qualify for can create substantial savings on your taxes