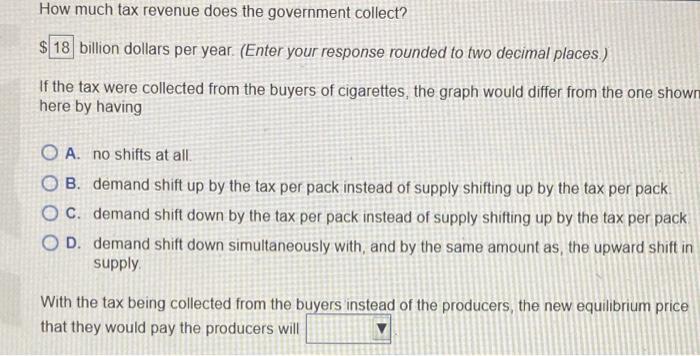

How Much Government Revenue Does The Gasoline Tax Generate Quizlet Web How much tax revenue does the government collect If the tax were collected from the buyers of cigarettes the graph would differ from the one shown here by having With the tax being collected from the buyers

Web EOC7 End of Chapter Problems Ch 7 Taxes 5 0 1 review The state needs to raise money and the governor has a choice of imposing an excise tax of the same amount Web increases by less than 1 000 To calculate the revenue government receives when a tax is imposed on a good multiply the A pre tax equilibrium price by the pre tax quantity

How Much Government Revenue Does The Gasoline Tax Generate Quizlet

How Much Government Revenue Does The Gasoline Tax Generate Quizlet

https://i.pinimg.com/originals/d2/3d/05/d23d05dd573fdd1c848a7c5c7bfca612.png

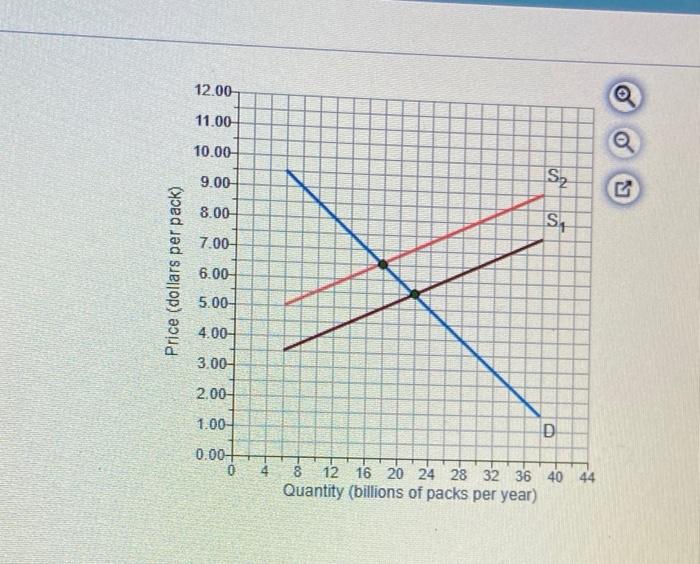

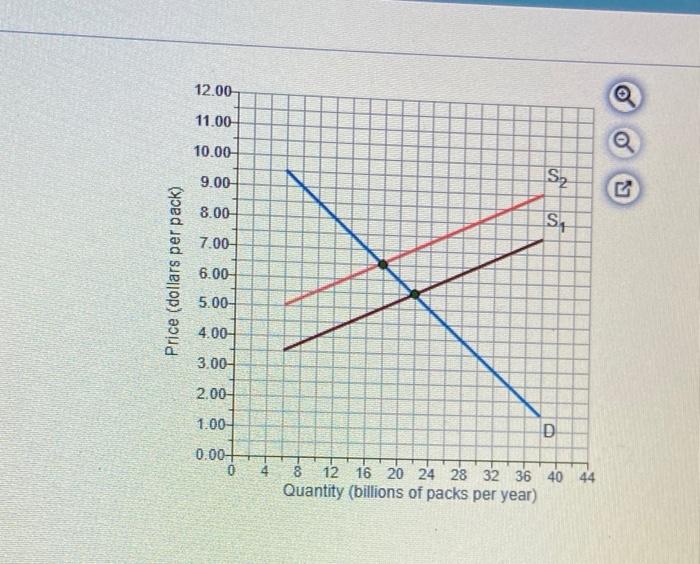

Solved Use The Graph To The Right Of The Market For Chegg

https://media.cheggcdn.com/study/ec9/ec980ab9-c238-4061-90a3-0a74c3319816/image

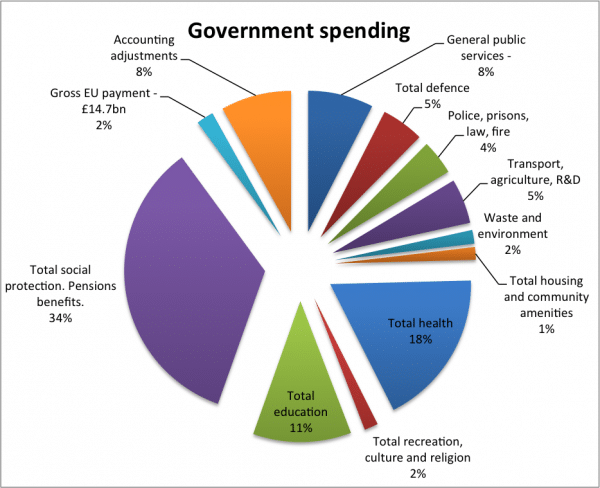

Government Spending The Meme Policeman

https://i1.wp.com/memepoliceman.com/wp-content/uploads/2017/02/government-spending.png?fit=1003%2C915

Web Benefits Received Policy the gasoline tax is a classic example of because users of the highways pay the gasoline tax Ability to Pay Policy progressive income Web Gasoline taxes can be employed to correct externalities associated with automobile use to reduce dependency on foreign oil and to raise government revenue Our

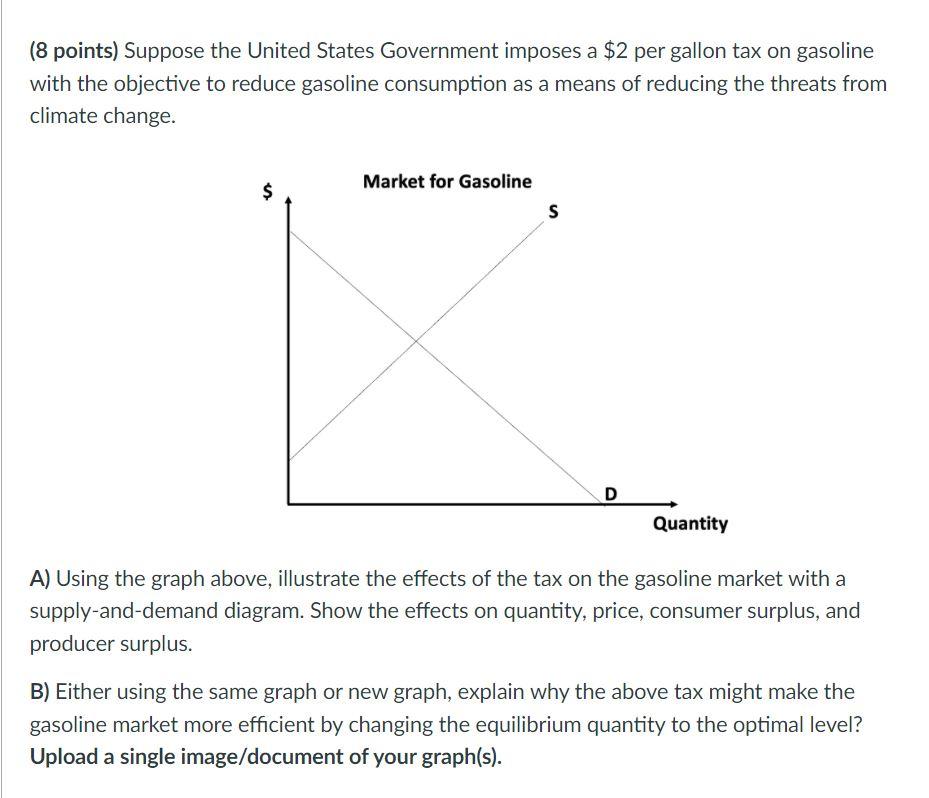

Web Find step by step solutions and your answer to the following textbook question Suppose the government decides to raise the gasoline tax as a way to reduce air pollution and Web State Taxes The United States federal excise tax on gasoline is 18 4 cents per gallon and 24 4 cents per gallon for diesel fuel 1 2 Proceeds from the tax partly support the

Download How Much Government Revenue Does The Gasoline Tax Generate Quizlet

More picture related to How Much Government Revenue Does The Gasoline Tax Generate Quizlet

Public Finance And Public Choice

https://saylordotorg.github.io/text_principles-of-economics-v2.0/section_18/29c7299d7ba75aa8dc44935b17a6f28e.jpg

How Much Money Does The Government Collect Per Person

https://staticweb.usafacts.org/media/images/2023_01_29_SOTU_Set1_Revenue_IG.width-1200.png

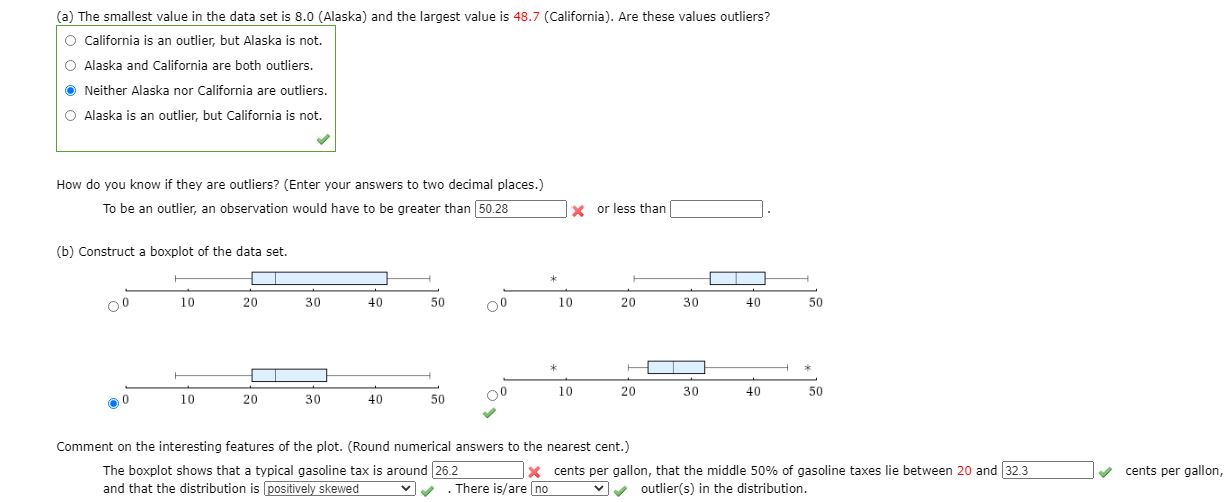

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

https://media.cheggcdn.com/media/878/878c29b3-038c-434e-898a-4cba476034bd/phpoowESG.png

Web Terms in this set 4 What is the greatest source of tax revenue for the federal government Personal Income Taxes What are excise taxes Taxes levied on the Web Vor 5 Tagen nbsp 0183 32 Throw in the 18 4 cents federal tax and the total gas tax rises to 50 cents per gallon Gas taxes thus accounted on average for about 15 of the average retail

Web People will consume more beef if the price increases from 1 to 2 per pound l revenue by 500 C 6 While waiting in line to buy two tacos at 75 cents each and a medium drink Web How much government revenue does the gasoline tax generate Enter a numeric response using a real number rounded to two decimal places The gasoline tax is

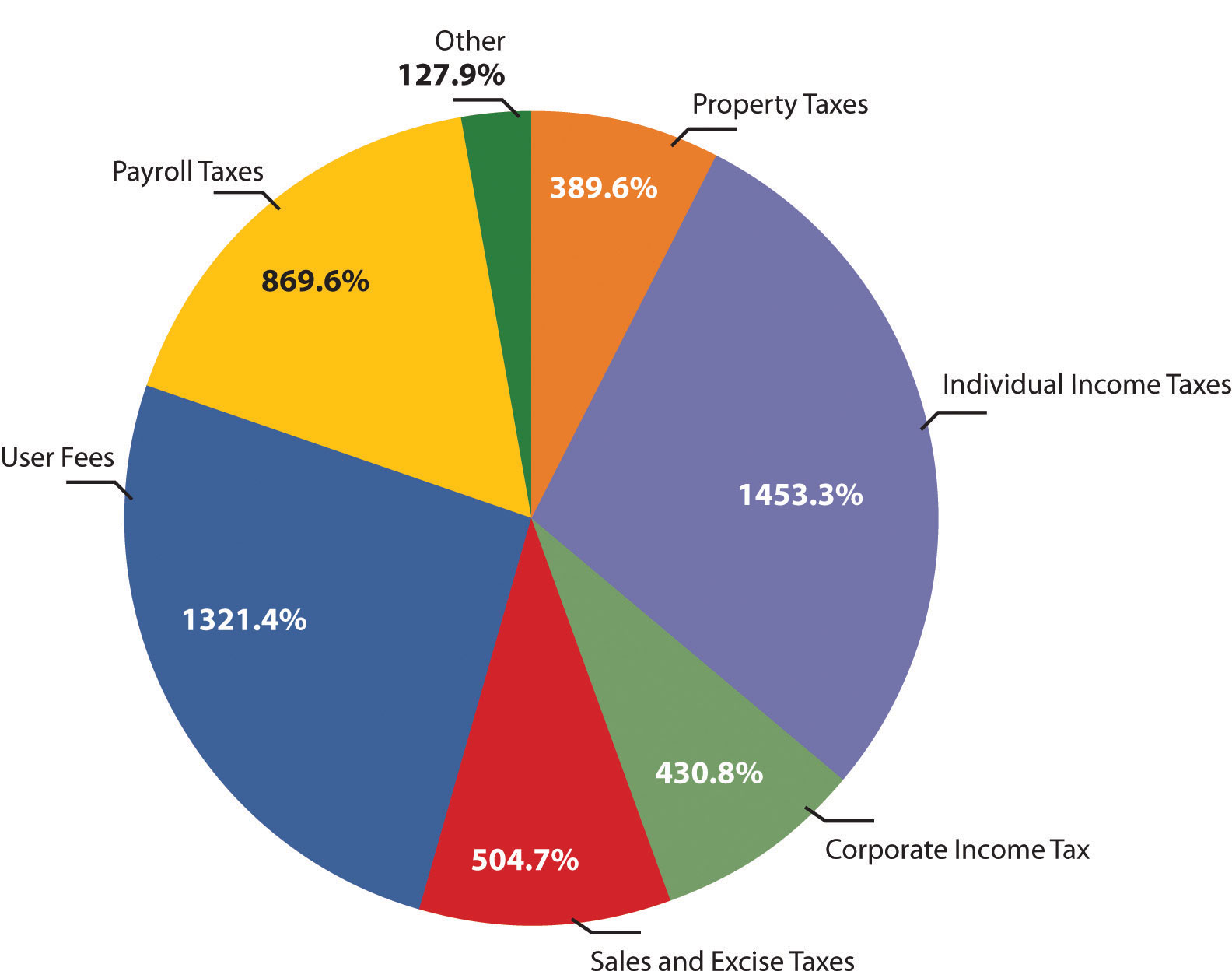

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

https://files.taxfoundation.org/20220211164025/Individual-income-taxes-are-the-most-important-revenue-source-for-the-US-Sources-of-US-tax-revenue-by-tax-type-2022.png

Occupy ONLINE Federal Budget 101 Where Does The Money Come From

https://1.bp.blogspot.com/-evSlPe1OIMk/UF6khjxqvrI/AAAAAAAAFCw/4Q8_aOKgz2c/s1600/Figure8.5.png

https://quizlet.com/784979859/tax-do-not-del…

Web How much tax revenue does the government collect If the tax were collected from the buyers of cigarettes the graph would differ from the one shown here by having With the tax being collected from the buyers

https://quizlet.com/736064273/eoc7-end-of-chapter-problems-ch-7-taxes...

Web EOC7 End of Chapter Problems Ch 7 Taxes 5 0 1 review The state needs to raise money and the governor has a choice of imposing an excise tax of the same amount

How Much Tax Revenue Does The Government Collect Chegg

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

Solved 8 Points Suppose The United States Government Chegg

What Does The Government Spend Its Money On Economics Help

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

Taxes Subsidies Mr Banks Economics Hub Resources Tutoring Exam

Taxes Subsidies Mr Banks Economics Hub Resources Tutoring Exam

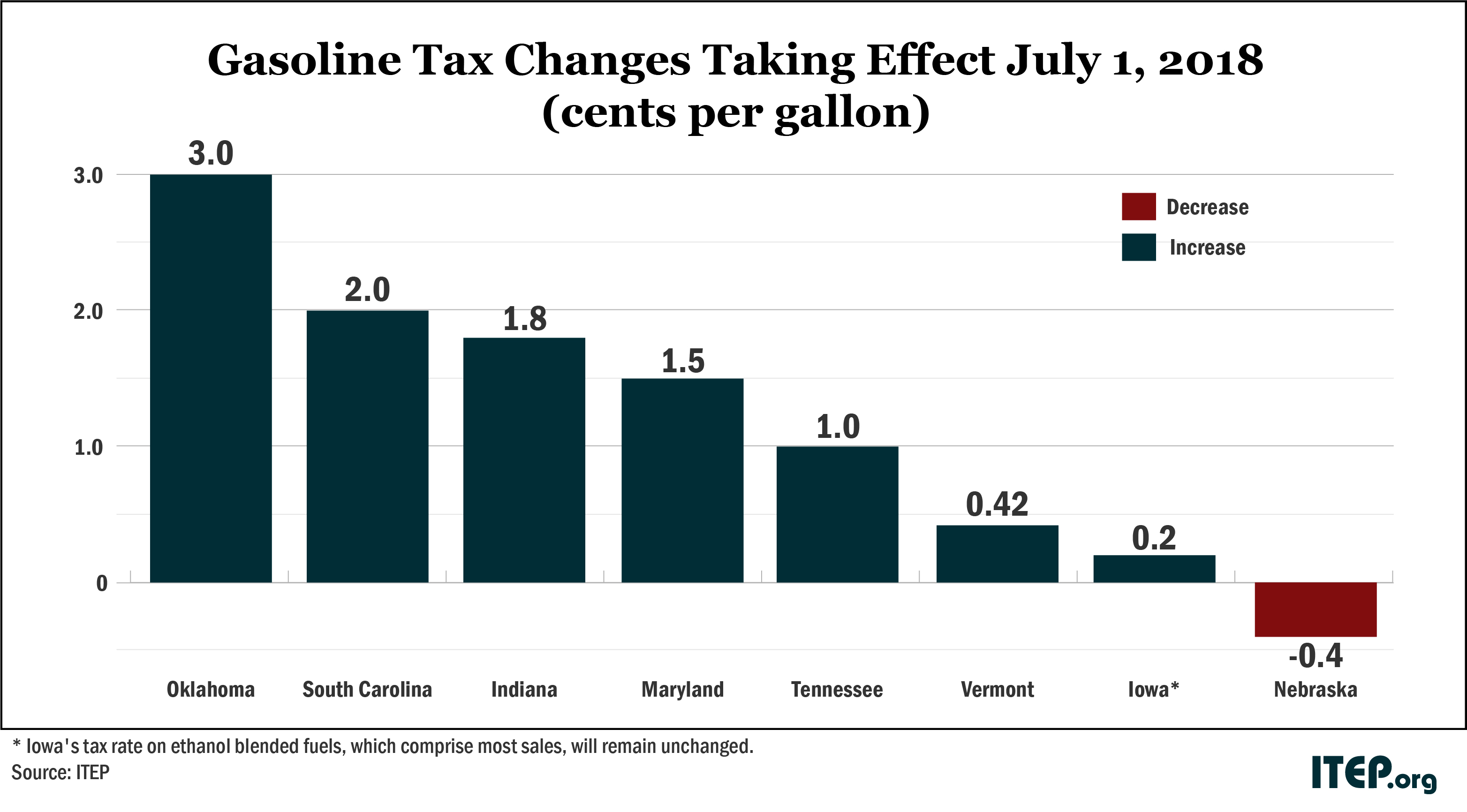

Gas Taxes Rise In Seven States Including An Historic Increase In

At A Glance Treasury gov au

Economics Fiscal Policy Explained Civilsdaily

How Much Government Revenue Does The Gasoline Tax Generate Quizlet - Web Benefits Received Policy the gasoline tax is a classic example of because users of the highways pay the gasoline tax Ability to Pay Policy progressive income