How Much Interest Income Is Tax Free For Senior Citizens Older adults have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay taxes

In the case of senior citizens if taxable income is up to Rs 5 00 000 then they can claim rebate from tax under the old tax regime i e they are not required to pay Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the

How Much Interest Income Is Tax Free For Senior Citizens

How Much Interest Income Is Tax Free For Senior Citizens

https://img.money.com/2023/02/News-2023-How-To-File-Taxes-Free.jpg?quality=60&w=1280

How Much Interest Income Is Tax Free For Senior Citizens Leia Aqui

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-for-senior-citizens-FY-2022-23.webp

How Much Interest Income Is Tax Free For Senior Citizens Leia Aqui

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ttb.jpg

1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh for those below 60 The exemption Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post

Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest Your taxable income may include compensation for services interest dividends rents royalties income from partnerships estate or trust income gain from sales or

Download How Much Interest Income Is Tax Free For Senior Citizens

More picture related to How Much Interest Income Is Tax Free For Senior Citizens

A Look Into US Cities Where Homes Are Cheap And Income Is Tax free

https://www.thepreparedninja.com/wp-content/uploads/2019/04/images2078-5cb5fea5ab413.jpg

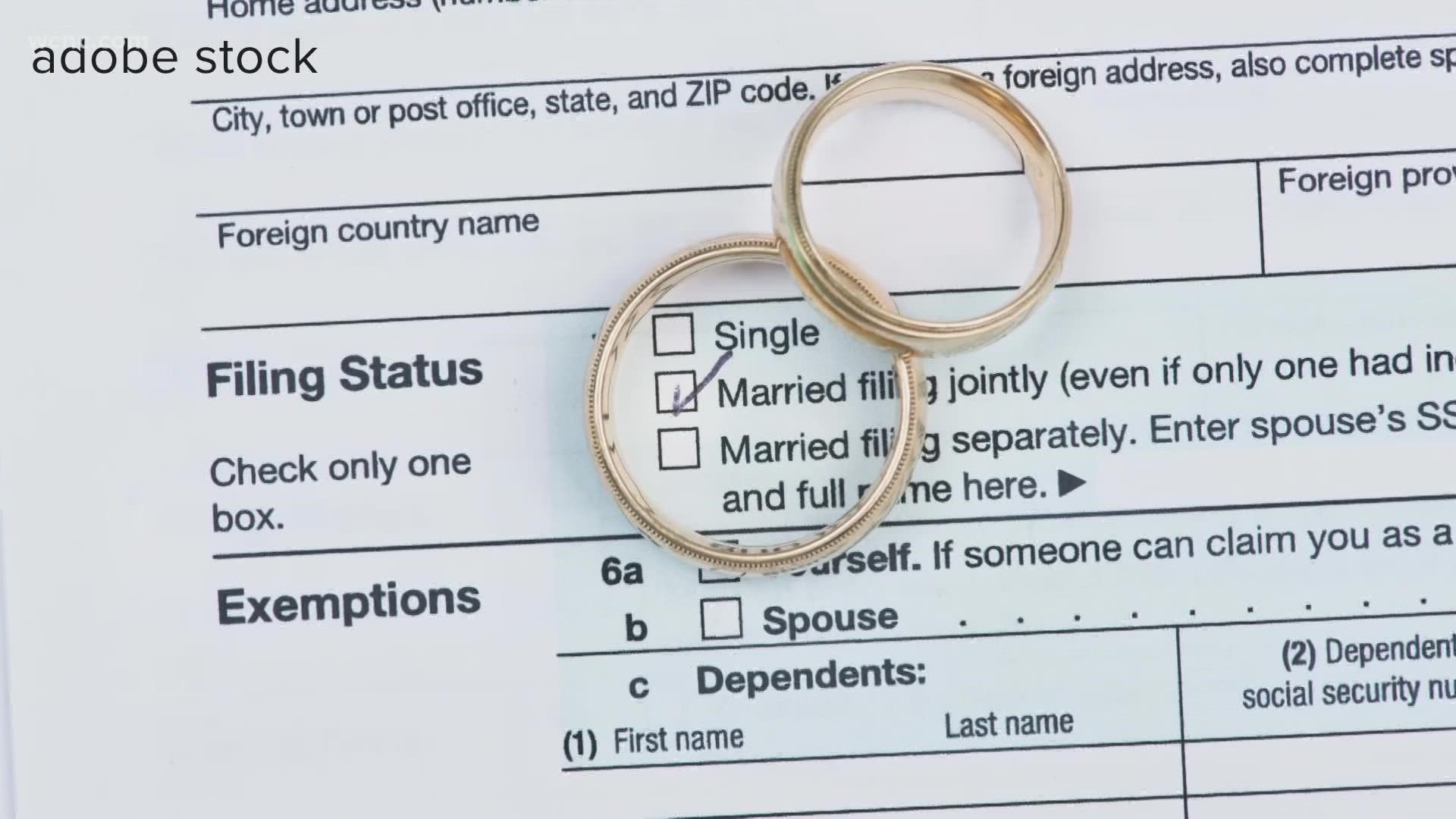

Can Married Couples File Taxes As Single VERIFY Wcnc

https://media.wcnc.com/assets/WCNC/images/0655f001-4ebb-46a4-9bd2-8c4a696cd59d/0655f001-4ebb-46a4-9bd2-8c4a696cd59d_1920x1080.jpg

Why Should Toilet Free For Senior Citizens And Ladies

https://i.ytimg.com/vi/KmyPhf4G0PQ/maxresdefault.jpg

Net taxable salary will be Rs 2235900 on which tax payable will be Rs 5lakh Find out the income tax slab rates for senior citizens for the financial year 2024 25 As of 2023 the tax free amount for senior citizens is as follows 1 Individuals aged 60 to 80 years For income up to 3 lakh No tax For income between

How much is the income tax limit for senior citizens Up to Rs 3 00 000 in a financial would be tax free for Senior Citizens between 60 to 80 years of age What is the oldest age at The Income Tax Act 1961 levies a tax on every individual who earns an annual income over the tax exempt limit at a prescribed rate In this regard a senior citizen s earnings

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

Chapter 5 Income Taxation Chapter 5 Final Income Taxation This

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fc58b36757029db33ff8f29a031db7ee/thumb_1200_1553.png

https://www.irs.gov/individuals/seniors-retirees

Older adults have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay taxes

https://cleartax.in/s/income-tax-slab-for-senior-citizen

In the case of senior citizens if taxable income is up to Rs 5 00 000 then they can claim rebate from tax under the old tax regime i e they are not required to pay

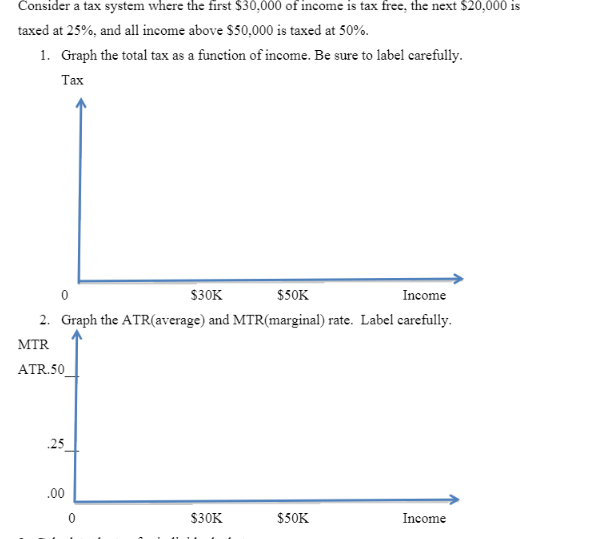

Solved Consider A Tax System Where The First 30 000 Of Chegg

Ca Tax Brackets Chart Jokeragri

How Much Income Is Tax Free Ultimate Guide Accotax

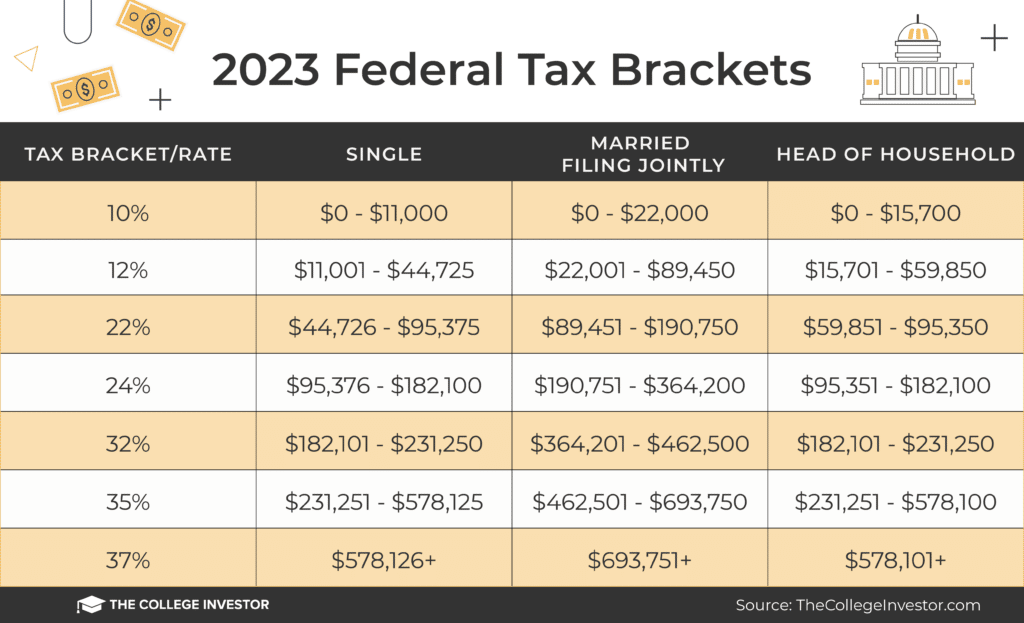

Tax Resource And Help Center The College Investor

Solved Which Of The Following Types Of Income Is Tax

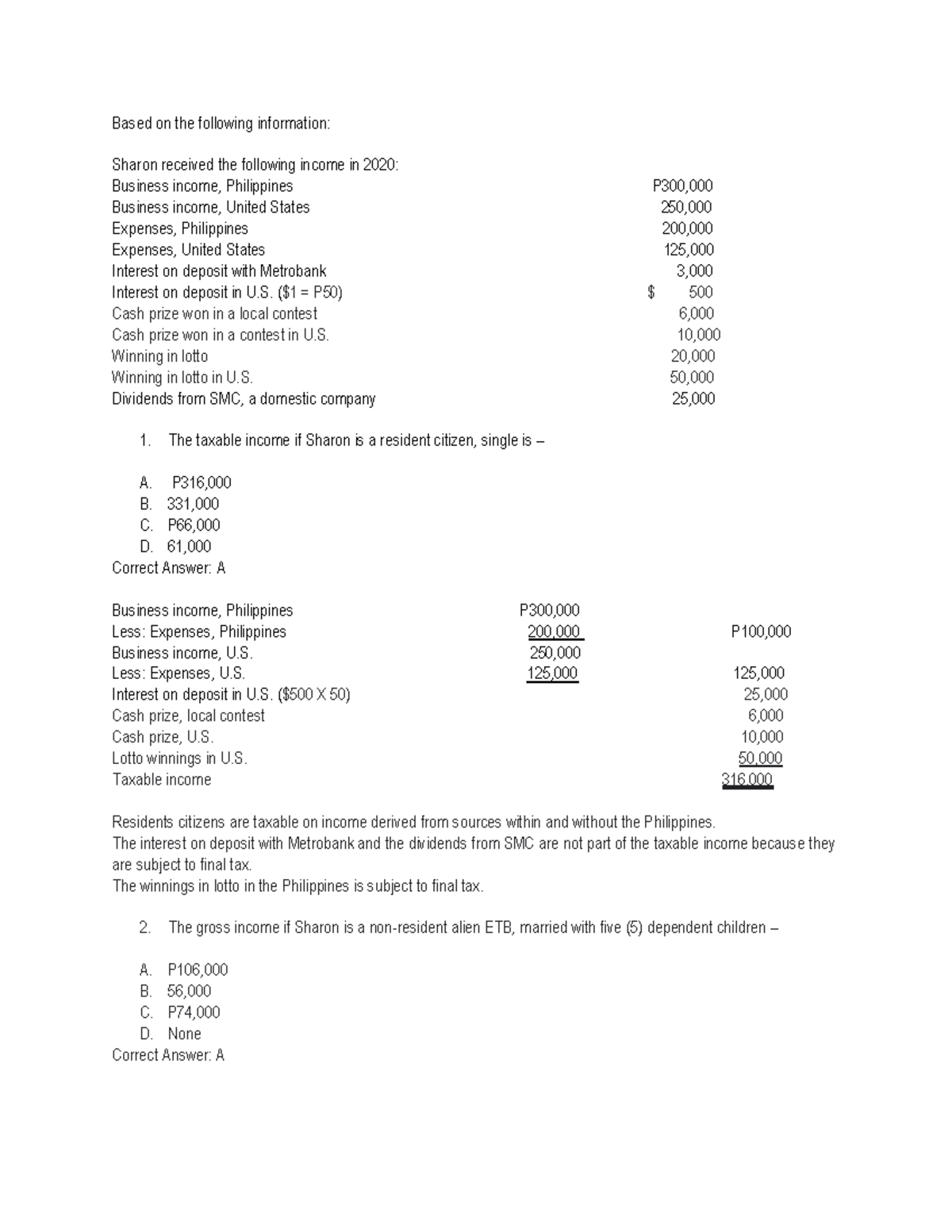

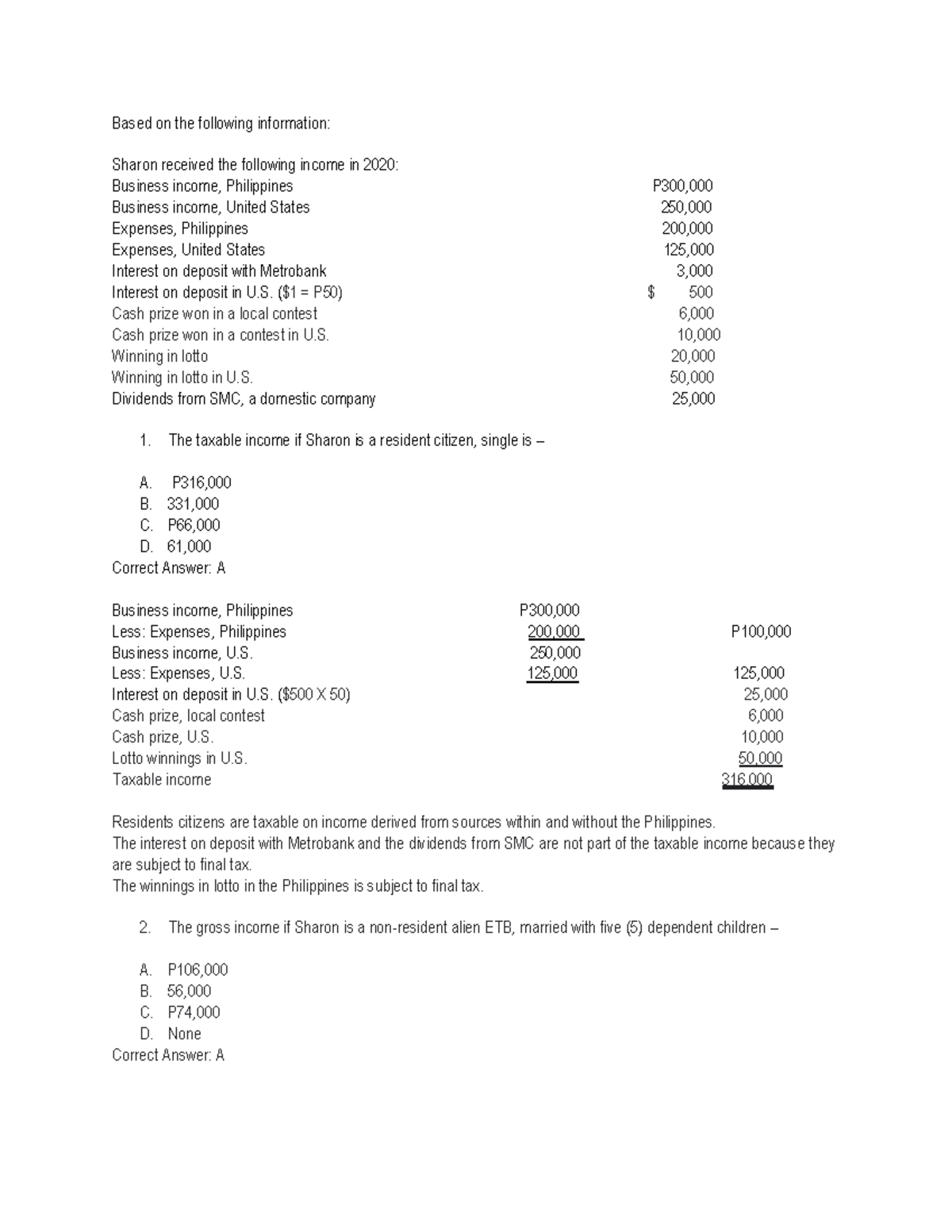

WORD Problems Taxation Mavod Based On The Following Information

WORD Problems Taxation Mavod Based On The Following Information

The Future Of Agriculture Insight Charles Sturt University

Swimming Pools In Johannesburg

What Is Net Interest Income NII Formula Calculator

How Much Interest Income Is Tax Free For Senior Citizens - Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post