How Much Interest On Home Loan Can Be Claimed The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can individually claim Rs 3 50 lakhs per annum as

How Much Interest On Home Loan Can Be Claimed

How Much Interest On Home Loan Can Be Claimed

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

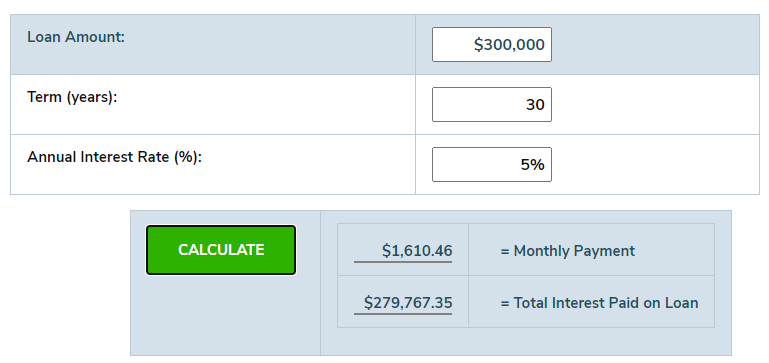

Calculate My Loan Payment RaniInnarah

https://investinganswers.com/images/loan-interest-payment-1.png

How To Calculate Interest On A Car Loan Discount Shop Save 69

https://cdn.mozo.com.au/images/atwood/482/content_first1.jpg

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh You can deduct the interest you paid during the tax year on the first 750 000 of your mortgage according to the IRS For married couples filing separately the limit is 375 000 If you took

How much interest can I claim Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

Download How Much Interest On Home Loan Can Be Claimed

More picture related to How Much Interest On Home Loan Can Be Claimed

Home Loan Tax Benefits Vineesh Rohini

https://www.vineeshrohini.com/wp-content/uploads/2023/02/loan-benefits-1024x576.jpg

How To Take Loan With Cash Pal Loan App

https://indiafinanceguide.com/wp-content/uploads/2022/05/logo-1.png

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/07/Home-Loan-Interest-Rates-loanfasttrack-1-1024x684.png

Under Section 24 b Interest Payment For a self occupied property you can claim a deduction of up to 2 00 000 on interest payment Since you paid 1 40 000 as interest you can claim the entire amount as a deduction Calculating the Tax Savings Suppose you fall into the 30 income tax bracket An additional deduction under Section 80EE is available to homebuyers up to Rs50 000 To claim this deduction the following conditions must be met The loan amount must be Rs35 lakh or less and

The maximum deduction limit under Section 24 could either be 30 of GAV of the rented property or Rs 2 lakh deduction against home loan interest payment of self occupied property or The entire home loan interest payment in case of rented properties A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up to 4 lakh

How Much House Can I Afford Insider Tips And Home Affordability

https://i.pinimg.com/originals/ff/f6/09/fff609a2713986a454a4153ea1437f5f.png

How Much Can I Borrow Bank West LollyConrad

https://www.bankwest.com.au/content/dam/bankwest/web-assets/images/body-text-container/content/btc-table-understanding-home-loan-statements-01.gif

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

https://cleartax.in/s/deductions-under-section24-income-from-house-property

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction

Home Loans Australia Mortgage Need A Home Loan

How Much House Can I Afford Insider Tips And Home Affordability

How To Calculate Interest Rate Based On Interest Amount Haiper

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

How To Calculate Loan Interest Bank Info

How Much Interest On A 3000 Loan AizuddeenLang

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

CadencertGay

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

CadencertGay

SBI Vs HDFC Bank Vs ICICI Vs Axis Vs BoB Home Loan Rates Charges

How Much Interest On A 3000 Loan AizuddeenLang

Home Loan Interest Rate How To Know How Much Is Payable Over A Tenor

How Much Interest On Home Loan Can Be Claimed - The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh