How Much Is Child Tax Credit In Canada It is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB may include the child disability benefit and any

This booklet explains who is eligible for the Canada Child Tax Benefit how to apply for it how we calculate it and when we make payments If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit a monthly tax exempt payment administered by the Canada

How Much Is Child Tax Credit In Canada

How Much Is Child Tax Credit In Canada

https://prescottenews.com/wp-content/uploads/2021/08/Child-Tax-Credit.jpg

Everything About Child Tax Credit CTC NSKT Global

https://www.nsktglobal.com/static/images/Everything About Child Tax Credit.png

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

The Canada Child Benefit CCB is a federal measure designed to help meet the needs of parents with one or more children under the age of 18 The payments are monthly and tax free The Canada child benefit formerly the Canada child tax credit is a monthly payment available to parents and caretakers of children

Whether your children are eligible for the disability tax credit DTC for the period of July 2024 to June 2025 families could receive up to 3 322 for each child who The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must

Download How Much Is Child Tax Credit In Canada

More picture related to How Much Is Child Tax Credit In Canada

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty

https://images.squarespace-cdn.com/content/v1/610831a16c95260dbd68934a/1642741593352-71GIM9GJXM0IWTIS4V3C/Oct-monthly-poverty-data-2021+(1).PNG

The Canada Child Benefit CCB previously the Canada Child Tax Benefit CCTB is an income tested income support program for Canadian families It is delivered as a tax A family with a 90 000 income and two children between the ages of six and 17 would get 4 650 a year or 387 a month If that same family earned only

The Canada Child Benefit CCB is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB The CCB Canada Child Benefit is a tax free cash benefit for low and modest income families that provides substantial assistance every single month This benefit is based

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

https://www.canada.ca/en/revenue-agency/services...

It is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB may include the child disability benefit and any

https://www.canada.ca/.../canada-child-benefit.html

This booklet explains who is eligible for the Canada Child Tax Benefit how to apply for it how we calculate it and when we make payments

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

FAQ WA Tax Credit

Child Tax Credit 2022 Income Limit Phase Out TAX

What Is Child Tax Credit Federal Income Tax Return ExcelDataPro

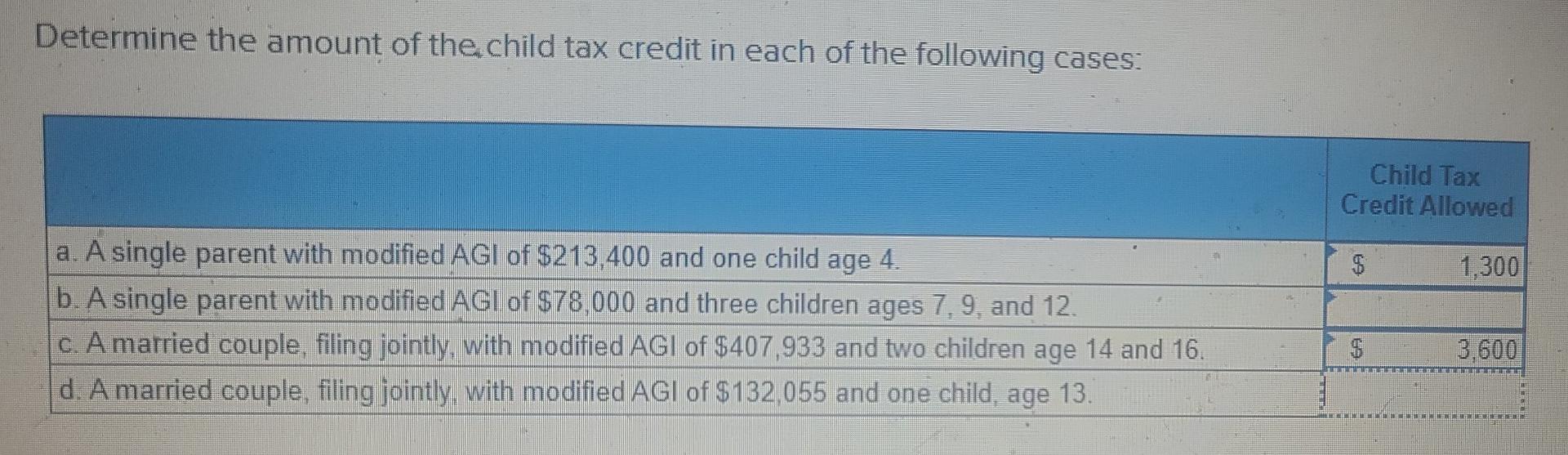

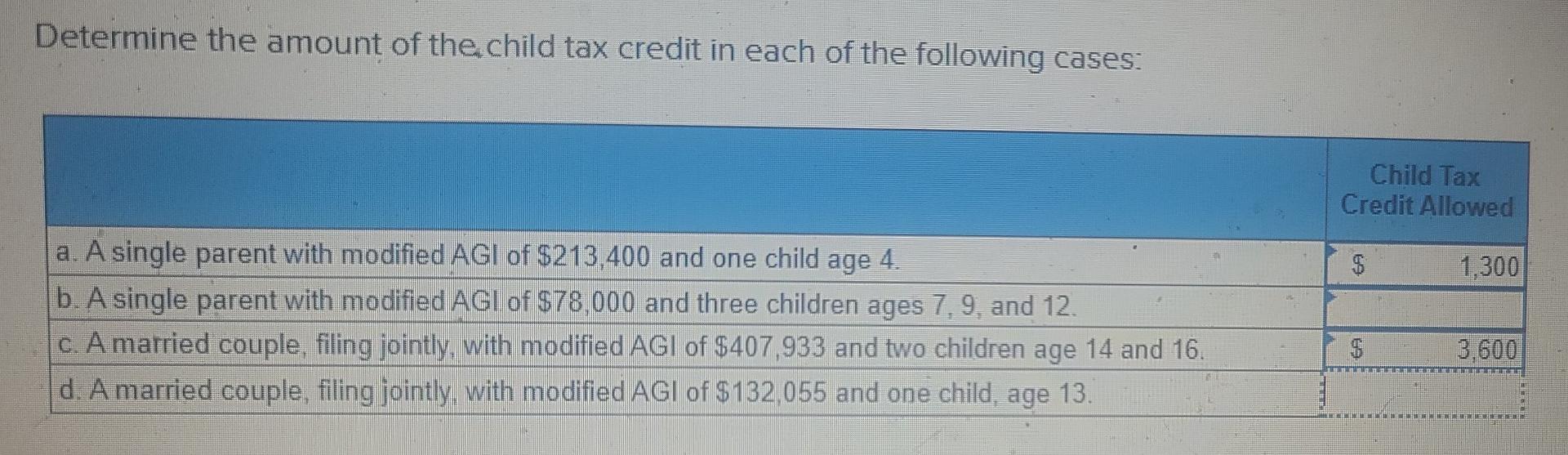

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

Child Tax Credit Payments Now Going Out To Parents Here s How It Works

How Much Is The Child Tax Credit In 2020 Trending US

I Didn T Get My Child Tax Credit Credit Walls

How Much Is Child Tax Credit In Canada - Either way you re probably wondering if you qualify for the Canada Child Benefit CCB This benefit is a tax free monthly payment from the federal government

.PNG)