How Much Is Property Tax In Calgary Alberta Web The provincial property tax is based on budget decisions made by the Government of Alberta in March Calculate your City of Calgary property taxes based on your propery s assessed value

Web The benchmark price of a detached home in Calgary in August 2023 was 697K Calgary s property tax rates are the third lowest in Alberta for urban municipalities with over 10K population Calgary property tax is based on the assessed value of your home Web 30 Juni 2023 nbsp 0183 32 7 penalty added On July 1 and October 1 a 7 penalty is added to any unpaid tax balance If you recently purchased a property You may not receive your tax bill but payment is still due There may be delays in processing ownership and mailing address changes with The Province of Alberta Land Titles Office

How Much Is Property Tax In Calgary Alberta

How Much Is Property Tax In Calgary Alberta

https://a.cdn-hotels.com/gdcs/production93/d1621/95a4c4b0-fe12-11e8-b004-0242ac110006.jpg

Calgary Property Tax How To Pay Calgary Taxes WHY Your Assessment

https://i.ytimg.com/vi/M7UX4XlKlfY/maxresdefault.jpg

IS LIVING IN CALGARY RIGHT FOR YOU 2021

https://spartamovers.com/wp-content/uploads/2021/05/AdobeStock_62712606-scaled.jpeg

Web 6 Sept 2023 nbsp 0183 32 City 2023 Property Tax Value 3 286 2023 Residential Property Tax Rate 0 657180 2023 Tax rates for Cities Near Calgary Best 5 Year Fixed Mortgage Rates in Canada Mortgage Term 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr Fixed Variable See More Rates Property Taxes in Alberta Web Your property tax is calculated by multiplying the assessed value of your property by the applicable current municipal and provincial tax rate s The City bills and collects the provincial property tax amount for the Province of Alberta Your annual property tax bill covers the period of January 1 to December 31 Current property tax rates

Web Municipal by The City of Calgary from property tax tax rate T otal assessment The Province of Alberta also establishes a tax rate based on the revenue it requires from property tax The formula used to determine the provincial tax rate T otal revenue required by Provincial tax rate the Province of Alberta from property tax Web Vor einem Tag nbsp 0183 32 The average assessment for a home in Calgary for 2024 is 610 000 the city said Wednesday compared to 555 000 last year With changes to the city budget and the tax shift of one per cent from non residential to residential owners will see an increase of approximately 15 per month or 7 25 per cent of the 2023 municipal property tax

Download How Much Is Property Tax In Calgary Alberta

More picture related to How Much Is Property Tax In Calgary Alberta

Downtown Calgary Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/6/6e/Downtown_Calgary_2016_-_Kevin_Cappis.jpg/1200px-Downtown_Calgary_2016_-_Kevin_Cappis.jpg

Who Pays The Least Property Tax In Ontario The Answer May Surprise You

https://media.alexirish.com/wp-content/uploads/2020/09/16194209/greater-toronto-property-tax-rates.jpg

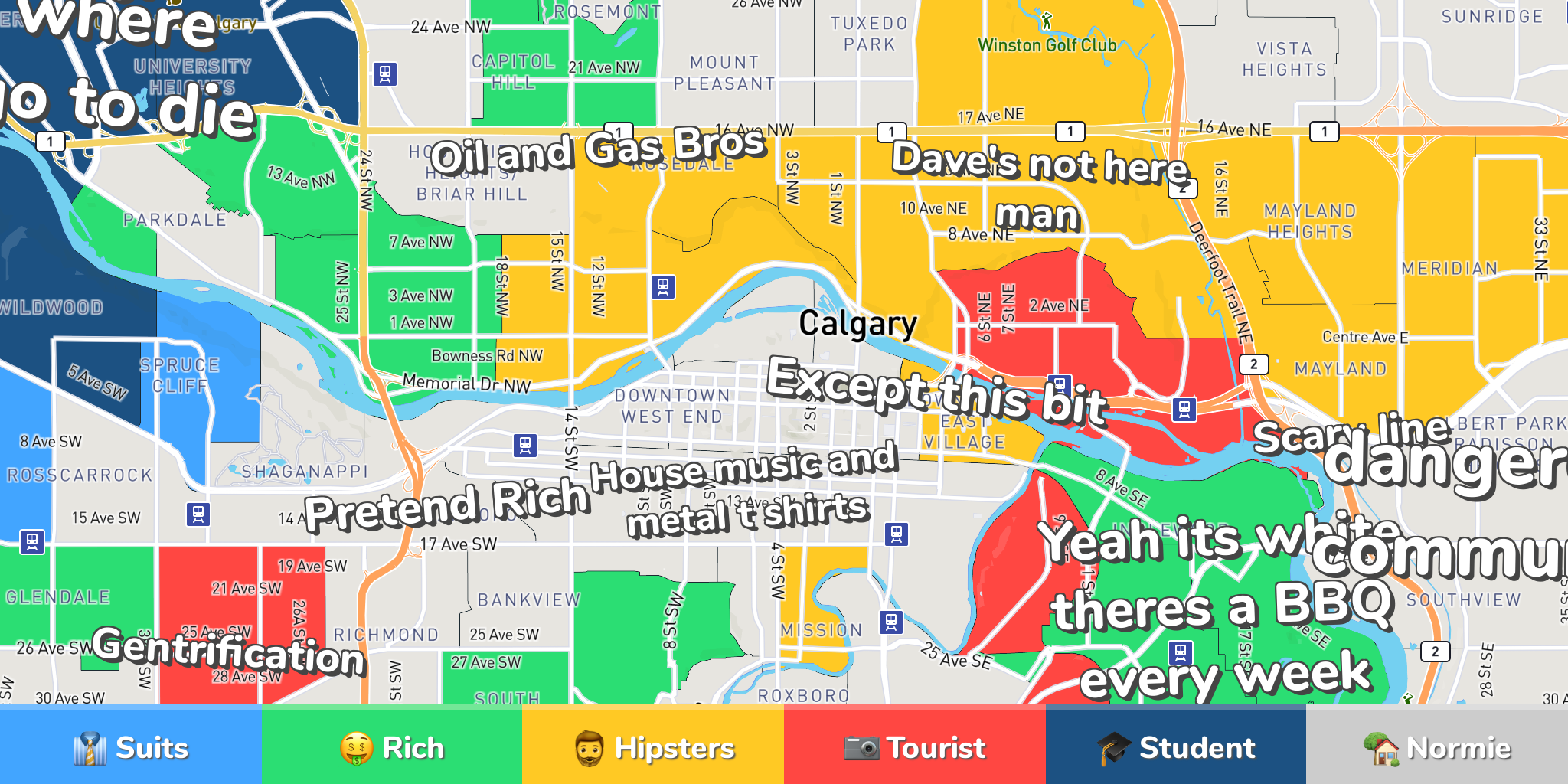

Calgary Neighborhood Map

https://hoodmaps.com/assets/maps/calgary.png?1631148646

Web Calgary s property tax is based on the assessed value of the home every year Calgary assesses properties based on guidelines set by the Alberta Assessment and Property Tax Policy Unit and the Ministry of Municipal Affairs The tax is calculated by multiplying the current year property value with the total tax rate which mainly consists of a Web Vor einem Tag nbsp 0183 32 On Tuesday the City of Calgary began rolling out its property tax assessment for 2024 mailing out more than 580 000 notices And there s been an increase in the assessed value of properties in Calgary The sustained year over year growth in residential market was primarily driven by a surge in net migration causing an influx of

Web 23 Nov 2023 nbsp 0183 32 A 9 6 vote in Calgary council chambers Wednesday was enough to approve a 7 8 per cent increase in property taxes for homeowners This means the average Calgary property owner will see at Web Vor einem Tag nbsp 0183 32 According to city officials the typical residential property market value increased by 10 per cent over 2023 s assessment and non residential assessments increased on average by three per

https://a.travel-assets.com/findyours-php/viewfinder/images/res70/515000/515509-alberta.jpg

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

https://www.calgary.ca/property-owners/taxes/calculator.html

Web The provincial property tax is based on budget decisions made by the Government of Alberta in March Calculate your City of Calgary property taxes based on your propery s assessed value

https://wowa.ca/taxes/calgary-property-tax

Web The benchmark price of a detached home in Calgary in August 2023 was 697K Calgary s property tax rates are the third lowest in Alberta for urban municipalities with over 10K population Calgary property tax is based on the assessed value of your home

The Rise Of Residential Property Tax In Arizona Klauer Law

Eighth Avenue Place In Calgary Alberta Canada With Icebursts Display

Stampede Season In Calgary Alberta Canada R CityPorn

Hecht Group 3 Things To Keep In Mind Before Paying Your Property

Calgary Alberta Canada February 2010 Flickr

Calgary Alberta Canada February 2010 Flickr

Calgary Alberta Canada Andjenadebie

Export Tables Pro Demo

Your Gap Year In Calgary Canada

How Much Is Property Tax In Calgary Alberta - Web Vor 2 Tagen nbsp 0183 32 Home owners will also be paying more on their property tax bills after the city approved an increase of 7 8 per cent a figure that would tack on approximately 16 per month