How Much Is The Age Tax Credit In Ireland If you or your spouse or civil partner are over 65 years of age you can get the Age Tax Credit If your income is below a certain limit you are exempt from income

However there are tax exemption limits for people aged 65 or over and there are some extra tax credits It is possible to get tax relief for covenants to people aged 65 and E General Tax Credits Q26 Am I entitled to an age credit You are entitled to the age credit if you aged 65 or over in the year of assessment For married couples once either

How Much Is The Age Tax Credit In Ireland

How Much Is The Age Tax Credit In Ireland

https://anytimetaxrefunds.ie/wp-content/uploads/2021/02/taxcre-800x534.jpg

Scheer In Quebec To Announce Tax Credit Boost For Low And Middle

https://www.ctvnews.ca/polopoly_fs/1.4600927.1568913118!/httpImage/image.jpg_gen/derivatives/landscape_620/image.jpg

The Home Carer Tax Credit In Ireland Explained Cronin Co

https://croninco.ie/wp-content/uploads/2023/07/Home-carer-tax-credit-Ireland.png

Overview Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that The main personal tax credits are as follows Tax credits 2024 EUR Single person with no dependent child 1 875 Married or in a civil partnership 3 750

Divorced This credit is 1 650 per year and is worth 31 73 per week off your tax bill 2 Incapacitated child tax credit You can claim this credit if you have a child who is permanently incapacitated and unable to support So your tax is reduced by 40 200 x 20 If you have the same tax allowance of 200 but the highest rate of tax that you pay is 40 then the amount of your income that is

Download How Much Is The Age Tax Credit In Ireland

More picture related to How Much Is The Age Tax Credit In Ireland

PAYE Explained A Guide To Understanding Irish Tax Credits And Reliefs

https://www.taxback.com/resources/blogimages/20200507122215.1588843335429.2ea42cc2d6c8d92d7a9d6d79f87.jpg

Kyle Jemtrud On LinkedIn This Rate Hike Is Climbing Faster Than Any In

https://media-exp1.licdn.com/dms/image/C4E22AQGLgrbMc_G-gQ/feedshare-shrink_800/0/1665256899087?e=2147483647&v=beta&t=49cgWvQA4IEdg8N35RAmcv6cFTR3nohUV3xrcDFAaxE

Small Business Loans In Ireland Borrow From 1000 To 10 000

https://www.mylenderloans.com/images/bad_credit2.jpeg

Age tax credit A person who turns 65 during the tax year is awarded an additional tax credit of 245 this amount is 490 for a married couple and is awarded as soon as either Your tax credits Tax credits reduce the amount of tax you pay There is more information about how tax credits work in Calculating your Income Tax Revenue

Everyone who pays tax in Ireland will have some tax credits For example If you are an employee or receiving a pension or social welfare payment such as a Jobseeker s Single Person Child Carer Credit 1 750 1 650 1 650 1 650 1 650 Age Tax Credit if single widowed or surviving civil partner 245 245 245 245 245 Age Tax Credit if

Age Tax Credit Anytime Tax Refunds Limited

https://anytimetaxrefunds.ie/wp-content/uploads/2021/02/taxre21-500x383.jpg

What Election Tax Promises Will Mean For Your Wallet

https://images.theconversation.com/files/294393/original/file-20190926-51452-1qc7mlj.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=503&fit=crop&dpr=2

https://www.citizensinformation.ie/en/money-and...

If you or your spouse or civil partner are over 65 years of age you can get the Age Tax Credit If your income is below a certain limit you are exempt from income

https://dev2-live.citizensinformation.ie/en/money...

However there are tax exemption limits for people aged 65 or over and there are some extra tax credits It is possible to get tax relief for covenants to people aged 65 and

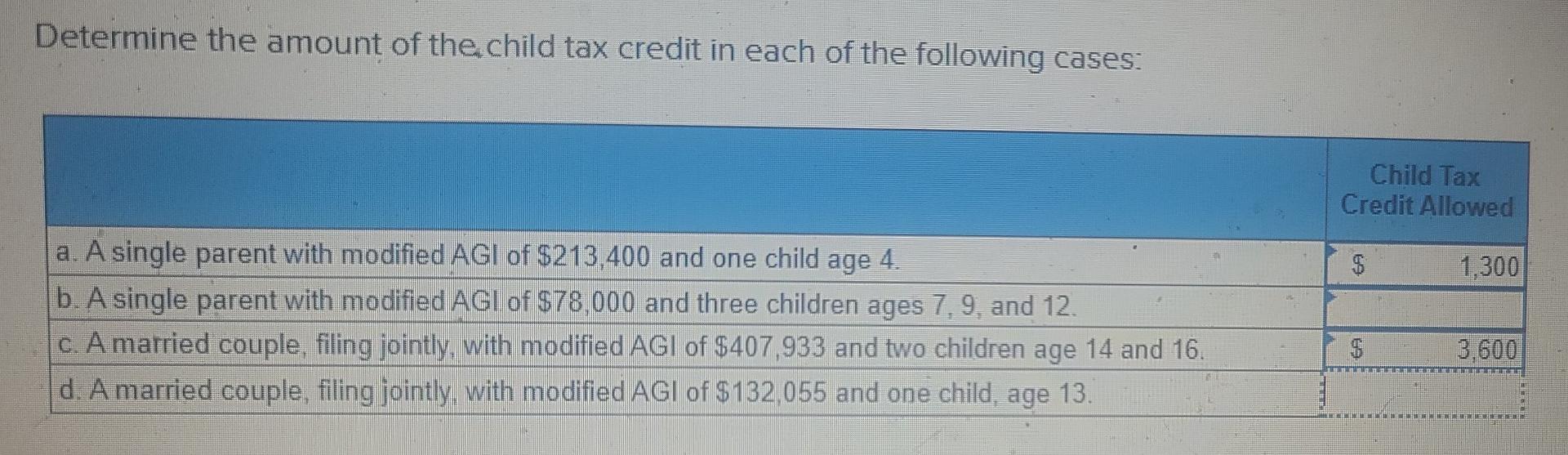

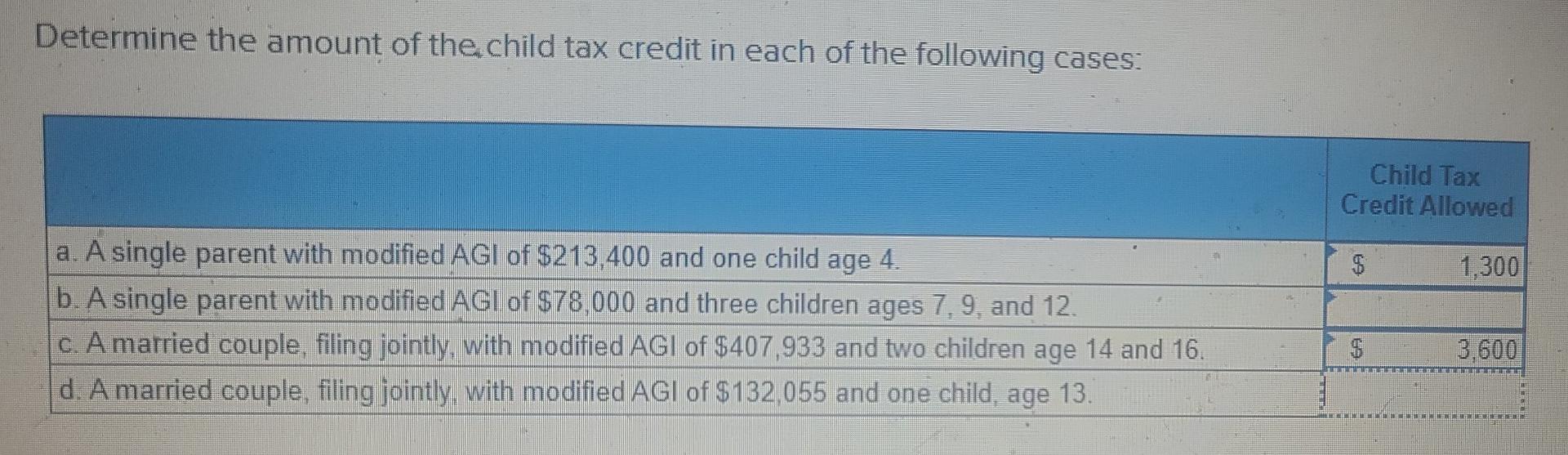

Determine The Amount Of Child Tax Credit In Each Of The Following Cases

Age Tax Credit Anytime Tax Refunds Limited

Age Tax Credit Anytime Tax Refunds Limited

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

What Is The Age Tax In Republicans Obamacare Replacement Plan The

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

6 capital gains tax strategies to help lower your tax bill MoneySense

Determine The Amount Of Child Tax Credit In Each Of The Following Cases

8 Tax Breaks Every Parent Needs To Know The Motley Fool

How Much Is The Age Tax Credit In Ireland - So your tax is reduced by 40 200 x 20 If you have the same tax allowance of 200 but the highest rate of tax that you pay is 40 then the amount of your income that is