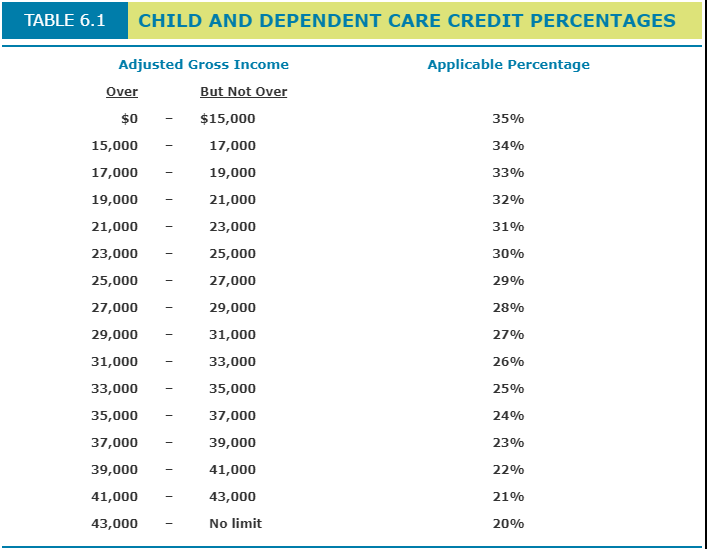

How Much Is The Child Dependent Tax Credit Qualifying expenses range from 20 to 35 and your percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit in 2024 is One factor to

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may receive up to

How Much Is The Child Dependent Tax Credit

How Much Is The Child Dependent Tax Credit

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Learn About The Child And Dependent Care Tax Credit Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/02/gettyimages-684060418-kidscredit-e1519138847780.jpg

Child Tax Credit Changes For 2023 Taxes PLUS Other Kiddie And Dependent

https://i.ytimg.com/vi/2fcIiqyn8Wk/maxresdefault.jpg

If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet specific

Everything you need to know about the 2024 child tax credit CTC including eligibility income limits and how to claim up to 2 000 per child on your federal tax return For 2024 taxes for returns filed in 2025 the IRS Child Tax Credit is worth up to 2 000 for each qualifying dependent child You can claim this full amount if your income is at or below the modified adjusted gross income

Download How Much Is The Child Dependent Tax Credit

More picture related to How Much Is The Child Dependent Tax Credit

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit-800x534.jpg

Child Dependent Care Taxes For Families 1040 Tax Guide YouTube

https://i.ytimg.com/vi/TE0LvlozgWI/maxresdefault.jpg

Tax Year 2021 Dependent Tax Credits And Deductions PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2020/01/boy-61171_1280.jpg

Our child tax credit calculator helps you to calculate how much credit you are eligible for The Child Tax Credit is a valuable tax benefit for families with dependent children currently offering up to 2 000 per qualifying child The Child Tax Credit has helped to reduce poverty and

You may qualify for the Child Tax Credit in 2024 and 2025 which is a tax credit for your dependent children that is better than a tax deduction since it lowers your taxes dollar for For 2024 taxes filed in 2025 the child tax credit is worth up to 2 000 per qualifying dependent child The refundable portion also known as the additional child tax

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

Calculate The Amount Of The Child And Dependent Care Chegg

https://media.cheggcdn.com/media/a88/a886d427-81f2-4ddc-958a-616226b1ade7/php3FULpR.png

https://www.kiplinger.com › taxes › child-and...

Qualifying expenses range from 20 to 35 and your percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit in 2024 is One factor to

https://www.irs.gov › newsroom › child-and-dependent-care-credit-faqs

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

2022 Child Tax Credit Refundable Amount Latest News Update

FAQ WA Tax Credit

Child Tax Credit

What Families Need To Know About The CTC In 2022 CLASP

What Families Need To Know About The CTC In 2022 CLASP

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Child And Dependent Care Credit What Counts As Qualified Expenses Marca

How Much Is The Child Dependent Tax Credit - For 2024 taxes for returns filed in 2025 the IRS Child Tax Credit is worth up to 2 000 for each qualifying dependent child You can claim this full amount if your income is at or below the modified adjusted gross income