How Much Is The Credit For Other Dependents A new Credit for Other Dependents worth up to 500 per qualifying dependent not to be confused with the Child and Dependent

The refundable portion of the credit also known as the additional child tax credit maxes out at 1 600 in 2023 increasing to 1 700 for 2024 The 500 Its purpose is to reduce a taxpayer s tax liability by up to 500 per qualifying dependent who does not meet the criteria for the Child Tax Credit What is a dependent A dependent is an individual who meets

How Much Is The Credit For Other Dependents

How Much Is The Credit For Other Dependents

https://www.twhc.com/wp-content/uploads/2022/03/twhc-dependants.jpg

What Is The Credit For Other Dependents ABIP

https://www.abipcpa.com/wp-content/uploads/2022/03/dependants-980x654.jpg

How The Credit For Other Dependents Can Benefit Tax Payers YouTube

https://i.ytimg.com/vi/pJlKLNMkdjs/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AGUA4AC0AWKAgwIABABGGUgRihDMA8=&rs=AOn4CLDQ-6CayghUh9A1UMhs7tlq491G4w

The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for the tax year 2021 only See the Temporary Provisions lesson earlier in this book for ODC means credit for other dependents SSN means social security number TIN means taxpayer identification number Other abbreviations may be used in this publication and will be defined as needed Delayed

This phaseout begins for married couples filing a joint tax return at 400 000 A taxpayer can claim this credit if They claim the person as a dependent on the The maximum credit amount is 500 for each dependent who meets certain conditions These include Dependents who are age 17 or older Dependents who have

Download How Much Is The Credit For Other Dependents

More picture related to How Much Is The Credit For Other Dependents

What To Do When Someone Takes Credit For Your Work Grammarly

https://contenthub-static.grammarly.com/blog/wp-content/uploads/2017/04/There-are-two-kinds-of-people-those-who-do-the-work-and-those-who-take-credit-for-it..jpg

Understanding The Credit For Other Dependents

https://www.payrollpartners.com/wp-content/uploads/2023/03/March-10-2023-2048x1536.jpg

An Overview Of The Credit For Other Dependents Crosslin

https://crosslinpc.com/wp-content/uploads/2022/05/Overview-1024x664.jpg

The credit for other dependents is a new 500 personal tax credit The credit is worth 500 for each qualifying dependent The credit is nonrefundable It is claimed on line 12 of the 2018 Form 1040 Phaseout What is the 500 Credit for Other Dependents Family Tax Credit What is the Child and Dependent Care Credit Who is a Qualifying Person for the Child and Dependent

The credit is 500 per qualifying dependent as long as the adjusted gross income AGI doesn t exceed 200 000 400 000 if filing jointly The credit goes down However these older children and other qualifying dependents may be eligible for a new tax credit of up to 500 called the credit for other dependents Dependents must be a

How Much Is The Maintaining Balance In BPI DigiWalletsPH

https://digiwalletsph.com/wp-content/uploads/2022/03/How-much-is-the-maintaining-balance-in-BPI.jpg

Rules For Claiming A Dependent On Your Tax Return 2023

https://digitalasset.intuit.com/IMAGE/A7GUqbw2k/rules-for-claiming-a-dependent-on-your-tax-return_L8LODbx94.jpg

https://turbotax.intuit.com/tax-tips/famil…

A new Credit for Other Dependents worth up to 500 per qualifying dependent not to be confused with the Child and Dependent

https://www.investopedia.com/ask/answers/102015/...

The refundable portion of the credit also known as the additional child tax credit maxes out at 1 600 in 2023 increasing to 1 700 for 2024 The 500

Tax Tip Tuesday Claiming The Credit For Other Dependents

How Much Is The Maintaining Balance In BPI DigiWalletsPH

The Credit For Other Dependents Am I Eligible

Child Tax Credit Other Dependents Part 1 Income Tax 2023 Accounting

Earned Income Credit 2022 Calculator INCOMEBAU

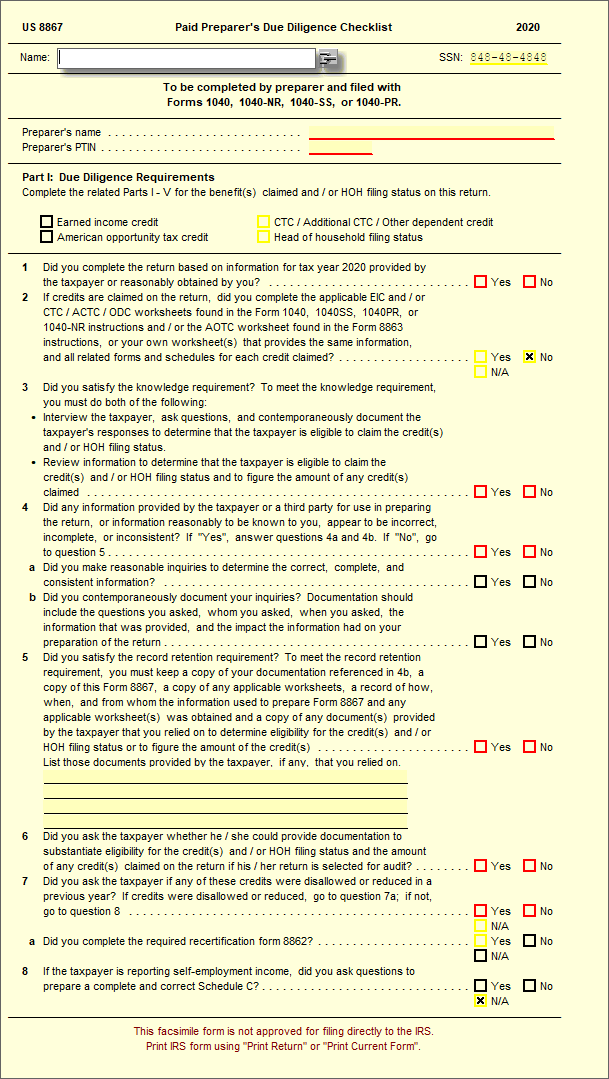

8867 Paid Preparer s Due Diligence Checklist UltimateTax Solution

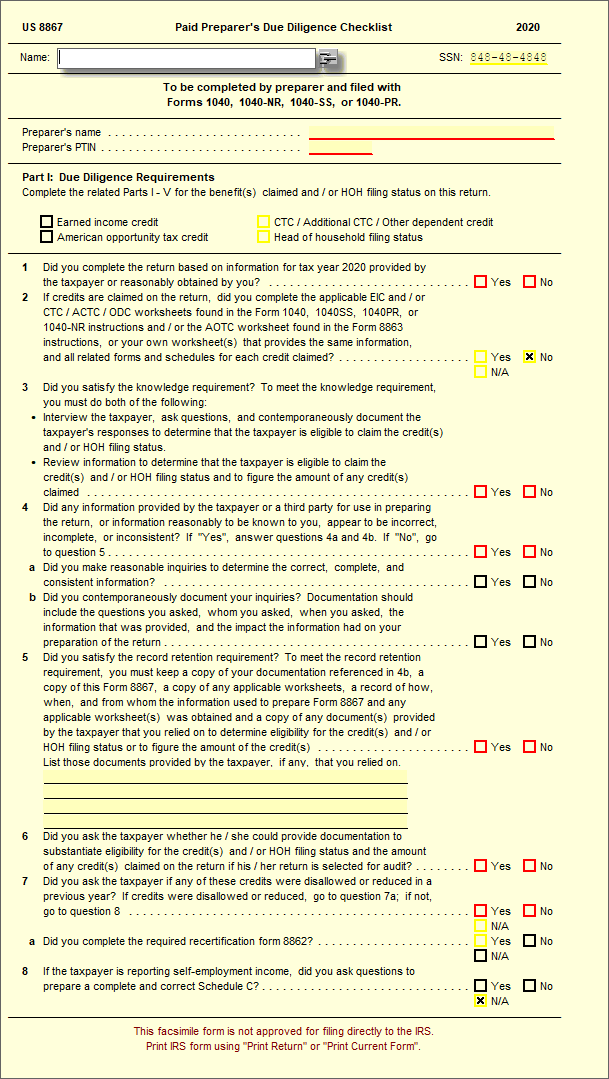

8867 Paid Preparer s Due Diligence Checklist UltimateTax Solution

/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

Tax Rules For Claiming Adult Dependents

Solved Baldwin University College Books Meal Plan 3710 Baldwin

IRS Highlights Info About The Credit For Other Dependents Crossroads

How Much Is The Credit For Other Dependents - The maximum amount of the credit is 500 per qualifying dependent The dependent must be a U S citizen a U S national or a U S resident alien Taxpayers