How Much Is The Energy Efficient Tax Credit 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for

How Much Is The Energy Efficient Tax Credit 2022

How Much Is The Energy Efficient Tax Credit 2022

https://www.wilsonlewis.com/wp-content/uploads/2020/10/45L-Credit.jpg

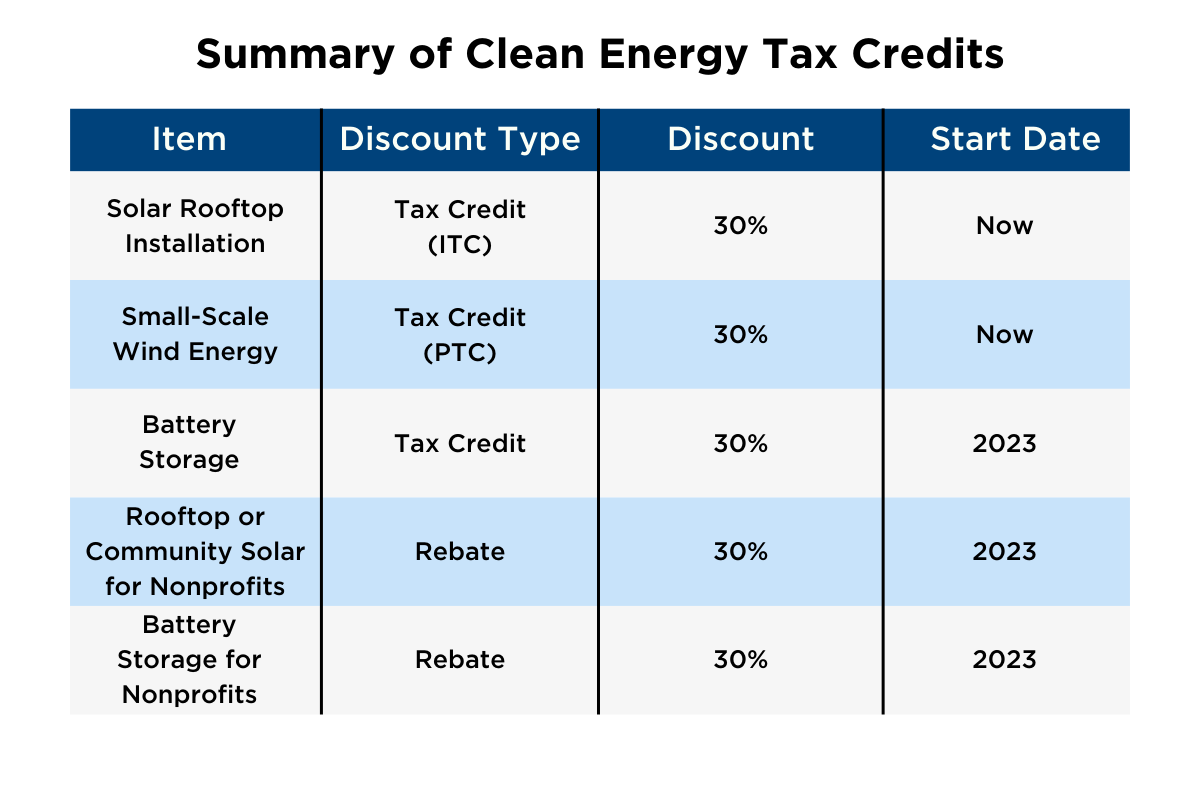

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Most Energy Efficient Appliances In 2023

https://www.solarreviews.com/content/images/blog/post/focus_images/1092_shutterstock_701043430.jpg

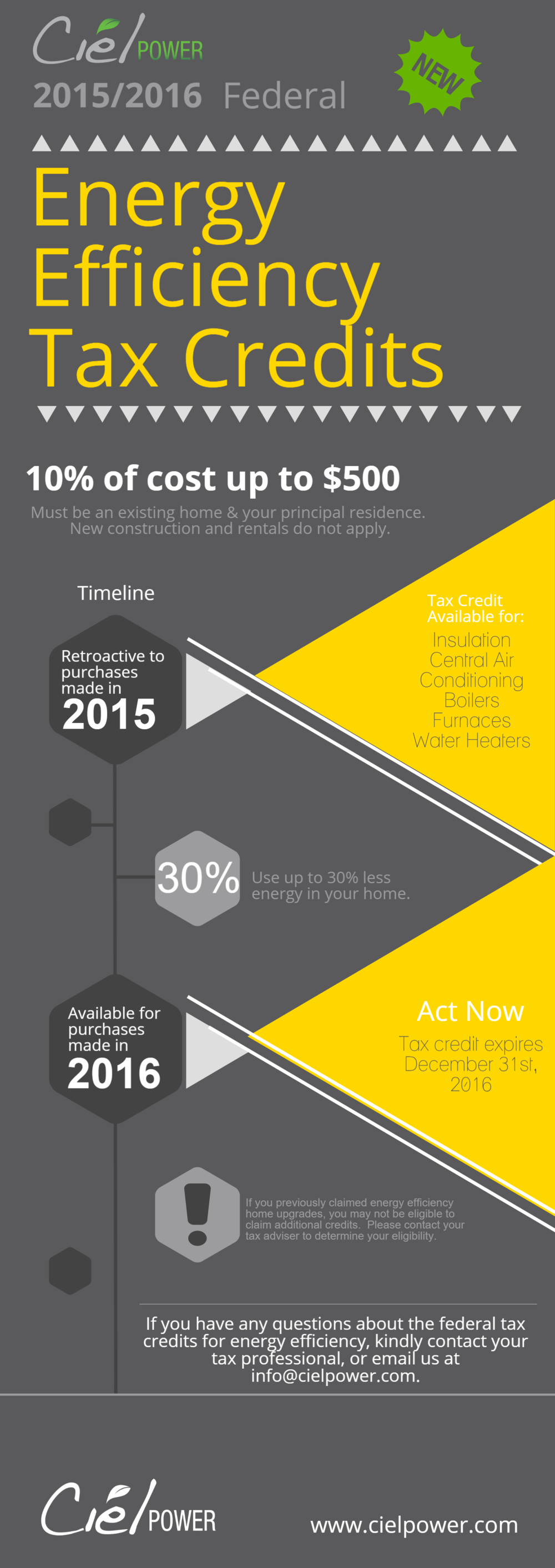

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on

Home Energy Efficiency Tax Credits There are currently available tax credits for many types of energy efficient home equipment and products The IRA authorized an increase of tax credit 2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax

Download How Much Is The Energy Efficient Tax Credit 2022

More picture related to How Much Is The Energy Efficient Tax Credit 2022

What Qualifies For The Energy Tax Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

Tax Credit Vs Tax Deduction What s The Difference Guide

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

Tax Credits For Energy Efficient Home Improvements

https://financialsolutionadvisors.com/wp-content/uploads/elementor/thumbs/FSA-Blog-Images-2-2022-12-01T181746.930-pyjoc27rm63svr9fif7s2udrrhpvjmbyvfmw5zjvk8.png

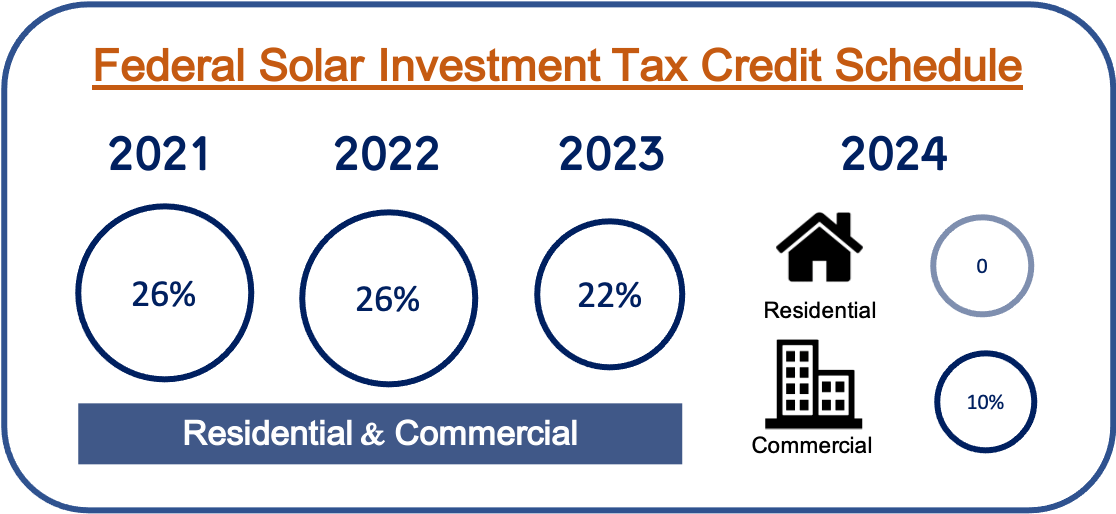

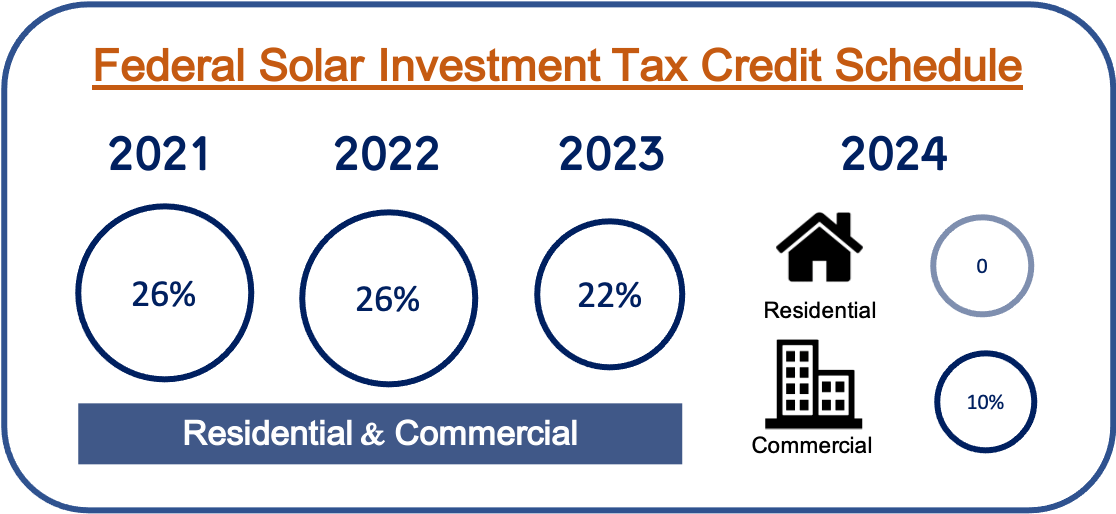

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers UPDATED JULY 2024 Visit our Energy Savings Hub to learn more The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of

Solar Tax Credit Calculator ChayaAndreja

https://hub.utahcleanenergy.org/wp-content/uploads/2021/02/Federal-ITC-Solar1.png

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on

https://www.energystar.gov/about/fede…

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

How Much Is The Maintaining Balance In BPI DigiWalletsPH

Solar Tax Credit Calculator ChayaAndreja

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Tax Credits For Energy Efficient Home Improvements 2022 YouTube

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Budget 2022 Ireland What Are The Changes To The Carer s Allowance

Home Improvement Tax Credit Energy Saving Tax Credit Utah

How Much Is The Energy Efficient Tax Credit 2022 - The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you