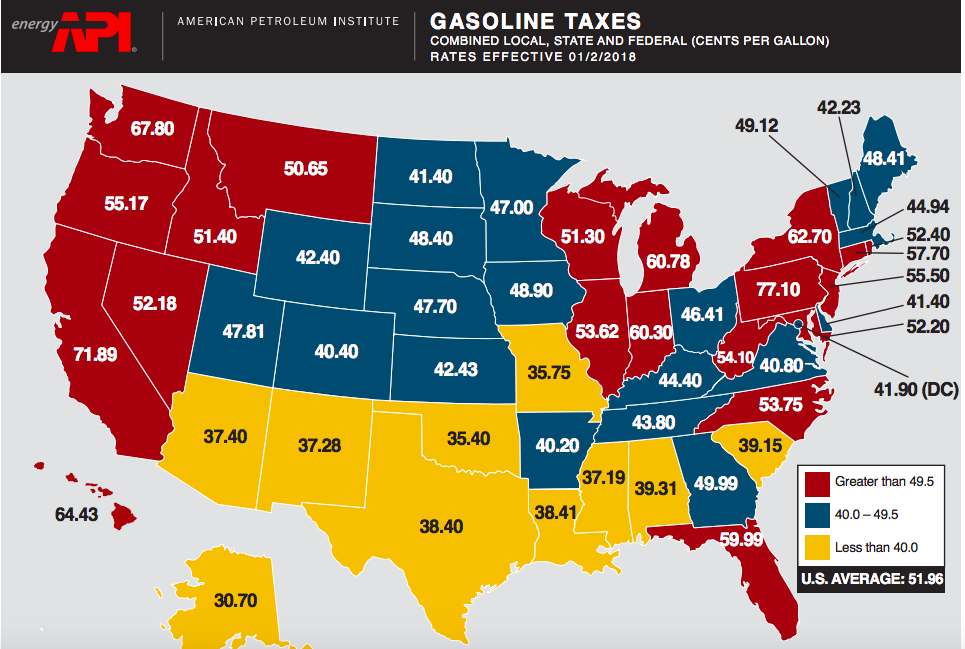

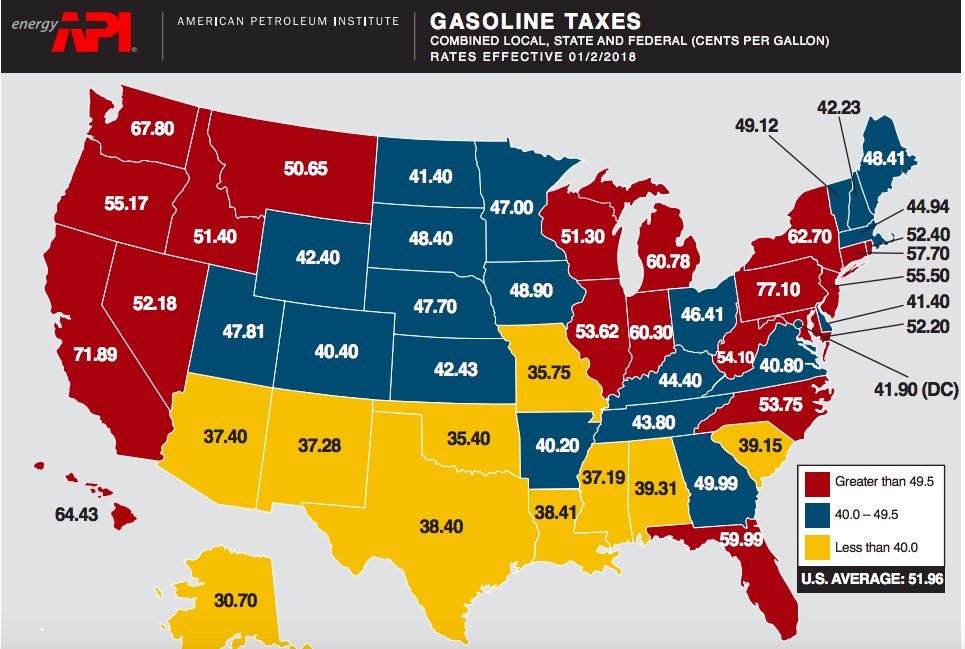

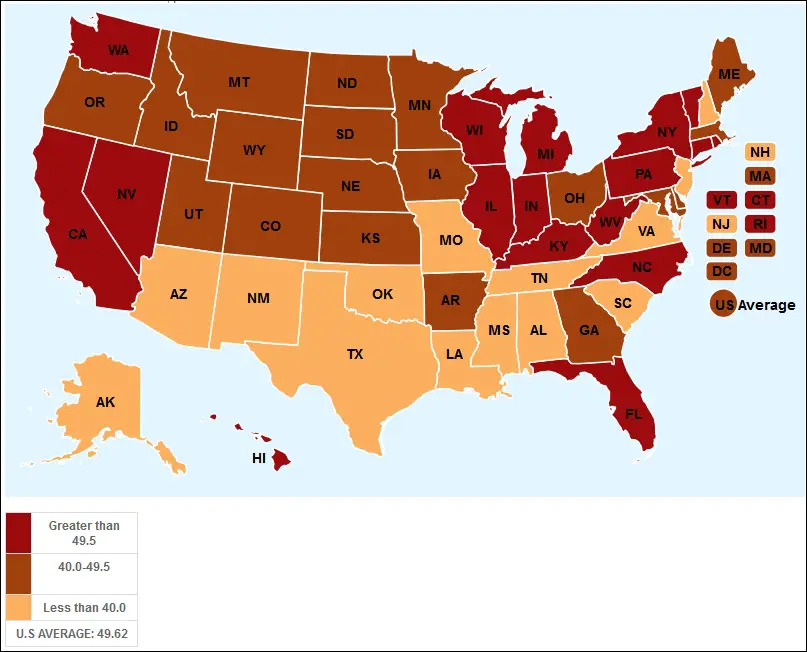

How Much Is The Gasoline Tax The United States federal excise tax on gasoline is 18 4 cents per gallon and 24 4 cents per gallon for diesel fuel Proceeds from the tax partly support the Highway Trust Fund The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 93 from 1993 until 2022 On average as of April 2019 state and local taxes and fees add 34 24 cents to gasoline and 35 89 c

The average excise duty on gas is 0 55 per liter 2 47 per gallon in Europe and 0 44 per liter 1 98 per gallon on diesel The United Kingdom levies the highest California pumps out the highest state gas tax rate of 77 9 cents per gallon cpg followed by Illinois 66 5 cpg and Pennsylvania 62 2 cpg The lowest state gas

How Much Is The Gasoline Tax

How Much Is The Gasoline Tax

http://instituteforenergyresearch.org/wp-content/uploads/2018/02/2018.02.27-Map-gas-tax.png

Diesel Vs Gasoline The Difference Trusted Since 1922

https://www.rd.com/wp-content/uploads/2019/12/shutterstock_634675289-e1575399337500-scaled.jpg

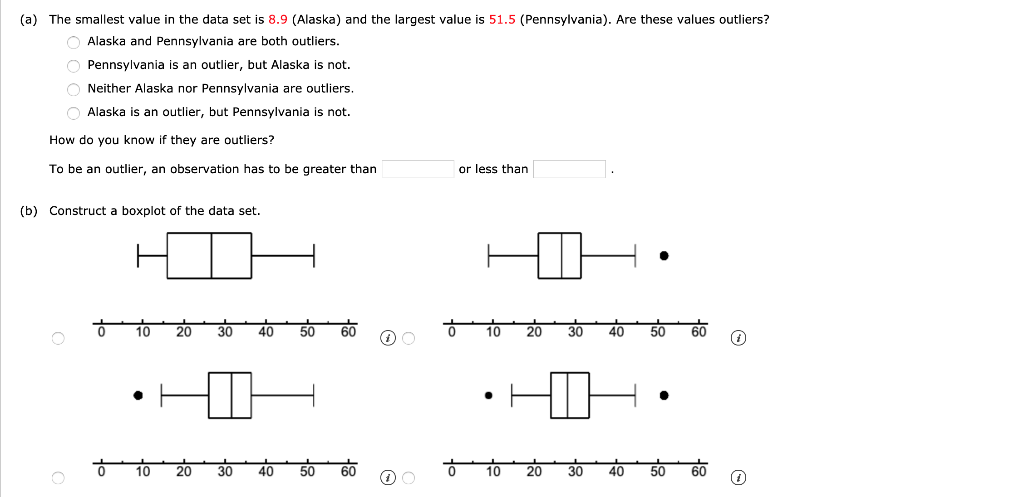

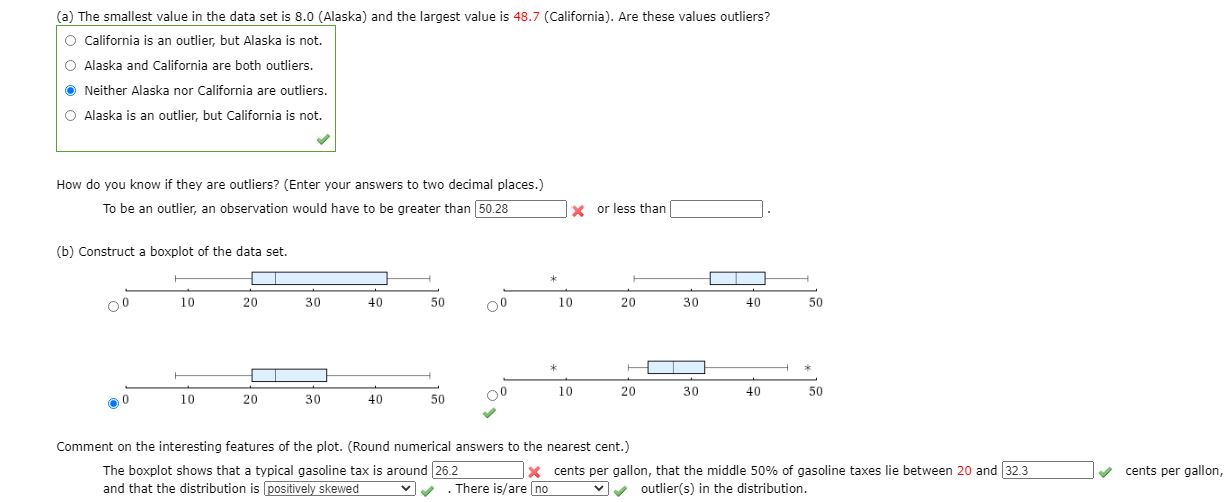

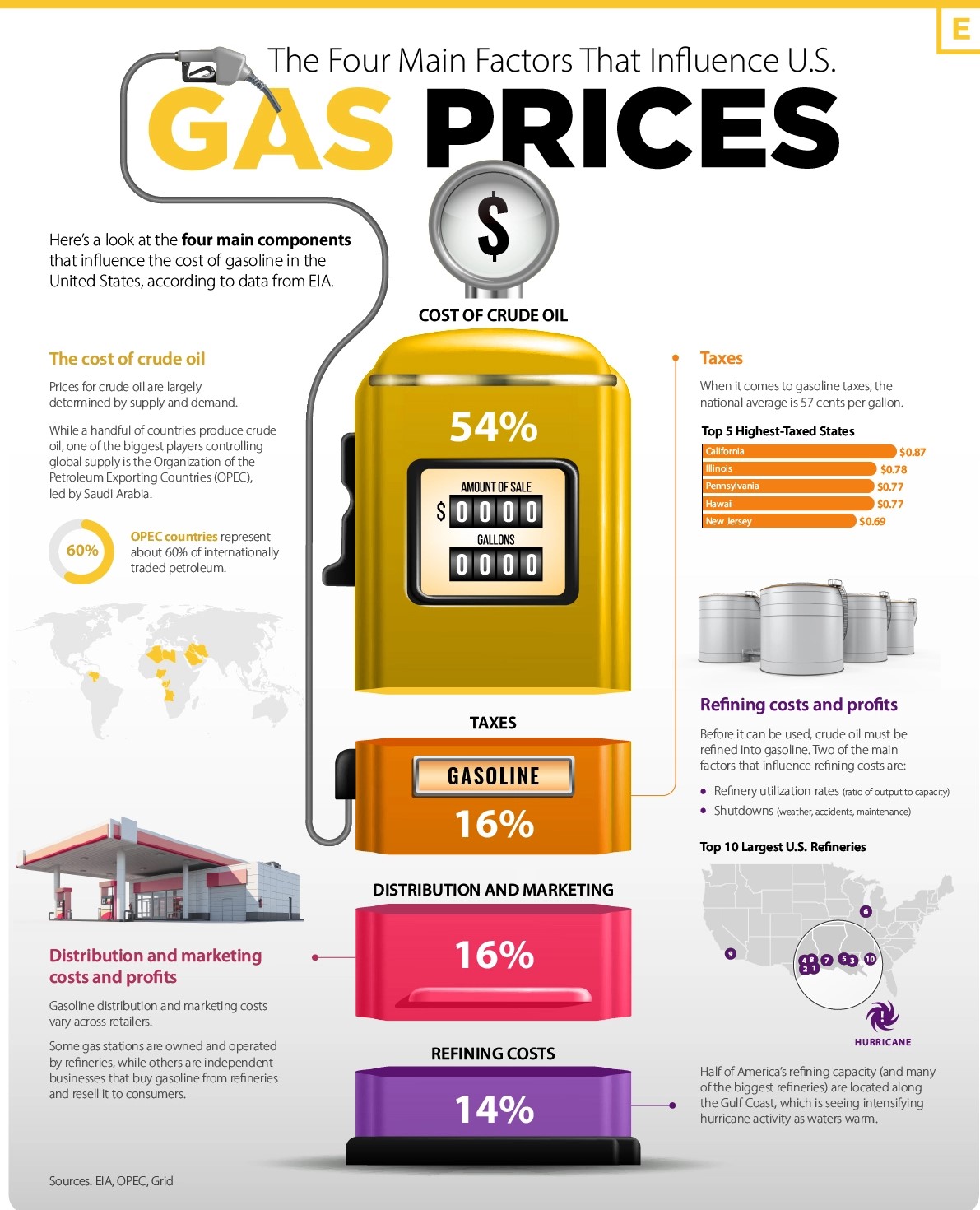

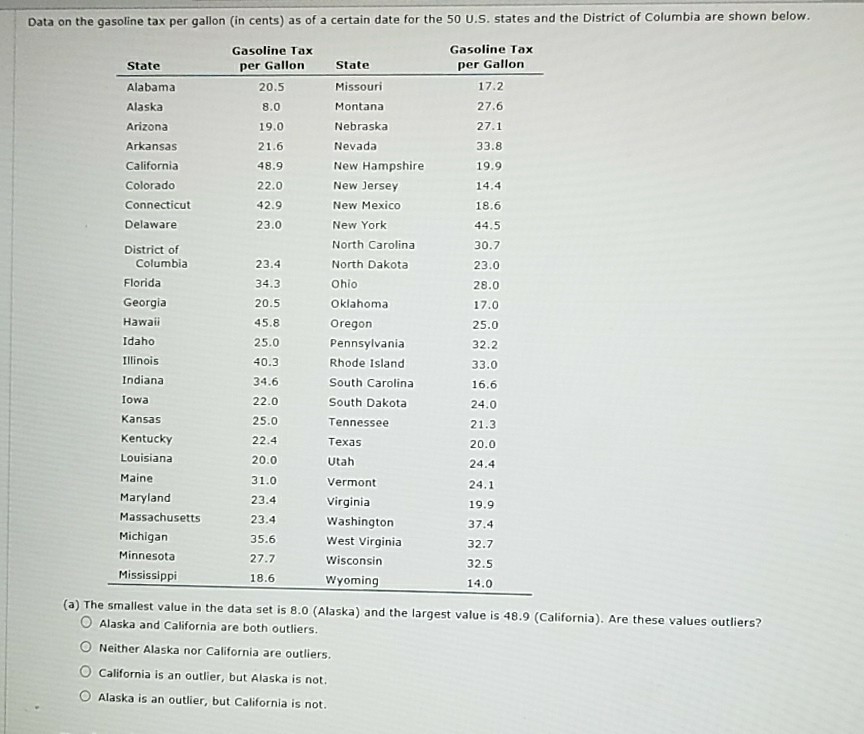

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

https://media.cheggcdn.com/media/055/0550952e-848e-4dff-a435-804c506e3aea/php74VAaX.png

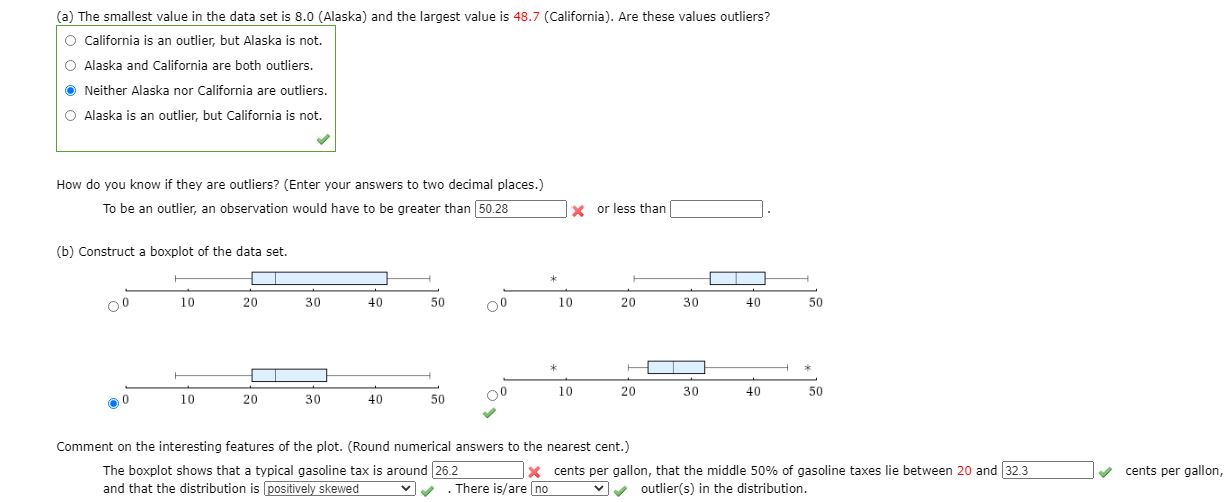

Now that gas prices have come down some states are raising gas taxes again States with the highest gas taxes According to the EIA the 10 states where drivers pay the highest average gas taxes in Federal and state governments charge an excise tax on gasoline to raise money for infrastructure projects and to help pay for mass transportation The federal

Federal taxes include excises taxes of 18 3 cents per gallon on gasoline and 24 3 cents per gallon on diesel fuel and a Leaking Underground Storage Tank fee of 0 1 cents per As of 2017 the excise tax on gasoline was 0 651 per liter regional prices varied from 0 407 to 0 6682 With a VAT rate of 20 the percent of the total price of gasoline

Download How Much Is The Gasoline Tax

More picture related to How Much Is The Gasoline Tax

State Gasoline Tax Rates In 2016 Tax Foundation

https://files.taxfoundation.org/20170113143141/GasTaxMap-01.png

Storing Gasoline At Home And When To Dispose Of It NEDT

https://www.nedt.org/wp-content/uploads/2021/04/NEDT-Gasoline.jpg

SOLVED A Particular Brand Of Gasoline Has A Density Of 0 737 G mL At

https://cdn.numerade.com/ask_previews/8e3c8701-a535-4212-ba32-19b9821bc877_large.jpg

Federal Motor Fuel Taxes The current federal motor fuel tax rates are Gasoline tax 0 184 gallon Diesel tax 0 244 gallon Aviation fuel tax 0 194 gallon Jet fuel tax Federal Gas Tax Holiday Right now the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel Those taxes fund

All told the fees come to 38 9 cents per gallon Add that to the 79 6 cents in taxes and California drivers pay 1 185 or rounded to 1 19 per gallon in taxes The federal gas tax is 18 4 cents per gallon on gasoline and 24 4 cents per gallon on diesel fuel On top of that states have their own gas taxes State gas taxes

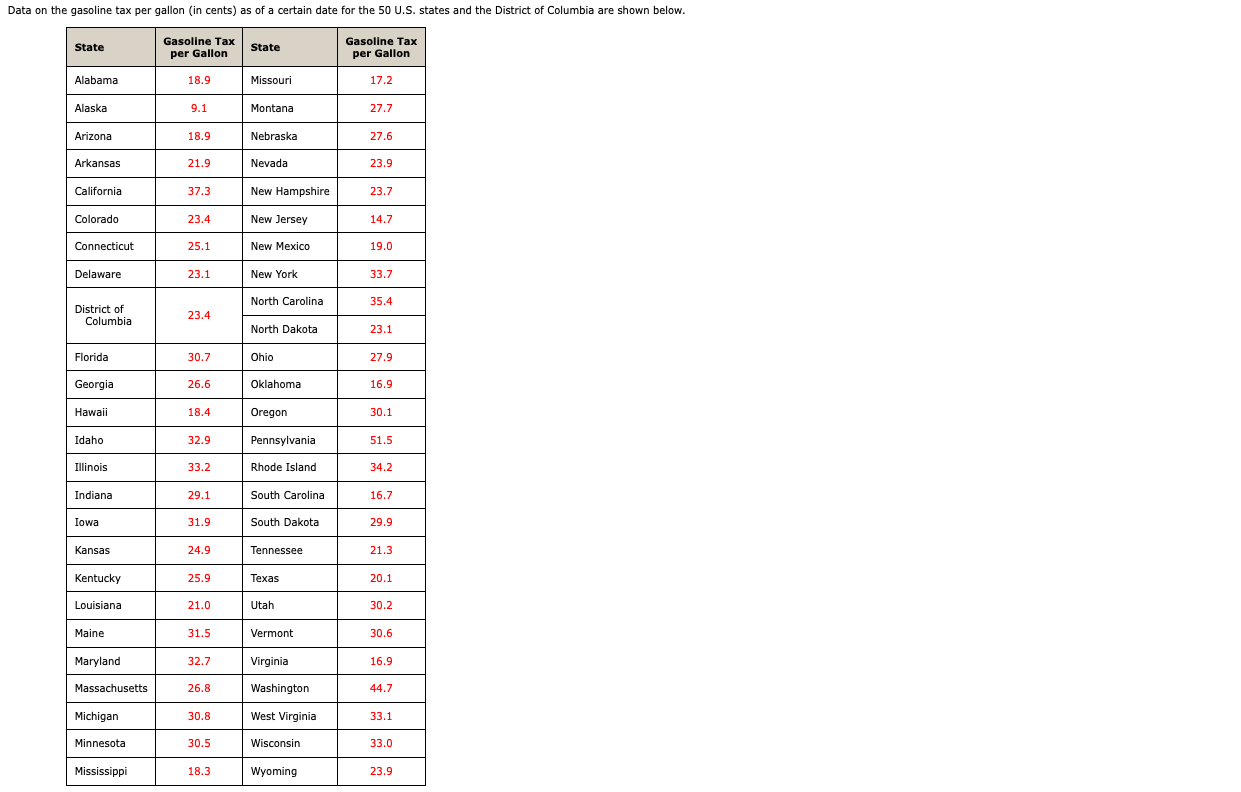

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

https://media.cheggcdn.com/media/878/878c29b3-038c-434e-898a-4cba476034bd/phpoowESG.png

The Automobile And American Life The Gasoline Price Grade Gap And The

https://4.bp.blogspot.com/-WEjqdqD4YEQ/VxjdNMrUPPI/AAAAAAAAKHU/zRVFGtNadpADv5iliqW2bO5w2QVQkSIOQCLcB/s1600/gasolineprice%2Bdifferential.jpg

https://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

The United States federal excise tax on gasoline is 18 4 cents per gallon and 24 4 cents per gallon for diesel fuel Proceeds from the tax partly support the Highway Trust Fund The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 93 from 1993 until 2022 On average as of April 2019 state and local taxes and fees add 34 24 cents to gasoline and 35 89 c

https://taxfoundation.org/data/all/eu/gas-taxes-in-europe-2022

The average excise duty on gas is 0 55 per liter 2 47 per gallon in Europe and 0 44 per liter 1 98 per gallon on diesel The United Kingdom levies the highest

The Ripple Effects Of The Gasoline Tax Increase The San Diego Union

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

Gasoline Prices Explained Department Of Energy

Gasoline Taxes By State

/162145616-56a102be3df78cafdaa7b6db.jpg)

How To Choose The Right Fuel Type For Your Car

Jared Unzipped Gasoline Has A Short Lifespan

Jared Unzipped Gasoline Has A Short Lifespan

The Truth Gasoline Taxes Vs Evil Exxon s Profits Plus Why Oil

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

How Much Is The Gasoline Tax - California pumps out the highest state gas tax rate of 66 98 cents per gallon followed by Illinois 59 56 cpg Pennsylvania 58 7 cpg and New Jersey 50 7 cpg