How Much Is The Residential Energy Credit For 2022 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate Residential Energy Property Costs Air Source Heat Pumps Heat pumps that are ENERGY STAR certified meet the requirements for this tax credit Tax Credit

How Much Is The Residential Energy Credit For 2022

How Much Is The Residential Energy Credit For 2022

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

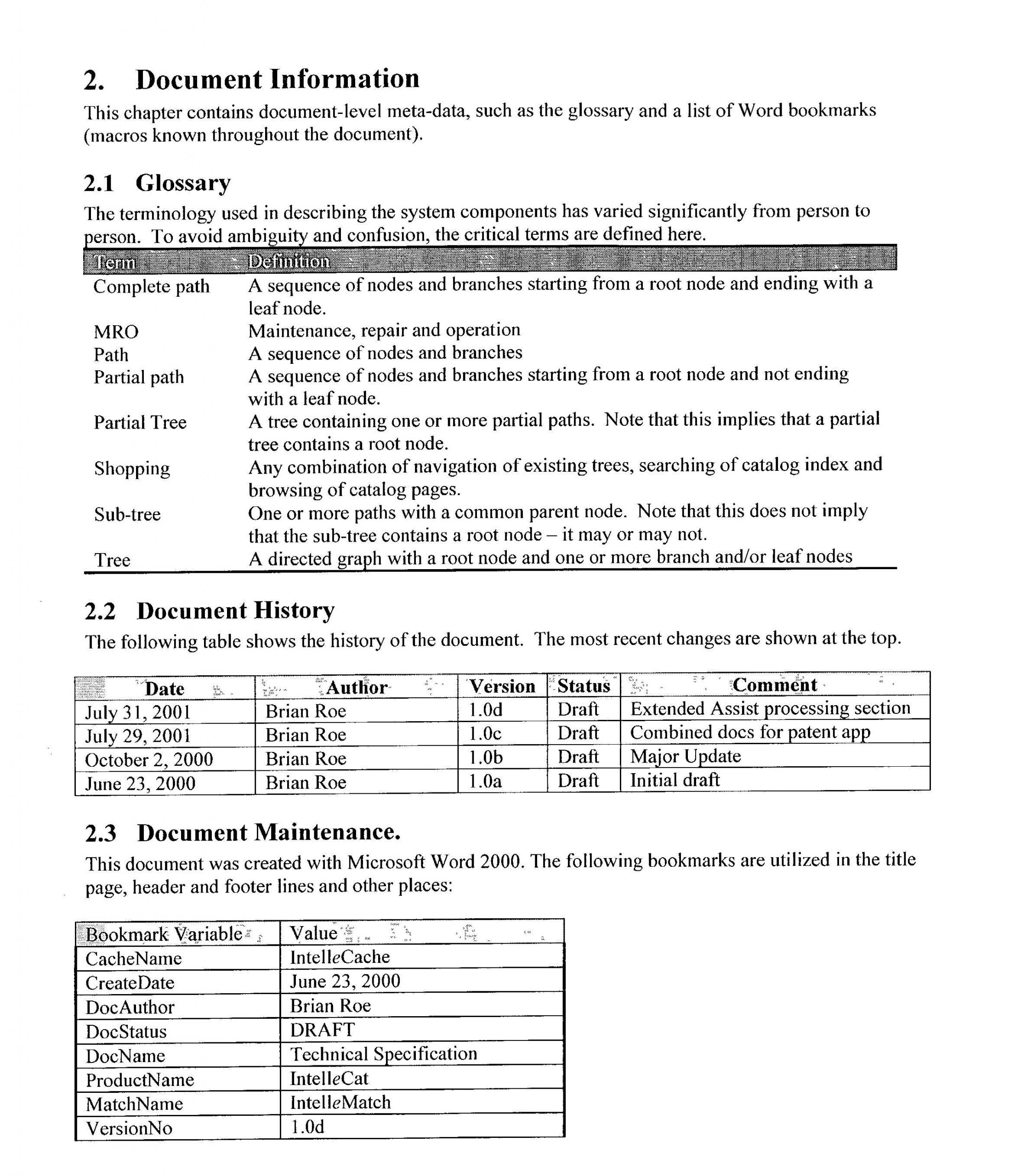

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving The IRS in December released Fact Sheet 2022 40 containing descriptions of the two tax credits and a series of FAQs to apply the rules to sample facts The fact sheet covers the following

The maximum lifetime credit for all types of property combined is 500 for tax year 2022 and all prior years No more than 200 can be for exterior windows The property must be original use property installed The Energy Efficient Home Improvement Credit offers a credit of 10 of the cost of energy efficient uprades for a maximum of 500 for all years combined The

Download How Much Is The Residential Energy Credit For 2022

More picture related to How Much Is The Residential Energy Credit For 2022

E Leclerc Livraison Nouveau Maitre D Resume Hello Master Salon Jardin

https://www.1redpaperclip.com/wp-content/uploads/2020/01/e-leclerc-livraison-nouveau-maitre-d-resume-hello-master-de-e-leclerc-livraison-scaled.jpg

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

For instance the credit for residential solar electricity will be worth roughly 7 500 for the average household Considering the upfront cost and average expected savings on electric bills from In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent

In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December The Residential Energy Credit was first created by The Energy Policy Act of 2005 providing 10 percent of the cost to install energy efficient home improvements up to a

Powering Progress IRS Releases Proposed Rules For Low Income Community

https://frostbrowntodd.com/app/uploads/2023/06/renewable-energy-solar-subsidy-incentives-stockpack-gettyimages-scaled.jpg

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

https://www.irs.gov/credits-deductions/residential...

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate

Budget 2022 Ireland What Are The Changes To The Carer s Allowance

Powering Progress IRS Releases Proposed Rules For Low Income Community

Residential Energy Credit Application 2024 ElectricRate

WATCH How Much Is The Salary Of A Certified Public Accountant In The

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Residential Clean Energy Credit Limit Worksheet 2022 Printable Word

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Residential Energy Use PieCaliforniaGeo

How Much Is The Residential Energy Credit For 2022 - A credit limit for residential energy property costs for 2022 of 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water