How Much Is The Solar Rebate Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

How Much Is The Solar Rebate

How Much Is The Solar Rebate

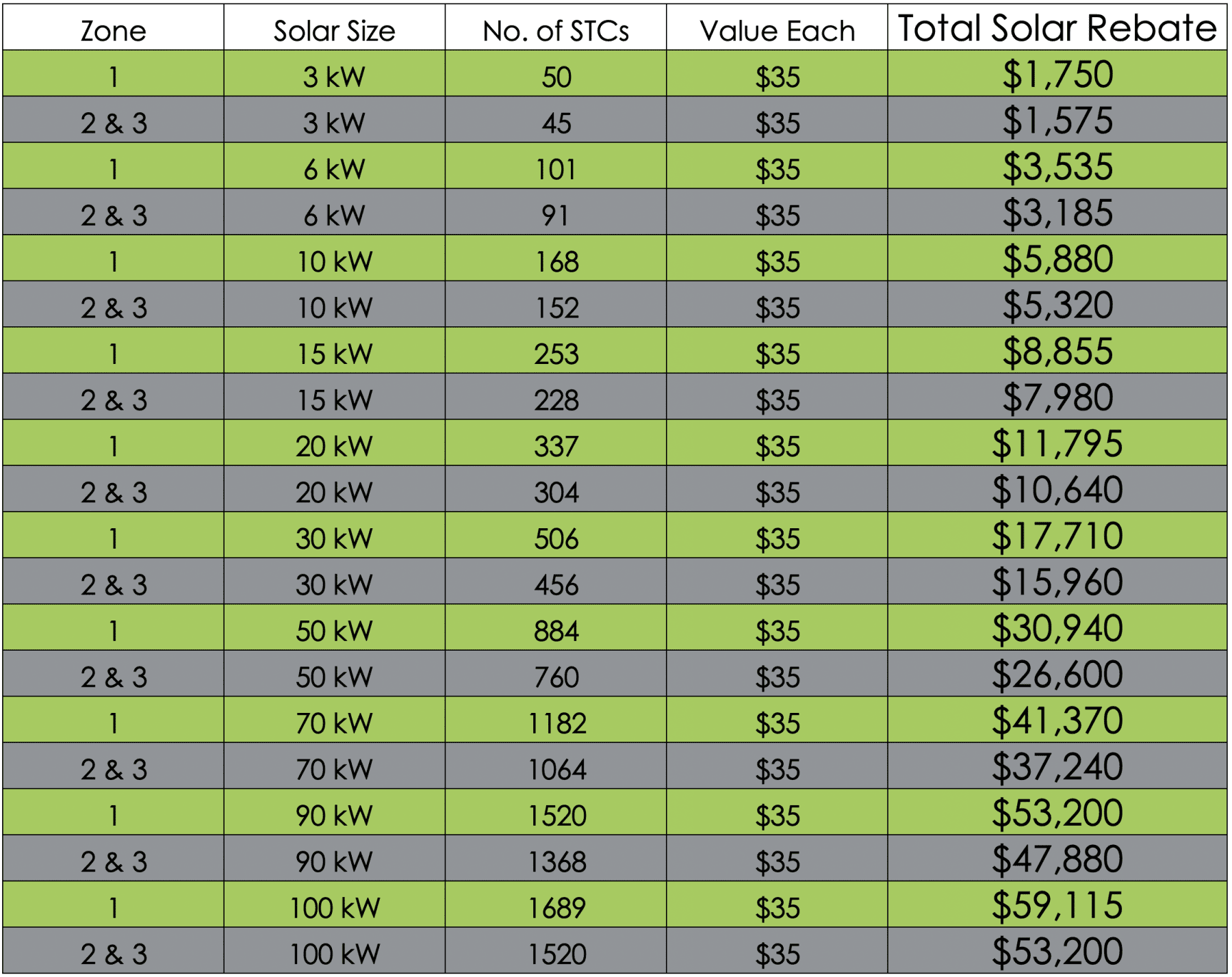

https://gienergy.com.au/wp-content/uploads/2020/09/Table-showing-solar-system-sizes-and-how-much-rebate-you-get-in-zone-1-and-then-zone-2-and-3.-The-rebate-ranges-from-1750-up-to-59115-depending-on-the-system-size.-1.png

Solar Power Rebate Solar System Rebate Solar Rebate NSW

https://isolux.com.au/wp-content/uploads/elementor/thumbs/rebate-pl2be5cmspxauxt6lae07f6p8kusnkrk47vj7xce80.jpg

Victorian Solar Rebate Program How Much Is It New 2023 Guide

https://gosolarquotes.com.au/wp-content/uploads/2020/09/Solar-Rebate-Phasing-Out.png

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates

Download How Much Is The Solar Rebate

More picture related to How Much Is The Solar Rebate

Victorian Solar Rebate Program How Much Is It New 2024 Guide

https://gosolarquotes.com.au/wp-content/uploads/2021/03/How-Much-Is-the-Solar-Rebate-in-Victoria1200x710-768x454.png

How Much Is The Rebate For Solar Panels In Mudgee The Daily Blog Online

https://www.thedailyblogonline.com/wp-content/uploads/2022/12/evgeniy-alyoshin-2ASQyjafflo-unsplash-scaled-1.jpeg

Space Solar Rebate Guide 2023 Edition Space Solar

https://www.spacesolar.com.au/wp-content/uploads/2021/06/shutterstock_349794935-scaled.jpg

The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

How much is the solar tax credit worth The solar tax credit is currently equal to 30 of the eligible costs associated with your residential solar project Exactly how much you save ultimately depends on the cost of your project The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Solar Rebate Guide In Melbourne Solar Panel Rebate Blog

https://www.gstore.com.au/wp-content/uploads/2021/02/the-solar-rebate-guide.jpg

What Is The Difference Between The Solar Rebate And Solar Feed in

https://www.infiniteenergy.com.au/wp-content/uploads/2021/11/What-is-the-difference-between-the-solar-rebate-and-solar-feed-in-tariffs1.jpg

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

Solar Rebate Guide In Melbourne Solar Panel Rebate Blog

How Much Is The Solar Rebate In Victoria Solar Run

What s Next For The Missouri Solar Rebate Renewable Energy Law Insider

Government Solar Rebate QLD Everything You Need To Know

2017 Australian Solar Rebate Changes Click To See If You Qualify

2017 Australian Solar Rebate Changes Click To See If You Qualify

How Do Solar Rebate Work In Victoria Densipaper

Victorian Solar Rebate Relaunches And Fills Up In 3 Days Energy Makeovers

Solar Power Vegas NV SOLAR RESIDENTIAL

How Much Is The Solar Rebate - For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates