How Much Is The Spousal Tax Credit Web 31 Dez 2022 nbsp 0183 32 If you reconciled with your spouse or common law partner and were living together on December 31 2022 you can claim an amount on line 30300 of your return

Web If at any time in the year you supported your spouse or common law partner and his or her net income line 23600 line 236 prior to 2019 is less than a maximum of up to 13 808 Web Using the 2022 example above the spousal tax credit is calculated by subtracting your partner s net income from 14 398 and multiplying the remainder by 15 which works

How Much Is The Spousal Tax Credit

How Much Is The Spousal Tax Credit

https://padivorcelawyercom.files.wordpress.com/2017/08/img_30881.png?w=576

What You Need To Know About Sole Proprietorship And Personal Tax Canada

https://canadataxaccountants.ca/wp-content/uploads/2021/06/cropped-shot-of-accounting-staff-are-using-calculators-and-graphing-to-pay-annual-taxes-.jpg

Tax Debt What Happens If You Ignore It Ideal Tax

https://www.idealtax.com/wp-content/uploads/2020/07/shutterstock_556308208-scaled-1.jpg

Web Vor 5 Tagen nbsp 0183 32 It is worth a maximum of 2 000 per qualifying child in 2023 for taxes paid in 2024 Up to 1 600 is refundable To be eligible for the CTC you must have earned Web 24 Okt 2021 nbsp 0183 32 The amount for an eligible dependent means tax credits for supporting one dependent The amount as of 2020 is a maximum of 13 229 How much is the

Web Every taxpayer gets a tax credit for the basic personal amount so any person can earn taxable income of 15 000 in 2023 without paying any federal tax and can earn Web You can claim the spouse or common law amount if you supported your spouse or common law partner at any time during the year and their net income was less than their

Download How Much Is The Spousal Tax Credit

More picture related to How Much Is The Spousal Tax Credit

Free Of Charge Creative Commons Spousal Privilege Image Legal 6

https://pix4free.org/assets/library/2021-05-12/originals/spousal_privilege.jpg

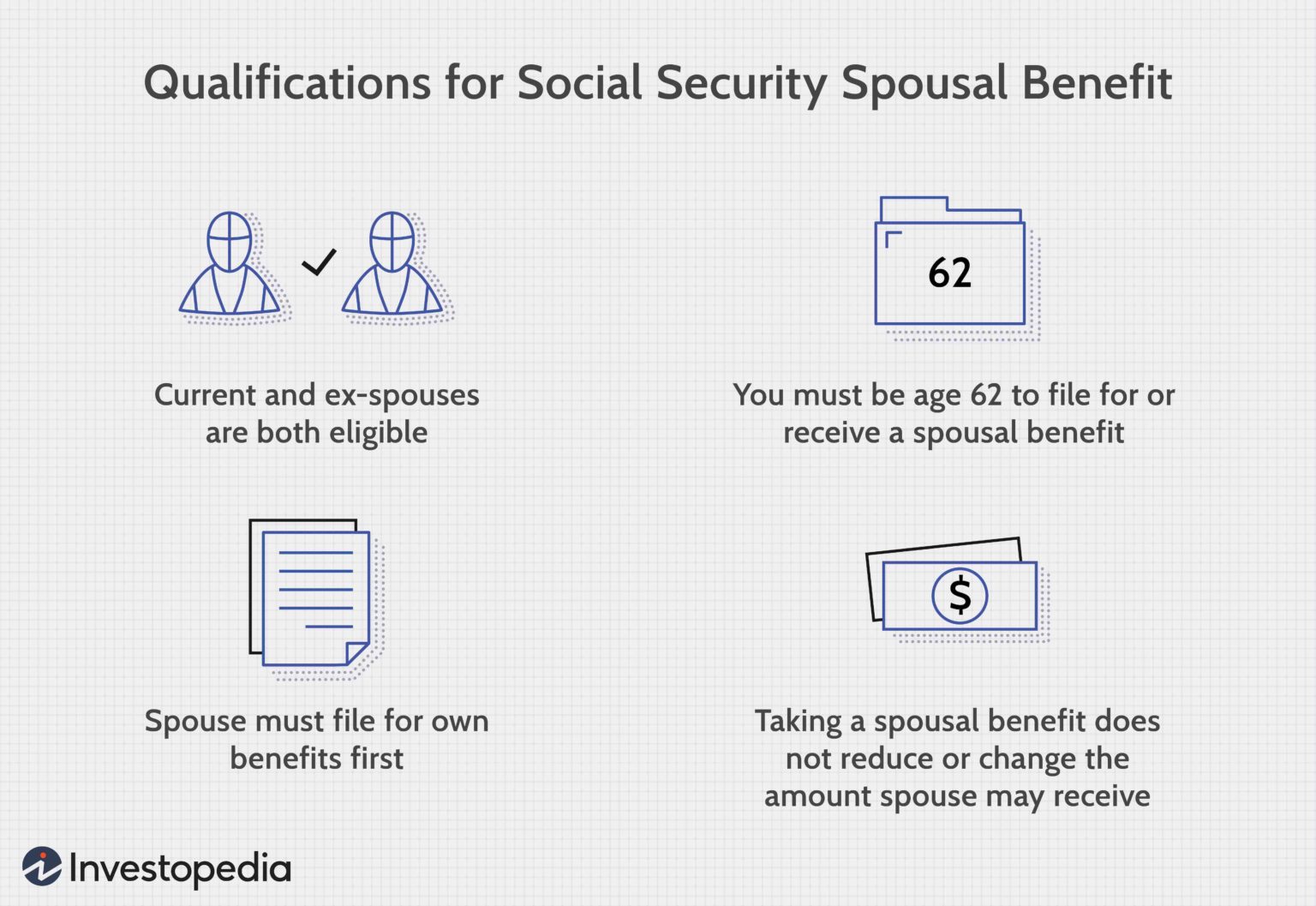

Social Security Spousal Benefit Learn How It Works

https://www.tododisca.com/en/wp-content/uploads/2022/06/Social-Security-Spousal-Benefit.jpg

Proof Of Relationship Spouse Open Work Permit Canada Spousal

https://i.ytimg.com/vi/TtvIDlUKxgQ/maxresdefault.jpg

Web 3 Aug 2023 nbsp 0183 32 You may claim the spousal tax credit if your partner makes less than your basic personal amount listed on line 30000 of your tax return To calculate the credit Web Vor 6 Tagen nbsp 0183 32 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may

Web 7 Sept 2023 nbsp 0183 32 For example if you make 120 000 this year and file single part of your income would land in the 24 tax bracket for 2022 On the other hand say you are married and filing jointly You make 120 000 Web 21 Jan 2022 nbsp 0183 32 If you or your spouse purchased a home during the tax year you may qualify for the homebuyer s amount of 5 000 To apply for this credit neither you nor

Spousal Consent Form California Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/65/776/65776239/large.png

How Do I Calculate My Federal Pension Government Deal Funding

https://governmentdealfunding.com/wp-content/uploads/2022/05/Should-I-take-a-lump-sum-pension-or-monthly-payments-1536x1057.jpeg

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

Web 31 Dez 2022 nbsp 0183 32 If you reconciled with your spouse or common law partner and were living together on December 31 2022 you can claim an amount on line 30300 of your return

https://www.taxtips.ca/filing/spousal-amount-tax-credit.htm

Web If at any time in the year you supported your spouse or common law partner and his or her net income line 23600 line 236 prior to 2019 is less than a maximum of up to 13 808

How Much Is The IRS Giving For Each Dependent Leia Aqui How Much Do

Spousal Consent Form California Complete With Ease AirSlate SignNow

Can Anyone Identify What This Tax Receipt Is For Canadian Money Forum

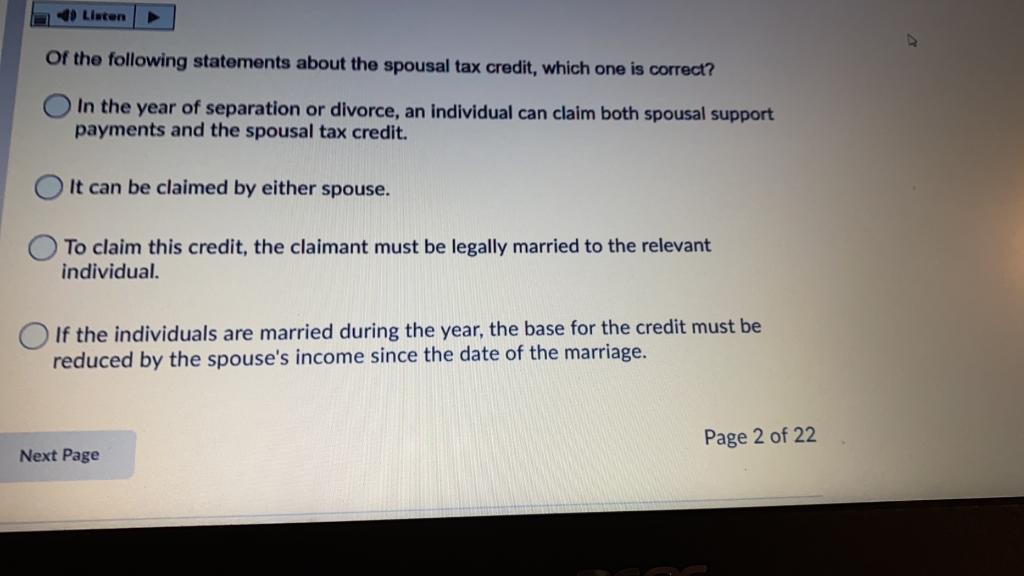

Solved Listen Of The Following Statements About The Spousal Chegg

Spouse Visa Document Requirements For Canada 2022

How Much Spousal Support Will I Get A CDFA Offers Insight Divorce

How Much Spousal Support Will I Get A CDFA Offers Insight Divorce

How Much Is The Down Payment For A 375 000 Home Moreira Team Mortgage

Spousal Support In Texas How Much And How Long Next With Lena Nguyen

How Much Is The UK VAT Rate The Accountancy Partnership

How Much Is The Spousal Tax Credit - Web You can claim the spouse or common law amount if you supported your spouse or common law partner at any time during the year and their net income was less than their