How Much Of My Health Insurance Premiums Can I Deduct Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your income for the year

You can only deduct medical expenses after they exceed 7 5 of your adjusted gross income This threshold had been scheduled to increase to 10 but a tax law passed at the end of 2020 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain criteria

How Much Of My Health Insurance Premiums Can I Deduct

How Much Of My Health Insurance Premiums Can I Deduct

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Can I Deduct Insurance Premiums

https://www.youngalfred.com/uploads/preview-blog-image/1526331031_pexels-photo-209224.jpeg

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

The contribution you make to your HSA is 100 tax deductible up to a limit in 2024 of 4 150 if your HDHP covers just yourself and 8 300 if it also covers at least one additional family member For 2025 these limits increase to You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

You figure the amount you re allowed to deduct on Schedule A Form 1040 For additional information on medical and dental expenses see Can I deduct my medical and dental expenses and Publication 502 Medical and Dental Expenses Medical care expenses include payments for the diagnosis cure mitigation treatment You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you to deduct up to 100 of your premiums

Download How Much Of My Health Insurance Premiums Can I Deduct

More picture related to How Much Of My Health Insurance Premiums Can I Deduct

Deduct Health Insurance Premiums Self Employed Customwebdesignny

https://www.godaddy.com/garage/wp-content/uploads/2016/03/deduct-health-insurance-costs.jpg

Health Insurance Cost Increases Stayed Low In 2013 For Job Based

http://i.huffpost.com/gen/1307258/original.jpg

The Cost Of Health Care Insurance Taxes And Your W 2

https://imageio.forbes.com/blogs-images/thumbnails/blog_1479/pt_1479_10092_o.jpg?format=jpg&width=1200

You may be able to deduct the cost of health insurance premiums on your income tax return You may need to itemize your deductions to take this deduction Health insurance premiums can be tax deductible under some circumstances Taxpayers who itemize may be able to use this deduction to the extent that their total medical and dental expenses including health insurance premiums exceed 7 5 of adjusted gross income

If you pay for health insurance after taxes are taken out of your paycheck you might qualify for the medical expense deduction If you paid the premiums for a policy you obtained yourself your health insurance premium is deductible when they are out of pocket costs The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Can You Deduct Health Insurance Premiums Without Itemizing YouTube

https://i.ytimg.com/vi/I6wl_v7oyLQ/maxresdefault.jpg

Why Do My Health Insurance Premiums Keep Going Up Each Year Part 3

https://www.trustedunion.com/wp-content/uploads/2019/02/Health-Insurance-Save-money-3.jpg

https://www.valuepenguin.com/health-insurance-tax-deductible

Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your income for the year

https://money.usnews.com/money/personal-finance/...

You can only deduct medical expenses after they exceed 7 5 of your adjusted gross income This threshold had been scheduled to increase to 10 but a tax law passed at the end of 2020

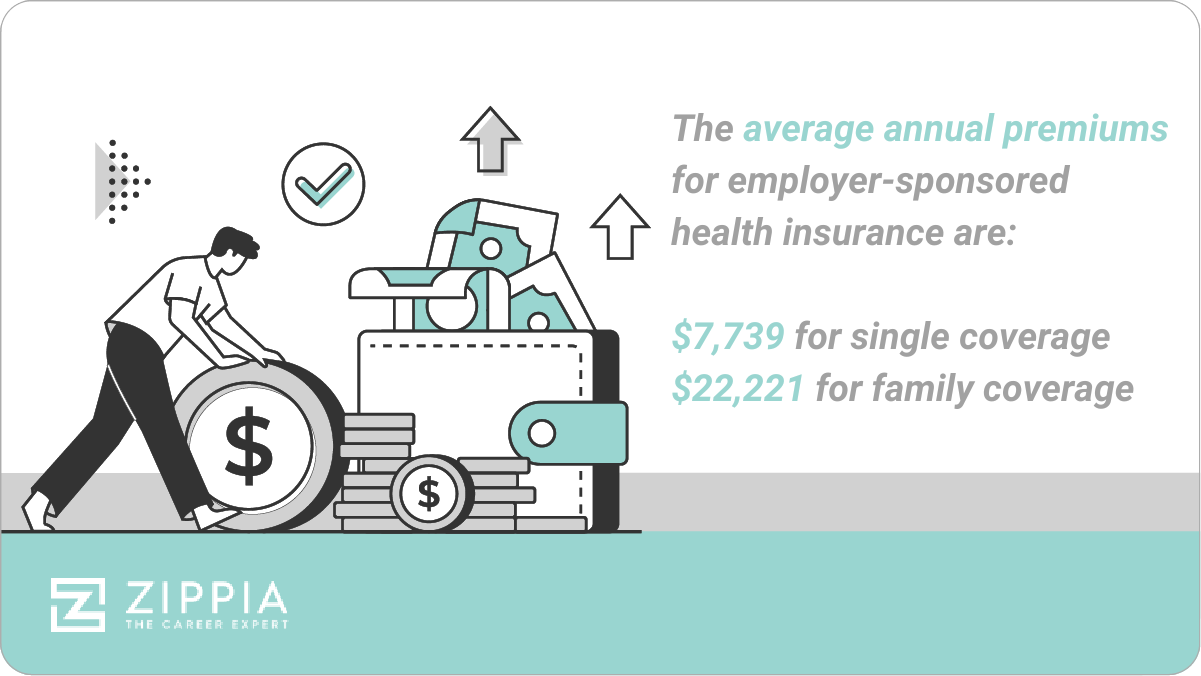

Average Cost Of Employer Sponsored Health Insurance 2023 What

Can You Deduct Health Insurance Premiums Without Itemizing YouTube

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg)

Are Health Insurance Premiums Tax Deductible

What Can I Do To Reduce The Cost Of My Health Insurance Part 4

I m Self Employed Can I Deduct My Spouses Health Insurance Premiums

Can Insurance Premiums Be Deducted AZexplained

Can Insurance Premiums Be Deducted AZexplained

Tax Deductions You Can Deduct What Napkin Finance

Can I Deduct My Health Insurance Premiums Exploring The Tax Benefits

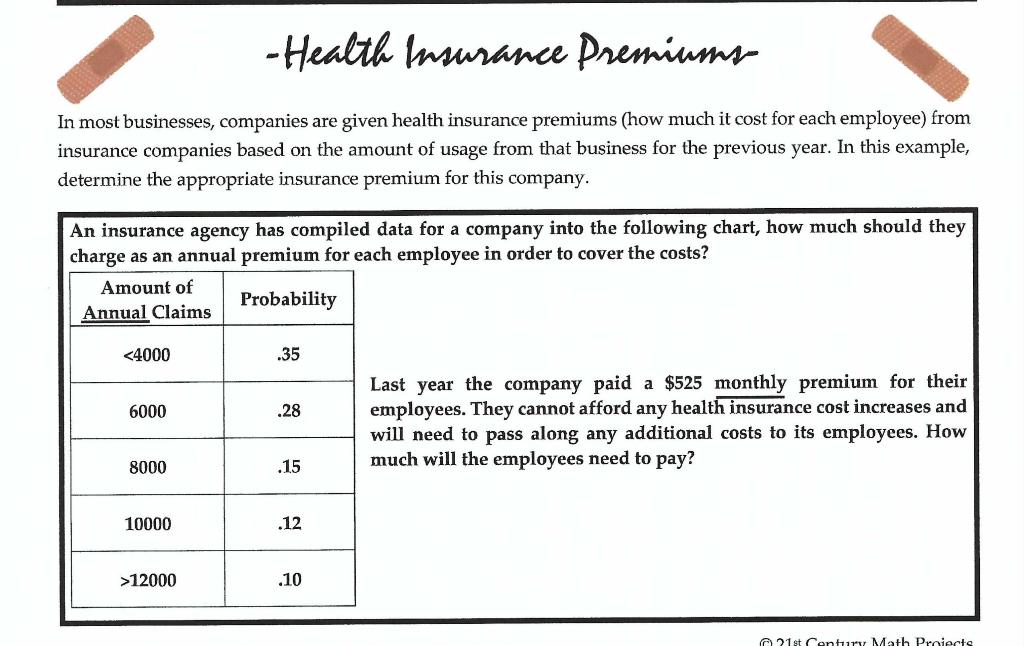

Solved Health Insurance Premiums In Most Businesses Chegg

How Much Of My Health Insurance Premiums Can I Deduct - You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you to deduct up to 100 of your premiums